The Influence of the Global Crisis on the Management of the Small Firms Active in the Romanian Pharmaceutical Industry

Abstract

The recent economic and financial crisis is considered global – as it has impacted national economies, business sectors, and companies. However, the impact of the crisis on a specific national economic system varies largely, case by case, both as intensity and lag time.

The purpose of this paper is to present some of the results of the research conducted in 2010 on how this global crisis has influenced the management of Romanian small and medium size enterprises (SMEs) active in the pharmaceutical sector (pharmacies) – in terms of their strategies and decisions made. The article reports some results in line with the author’s previous research on firms’ management and entrepreneurial spirit in Romania, bringing original elements – as decision lag time. The research methodology was survey-based, data being collected during August-September 2010.

The research offers interesting results on these companies’ management. In spite of early reactions to the global crisis, a decision lag time up to two years was identified. One surprising output is that pharma SME managers – regardless of their professional and entrepreneurial skills – display a certain lack of management knowledge and culture as well as a weak understanding of what strategic management actually is. Hence, the evident outcome is that there is a need for solid management education, and training programmes in subjects like decision making and strategy.

The research conclusions are useful for both scholars and practitioners: entrepreneurs and company decision makers, as well as for management training institutions, universities, and education policy makers who are participating in a life-long learning process striving to develop the managerial capacity of Romanian firms active in pharma industry.

1 Introduction

The current global financial and economic crisis began in December 2007 and sharpened in September 2008. The ‘global recession of 2009’ is considered by some authors as marking “the ending of a global development cycle which began in the early 1950s” (Gore 2010: 714). It has had and is continuing to have a considerable impact on different geographic regions (Jara, Moreno and Tovar 2009; Arieff, Weiss and Jones 2010; Fidrmuc and Korhonen 2010; Jha, Sugiyarto and Vargas-Silva 2010); on national economies and cross-country as well (Berkmen et al. 2009; Claessens et al. 2010; Lane and Milesi-Ferretti 2011); economic systems, business sectors, and companies. Significant research was focused on impact of the global financial crisis on different markets: equity, fixed income, foreign exchange, and emerging markets (Melvin and Taylor 2009).

The impact of this crisis varies within large limits – both as intensity and lag time (delay) – depending on how large, and powerful a national system is, how much it is connected to the global economy, and how sophisticated its banking infrastructure is. Wolf (2010) demonstrates that sophisticated finance does bring benefits (countries with larger financial sectors in ‘60s grew faster over the next three decades than those that did not). However, this global crisis had a softer impact on economies with less sophisticated financial products and, therefore, weaker ties with the American ‘bubble’ and ‘toxic’ financial products.

For some reasons (strong inter-links with many global firms, size of the economy) the impact of the crisis on the Romanian companies should be harder while, for other reasons (not-so-sophisticated financial products and services, government actions), softer – but delayed.

The impact of the global economic and financial crisis on Central, Eastern and South-Eastern European countries is presented by a Report of the European Central Bank, synthetically, in terms of key macro-economic indicators (Gardó and Martin 2010). As other transition economies, Romania has faced a double-shock: “a sudden stop and reversal of capital inflows, and an exports collapse due to the global slump” (Nuti 2009: 7).

It was in the summer of 2010 when the Romanian Government took action: the salaries in the public sector were cut by 25% (June 2010) and the state budget was amended (August 2010). It seems that these actions of the Government have made Romanian companies aware of the crisis rather than the company managers’ own analyses and predictions (Scarlat 2011).

The pharmaceutical sector is frequently included in the chemical industry, and it is usually focused on other topics than crisis impact (mostly innovation, product development, strategy – as far as mergers & acquisitions or outsourcing). In this respect, other European countries are more attractive than Romania – as Germany (Schmidt 2011), Switzerland (Seeger, Locker and Jergen 2011), Belgium (Abrahamsen et al. 2011; Essenscia 2011; Teirlinck and Poelmans 2012) or European market as a whole (Festel and De Cleyn 2011). On the other hand, the literature on the influence of global crisis refers to the industry in general (notably, European Parliament – Policy Department Economic and Scientific Policy: Impact of the Financial and Economic Crisis on European Industries, Brussels, 2009) and less to the management aspects.

Consequently, the references to the management of Romanian firms facing the crisis are not rich, and the literature on the crisis impact on the management of the Romanian pharmaceutical firms is practically missing. This paper contributes to fill this gap.

The purpose of this paper is to present some results of the research conducted in 2010 on how the global financial and economic crisis has impacted the management of the Romanian small and medium size enterprises (SMEs) active in the pharmaceutical industry. The research targeted pharma SMEs from larger urban areas (cities with a population larger than 100,000 inhabitants). The focus was on the pharmacies’ management and their managers’ strategic and current decisions.

More specifically, the research questions were: (i) How fast the managers reacted facing the crisis; (ii) How the crisis has influenced the firm strategy; (iii) Which were the decisions made by the managers under the pressure of the crisis; (iv) How the crisis has impacted the overall performance of the firm.

The next section is dedicated to a quick but relevant literature survey.

Then the paper’s structure is this: research objectives and methodology; results followed by discussion and conclusions. Some limitations are also mentioned and further research is suggested as well.

2 Theory framework

The term ‘financial crisis’ is applied to situations in which financial institutions lose significant part of their value, abruptly and unexpectedly. Over the last two centuries, many financial crises were associated with banking panics, crashes of stock markets, and the bursting of other financial bubbles, currency crises and sovereign defaults (Kindleberger and Aliber 2005, Laeven and Valencia 2008).

