Intellectual Property: An underestimated and undermanaged asset?

Abstract: Intellectual Property (IP) is becoming more and more important for competitive advantage and companies’ success. We argue that making IP a key issue is essential and will be one of the main factors driving future business success. Nevertheless many companies have not yet managed to integrate IP into strategy development and all critical business processes and thus do not get the maximum value out of it. This article aims to show how companies can systematically develop and implement an IP strategy following a three-step approach. First, it is important for the management to get a more transparent picture about strengths and weaknesses of the current IP position. Modern IP database tools help to achieve this goal. In the second phase the management should evaluate whether the company is successful in realizing the full market and strategic potential of technologies with IP strength and how to cope with areas of IP weaknesses. After an in-depth evaluation an IP-strategy should be defined and implemented. In our experience strategy execution requires a clear commitment from the top management, clear roles & responsibilities, proper monitoring, a more intensive collaboration on IP issues between R&D, Marketing, Patent attorneys and often even changes in corporate structures and processes.

Introduction

At leading companies in the pharmaceutical industry, patented products account for 80 to 90 percent of sales. Young sectors, such as biotechnology, are dependent on venture capital, and protecting knowledge is often the only collateral they can offer investors. In the chemical industry, patent protection is also extremely important; for example, BASF can primarily thank its patents for achieving a leading position in scratch-resistant paints. And in industries such as plastics manufacturing, process patents enable savings and create competitive advantage for those companies having them.

But protecting intellectual property is not patent management’s only purpose: Properly used, patent management supports developing and implementing growth and innovation strategies, using intellectual property (for example, through licensing), evaluating acquisition candidates or cooperation partners, and entering new markets such as the Chinese. [1], [2]

Realizing patent management’s payoffs, however, is only possible if economic considerations drive IP’s creation and commercialization. In most companies, IP is still more an issue for the legal department rather than for management. Typically, legal departments maximize IP protection rather than IP value creation. [3]

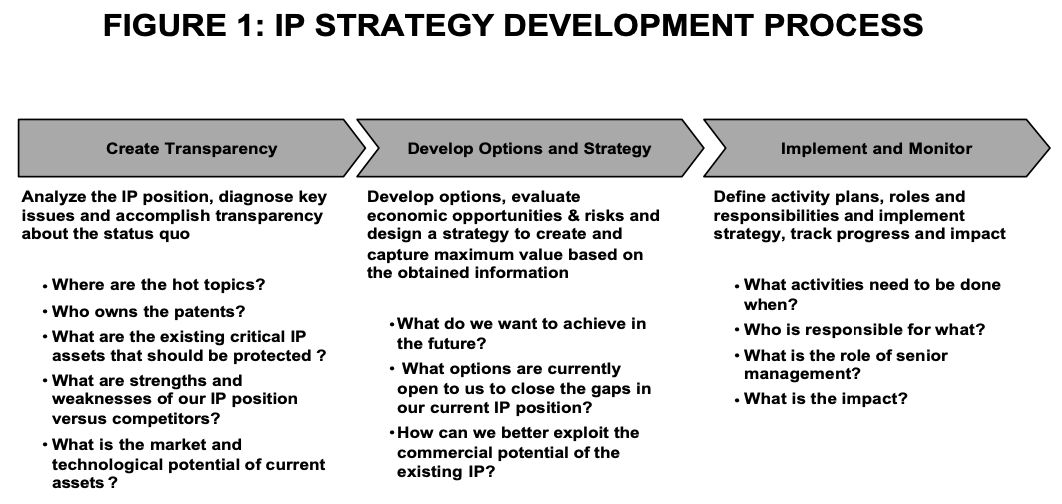

In our experience, it is crucial to better integrate IP into strategy development and all critical business processes, and this article aims to show how companies can systematically develop and implement an IP strategy following a three-step approach (see Figure 1).

First, it is important for the management to get a more transparent picture of the current IP position. Companies typically have some knowledge on technology trends and competitors’ actions but many of them show a lack of a comprehensive picture of the IP landscape. Analyzing patent data with modern database tools data can help companies to achieve this goal. Tools such as Aureka [4] allow to cluster patent data so that the management can easily get an aggregated view on technology fields. The management should then carefully evaluate the strengths and weaknesses of the own IP position versus competitors. This typically leads to the question whether the company has managed to leverage a strong IP position for commercial market success—or in case of a rather weak position—whether the company should try to catch up or abandon the field. This helps the management to develop several options. Based on an evaluation according to economic opportunities and risks promising options are selected. The next step is to (re -)design strategies to capture maximum value from existing IP and (possibly) to create new IP . Strategy implementation involves taking action, define activity plans, roles and responsibilities; and track progress and impact. Involvement of the senior management is as critical as the measurement of specific indicators. Implementation is very often the key hurdle in many companies.

