Value pricing in the chemical industry – Rebooted

Value pricing has been a topic in the chemicals industry for decades. Still, according to Simon-Kucher studies in the industry, managers feel they have to improve when it comes to their ability to capture value through better pricing. The authors describe what helps to rigorously implement a value pricing approach in the chemicals industry. They outline how to understand “willingness-to-pay” (WTP), they challenge the “one-size fits all” approach and give an explanation why many segmentation model fail, they question traditional price metrics and their ability to capture value, they address how to define the right pricing strategy and they elaborate about value communication. The authors show that it is time to reboot the thinking about value pricing. They lay out five rules that serve as your reset buttons.

1 Introduction

Over the last decade, chemical companies have become pro-active and professional in adjusting their capacity to volatile demand in order to protect prices and margins. As engineers hard at work, they manage their assets well to protect value. The more upstream the business model, the truer that is.

But how is the chemical industry doing downstream on the commercial side? How are they doing when it comes to their ability to capture value through better pricing?

In their own words: not well.

In early 2017, Simon-Kucher asked managers in the chemical industry in Europe where they see the strongest need for optimization in sales tasks, starting from strategy to organization to implementation. The result was very clear. The majority of the managers saw the most important improvement potential in establishing a value-selling culture (Simon-Kucher, 2017).

The good news is that the managers see how acute this need is. The bad news is that this is not new. Haven’t chemical companies invested considerable time and money over the last 15 years to select and develop their sales teams to be able to argue value and to capture value in pricing?

It’s time for companies to step back and reboot their thinking around value pricing. The great news is that companies in all segments of the chemical industry have a lot to build on.

Reboot = Innovate

Innovations which can demonstrate true added value are the only way forward for the chemical industry, if managers want to make value pricing finally work to their advantage. This also means business model innovation and not merely product and service innovation. Let’s begin with the latter.

Innovation power and value delivery is typically not the main bottleneck in chemicals. The chemical industry has highly qualified engineers in operations and strong R&D departments. Current innovations range from new material types to opportunities through new digital technologies. New composite materials, for example, help to reduce component weight and the weight of cars significantly. Materials such as graphene from carbon are stronger, lighter, and more temperature-resistant than any chemical product before. New digital technologies allow companies to track how chemicals perform in operations and processes at their customer, a rich source of data which provides insights on how to improve the product continuously and/or enforce process efficiencies.

So where is the innovation bottleneck? Far too often it is in how chemical companies deal with pricing, and how they price their attractive and in some cases groundbreaking innovations.

Pricing in general: Help sales argue value better

Increased competition, the hunt for volume, and shorter product lifecycles are putting downward pressure on prices in the chemical industry. At the same time, procurement continues to become more and more professionalized. Your customers bring in skills and expertise in an effort to drive down prices or achieve the most favorable price-value relationship.

Some 39% of the respondents in the Simon-Kucher & Partners Global Pricing Study (Simon-Kucher, 2014) attributed these higher pressures to the rising negotiation power of customers. Increased price transparency stood out for 36% of the respondents. Another frequently cited reason was lowprice competition, either from new attackers or from incumbents.

Facing these challenges and sticking to a costplus mindset in pricing leaves the sales teams in the chemical industry doomed. They are forced to withstand the heat in the price-focused discussions with their customers without the protection of value arguments. Is this fair support for the sales team?

Pricing for innovations: A make-or-break decision

Value pricing is most important for new products and innovations, but this is also where it fails most often (see figure 1). A key insight of Simon-Kucher’s Global Pricing Study was that almost three out of four new products (72%) fail to achieve their profit targets. Furthermore, one in four companies does not have a single new product in their portfolio that has achieved its profit targets. Is this the fate that the teams which developed these innovative products deserve? Not getting the pricing right for these will destroy the value of these innovations forever, wasting enormous opportunities (Tacke et al., 2014).