The economic crisis mechanism is intimately associated with the theory of free-market economy. The current global crisis (for direct insights see: Paulson, 2010) gave credit to Minsky’s model of the credit system: Minsky (1986, 2008) stated that the free-market financial system swings between robustness and fragility (i.e. business cycle); after recession periods when companies expect profits to rise and lenders hope that the loans will be repaid – hence the risk aspect. The development is expectation- and speculation-based (Hamm 2009).

Taleb (2007) has warned the bankers about using in excess probabilistic models and missing the possibility of catastrophic events (‘black swans’). The metaphor of ‘black swans’ is used just to define highly improbable, almost impossible to predict events. “Instead of perpetuating the illusion that we can anticipate the future, risk management should try to reduce the impact of the threats we don’t understand“ (Taleb et al. 2009: 78). More recently, Paté-Cornell (2012) re-examines the concept and adds the ‘perfect storm’ metaphor – to describe “the unthinkable or the extremely unlikely” (as the extreme unlikely conjunction of three different regular storms: a storm that started over the US, a cold front coming from the North and the tail of a tropical storm coming from the South). Even less probably, the elements in conjunction are cause-effect linked (see Fukushima accident: Scarlat, Simion and Scarlat 2011).

The current crisis was such an unexpected black swan. Was it unavoidable? Trying to answer this question, Kaplan et al. (2009) emphasize the role played by the CROs (Chief Risk Officers). As the myth of the rational market is gone (Fox 2009), the ‘black swan’ events are behind standard deviations. The unfamiliar and difficult-to-predict events make the decision process incomparably more difficult. The crisis dynamics and predictability are investigated by more and more sophisticated mathematical models and analyses of dynamic series. Akaev (Akaev et al. 2010; Akaev, Fomin and Korotayev 2011) has predicted a “second wave of the global financialeconomic crisis” – based on the “gold bubble” (price of gold) and prices of other commodities. Other theorists are more optimistic: the next economic crisis could be avoided (Read 2009).

The crises arise from inherent problems in the economy and, undoubtedly, their negative effects are far more destroying for the economies. On the other hand, a crisis is an opportunity in disguise (Rumelt 2009: 35): “To survive – and, eventually, to flourish – companies must learn to exploit it”. There are companies and actually company managers that perceive crisis circumstances as opportunities rather than threats: they take action, restructure their companies and/or product range, and get rid of ballast: sell less productive units, discontinue less profitable products, licence less talented people, even leaving too risky markets. In pharmaceutical terms, the company illness is cured and these kinds of actions contribute to heal the economy overall; i.e. the crises have some positive effects too – if the company managers are strategically proactive and responsive.

Recent research (Gulati, Nohria and Wohlgezogen 2010) shows that 9% of companies come out of a recession stronger than ever. Even failing early and fast in order to quickly recover and have a better start during post-crisis recovery is familiar to and used by many strategists: as example, UBS AG (Union Bank of Switzerland) cut staff dramatically while recruiting young professionals in 2008; in January 2009, the bank’s shares outperformed an index of European banks over the previous quarter (Economist 2009).

Hence: the importance of the responsiveness facing crisis prospective and even crisis prediction.

The current global crisis has impacted the way managers think strategically. Recent studies are focused on SMEs (small and medium-size enterprises) strategic answers to crisis, in different regions. Ho et al.(2010) have examined the strategies of the SMEs from Hong Kong under the ‘financial tsunami’. They found ten factors as critical for a company in an uncertain financial situation.

Before the crisis, the trend was towards longer term decisions (five years or more). Foresight exercises design scenarios and strategies by sectors or regions, for time horizons of 10-15 years or even more. This crisis is having a contrary effect – five years horizon seems to be too long for strategic decisions, because of the crisis turbulences. Will the next phase of management practice continue to be the classical strategic management (five years time horizon, more or less)? Will it evolve to longer term foresight exercises and scenarios? Will it become more conservative and risk averse (like ‘three-year-strategies’)? Looking for answers, the opinions of the management gurus are reconsidered. Excerpted elements from Peter Drucker’s previous works are brought to light by Kanter (2009): trategic, long-term-vision is critical to leading through turbulent times.

Finding the right strategy during and post-crisis is vital for top managers (Sull 2009, 2010; Ghemawat 2010, Gulati, Nohria and Wohlgezogen 2010). Ghemawat argues that companies – under the pressure of international trade shrinkage and the still higher pace of China and India’s development – “must factor these developments into their strategies in the new decade … the response will be to retrench and focus on home markets … managers cannot afford to ignore the risks of pursuing a global strategy in the uncertain years ahead” (Ghemawat 2010: 56). As the range of possible futures is large and uncertainty high, the flexible strategy is preferred to rigid strategic planning: “the companies that nurture flexibility, awareness, and resiliency are more likely to survive the crisis, and even to prosper” (Bryan and Farell 2009: 24).

This crisis definitely marks a new era in strategic management – in terms of understanding the company strategy and strategic management by its managers.

Examining the SMEs strategies under crisis, and analyzing the critical factors for a company in an uncertain financial situation, Ho et al.(2010) have found that only two out of ten regard cost reduction.

The management is a complex process even in stationary systems; in turbulent periods its complexity increases exponentially and all the company functions are affected accordingly. Rigby, Gruver and Allen (2009) pay special attention to ‘unwise cost cutting during hard times’. Quelch and Jocz (2009) offer ‘7 smart ways to economize on advertising’ as a good management reaction to consumers’ strict priorities and reduced spending – a strong argument against the typical reaction of managers to cut costs.

The crises offer lessons to be learnt – not exclusively for academia: lessons from the 90’s Asian crisis (Sing and Yip 2000); how to recover after a recession (Schendel, Patton and Riggs 1976; Hofer 1980; McLaughlin 1990); and how to use marketing strategies to make the company recessionresistant (Pearce and Michael 1997). “During the crisis, it is vital to gain more information … to substantially invest in marketing and distribution, to limit abatements, and to ensure professionalism in pricing despite the turbulences of the crisis” (Schmidt 2011: 35).

