The spatial dynamics of the European biotech industry – a NEG approach with vertical linkages

After a period of consolidation, the European biotech industry faces new challenges in the course of increasing internationalization, especially in terms of the EU Eastern enlargement. On one hand, the accession of the new member states opens the emergence of new research, production and sales opportunities. On the other hand, the increasing competitive pressure may imply an essential risk for local biotech firms. Against this background, the paper reviews the potential development of the European biotech industry with respect to its spatial structure. On the first stage, the present industrial situation as object of investigation is described and evaluated with respect to a further model implementation. In this context, the article introduces the findings of an online survey concerning international trade, conducted with German biotech firms in 2006. On the second stage, the results are completed by the outcomes of a numerical simulation within the New Economic Geography (NEG), considering vertical linkages between the biotech and pharmaceutical industries as an agglomerative force. The analysis reveals only a slight relocation tendency to the European periphery, constrained by market size, infrastructure and factor supply. Based upon the findings, the paper concludes with suggestions for economic policy in terms of research and location promotion.

Introduction

Significant changes in spatial concentration and specialization of European industries accompany the EU integration process. The empirical study of Midelfart-Knarvik et al. (2000) reveals that since the 1970s, medium and high-tech industries have been characterized by increasing dispersion. In this context, the geographical concentration of the pharmaceutical industry shows a particularly sharp decrease: 12% of the production was relocated from Germany and Italy to Denmark, the UK, Ireland and Sweden.

Against the background of strong sectoral interdependencies between the biotech and pharmaceutical industries, changes in the economic geography of biotechnology may be expected as well.1

In the course of the EU enlargement in 2004, European industries did not only face enlarged sales markets, they also faced alternative production and research locations. In this context, it is debatable if the efforts of economic policy, especially in Germany, France and the UK, to establish a growing biotech landscape are endangered by a potential relocation to acceding countries in Central and Eastern Europe (CEE).2 This risk appears to be imminent in the light of the dynamic economic growth, increasing foreign direct investments, and increasing high tech exports from CEE countries. In contrast, the acceding countries show substantial deficits in research infrastructure, proprietary developments of products and processes, purchasing power, and in the supply of highly qualified labour.

Against the background of these questions, this paper aims to make a quantitative contribution within this debate addressing on the central issue: To what extent does the EU enlargement have an impact on the spatial formation of the European biotech industry?

Although the location and agglomeration of biotech firms have been analyzed in a wide range of scientific publications, the spatial dynamics of the European biotech industry as a whole appears to be a blind spot against the multitude of country studies.3 Therefore, this paper aims to make a quantitative contribution using a numerical simulation of a standard model of the New Economic Geography (NEG). In combination with the empirical results of primary and secondary statistics, this approach allows to construct a scenario for the future development of the European biotech geography. This requires a consideration of the industrial structure and determinants of foreign trade.

As the study of Midelfart-Knarvik et al. (2000) demonstrated and intensely discussed in the regional economic literature, the impact of interindustrial linkages on agglomeration dynamics has significantly increased.4 In this regard, Central and Eastern European locations attract downstream sectors to an increasing degree. This implies also a stronger relocation of the biotech industry in its essential capacity as an upstream supplier for the pharmaceutical and medical sectors. Therefore, this paper aims to fertilize the discussion of spatial restructuring within the context of sectoral interdependencies between the biotech and pharmaceutical industries.

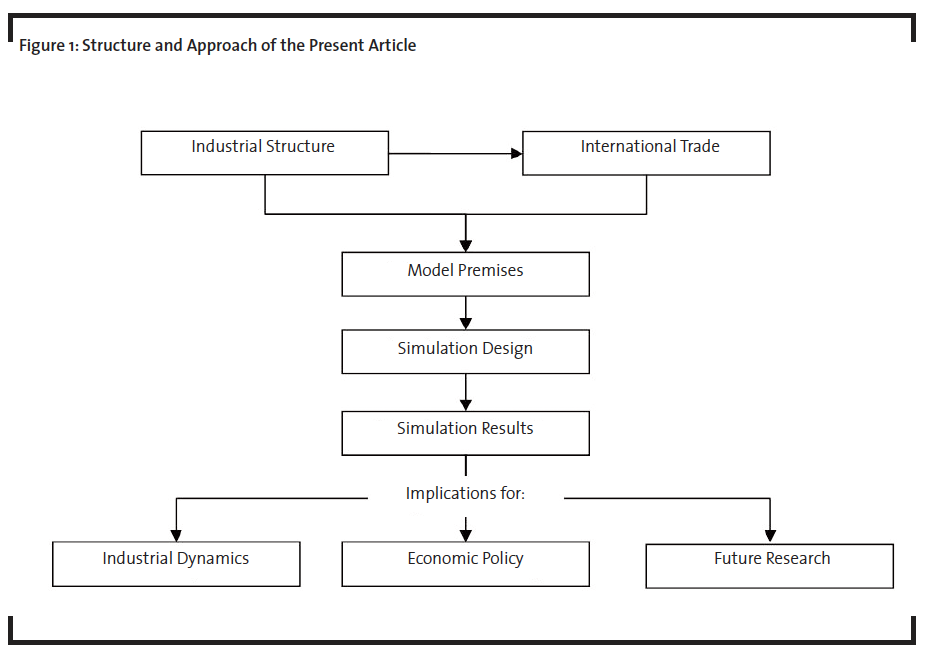

Figure 1 represents the approach of this analysis. In the first steps, comprised in section 2, the paper provides the analytical base and legitimization of the model assumptions underlying the numerical simulation in section 3. Because of the cen- tral importance of the vertical integration of the biotech industry within the pharmaceutical supply chain, the sectoral interdependencies are the focus in characterizing the real object of investigation. In the following section, based on the specification of real economic facts of the preceding segment, the paper identifies the structure of international trade within the European biotech industry as a major determinant of its spatial formation.

In this context, the article refers to the results of an online survey, conducted by the department Innovation and Growth of the University of Lueneburg and supported by two major industrial associations.5 A detailed presentation of the survey results associated with an extensive analysis of the biotech industry and its foreign trade activities are discussed in Kranich (2007) and in a working paper for the survey results (Kranich, 2007).

Based upon the empirically established model assumptions, Section 3 sets up a standard NEG model incorporating vertical linkages (Venables, 1996). This model provides the basis for the simulation study of the EU-15+10 enlargement. Finally, Section 4 discusses the results and draws conclusions for: i) potential industrial development paths; ii) economic policy in terms of location and research promotion; and iii) for further research concerning the spatial dynamics of the European biotech industry.

1 The term biotech(nology) follows the definition according to the OECD (2005): “The application of science and technology to living organisms, as well as parts, products and models thereof, to alter living or nonliving materials for the production of knowledge, goods and services.” Analogously, a biotech company is:“… defined as a firm engaged in key biotechnology activities such as the application of at least one biotechnology technique (…) to produce goods or services and/or the performance of biotechnology R&D (…)”.

2 With regard to the diffuse common definition of the term CEE, here it synonymously refers to the EU accession countries only.3 See for country studies e.g.Cooke(2001) for UK, Corolleur et al. (2003) in the context of France, Dohse (2000) for Germany.