Below we outline five rules for successfully rebooting the idea value pricing. The key principles apply for product and service innovation, for business model innovations as well as for breathing new life into established products through re-positioning.

2 Five rules for successful value pricing

1. The “willingness-to-pay” talk: You can’t price without it

Imagine that your sales team knew that the next customer they call on has three requirements, in this order. They want superior quality consistency, because it improves their machine uptime or their own end product. They want technical support available on call, because they have limited skilled technical resources in house. And they want a good price.

That is an ideal opportunity for value-selling. What implications would these have on your offer design, price positioning, and value communications? Knowing this separates the companies who can differentiate from the companies who merely compete.

The problem is that so many companies never give themselves this opportunity. They never had the “willingness-to-pay” (WTP) talk with their customers. Without that talk, a pricing discussion during a sales call is like a pop quiz, a last-minute guessing game based on hunches or experience rather than knowing what this customer wants.

Rather than leaving pricing to the last minute, the offer design, price positioning, and value communications process should start with pricing. The product or offer needs to be designed around the price, not the other way around. Companies often have an idea what customers will say about their “willingness-to-pay” (WTP), but they have not actually asked them in order to truly understand it.

You have to have these conversations. Our clients position these discussions with their customers as “value talks”, not as pricing discussions to measure and define value. They take in different views, depending on who the decider is: the production guy, the R&D folks or the procurement.

The most important goals of these value talks or WTP talks is to understand the price range customers have in mind (meaning their overall WTP) and the extent of their interest in specific features (what matters and what doesn’t). This will help to focus product and offer development on differentiation versus competition, knowing what customers will value at all and value most.

In the example above, the company making the sales call was convinced its offer was differentiated from competition by superior quality consistency, by having local stock in the country, and by good customer relations. But at the same time, they said their customers’ top priority was getting the lowest price. The customer refuted that view when we talked to them.

Insights on WTP are also indispensable when it comes to assessing and monetizing solutions based on new digital technologies. The revenue and monetization model of new business models need a prototyping and customer testing. What is the WTP for a real-time data-driven process for water management, as provided by Ecolab (Blog Microsoft) as compared to the price of a water chemical? Would customers accept and value a process integration at all?

Customer feedback is essential. Companies typically capture it in multiple iterations in a pragmatic and quick form in order to understand what customers really value, but without taking too much time to market.

Having “the talk” and learning how you can best serve your customers is a win for everyone. It’s time to win.

2. “One-size-fits-all” and rigid solutions: Don’t default to them

We have not found a single market where customer needs are homogenous. So why do companies offer “one-size-fits-all” solutions? There are two reasons. Either they develop products or offerings for the “average” customer, whoever that may be. Or they have at least one segmentation, which is nice in theory but hardly useful in practice because the segmentations are not actionable.

Your segmentation must become a driver of product design or offer development. To ensure this, you need to build it upon what you learned in Rule #1: a deep understanding of the customers, their needs, and their WTP.

In a recent consulting project for a coatings and adhesives producer, the client wanted to develop a customer segmentation in order to derive differentiated offerings. Their hypothesis was that they had two segments. The price sensitive segment would be best served with a “lean” offer at a competitive price, without any value-added service. The value-seeking segment would be willing to pay a premium for a premium offer. Even better, the client felt they could pigeonhole their customers into either the price-seeker or the value-seeker box. Once in the box, the customer would receive either the lean or the premium offering.

There was a kernel of truth in these hypotheses, but they were based on incomplete informati on. T h e dif fe rence make r was the “value talk”, which in this case began with a customer survey. It revealed th at a lmo st all customers considered the fees for the value-added services for the premium offer as already included in the current product price. Offering differentiated service packages for different segments would have been very difficult to implement without risking price erosion by introducing the “lean” offer.