Hence: the importance of the lessons learnt from previous crises and wise decisions facing current and future ones – not automatically cutting the costs of marketing research, research and development, and human resource.

The scope of this paper is not to display the history of crises or investigate their causes [political roots of the multi-facets global crises should not be under-represented; actually, “the crisis of the euro zone is a geopolitical as well as an economic event” (Mead 2012: 18)]. The paper intends to offer a picture of how SME managers from Romanian pharmaceutical industry are aware of these three major actions:

- Be proactive and act quickly

- In an uncertain environment and future, act strategically

- Facing a crisis, act wisely (not necessarily cutting the costs).

3 Research objectives and methodology

According to the Health Ministry, there were 6,902 pharmacies in Romania at the end of 2010, including 4,753 in urban areas (http://www.ceepharma.com).

This research targeted pharma SMEs from urban areas (population over 100,000 inhabitants). According to the Romanian law – in line with the European Union regulations – SMEs are firms with less than 250 employees. For this reason, the sample did not include the larger pharma chains. A sample of 475 pharma units was designed (10% of the total number of pharmacies in urban areas). The sample was representative as structure (number of pharma units in the sample – proportional to the city population). Then, the specific pharmacies were selected randomly and the interview operators were trained accordingly.

The research focus was on the Romanian pharmacies’ management and the overall research objective was to identify the way their managers acted facing the global economic and financial crisis, and analyze the managers’ strategic and current decisions. Addressing this objective, a set of specific research objectives was set (observing the three actions mentioned by the end of the previous section):

- How fast they reacted; is the corresponding lag time depending on the company size?

- What impact the crisis had on company strategy: did it change or not? If yes, how?

- Which were the most common decisions made by the managers under the pressure of the crisis; where there any mistakes made? What sort of? Is there a reason behind?

- How has the crisis impacted the firm overall performance, in the managers’ view?

The survey was conducted between August-September 2010, picturing a two year period (August 2008 – July 2010). The research methodology was questionnaire-based survey – questionnaire was designed to match the research objectives. It was pretested and discussed with eight business owners and managers during the first part of 2010, then reviewed, and finally administered. To get a higher rate of answers, the survey was completed as a face-to-face interview.

As an exploratory survey, there was no age discrimination among firms. Not only business owners and top managers, but also other managers or employees were invited to answer the questionnaire.

4 Research results

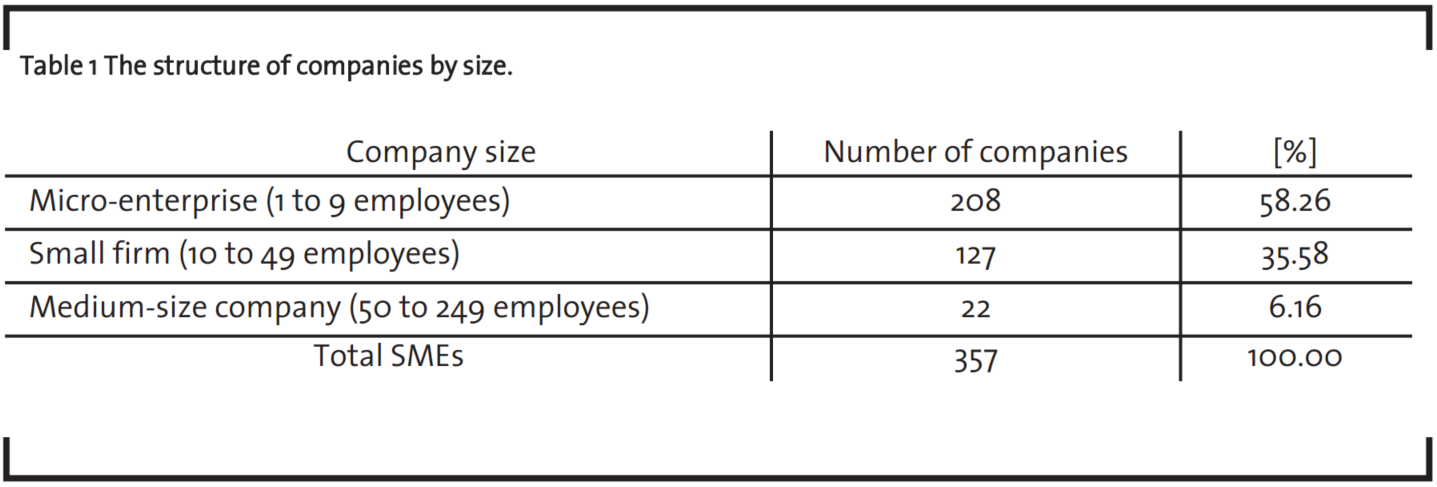

The rate of return was pretty high (77.5% i.e. 368 filled questionnaires out of 475 pharma units approached). For a couple of reasons (incomplete information, more than 250 employees), eleven questionnaires were rejected; finally, the data from 357 respondents were processed. The demographic features (company size) are depicted below (Table 1). The sample was not designed to be representative in terms of the structure but to have enough firms in each category – in order to characterize that group.