4 See Amiti (1998), Hummels et al. (1998), Markusen and Melvin (1984), Porter (1990) as an exemplary listing of empirical studies concerning vertical linkages.

5 Federal Association of the Pharmaceutic Industry in Germany (BPI), German Association of Biotechnology Industries (DIB).

7 EuropaBio (2006).

8 Rough estimation based upon Proventa (2004).

9 OECD(2006).

10 Polish Information and Foreign Investment Agency: Biotechnology Sector in Poland 2004.

11 South Moravian Innovation Center (2007).

The European Biotech Industry

Industrial Structure and Vertical Integration

In 2004, the European biotechnology industry counted about 2,200 firms generating a total turnover of € 22 bn (EuropaBio, 2006). Germany, the UK, and France occupied the leading positions in terms of firm number (Table 1).

Furthermore, with respect to turnover, Denmark and Switzerland joined the leading group, which can be traced back to the presence of large multinational corporations. In general, it is apparent that the leading Western European agglomeration areas are also occupied by the larger part of biotech companies. This conclusion corresponds also with the results of Allansdottir et al. (2002). The authors draw a similar picture of the spatial concentration of the European biotechnology using patent statistics. The study reveals that the most innovative regions in terms of patents are in Germany, France, the UK, the Netherlands and Italy. Another remarkable result is that the leading positions correlate to the spatial concentration of downstream sectors (material sciences, organic chemicals, pharmaceuticals and polymers). Furthermore, several studies emphasize the role of local universities and research institutions as well as the supply of a highly educated workforce for the emergence and growth of biotech clusters.12

Summarizing, these results allow the conclusion that: i) the local conditions in R&D infrastructure and capacities; ii) the size of sales markets; and iii) the connection to the (pharmaceutical) downstream sector play an important role for the spatial formation of biotechnology. In this context, the relevance of location factors depends upon the level of geographical aggregation. In international terms, the degree of industrialization, the consumer as well as the downstream market size, and the connection to global markets determine the extent of national biotech industries. On the national level, only few regions benefit from the local presence of biotech firms. In contrast, the occurrence of regional clustering is restricted to national agglomeration areas characterized by high performing endowments of research facilities and highly skilled labor.

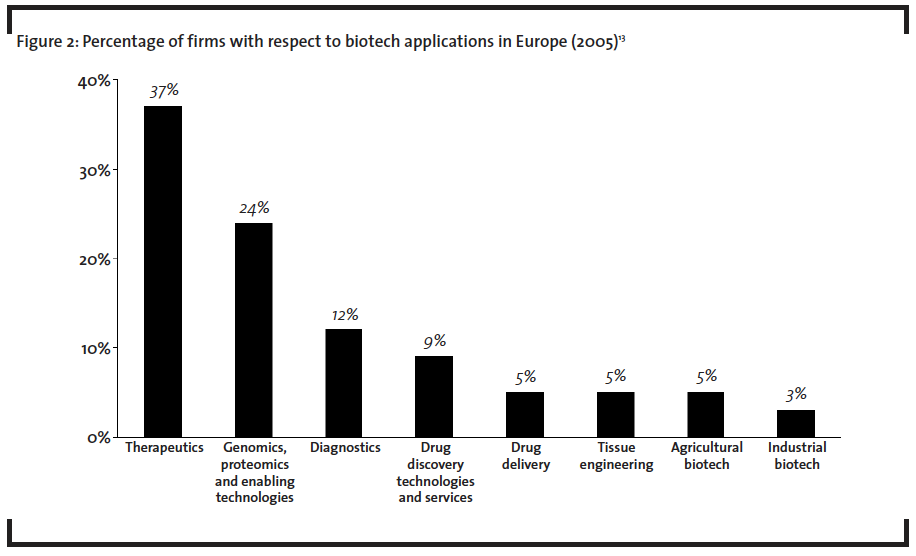

Turning to the cross-sectional orientation of the European biotech industry, Figure 2 shows the percentage of firms with respect to the fields of biotechnological application. In this context, Pharmaceuticals and Enabling Technologies (platform technologies), with 37% and 24%, respectively, are the outstanding categories. Overall, the figure indicates the superior importance of the pharmaceutical sectors for the biotech industry, which legitimates the simplification of the simulated supply chain in section 3, consisting of the pharmaceutical industry as a single downstream sector for the biotech industry.

A common attribute of the majority of biotech firms is the small and medium firm size. According to the OECD survey (2006), the share of companies with less than 50 employees lies between 63% (Belgium) and 86% (Germany). Only few large Life Science Corporations (LSC) dominate the biotechnology industry in Europe.14 These firms attend different markets, primarily for pharmaceuticals but also for chemicals, health care and consumer goods. In Germany, for instance, approximately 30 firms, covering a share in total biotech sales of nearly 70%, occupy this category.

Also in contrast to the majority of core biotech firms, the LSCs are vertically integrated in all stages of the value-added chain from R&D until distribution. In addition, these companies interact with biotech core firms in ways such as the purchase of intermediate inputs, contract research, sales cooperation, and license agreements. In general, the representative core biotech firm is small or medium sized, operating as an intermediate supplier of products, knowledge (licenses and patents) or external knowledge production (contract research) for the pharmaceutical and medical industries. The vertical separation of these upstream and downstream sectors is relatively stable while both industries have recently experienced a period of horizontal consolidation. In this context, Pisano (1990) considers the vertical division of labor between core biotech and established firms in the pharmaceutical industry. The paper concludes that, though both sectors show a tendency for vertical integration due to transaction costs and the need for technology adaptation by the downstream sector, these endeavors are limited by capital restraints of the core biotech firms and a longsome know-how accumulation process within established downstream firms.15

In addition, any more arguments for vertical separation may be supplemented. Since the 1980s, public technology promotions, on one hand, and the increasing availability of venture capital, on the other hand, have advanced the emergence and growth of biotechnology out of the fundamental research in academic facilities. Due to high fixed cost in R&D and production, as well as the extensive research risk, only a few core biotech firms succeeded in becoming established as fully integrated units. The technological gap of the LSCs with respect to biotechnology forwarded their demand for biotech products and services, especially in the form of contract research, and strengthened the division of labour between both sectors. Since the industrial consolidation in the course of the collapse of the stock market bubble in 2001, many biotech companies had financial shortages. In consequence, the firm population decreased by market exits, mergers and acquisitions. Another result was the adjustment of the business models to a stronger focus on services and technologies rather than proprietary development, production and distribution. Finally, these factors resulted in an increased vertical separation between core biotech and life science industries at increased sectoral interdependencies.16

Based upon these results and the findings of existing literature, the relationship between the core biotech industry and LSCs is characterized by: i) the demand for biotech intermediate products and services of the life science industry; ii) the LSCs as competitors for fully integrated biotech firms; iii) the make or buy decision of LSCs with respect to biotech services and intermediates; and iv) the intensity of competition within the biotech industry.