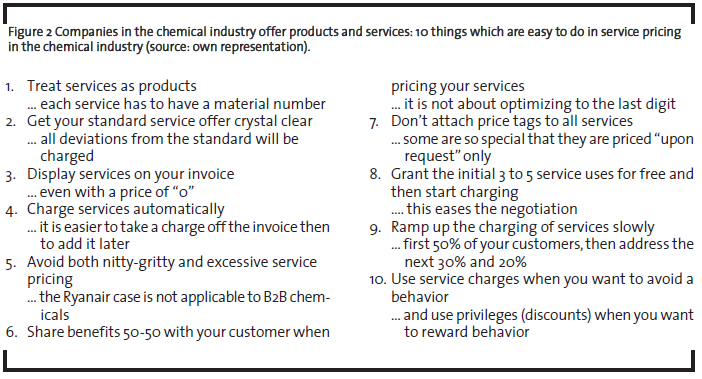

We recommended to de-bundle the offer and use service fees as mark-ups on product prices in order to quantify the value and make the product and service value transparent to the customer (see figure 2). We also recommended a slow migration from a premium offer towards a “lean” offer by taking out services for price sensitive customers. This would help mitigate the risk of price erosion.

Your ultimate goal is to help your customers self-select their segment, rather than selecting the segment for them and imposing a sol ution. Customers buy what they need and what meets their willingness or ability to pay. Providing them with options and letting them choose is how segmentation works best.

You have no obligation to serve every segment . Your obligation is to describe and thoroughly understand the most attractive ones in detail, in order to address them right.

3. The monetization model: Go beyond the traditional price metric

Chemicals are typically priced by the kg, ton, or liter. But such monetization models seldom reflect the true value of a product. Customers don’t buy products. To quote Peter Drucker (Drucker, 1954), they buy the added value or the benefits that the product and the manufacturers provide. Your monetization model needs to reflect this added value.

Take the case of lightweight composite materials. In automobiles, they help drivers reduce their fuel consumption, lower their emissions, and perhaps even pay lower taxes. They even help improve the overall driving experience. That is an impressive package of benefits. The car manufacturer, in turn, has a much more robust price-value position thanks to better product performance, has reduced costs, and may even profit from the positive impact on brand perception as it brings innovative technologies to market. That is another impressive package of benefits.

The chemical companies’ traditional metric to price these lightweight materials would be per kg. But it should be clear that this model reflects neither the value of lightweight material (think benefits!) nor the specific value of the car components which use them. Only a price per component (including the component design) will be able to monetize this considerable value added.

Monetization models can confer significant competitive advantages on a new product. They can also be true game changers. When done right, the best monetization models are a win-win for you, your customers, and your customers’ customers.

Think back to the Ecolab example and the realtime data-driven process for a water management solution. The added value is the ability to identify ways to operate a specific water treatment plant more effectively and efficiently on a continuous basis, based on gathered information and benchmarks. The value is derived from the solution, the combination of water chemicals and services. A model based on kg or bags of water chemicals doesn’t align with this value. Instead, the monetization model should be based on an inexpensive or free installation of the hardware and a subscription price model to generate recurring revenue streams.

To quantify the value of the solutions, you have several options, and these often work best in combination. You can conduct expert panels with purchasers and engineers. You can conduct customer surveys. And you can draw on your considerable inhouse expertise and estimate the value based on assumptions and approximations.

4. The pricing strategy: Pick the winning option

In the previous section we said that the car company using lightweight materials has a more robust price-value position. The challenge for that company is how to take advantage of that newfound position. The answer lies in pricing strategy.

There are two basic options: price low for a penetration strategy or aim high for a skimming strategy.

To make this decision a company needs to gather data on four pillars: value, price, cost, and volume. Understanding what customers are willing to pay, how the volume changes when you change the price, what potential competitive responses are, and how to react to them, is at the core here. The insights from this information shape the pricing strategy.

Let’s take the launch of “green” products as an example. We recommended that a client offers “green” products at premium prices on top of their standard offering. This price strategy entails successively skimming the value by starting with the customers who are willing to pay the most. The customers have the choice to buy the cheaper standard solution or the premium “green” product. If capacity utilization targets do not allow for this high price niche strategy, marketing cooperation or joint ventures could make sense in order to relieve the volume pressure and allow for value capturing.