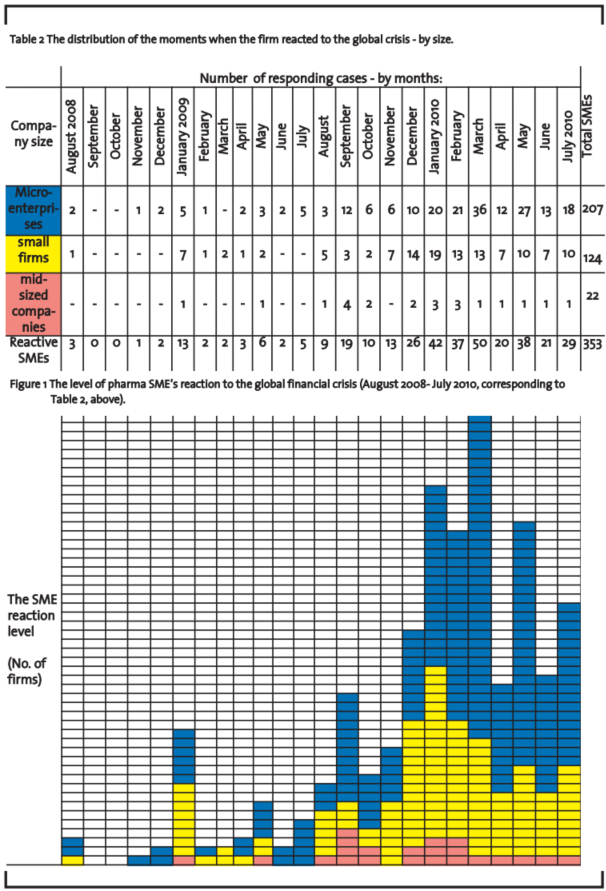

Table 2 presents the necessary figures for a documented answer to the first survey objective (i). Legend: sky-blue colour for microenterprises; golden – small firms; green – medium size companies.

The total number of microenterprises in Table 2 (207) is not identical to that in Table 1(208) because one microenterprise reacted earlier than August 2008 (as early as May 2008); this was a singular and exceptional case. The total number of small firms in Table 2 (124) is not identical to that in Table 1 (127) because two small firms did not reacted yet (by the time of survey) and one small company has stated ‘do not know’.

For these reasons, the number of SMEs in Table 2 (353) totals 4 SMEs less than in Table 1 (357).

There are several notable aspects of the research results that answer to the first research question – as pictured in Figure 1. The surveyed period of two years (August 2008 – July 2010) is divided into two equal periods, each of them with distinct features.

Period I: August 2008 – July 2009

The first reactions to crisis were visible as far back as August 2008 (two microenterprises and one small firm). This was an ‘early reaction’ – as the following two months no reaction was reported and after other three months only (January 2009) more pharma SMEs (13) have reacted.

This relative maximumin January 2009 (Figure 1) means a decision lag time of more than one year– as far as early decisions.

Excepting January 2009, the whole period August 2008 – July 2009 depicts management/managers’ passivity.

Period II: August 2009 – July 2010

During this period, the reaction of the pharma SMEs facing the crisis is stronger – meaning more active management and more decisions made by the managers. There is an oscillatory level of reaction (‘up’-s and ‘down’-s), over a positive trend that culminates with an absolute maximum in March 2010(Figure 1). This means a decision lag time of more than one year from early decisions in January 2009, and more than two years since crisis spark, in December 2007.

After March 2010, the reaction level decreases apparently; however, it is not clear if this decline means less reaction in reality or it is just because the survey ended by September 2010. Further research would be recommended.

To note that oscillatory appearance (alternating ‘up’-s and ‘down’-s) is common to both periods.

All the above apply to all pharmacy sizes, excepting the remark to the absolute maximum: it is in March 2010 for pharma microenterprises, but in January 2010 (two month earlier) for the small pharmacies, and in September 2009 (six month earlier) for the medium size ones. The data suggest this: the smaller the company size, the slower in reaction. This paradox (it was expected that smaller the firm, more flexible and reactive it should be) may be explained by weaker managerial skills of the managers in smaller companies. Deeper investigations might be conducted in this respect (possible correlations between the decision lag time and company age or industry).