In consequence, an increasing independence of the LSCs from the core biotech industry may be expected for the future, assuming an unchanged market condition. The crucial factor for this development is the tendency of the LSCs to (re-)integrate biotech R&D as a core competence, which is primarily dependent upon the (anticipated) market size for biotech products and applications. This mainly concerns activities, which could not be integrated in default of technological knowledge but are of strategic importance for (pharmaceutical) corporations. In contrast, activities with a high degree of homogeneity, low economies of scale, or minor demand (i.e., specialized services) may be unaffected by the integration propensity of LSCs. Furthermore, a reduction of public technology promotion and hence a reduction of subsidization of core biotech firms would decrease cost advantages of outsourcing biotech activities, which finally reinforces the integration tendency of the life science industry.17 Concerning the opposite dependency of the biotech core industry upon the LSCs, it is necessary to differentiate with respect to different firm types, again. Generally, the increasing concentration in the downstream sector implies a further shifting of market power to the LSCs from the biotech core firms in their capacity as either intermediate suppliers or fully integrated competitors. In this context, it is noted that with respect to market segment and degree of differentiation, the impact of increasing concentration on the biotech sector may vary. On one hand, the fields of biotech products and services are quite heterogeneous, with the result that, on closer examination, the industry disaggregates into separate submarkets with frequently oligopolistic structures. Because of the wide range of biotechnological applications and the innovative potential, customers in different industries prefer a certain degree of diversity in terms of products, processes and suppliers. In consequence, it may be a successful business strategy to focus on a few segments rather than to compete on a homogenous or large-scale production. A vertical acquisition of core biotech companies by LSCs is an exception and conceivable, if the take-over: i) represents an opportunity for vertical restraint with respect to downstream competitors; ii) grants access to strategically important know-how, licenses and patents; or iii) is beneficial due to strong complementarities between intermediates and final products and services.18

12 See e.g., Audretsch and Stephan (1996), Feldman (2000), Stuart and Sorenson (2003).

13 Ernst & Young (2006)

14 Life Sciences are qualified as “…any of the branches of natural science dealing with the structure and behaviour of living organisms” (WordNet: http://wordnet.princeton.edu/perl/webwn?s=life%20science). In these categories particularly fall biochemistry, nutritional sciences, medical technology, pharmacy, environmental technology. The term life science corporation (LSC) follows the definition of Ernst & Young (2000), which is also used by the German Federal Statistical Office (2002): large corporations of the life science industry are firms with more than 250 employees, which do not focus on biotechnology as the only business segment, but undertake intensive R&D efforts for products and processes of modern biotechnology or achieved an annual turnover of more than € 10 m with modern biotech products. In contrast, core biotech firms primarily work with the use of modern biotechnological processes and firm size is smaller than the thresholds of the LSCs.

15 See also Audretsch (2001).

16 See Kranich (2006) for a theoretical discussion of allocation in vertically linked industries.

17 This hypothesis was also confirmed by experts in personal interviews.

International Trade

For evaluating the impact of international trade on the German biotech industry, our department conducted an online survey in 2006. The target audience contained 810 firms consisting of German biotech core companies, equipment suppliers, and LSCs that were compiled by address files of the industrial associations, as well as internet and database search. The subject matters of the survey were led by the central questions: To what extent are biotech firms involved in foreign trade? What significance do the emerging countries Brazil, Russia, India, China (frequently abbreviated BRIC) and the Eastern EU accession states have in terms of sales market, research and production location?

In this context, the survey was structured into five parts: A) the location factors of German biotech firms within Germany; B) international activities of the industry in terms of R&D, production and sales; C) opportunities and risks of globalization for the interviewed firm with a focus on BRIC and Eastern Europe; D) opportunities and risks due to globalization for the overall German biotech industry; and E) information about the interviewed firm with respect to size, business focus, region and age.

The firm survey was accompanied by an expert survey with 106 persons from industry, politics, industrial associations and science.19 Both questionnaires were identical except for firm specific questions. The online survey represents the first study concerning the internationalization of (German) biotech firms. Because the survey primarily asked for qualitative evaluations, the significance of the results cannot be statistically proved. Nevertheless, the outcome appears to be valid in consideration of the feedback rates, which are 12% of firms and 27% of experts, as well as the representative cross-section in terms of application field, firm size and firm age. The expert survey was conceived to check the answers of firms from a different point of view, especially concerning country evaluation and interpretation of firm response.

In the context of this paper, the online survey confirms the major importance of the location factors for biotech firms (Germany), as discussed in the previous subsection. For international activities, the survey concludes that the most important determinants are: i) the enlargement of sales markets; ii) the unification of admission standards (the reduction of market entry barriers); and iii) the access to technological knowledge of research institutions.

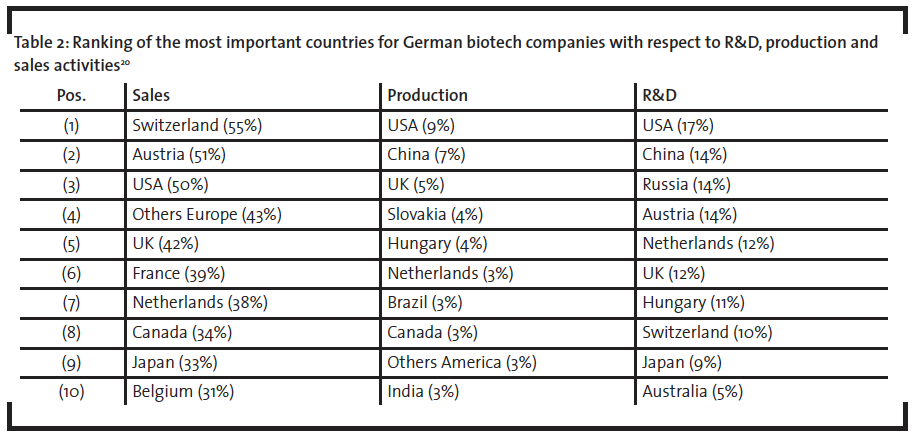

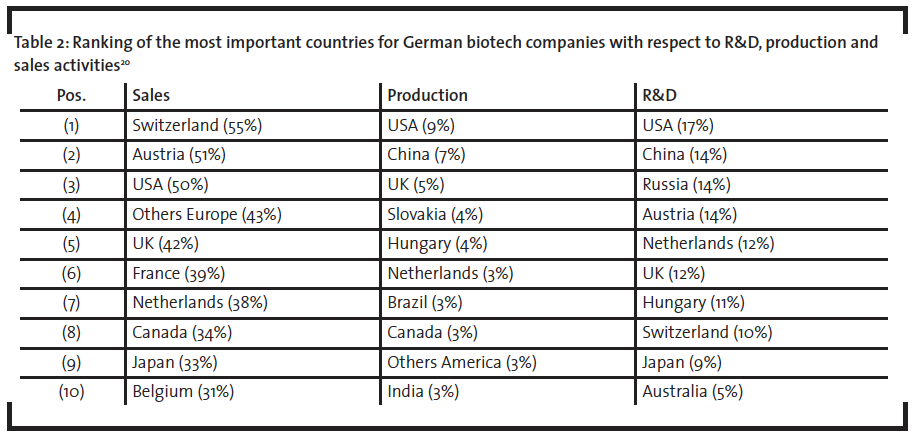

The study reveals that biotech companies participate to a high degree in international trade. About 66% of the firms generate a turnover of at least 30% abroad, where 34% of the firms gain more than 70% of their annual turnover by the export business. Despite the high trade intensity, the majority of firms (41%) realize only less than 10% of their turnover beyond Europe. This implies that the foreign sales of the German biotech industry focuses on Western Europe as indicated in table 2, which shows the rankings of foreign countries preferred by German biotech firms. The percentages in brackets represent the relative frequency of firms, which established a relationship to the corresponding country. In this regard, the indications summarize the foreign activities in terms of their varying intensity. In respect of sales, for instance, the foreign activities range from pure exporting, sales corporations to own subsidiaries; concerning R&D this contains (bilateral) contract research or own foreign R&D facilities.