Create transparency in the strengths and weaknesses of your IP position

A food additives manufacturer had to deal with stronger price pressure and lower margins for its traditional products over a long period of time, the company tried to bolster its traditional fermentation business with sweeteners. Management was aware that its main rival in this field was ahead of the game, but its estimates put it right behind the rival in second place. Despite patents from its own research, however, the manufacturer seeking to branch out had only achieved modest commercial success. When rumors began to circulate in the industry that the company’s rival wanted to take over a smaller concern, management decided to rethink its strategy.

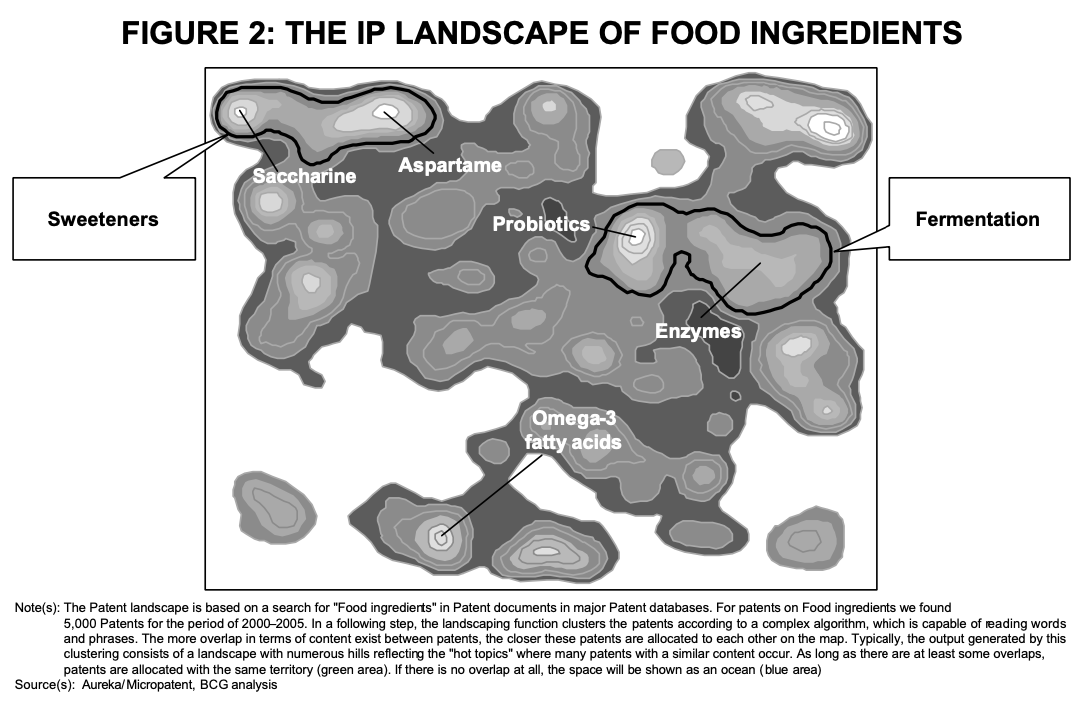

The company began by analyzing its own IP position in food additives. With the help of Aureka’s IP landscaping tool, the management generated an overview of the food additives IP landscape then took a closer look at fermentation and sweeteners. Analyzing the data behind each topic revealed that sweeteners have about twice as many patents as fermentation. The company then conducted a simple analysis to see how many patents had been published annually; doing so revealed that patent activity has been growing much faster in fermentation than in sweeteners. This was not surprising as sweeteners are considered a mature technology whereas recent discoveries of new applications for fermentation have led to a surge in R&D activities.

In the next step, the company ranked players (owners) by patent frequency, realizing it had many patents in the more mature field of sweeteners and that it was far behind its major competitor in the field of fermentation. The number of patents a company has is only a very rough indicator of IP position: one key patent can be far more valuable than having a hundred worthless ones. The next step for assessing IP position is typically, therefore, to assess patent quality.

Which technologies help a company to differentiate its current products from competitors’? Do patents protect those technologies? This assessment typically requires employing legal, technical, and business expertise. For the food additives manufacturer, it turned out that the company had a strong IP position in the area of sweeteners, and management identified a number of key patents important to their value proposition.