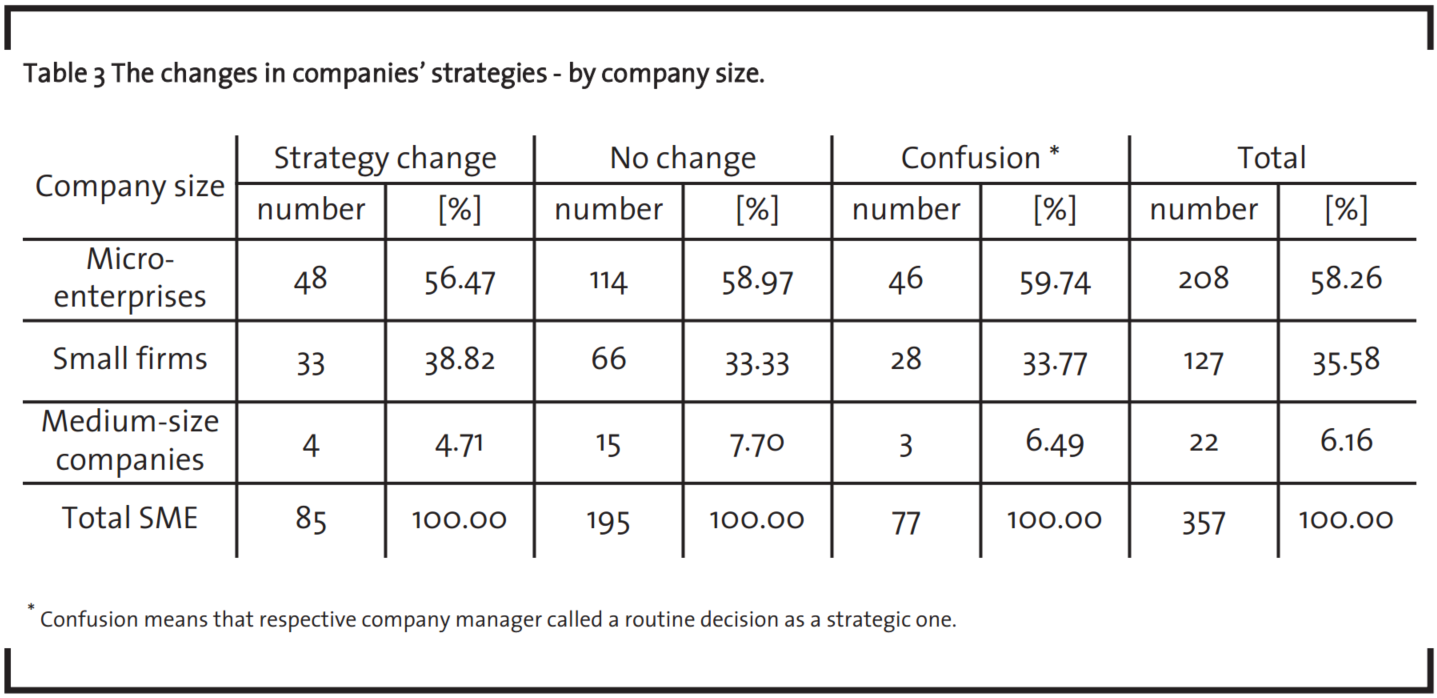

Table 3 depicts the impact of the crisis on the company’s strategic approach (second research objective).

It is surprising to note that:

- As little as 85 companies out of 357 (23.81% i.e. less than a quarter) decided that the crisis calls for extreme decisions – which is changing the company’s strategy;

- Facing the global financial crisis, more than half of the pharmacies (195 which represents 54.62%) made no change in their strategies;

- There is a worrying good part of 77 firms (21.57%) that consider routine decisions as strategy change – which is a strong evidence of lacking the elementary managerial knowledge and culture.

Analysis by company size shows, in general, same structure across preferences for strategy change. However, the confusion is slightly more common among microenterprises (59.74% compared to 58.26%) while ‘No change policy’ is preferred by the medium-sized pharmacies (7.70% vs. 6.16%). Small firms display a larger availability for strategy change (38.82% vs. 35.58%).

Changes of the product range, changes in strategic alliances, retrenching are the most common strategy changes among the pharma SMEs. No case of approaching new markets was reported.

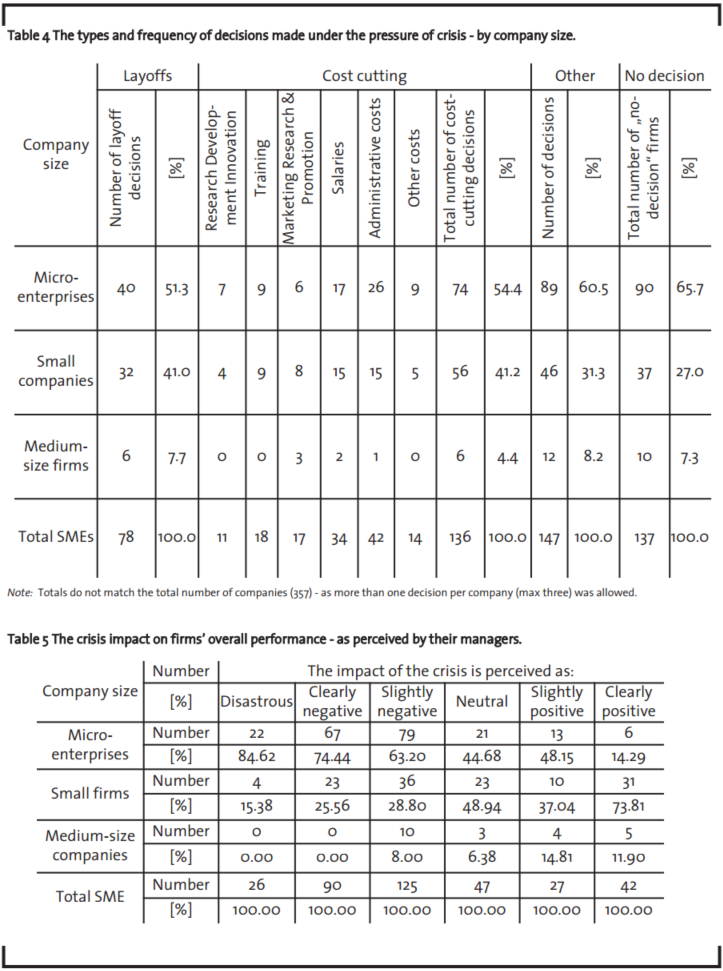

The most frequent decisions made by the managers under the pressure of the crisis (the third research objective) are presented in Table 4. More than one third of the responding firms (38.37%) made no decisions (no action facing the crisis), meaning no responsiveness and lack of managerial abilities ultimately.

The key results are:

- Cost cutting was the most consistent reaction of the companies facing the crisis; however, observing the sample structure, microenterprises are less inclined to do it than small pharmacies (the size of microenterprises may be a valid argument);

- Layoffs are the second-in-line decision to face the crisis; again, microenterprises are less active in making this type of decision than small pharmacies (the larger employee-base of the second category might be a good reason);

- In exchange, micro-pharmacies are more active in making other decisions – as: increasing the price (in-depth study shows about one in five – 19.05%), reducing the inventory (17.69%), product and sales promotions (11.56%);

- The medium size firms made decisions related to the range of products (less imports, new or eco-products, even cheaper products), and invested in developing the firm’s identity and image;

- Other frequent decisions: renegotiation of the contracts (8.84% of all SMEs), new methods of payment (6.12%), price discounts (4.76%), freezing the salaries and hiring process (4.08%).

- Very few decisions (one or two of each type) were related to: marketing research, staff training, research in product innovation; better quality of the services provided to the clients.