With respect to sales, the most important destinations are in Western Europe: Switzerland, Austria, the UK, France and the Netherlands. Regarding the foreign engagement in terms of production, the results confirm the statements of trade theory, where the trade volume is determined by spatial closeness and the market size of foreign trade partners. This explains the high relevance of the Western European countries, on the one hand, and the importance of North America, where the USA represents the largest global pharmaceutical market, on the other hand. In terms of production, it is apparent that Western European countries are underrepresented. which can be traced back to their geographical closeness to Germany in which the largest part of manufacturing for the European market is located. Furthermore, countries featuring a large (expected) market size but are distant from Europe, e.g., USA or China, tend to be supplied by local production. For R&D, the biotechnological leader, the United States, is closely followed by China, Russia and Western Europe. This implies that R&D activities follow not only the research potential and infrastructure, but also the market size and manufacturing, which explains the relatively strong correlation to the production ranking. This relocation dependency may be an evidence for strong vertical linkages between R&D and production (or downstream sectors).

In the survey we explicitly asked for an evaluation of the BRIC and CEE countries in terms of their competitive position and biotech market potential. The majority (60%) of the survey participants consider the role of competitors from the emerging countries China and India as relevant. In contrast, about 69% attribute a meaningful market potential to those countries. Overall, the questioned firms plan to expand their sales activities in the emerging BRIC (65%), followed by 32% and 9% that intend to establish R&D or production capacities.

Regarding the EU accession states, about 63% of the responding firms assess the competitive risk from the CEE countries as unimportant or almost unimportant. With respect to the market potential, a clear rating is not available. About 48% of the firms assess the market size as relevant opposed to 45%, which see no potential in Eastern Europe. Nonetheless, 61% of German biotech firms plan an extension of sales in the CEE countries, as well as 32% in R&D and 9% in production. The importance of the CEE countries, in terms of biotech upstream activities, particularly concerns Hungary and Slovakia, as also shown in Table 2. These results raise the question: What factors are responsible for the relatively weak position of the CEE countries compared to the BRIC states?

At first, the economic potential in the CEE countries is restricted in several ways: the low market size and purchasing power, the below-average research infrastructure in comparison with Western Europe, as well as the scarce supply of highly qualified biotechnologists. Furthermore, the Eastern European research locations are suffering from two dilemmas: first, the geographical closeness to the industrialized European core implies that highly skilled R&D can be undertaken without leaving the core. The case is different in China and India, where the immense market potential and the spatial (and political) distance requires a local establishment. Second, the European integration process promotes the interregional mobility of workers. The income and professional perspectives are significantly better in Western Europe, which makes highly skilled specialists leave peripheral regions to look for job opportunities in the core.21

With respect to the pharmaceutical industry as a downstream sector for biotech companies, further barriers for development occur. Although the pharmaceutical industry has recently been characterized as a dynamic development, the total market size accounts just for 6% of the European Union. In this context, Poland plays with € 3.8 bn , the largest part of the CEE countries, followed by Hungary (€ 1.9 bn), Czech Republic (€ 1.6 bn), and Slovenia (€ 672 m).22 In 2003, the local pharmaceutical industry in the CEE countries achieved revenues of € 5.3 bn. The largest Eastern European manufacturer with 202 firms is Poland, ahead of Hungary with 102 firms. A major part of sales growth can be attributed to the imports of multinational corporations (via sales branches) and locally produced generics. Therefore, it can be concluded that local manufacturing predominantly supplies local markets so that the competitive risk from the CEE countries is relatively low. Competitive advantages in labour costs have a lower impact due to high capital and technology intensity in the biotech and pharmaceutical sectors, which was also confirmed in personal expert interviews. According to expert opinions (survey and interviews), the expansion of international biotech activities in the CEE countries is currently constrained to production and services of standardized products and processes, especially in the field of clinical testing and automatic screening.

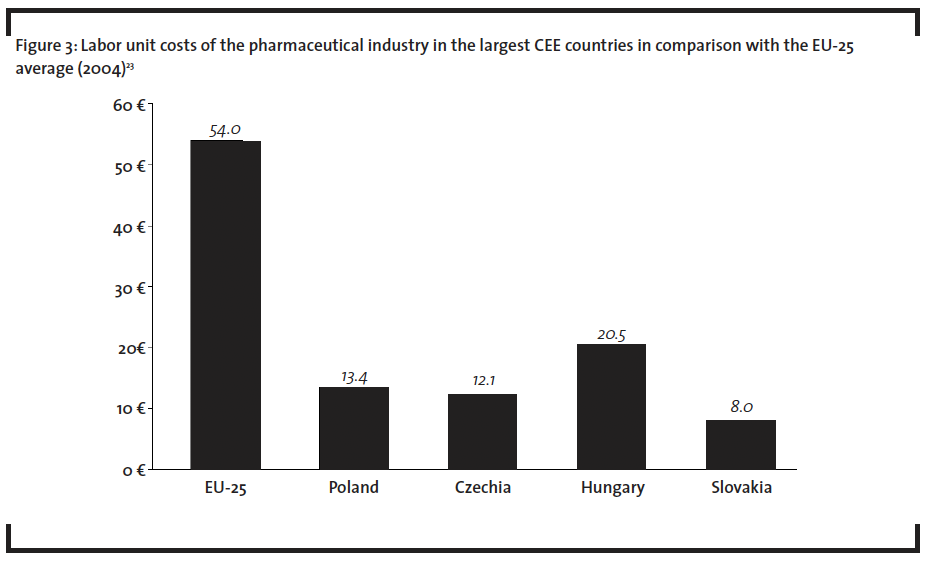

Opposed to these dampening factors for an eastward relocation, the spatial formation of the biotech industry is also dependent upon the dynamics of the pharmaceutical sector. Although this downstream sector is currently weakly established in the CEE states, it sensitively responds to national wage differences. Figure 3 shows the labor unit costs of the pharmaceutical industry (2004) for Poland, Czechia, Hungary and Slovakia compared to the EU-25 average, which is about onefourth of the Eastern accession states.

These cost advantages imply a motive for an eastward relocation of pharmaceutical firms. In the course of the EU integration process, trade barriers between European countries have fallen, which has made it profitable to attain the large Western European pharmaceutical markets from distant low cost locations. A spatial shifting of the pharmaceutical industry, characterized as being the relevant market for biotech firms, involves also a relocation tendency of the corresponding upstream sector via vertical linkages. This linkage driven development may entail increasing spatial technology diffusion that could (partially) compensate the technological gap of the CEE research facilities. Against this background, the next section introduces a modeling framework for quantifying the spatial dynamics of the European biotech industry from this vertical linkage perspective.