Our observation is that companies with welldefined pricing strategies are 40% more likely to capture their value potential than firms that don’t have them (Sebastian and Maessen, 2010).

5. The communication challenge: Focus on benefits, not features

Take a close look at this value proposition: “Shipping customers have achieved savings of up to 9% through improved ship fuel efficiency due to our recommendation of which coating to use”.

The power of such a statement comes from the fact that it describes, explains, and quantifies a benefit. While this sounds simple, we routinely see companies struggle in the chemical industry with crafting this kind of value communication. They struggle because they don’t quantify benefits. They focus on features customers don’t feel are important. They don’t thoroughly test value communication messages with customers.

Mastering the value communications is just as important as mastering the process of value delivery. If you can’t clearly communicate your value, how can your customers understand why they need your offer and why they should pay for it?

The value message above on shipping comes from AkzoNobel. They use insights from Big Data to sell the value of their marine coatings. Millions of data points out of their labs, together with advanced analytics techniques, proprietary algorithms and models, generate a full cost-benefit analysis which helps the company identify the most fuel efficient anti-fouling coating under different scenarios. They can make highly specific predictions that are dependent on vessel type, trading route, speed, and activity.

Segment-specific customization, monitoring, and continual improvement are vitally important to conveying compelling value messages. It is important to have marketing departments that gather marketing intelligence and compile market databases, as well as product managers who manage the supply chain. But they alone are not sufficient to support value communication. You need dedicated people in functions charged with value communication.

3 Summary and conclusion

We have laid out five rules to reboot your thinking on value pricing and help you rigorously implement a value pricing approach. Here is a brief recap:

- You need to design your products and solutions around the price, not the other way around (Ramanujam and Tacke, 2016). Have the value talk with customers. Although you may have an idea of what your customers are willing to pay, ask them directly and understand it thoroughly.

- Your segmentation must be actionable and based on a deep understanding of your customer base. Refrain from pigeonholing your customers. Develop differentiated offerings for the segments you want to serve, and serve them right.

- Prices by kg, ton, or liter seldom reflect the true value of a product. Challenge your monetization model. Done right, it can become a true game changer and create a significant competitive advantage.

- Your choice of pricing strategy is decisive. Aim to provide your customers with options. Skimming enables you to start capturing value from customers who are willing to pay the most. Companies with short- and long-term monetization plans are more likely to capture their value potential than firms that don’t have them.

- Value communication is as important as value delivery. Develop compelling messages focused on important benefits. Tailor them to your segments, and continually improve them with a dedicated function charged with the value communication task.

Value pricing has been a topic in the chemicals industry for decades. Still, managers feel they have to improve. It is time to step back and reboot the thinking around value pricing. These five rules are your reset buttons.

References

Drucker, P.F. (1954): The practice of management, Harper & Row, New York, NY.

Ramanujam, M. and Tacke, G, (2016): Monetizing Innovation: How Smart Companies Design the Product Around the Price, Wiley, Hoboken, New Jersey.

Microsoft Blogs (https://blogs.microsoft.com/transform/feature/ecolab-and-microsoft-team-to-face-watershortage-challenges/)

Sebastian, K.-H. and Maessen, A. (2010): Green and Profitable: Mission Impossible? (White paper)

Simon-Kucher Sales Excellence short study (2017): Online study during February-March 2017 with 69 managers in Europe, thereof about 30% executives (study report available upon request)

Simon-Kucher Global Pricing Study (2014): Online study during May-June 2014 with around 1,600 managers – including over 600 executives – from more than 40 countries, (study report, available at www.simon-kucher.com)

Tacke, G., Vidal, D. and Haemer, J. (2014): Profitable Innovation, (e-book, available at www.simonkucher. com)