The decisions made by types of costs which were cut are important too. It is encouraging to notice that cutting the administrative costs is more frequent than cutting the research-development-innovation, training and marketing costs.

The last research objective (crisis impact) is fulfilled – as the data presented in Table 5 show.

The impact of the crisis is seen in a broad display, from clearly positive to neutral to disastrous. Overall, the crisis impact is perceived as slightly negative (most of the opinions – 125). With respect to the sample structure, the microenterprises have a worse prospective (the percentage is maximum for ‘disastrous’ and decreases to the minimum – which corresponds to ‘clearly positive’ perception). The situation is exactly the opposite for the medium size companies and, more visible for the small companies (the maximum value – 73.81% – is for ‘clearly positive’ and falls down to only 15.38% in case of ‘disastrous’ future). This means that crisis is perceived as more severe by the microenterprises.

To conclude, the microenterprises are not only smaller but slower in reactions; they are more reluctant to take action, and have a darker prospective of the future. Their management knowledge is limited and so is their arsenal of managerial tools.

As overall result, the answer of the pharma SMEs is ‘no’ to all three major actions: their management/managers did not act quickly facing a crisis; did not act strategically in uncertain environment and future; did not act wisely, not necessarily cutting the costs.

5 Discussion and further research

As the Romanian financial system is not as sophisticated as the Western one, it was expected a late and not-so-devastating crisis impact. On the other hand, the SMEs are the economy’s most dynamic and flexible sector, able to take the challenges (Scarlat 2003), and the links to the foreign corporations make Romanian companies more sensitive to crisis. The overall result was a delayed reaction of the firms (up-to-two-years decision lag time). The government has reacted even later (salaries in public sector cut in June 2010). It is an explanation but not an excuse for passive, inert management of the Romanian companies (Scarlat 2011). The delayed reaction of the Romanian firms, combined with the hesitations in the public sector management, lead to a longer crisis than expected; in addition to this, the current euro crisis will worsen the situation (International Monetary Fund 2012).

The survey results suggest that smaller the company size, slower in reaction. This is explained by weaker managerial skills of the managers in smaller companies. Deeper investigations might be conducted in this respect as well as trying to identify other possible correlations: if the corresponding decision lag time is depending – besides the company size – on industry or the company age.

The decisions made by Romanian managers show a relative small number of options – as compared to possible actions in front of a serious crisis (Ho et al.2010). Reasonable interpretations might be:

- the crisis is not perceived as serious by the respective managers;

- they do not know how to answer to such threat (more likely).

Less than a quarter of surveyed SMEs decided that crisis calls for extreme decisions – which are changing the company’s strategy. SMEs have shown serious lack of strategy knowledge and management culture. The proportion can easily by higher considering the possibility that ‘no change policy’ (195 out of 357 companies) might cover the lack of any strategy!

The impact of the crisis is seen as negative by two thirds of the pharma SMEs (241 out of 357) but the percentage is higher for microenterprises: more than four out of five (168 out of 208 which is 81%). The smallest SMEs are more sensitive, the crisis is tougher for them, and they feel the crisis impact more clearly. The lack of management culture is a key-issue within a vicious circle: no managerial tools, no/slow action; no decision, then negative impact, layoffs and cost cutting (management training included) and so on. The crisis is more severe for the smaller but most numerous SMEs.

Overall, the research results are positive; some answers are offered but more questions arise. A few lessons were learnt to improve the research methodology – as format of the questionnaire (more focused on management issues like decision making cycle). Most of the survey results are in line with previous research (Scarlat 2010, 2011).

A significant limitation of this research is that only urban pharma firms were surveyed. However, unless a further research will be conducted, there are arguments to assume that in rural areas the diagnosis and results will not be more optimistic.

6 Conclusions

This exploratory research aimed at identifying characteristic elements of the Romanian pharma SMEs’ management, under the pressure of the crisis, by size. The results have matched the research objectives and promisingly created a foundation for further in-depth studies on correlations between firms’ reaction and their performance, eventually by company size and age, region, or industry.

6.1 Late recognition and reaction

The early reactions to the global crisis were reported as early as August 2008; January 2009 marked a local maximum; reaction increased to an absolute maximum (March 2010), then decreased but kept high to the end of survey period (July 2010). A decision lag time up-to-two years was identified. There is no strong argument for setting a definite deadline for crisis impact.

The survey results demonstrate an even worse situation for microenterprises: smaller the company size, slower in reaction– explained by weaker managerial skills of their managers.

6.2 Lack of strategy

Less than one in four pharma SMEs (23.81%) decided to change the strategy in order to fight the crisis challenge. More than three quarters of the SMEs have no real strategy: over half of them (54.62%) made no change in their strategies and almost a quarter (21.57%) made serious confusions in terms of strategy. The most common strategies among SMEs are rather defensive: change of the product range, changes in strategic alliances, retrenching. Lack of strategy is almost equally distributed among pharma SMEs.

6.3 Lack of management knowledge and culture and skills. Management errors

The most frequent decisions made by the managers under the pressure of the crisis are personnel licensing and cost cutting as well as: price increase, lower inventory, product and sales promotions, salary freeze, contract renegotiation – following to no clear strategy or set of priorities.

There is a strong evidence of lacking the elementary managerial knowledge among pharma SMEs as almost a quarter of the firms surveyed consider routine decisions as strategy change. The strategy confusion is more common among microenterprises; they are more flexible, willing to act and change but they lack the management arsenal and knowledge.

6.4 More severe crisis for microenterprises

The crisis impact is perceived as negative by two thirds of the pharma SMEs surveyed; however, the percentage is higher for microenterprises (more than four out of five). The smallest SMEs are more sensitive, the crisis is tougher for them, and they feel the crisis impact more clearly. The crisis is more severe for the pharma microenterprises.