Simulation

The Model

The New Economic Geography, initially introduced by Krugman (1991), provides explanations for industrial agglomeration based upon increasing returns and imperfect competition. Based upon classical economic geography models (e.g., Christaller, 1933; Lösch, 1940), the first proceeding, commonly referred to as the core-periphery mode”, explains industrial agglomeration with respect to regional mobility of workers. Later on, the theoretical debate was extended by the implementation of vertical linkages as a further agglomerative force, as discussed in the first section, where Krugman and Venables (1995) as well as Venables (1996) provided seminal papers.

For modeling the European biotech industry, this paper picks up the latter model roughly illustrated in this section.

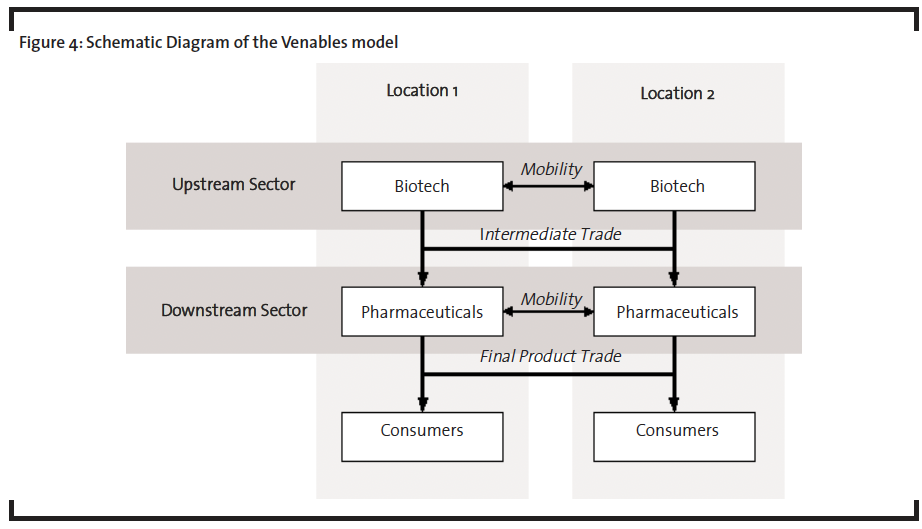

The Venables model considers a simple supply chain consisting of an upstream sector providing a downstream sector with intermediate products while this downstream sector supplies consumer with final products. Both such vertically linked industries are spread across two spatially separated locations (Figure 4). Both industries produce a continuum of differentiated goods by the use of labour, while the downstream sector additionally employs the output of the upstream sector as a further input factor. The downward arrows between sectors and consumers indicate these commodity flows. Both types (intermediate and final products) are internationally tradable signified by the sectoral cross-links labeled by ‘trade’. The firms in both industries are competitive monopolists, so that due to increasing returns and (technical) preference structure, one firm produces only one differentiated variety.

The market supply attends to a representative private household, which demands not only the whole consumer good continuum, but also a homogenous outside good, which can be considered, as all these goods, which are not in the focus of this model. The allocation between both sectors is characterized by mutual interdependencies, which are also referred to as forward and backward linkages. The forward linkage, also called demand linkage, describes the dependency of the upstream industry upon the downstream industry: the larger the downstream sector, the larger is the relevant market for the intermediate sector. The backward linkage, also described as cost linkage, results from the price index effect: the more firms produce in the upstream sector, the higher is the competitive pressure implying decreasing intermediate prices, which finally decrease the procurement costs of the downstream industry. It is applied for both mechanisms: the larger the first sector is, the larger is the other. In the framework of the NEG, the spatial distance between locations is represented by trade costs (usually Samuelson iceberg costs), which are dependent upon the value of goods exported from location r to location s. Trade costs involve not only transportation costs but also every cost arising from international trade. These include tolls and import taxes, insurance rates, labour and storage costs, etc., and additionally efforts caused by lingual and cultural differences or varying legal conditions, but are difficult to quantify. Against this background, not only local market size and production costs influence the location decision of firms, but also the amount of trade costs. The higher the trade costs, the stronger firms tend to locate at the larger market for reducing the costs of spatial transfers. In contrast, at low trade costs, local cost advantages become more important than local market size.

The model results in two spatial distribution functions, νu and νd, where the first one describes the spatial spreading of the upstream industry, and the second one of the downstream industry.24 The distribution of an industry is measured by the ratio of sectoral output in location s to the corresponding output in location r. For an example if νu takes the value 5, the total output of the upstream industry in location s is five times higher than the output of the same industry in location r, implying that the upstream industry geographically concentrates in s.

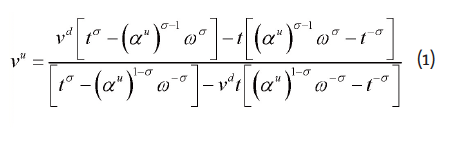

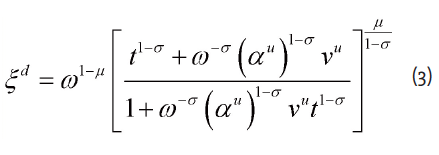

In this context, equation (1) represents the spatial distribution of the upstream industry dependent upon several exogenous parameters and the distribution of the downstream industry, νd:

Equation (1) reveals two mechanisms. First, it contains the forward linkage, which implies that the distribution of the downstream sector positively determines the distribution of the upstream sector. Second, we find parameters representing the production situation in both locations: α and ω. The first one is the ratio of production coefficients in location s to location r reflecting productivity differences. The second one, ω, defines the ratio of wages in both locations and can be interpreted as the wage differential.25 In general, the location with lower production costs is the location with a smaller consumer market, and thus, with a lower concentration of downstream firms. This, in turn, reduces the motivation of upstream firms to move to the location characterized by cost advantages. The tension between those opposing mechanisms is determined by the level of trade costs, t, with the result that, at a certain degree of trade integration, one force exceeds the other one. In the extreme, where international (intermediate) trade is costless, the upstream industry totally agglomerates in the country with lower production costs.

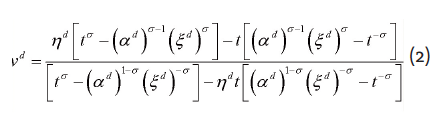

Equation (2) describes the spatial distribution of the downstream industry with respect to the distribution of the upstream industry.

Similarly as in equation (1), the outcome is dependent upon the backward linkage and local production and cost conditions. In this context, the variable ξ defines the relative downstream costs that are the procurement costs for intermediates in the ratio of location s to r, again:

This expression depends upon the wage differential, trade costs, the size of consumer markets, μ, and finally upon the distribution of the upstream industry. The level of trade costs determines the relevance of the upstream industry distribution. With decreasing trade costs, the concentration of the downstream industry becomes increasingly independent of the location of upstream firms. Under specific conditions, a potential outcome is the total geographic specialization, where upstream and downstream industries totally agglomerate in different locations. The interaction of mechanisms summarized in the functions (1) and (2) allocate an equilibrium distribution of both sectors, where the intersection of the corresponding graphs defines one or multiple equilibrium states. In the following subsection, we adapt the modeling framework to the case of the European biotech and pharmaceutical industries.