7 Managerial implications

The major managerial implications are the lessons learnt: mastering the tools for crisis predictability; proactiveness and responsiveness; flexible

strategy; avoiding cutting the costs uniformly – with little or no analysis and/or right priorities set. Beside its importance as theoretical concept, the decision lag time (applied in case of crisis) can be used as an overall indicator of the strategic management capacity: longer the decision lag time, lower the strategic management capacity.

The research results and conclusions demonstrate that managers of the Romanian pharmaceutical SMEs display serious lack of management culture, strategy knowledge, and decision making skills. Consequently, there is an urgent need to educate and train their managers.

The vicious circle of lacking the managerial culture (slow reaction – poor decisions – negative impact on the company performance – …,) could be broken by training programmes in management (strategy, decision making, management skills).

As the crisis impact and lack of management knowledge and skills is more profound among microenterprises, their managers (entrepreneurs) need training programmes in the same areas, with a special focus on basic principles of business management and entrepreneurship.

The research conclusions and recommendations are useful for both scholars and practitioners: entrepreneurs and company managers, as well as for management training institutions and universities, education policy makers who are striving to develop the managerial capacity of the Romanian pharma companies.

References

Abrahamsen, M., Acar, O., Brinded, B. and Rainisch, V. (2011) The Belgian Pharmaceutical Cluster, Harvard Business School: Institute for Strategy and Competitiveness, Cambridge, Massachusetts.

Akaev, A.A., Fomin, A.A., Korotayev, A.V. (2011) “The Second Wave of the Global Crisis? On mathematical analyses of some dynamic series”, Structure and Dynamics eJournal, 5(1), pp 1-10.

Akaev, A., Fomin, A., Tsirel, S., Korotayev, A. (2010). “Log-Periodic Oscillation Analysis Forecasts the Burst of the “Gold Bubble” in April – June 2011”, Structure & Dynamics, 4(3), pp 1–11.

Arieff, A., Weiss, M.A., Jones, V.C. (2010) The Global Economic Crisis: Impact on Sub-Saharan Africa and Global Policy Responses, CRS Report for Congress, R40778. US Congressional Research Service.

Berkmen, P., Gelos, G., Rennhack, R. and Walsh, J.P. (2009) The Global Financial Crisis: Explaining Cross-Country Differences in the Output Impact, IMF Working Paper, WP/09/280, International Monetary Fund.

Bryan, L. and Farell, D. (2009) “Leading through uncertainty”, The McKinsey Quarterly: ‘The crisis: A new era in management’, No. 1, pp 24-34.

Claessens, S., Dell’Ariccia, G., Igan, D., Laeven, L. (2010) “Crosscountry experiences and policy implications from the global financial crisis”, Economic Policy, 25(62), pp 267-293.

Economist (2009) “Bank strategy: Return to wealth”, The Economist, 390(8612), January 3rd – 9th 2009, p 56.

Essenscia (2011) Belgium, a world champion for chemicals and plastics, Essenscia – The Belgian federation for chemistry, plastics and life sciences, Brussels, pp 1-49.

European Parliament – Policy Department Economic and Scientific Policy (2009) Impact of the Financial and Economic Crisis on European Industries, European Parliament, Brussels, pp 1-65.

Festel, G. and De Cleyn, S.H. (2011) “R&D Spin-outs in the Pharmaceutical Industry”, Journal of Business Chemistry, 8(3), September 2011, pp 101-113.

Fidrmuc, J. and Korhonen, I. (2010) “The impact of the global financial crisis on business cycles in Asian emerging economies”, Journal of Asian Economics – ‘The Financial Crisis of 2008-09: Origins, Issues, and Prospects’, 21(3), pp 293-303.

Fox, J. (2009) The Myth of the Rational Market. A History of Risk, Reward, and Delusion on Wall Street, HarperCollins, New York.

Gardó, S. and Martin, R. (2010) “The impact of the global economic and financial crisis on central, eastern and southeastern Europe. A stock-taking exercise”, European Central Bank, Occasional Paper Series, No. 114, June 2010.

Ghemawat, P. (2010) “Finding Your Strategy in the New Landscape”, Harvard Business Review, March 2010, pp 54-60.

Gore, C. (2010) “The global recession of 2009 in a long-term development perspective”, Journal of International Development, 22(6), pp 714-738.

Gulati, R., Nohria, N., Wohlgezogen, F. (2010) “Roaring Out of Recession”, Harvard Business Review, March 2010, pp 62-69.

Hamm, S. (2009) “The Dalai Lama on the Economic Crisis”, Business Week, May 18, 2009, p 16. Excerpts from an interview on May 5, 2009, in New York

Ho, G.T.S., Choy, K.L., Chung, S.H., Lam, C.H.Y. (2010) “An Examination of Strategies under the Financial Tsunami”, Industrial Management & Data Systems, 110(9), pp 1385-1401.

Hofer, C.W. (1980) “Turnaround strategies”, Journal of Business Strategy, 1(1), pp 19-31.

International Monetary Fund (2012) World Economic Outlook: Growth Resuming, Dangers Remain, IMF – World Economic and Financial Surveys – April 2012, Washington.

Jara, A., Moreno, R. and Tovar, C.E. (2009) “The global crisis and Latin America: financial impact and policy responses”, Bank for International Settlements – BIS Quarterly Review, June 2009, pp 53-68. Also available at: http://ssrn.com/abstract=1513216 – accessed on January 12, 2013.