Simulation Design

Within the simulation study, the Venables model is utilized to analyze the impact of the European enlargement in 2004 (EU15+10) upon the European biotech industry. In doing this, the following facts, presented in the second section, are explicitly taken into account: i) the strong focus of biotech firms on upstream activities incorporating R&D and the production of intermediates; ii) the dominance of the pharmaceutical industry as a major application field; iii) the great importance of inter-European trade; and iv) the spatial concentration of industries in the Western European countries. Based upon these facts, we make the following assumptions:

- The biotech core industry is considered an upstream sector of the pharmaceutical industry as indicated in Figure 4.

- Both sectors have access to the same labour market.

- Because only a singular supply chain is modeled, the partial-analytical version of the Venables model is used implying exogenous wages and income.

- We summarize the Western European countries (AT, BE, CH, DE, DK, FR, GB, IT, NL) to one location, referred to as the core region, and the residual European states (E, FI, GR, IE, PT, NO, SE) to a second location, defined as the peripheral region.26

This approach allows not only an analysis within a two-location version but also a modeling of the European Eastern enlargement by adding the CEE countries to the periphery.

All in all, this simulation design raises several problems: i) the Venables model does not incorporate R&D activities so that corresponding expenditures fall in production fixed costs; ii) capital as an important input factor, especially in the pharmaceutical industry due to high development costs of new agents, are neglected; iii) the model does not involve the decisive public research infrastructure; and iv) the agglomeration forces are ascribed to vertical linkages only, but not to factor mobility, for instance.

Nonetheless, this approach features convincing advantages with respect to the present case. The markets for biotech products and services as well as pharmaceuticals are fragmented to a high degree, which can be traced back to the relative low substitutability between products on the one hand, but also to the distinctive consumer preference for diversity, on the other hand. In addition, due to patents and property rights, temporary niche markets appear, which only few firms provide. The choice of monopolistic competition sufficiently takes account for the structures in both sectors. Furthermore, both industries are characterized by increasing returns, principally in R&D and production. It may be held again to the missing implementation of explicit R&D activities and associated demand effects that the Venables model describes basic agglomeration dynamics of vertically linked industries; this is also valid in the biotech and pharmaceutical industries. The simulation results, which can be interpreted as agglomerative potential, will be completed by the impact of entrepreneurial R&D and public research policy.

Simulation Results

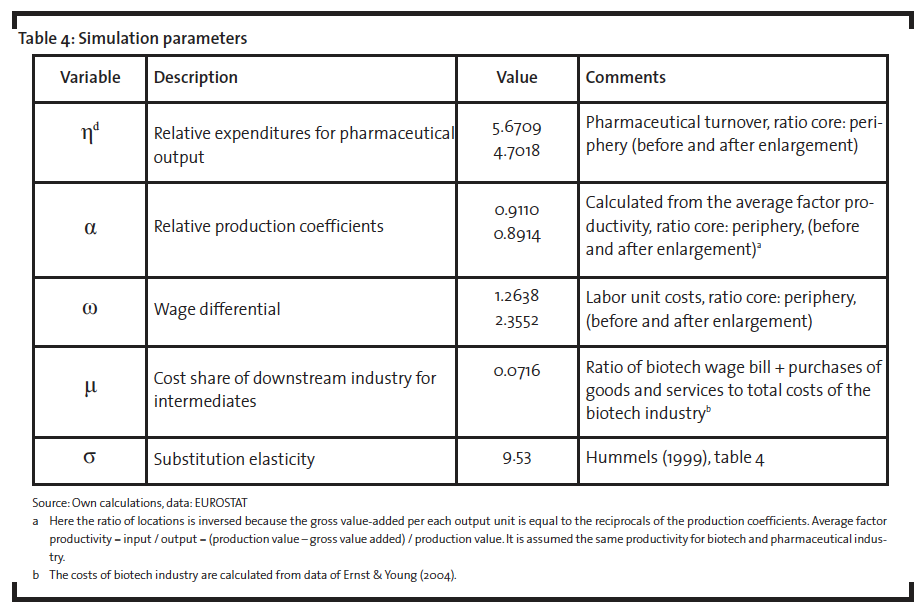

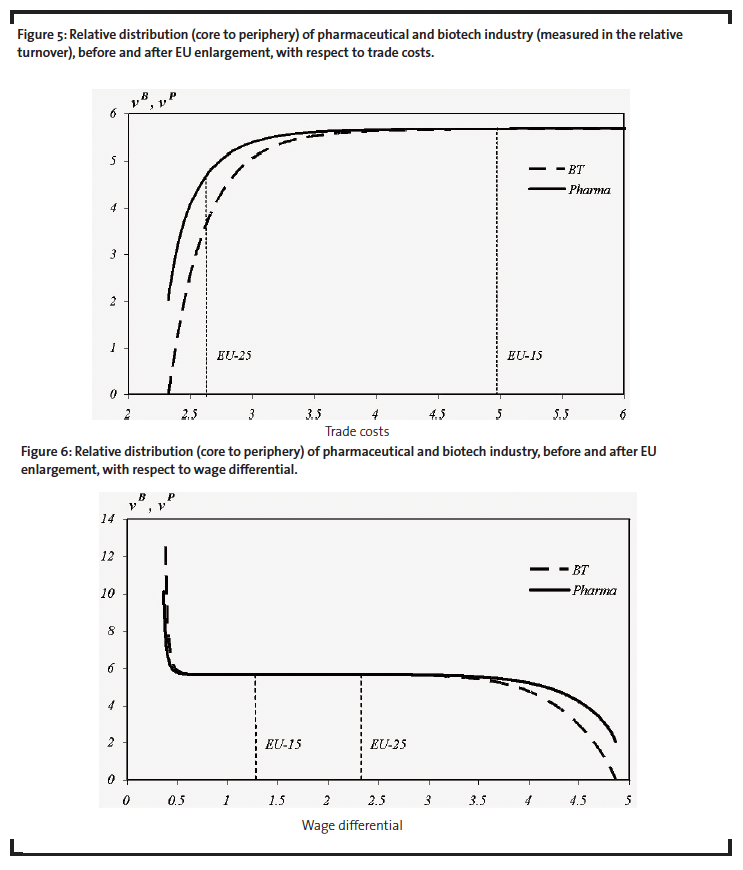

Figure 5 and Figure 6 illustrate the simulation outcomes as well as the comparative-static analysis based upon the simulation parameters in Table 3. Figure 5 shows the distribution of sectoral output in the ratio core to periphery with respect to trade costs. Here, νb stands for the distribution of the biotech instead of upstream industry and νP for pharmaceutical in terms of the downstream industry. Both marks indicate the calibrated trade costs level for the period before and after the EU Eastern enlargement in 2004. This means for “EU-15” that before the European enlargement in 2004, both industries very spatially concentrated in the same degree: the biotech and pharmaceutical industries were 5.8 times stronger agglomerated in the European core compared to the periphery.