Jha, S., Sugiyarto, G. and Vargas-Silva, C. (2010) “The Global Crisis and the Impact on Remittances to Developing Asia”, Global Economic Review: Perspectives on East Asian Economies and Industries – Special Issue: Global Financial Crisis and its Policy Implications in East Asian Emerging Economies, 39(1), pp 59-82.

Kanter, R.M. (2009) “What Would Peter Say”, Harvard Business Review, November 2009, pp 65-70.

Kaplan, R.S., Mikes, A., Simons, R., Tufano, P., Hofmann, M. (2009) “Managing Risk in the New World”, Harvard Business Review, October 2009, pp 68-75.

Kindleberger, C.P. and Aliber, R.Z. (2005) Manias, Panics, and Crashes: A History of Financial Crises, 5th ed., John Wiley & Sons, Inc., Hoboken, New Jersey.

Laeven, L. and Valencia, F. (2008) “Systemic banking crises: a new database”, International Monetary Fund Working Paper 08/224.

Lane, P.R. and Milesi-Ferretti, G.M. (2011) “The Cross-Country Incidence of the Global Crisis”, IMF Economic Review, No. 59, pp 77-110.

McLaughlin, M. (1990) “How to survive a recession”, New England Business, No. 7, pp 35-37.

Mead, W.R. (2012) “The Euro’s Global Security Fallout”, The Wall Street Journal, XXX(100), June 20, 2012, p 18.

Melvin, M. and Taylor, M.P. (2009) “The Global Financial Crisis: Causes, Threats and Opportunities”, Journal of International Money and Finance, 28(8), December 2009, pp 1243-1245.

Minsky, H.P. (1986, 2008) Stabilizing an Unstable Economy, McGraw-Hill, New York.

Nuti, M.D. (2009) “The impact of the global crisis on transition economies”, Economic Annals, 54(181), pp 7-20.

Paté-Cornell, E. (2012) On “Black Swans” and “Perfect Storms”: Risk Analysis and Management When Statistics Are Not Enough. Risk Analysis, 32(11), November 2012, pp 1823-1833.

Paulson, H. (2010) On the Brink. Inside the Race to Stop the Collapse of the Global Financial System, Headline, London.

Pearce, J.A., Michael, S.C. (1997) “Marketing strategies that make entrepreneurial firms recession-resistant”, Journal of Business Venturing, 12(4), pp 301-314.

Quelch, J.A. and Jocz, K.E. (2009) “How to Market in a Downturn”, Harvard Business Review, April 2009, pp 52-62.

Read, C. (2009) Global financial meltdown: how we can avoid the next economic crisis, Palgrave Macmillan, New York.

Rigby, D.K., Gruver, K., and Allen J. (2009) “Innovation in Turbulent Times”, Harvard Business Review, June 2009, pp 79-86.

Rumelt, R.P. (2009) “Strategy in a ‘structural break’ “, The McKinsey Quarterly: “The crisis: A new era in management”, No. 1, pp 35-42.

Scarlat, C. (2003) Antreprenoriat si Managementul intreprinderilor mici si mijlocii, Printech, Bucuresti.

Scarlat, C. (2010) “Management under the economic and financial crisis: Management in crisis. What the Romanian firms reveal”, CD Proceedings of the Third International Conference the Future of Europe: “The Economic and Financial Crisis Impact on the European Business Environment” (Editors: Silviu Negut et al.), 18-19 November 2010, Bucharest, Romania. ASE Publishing House, Bucharest, pp 125-140.

Scarlat, C. (2011) “The management of the Romanian companies under crisis: Were their managers aware of?”, in Predictability in nonlinear dynamic systems: The economic crises (Editor: Eugen Scarlat), Politehnica Press, Bucharest, pp 19-35.

Scarlat, C., Simion, C. and Scarlat, E.I. (2011) “Managing new technology projects: Some considerations on risk assessment in the case of NPP critical infrastructures”, Proceedings of ICEMMS 2011 International Conference, August 8-10, 2011. Beijing, P.R.China. “2011 2nd IEEE International Conference on Emergency Management and Management Sciences” (Edited by Li Wenzheng). IEEE Press. IEEE Catalogue Number: CFP1133J-PRT.

Schendel, D., Patton, G.R. and Riggs, J. (1976) “Corporate turnaround strategies: A study of profit decline and recovery”, Journal of General Management, 3(3), pp 3-11.

Schmidt, R. (2011) “Pricing in the crisis? An empirical analysis”, Journal of Business Chemistry, 8(1), January 2011, pp 35-45.

Seeger, S., Locker, A. and Jergen, C. (2011) “Working capital management in the Swiss chemical industry”, Journal of Business Chemistry, 8(2), May 2011, pp 87-98.

Singh, K. and Yip, G.S. (2000) “Strategic Lessons from the Asian Crisis”, Long Range Planning, 33(5), pp 706-729.

Sull, D. (2009) The Upside of Turbulence, HarperCollins, New York.

Sull, D. (2010) “Are You Ready to Rebound?”, Harvard Business Review, March 2010, pp 70-74.

Taleb, N. (2007) The Black Swan: The Impact of Highly Improbable, Random House Publishing Group, New York.

Taleb, N.N., Goldstein, D.G., and Spitznagel, M.W. (2009) “The Six Mistakes Executives Make in Risk Management”, Harvard Business Review, October 2009, pp 78-81.

Teirlinck, P. and Poelmans, E. (2012) “Open innovation and firm performance in small-sized R&D active companies in the chemical industry: the case of Belgium”, Journal of Business Chemistry, 9(3), October 2012, pp 117-132.

Wolf, M. (2010) Fixing Global Finance, Johns Hopkins University Press, Baltimore, Maryland

http://www.ceepharma.com/97360/Demographic-criteriarestrict-opening-of-new-pharmacies-in-Romania-until-2012.shtml – accessed on May 3, 2012.