The trade cost values for “EU-15” and “EU-25” are indirectly determined from the real ratio of sectoral turnovers for 2003 and 2005, while the distributions are functions of trade costs.

The Eastern enlargement implies for the European Union not only a larger common economic area, but also a simultaneous convergence of legal conditions, an increasing expansion of transportation infrastructure, an abolition of tolls and import regulations, and decreasing average trade costs with increasing trade volume.

With decreasing trade costs, the spatial concentration of both sectors, characterized by a decreasing ratio, declines to the benefit of the peripheral countries. Furthermore, the biotech industry

shows a stronger relocation to the periphery compared to the pharmaceutical industry, apparent at the divergence of the sectoral distribution on the left hand side of the figure. This implies that the pharmaceutical sector features an increasing relative specialization at a decreasing spatial concentration in comparison to the upstream sector. The reason for this development is the stronger sales market orientation of the pharmaceutical industry: the expenditures for respective products in the Western European states are almost five times higher than in the periphery (Table 3, first line).27

Figure 6 shows the simulation results with respect to a change in the relative wages (again: core to periphery).

The European enlargement is associated with an increasing wage differential from 1.2 to 2.3, in consequence of the accession of the CEE countries. It is apparent that the current and the past wage differential lie in a relatively inelastic range of the sectoral distribution function. The spatial concentration does not respond to an increasing (decreasing) wage differential until the value is above 3.5 (below 0.5). Only in a situation beyond these values, the figure shows relative specialization and a tendency to a symmetric outcome (increasing asymmetry). In the course of economic integration, a convergence of wages and income is expected within the EU, which corresponds with a limiting wage differential of 1. With respect to figure 6, the economy moves from a wage ratio of 2.3 leftward to 1 without affecting the spatial distribution of both sectors. The reason for the rigidity is the strong forward linkage between biotech and pharmaceutical linkages, which more than compensate differences in local production costs. This means that the dependency of the biotech industry upon the pharmaceutical industry, which primarily orientates on the larger core market, has a stronger impact on the location decision than lower wages in the periphery.

Discussion and Conclusions

Considering the simulation, the results provide two central messages. First, the strong vertical linkages between biotech and pharmaceutical industries compensate the dispersive impact of wage differentials across European countries. Because the European core features the larger consumer market, it primarily determines the downstream sector distribution, which exerts a strong attraction for the biotech industry. Wage differentials within the real parameter domain do not have an impact on the concentration of both the biotech and pharmaceutical industries. The second implication is the sensitivity of sectoral distribution with respect to the level of trade costs. The simulation shows that a further decrease results in an increasing relocation of both industries to the European periphery. In the face of this outcome, the concerns, that public investments in the core get lost by a relocation of the biotech industry, appear to be justified. However, this conclusion requires a further discussion. One point of critics is addressed to the simulation design. In this context, the partial-analytical approach implying exogenous income and wages may provide a relevant dampening effect for the industrial relocation. On the one hand, there is the limited supply of highly qualified labour and the research infrastructure in the periphery, which is not included in the model but represents crucial location determinants, as shown in the previous section. The supply of skilled labour and R&D facilities in the CEE countries are restricted by mobility as well as low capacities for public investments in the capital-intensive biotech and pharmaceutical research. On the other hand, a further limitation stems from the model design: the periphery is considered as one common location implying a homogeneous economic area. In reality, the periphery disaggregates into spatially separated countries arranged like a ring around the core. Some peripheral countries are quite distant from each other so that the underlying assumption of costless intraregional trade is questionable. Nevertheless, this argument may be countered by several empirical studies concerning the exports of peripheral countries, e.g., the Eastern European states.28 The largest part of the peripheral exports concentrates on trading with the core while the intraperipheral flows of trade are relatively low. Without these distortions, the spatial production network would be much more filigree; furthermore, the market size of the periphery would be significantly reduced, which works against dispersion.

Summarizing and turning back to the central question posed in the first section, a restrained relocation tendency from the European core to the periphery results for both, the biotech and pharmaceutical industries. Restrictions in labour, infrastructure, and technology supply considerably dampen the industrial shifting. Along with the low peripheral market size (for both sectors), only moderate changes arise in the spatial distribution.

Against the background of these results: What can be concluded for economic policy?

Baldwin et al. (2003) summarized central issues of the NEG with regard to economic policy. Nonlinearities, thresholds, and discontinuities determine agglomeration, and thus an efficient economic political intervention. As shown in the previous section, the current wage differential is in an inelastic range of sectoral distribution, which also will not be left at complete convergence. Public intervention via price or factor cost subsidization for promoting industrial agglomeration potentially requires enormous expenditures in which legitimization is questionable with respect to proportionality and economic efficiency. Therefore, it is important to note that, with decreasing trade costs, the efficiency of agglomeration stimulating instruments is increasing.

From the viewpoint of regional policymakers, political options are even more restricted due to financial and hierarchical constraints. In addition to lower public budgets, a conflict of regional and supraregional interests develops. While industrial agglomeration is desirable for local policy, on the national or supranational level, these ambitions lead to industrial dispersion and a loss of spatial efficiency due to lower economies of scale. The solutions proposed for this dilemma refer to spatial specialization implying the emergence of industryor technology-specific clusters. The basic idea is to compensate missing spatial economies of scale by competitive advantages due to specialization. This approach is debatable with respect to the following facts:

- Biotech products and services find use only in few applications, which are dominated by the medical and pharmaceutical sectors.

- The biotech industry disaggregates in many small-scale niche market and technology fields, which are not inevitably interconnected. This implies that endogenous agglomeration tendencies by spillover effects are lower as they would be for a more homogenous industry.

- The vertical linkages between biotech and pharmaceutical industries are strong in such a way that the upstream industry primarily orientates on the location of the downstream industry. The pharmaceutical industry is agglomerated in the European core as a result of larger sales markets. A spatial separation of the sectors implies an immense subsidization of peripheral regions, public investments in a highly qualified labor supply and sufficient infrastructure.

- Without supranational coordination, regional (national) politics may be conflicting what is associated with a loss of spatial efficiency and common welfare.

In the context of these conditions, a final and general recommendation for economic policy is not possible because the political tradeoff between spatial economies of scale and regional equality depends upon the aversion to asymmetry of the European population. As demonstrated by Charlot et al. (2004), the industrial core is almost able to compensate the periphery for welfare losses resulting from agglomeration. This implies interregional transfers as realized by the European Regional Development Fund (ERDF), for instance. The related question is: For what purposes should these interregional investments be applied? With respect to the present case, a promotion of peripheral industries is reasonable if these industries do not only feature comparative cost advantages, but also low trade costs and major economic importance in terms of output and employment. For Eastern Europe, this may concern industries with a relative high labor intensity, distinctive product or process standardization, and largescale production. However, a further consideration of an optimal European technology mix requires a comprehensive analysis of the European industries and may be subject for future research. In this context, the outcomes of this paper suggest a further consideration of public technology promotion in their capacity as location factor, potential spillover effects between biotech firms as a relevant agglomeration force on the regional level, as well as the international mobility of biotech researchers as a destabilizing impact for the European periphery.

What can finally be concluded for the theoretical background? First, simulation and empirical results confirm the statements of the NEG. Models of the classical trade theory predict that regional differences in terms of production costs tend to converge and economic activities to disperse. In contrast, modern approaches by the NEG as well as the New Trade Theory emphasize agglomeration based upon increasing returns and imperfect markets and the corresponding differences regarding wages, income and factor endowments. However, this paper reveals that the core-periphery structure of European industries may remain, in spite of increasing trade integration and decreasing wage differentials. Exogenous asymmetries between countries, e.g., in terms of country size, suggest an attractive field for future research despite the loss of analytical convenience given by symmetric countries. Second, the reason for the success of the NEG is the potential to provide quantitative statements compared with alternative location theories. In consequence, case studies and econometric analysis of the spatial formation of industries may be complemented by a stronger use of numerical simulations, especially in the context of multi-country frameworks.

Thankful acknowledgement for the financial support of the Ministry of Science and Culture of Lower Saxony, and for the support of BPI e.V. and DIB during the online survey. Furthermore, I would like to thank for the valuable comments of the unknown referee.

References

Alllandsottir, A., Bonaccorsi, A., Gambardella, A., Mariani, M., Orsenigo, L., Pammolli, F., Ricaboni, M. (2002), Innovation and Competiviness in European Biotechnology, Enterprise Papers, 7, Enerprise Directorate General, European Commission, Luxembourg.

Amiti, M. (1998), New Trade Theories and Industrial Location in the EU: A Survey of Evidence, Oxford Review of Economic Policy, 14(2), p. 45-53.

Ando, M., Kimura, F. (2006), Fragmentation in Europe and East Asia: Evidences from International Trade and FDI Data, in: Ruffini, P.-B., und Kim, J.-K. (2007), Corporate Strategies in the Age of Regional Integration, Cheltenham, 2007.

Audretsch, D.B., Stephan, P.E. (1996),Company-Scientist Locational Links:TheCaseofBiotechnology,AmericanEconomic Review, 86(3), p. 641-652.

Audretsch, D.B. (2001), The Role of SmallFirms in U.S. Biotechnology Clusters, Small Business Economics, 17, p. 315.

Baldwin, R., Forslid, R., Martin, P., Ottaviano, G. and RobertNicoud, F. (2003), Economic Geography & Public Policy, Princeton University Press, Princeton and Oxford.

Charlot, s., Gaigne, C., Robert-Nicoud, F., Thisse, J.F. (2004), Agglomeration and welfare: the core-periphery model in the light of Bentham, Kaldor, and Rawls, Journal of Public Economic, 90, p. 325-347.

Christaller, W. (1933), Die zentralen Orte in Süddeutschland, Jena.

Cooke, P. (2001), Biotechnology Clusters in the U.K.: Lessons from Localisation in the Commercialisation of Science, Small Business Economics, 17, p. 43-59.

Corrolleur, F., Mangematin, V., Torre, A., (2003), French Biotech Start-Ups and Biotech Clusters in France. The Importance of Geographic Proximity, in: Fuchs, G., Luib, B., Biotechnology in Comparative Perspective Growth and Regional Concentration,London:routeledge.

Dohse, D. (2000), Technology Policy and the Regions the Case of the Bio-Regio Contest, Research Policy, 29(9), p. 1111-1133.

Ernst & Young (2000), Gründerzeit Zweiter Biotechnologie-Report, Ernst & Young Deutsche Allgemeine Treuhand AG, Stuttgart.

Ernst & Young (2004), Per Aspera Ad Astra Deutscher Biotechnologie-Report 2004, Ernst & Young, Deutsche Allgemeine Treuhand AG, Stuttgart.

Ernst & Young (2006), Zurück in die Zukunft Deutscher Biotechnologie-Report, Ernst & Young Deutsche Allgemeine Treuhand AG, Stuttgart.

EuropaBio (2006), Biotechnology in Europe: 2006 Comparative Study, The European Association for Bioindustries, Brussels.

Feldman,M.P.(2000),WhereScienceComestoLife:University Bioscience, Commercial Spin-Offs, and Regional Economic Development, Journal of Comparative Policy Analysis: Research and Practice, 2, p. 345-361.

German Federal Statistical Office (2002), Unternehmen der Biotechnologie in Deutschland Ergebnisse einer Pilotstudie für das Jahr 2000, Federal Statistical Office, Wiesbaden.

Hummels, D., Rapoport, Yi, K.-M., (1998), Vertical Specialization and the Changing Nature of World Trade, Economic Policy Review, 4(2).

Hummels, D. (1999), Toward a Geography of Trade Costs, Mimeo, Purdue University.

Kranich, J. (2006), The Strength of Vertical Linkages, Working Paper Series in Economics, 20, Lüneburg.

Kranich, J. (2007), Biotechnologie und Internationalisierung Eine Bestandsaufnahme der deutschen Branche, VDM Verlag, Saarbrücken.

Kranich, J. (2007), Biotechnologie und Internationalisierung, Ergebnisse der Online-Befragung,Working Paper Series in Economics, 45, Lueneburg.

Krugman, P.R. (1991), Increasing Returns and Economic Geography, Journal of Political Economy, 99, p. 483-499.

Krugman,P.R.,Venables,A.J.(1995),GlobalizationandtheInequality of Nations, Quarterly Journal of Economics, 110(4), p. 959-968.

Lösch, A. (1940), Die räumliche Ordnung der Wirtschaft, Eine Untersuchung über Standort, Wirtschaftsgebiete und internationalen Handel, Fischer, Jena.

Markusen, J.R., Melvin, J.R. (1984), The Theory of International Trade and its Canadian Applications, The Canadian Journal of Economics, 18(4), p. 929-931.

Martin, S. (1993), Advanced Industrial Economics, Blackwell, Oxford, Cambridge.

Midelfart-Knarvik, K.H., Overman, H.G., Redding, S.J., Venables, A.J. (2000), The Location of European Industry, European Commission. Economic Papers 142, ECFIN/318/00EN.

OECD (2002), International Mobility of the Highly Skilled, OECD Policy Brief, July 2002.

OECD (2005), A Framework for Biotechnology Statistics, OECD, Paris, 2005.

OECD (2006), OECD Biotechnology Statistics 2006, OECD, Paris, 2006.

Pisano, G.P. (1990), The Governance of Innovation: Vertical Integration and Collaborative Arrangements in the Biotechnology Industry, Research Policy, 20, p. 237-249. Porter, M.E. (1990), The Competitive Advantage of Nations, Free Press, New York.

Proventa (2004), Human Biotechnology in Hungary, An Industry Overview, PROVENTA Capital Advisors GmbH, Bad Homburg. South Moravian Innovation Center (2007), Czech Biotech Report 2007.

Stuart, T., Sorenson, O. (2003), The Geography of Opportunity: Spatial Heterogeneity in Founding Rates and the Performance of Biotechnology Firms, Research Policy, 32, p. 229-253.

Venables, A.J. (1996), Equilibrium Locations of Vertically Linked Industries, International Economic Review, 37(2), p. 341-359.