What technologies does a company need to successfully expand into new fields? As it turned out, high patent quality could not compensate for the quantitative weakness of the company’s patents in the field of fermentation. On the contrary, the company’s main competitor had the key patent, which it had codeveloped with a famous research institution.

Completing this phase helped management gain a much clearer picture of its IP position’s strengths and weaknesses—and yielded direct implications for options and strategy development.

Develop Options and Strategies

Do you realize the full market and strategic potential of your IP strength?

Based on the transparency phase analysis, management revisited its marketing strategy for these core products. The analysis revealed that the company was not really using key patents to position its core products against competitor products lacking a unique positioning in the relevant technology. As the company did not integrate differing aspects of its value proposition, it was simply giving away its precious IP too cheaply.

In cooperation with marketing, management developed a new strategy that licensed out key patents. Taking this approach is attractive when the technology cycle is in a mature stage (or the cycle is very short) or when production is not a company’s core competency. (The risk exists that if the licensing partner does not guarantee high quality, the company’s reputation and brand name may suffer; finding the right partner is crucial, especially when expanding to new regions such as China)

Even if the idea and patent belong to the company’s core segments, a licensing strategy can make sense. P&G is a good example of this. P&G owns the patent for a new chemical, let’s assume that its name is “Soapacene”, which a supplier produces. The “price” for the right to resell “Soapacene” to third parties is a licensing fee the supplier pays to P&G, who gives the supplier a (volume-based) discount on the volume it needs – so that P&G can generate a cost-based advantage over its competitors. [5]

The rest of the patents in sweeteners fell into two categories: patents that could become essential to the food additive manufacturer’s business in the future—these should be kept but regularly revisited, and patents that did not create value at all—these could be abandoned (or donated to research institutions) immediately.

DuPont was one of the first companies to systematically sort out non-value-creating IP. By doing so they managed to save $64 million annually in patent and administration fees.

How can you close identified gaps and protect your position?

Given the weakness in the emerging field of fermentation, the food additives manufacturer’s basic options were to either strengthen its IP position or rid itself of the technology. In order to develop options, it is crucial to first understand the possible reasons contributing to this situation.

(1) Creating your own IP

One possible explanation is that the R&D department might have misjudged new technology trends and as a result steered R&D efforts in the wrong direction. An alternative explanation is that the legal department did not protect technology appropriately. Patent claims were either written so that other players could recognize their potential or patent lawyers did not recognize how to stake claims. Furthermore, business may not have systematically built and employed a patent portfolio to weaken the competition (blocking and tackling). Further investigation would then be appropriate to address these issues in future R&D and patenting processes.

(2) Get access to external IP

In a fast-moving technology like fermentation it may simply take too much time for a company to rely on its own efforts. More and more companies discover that cooperation, in-licensing, and even acquiring IP can be economically far more attractive and efficient.

Cooperation or in-licensing are usually preferred when M&A is not feasible, economically unattractive (for example, few synergies), or requires too much commitment (for example, high business risk). Still, many companies see ownership as the best way to capture value.

When P&G decided to focus on fast-growing business units, it quickly became clear that innovation activities would have to be expanded considerably. A review of in-house capacities and externally available technologies showed that it would be smarter to do more in-licensing. The current CEO, A.G. Lafey, formulated the objective by saying that about half of P&G’s innovations should come from outside the company. [6]

Hitachi Chemical recently acquired a basic patent for resistant materials useful for manufacturing IC package substrates and the like. As a leading producer of resistant materials, Hitachi had to leverage its own technologies by acquiring the patent. They are starting to build a patent network of resistant materials to keep their currently advantageous position.

Robert Hirsch, head of the relevant department at DuPont, has said that IP management is currently undergoing a fundamental cultural change. He admits that acquiring outside technologies is not sufficiently mature, but points out that it was possible to raise licensing income by about a third, to over $400 million. Here, IP management at DuPont is taking a radically new course: To find new partners for licensing agreements, there is the online forum “yet2.com,” an Internet-based technology whose establishment DuPont sponsored but which now acts independently. It was the source of no less than 15 new deals in 2004 (to compare: 2003 saw a total of 30 deals). [7]

Implement and Monitor

Define clear roles and responsibilities and take action

All previously mentioned tasks and decisions are fairly complex. It is therefore crucial that companies define specific action plans with clear roles and responsibilities for implementation and that top management—sometimes including even the CEO—systematically integrate IP into their strategy processes. Although most companies employ patent attorneys, in our experience most companies have not yet integrated IP comprehensively.

Successful implementation requires that employees understand the importance of IP issues to the company. It is crucial that the CEO make a clear statement on the company’s general direction: When Joe Palmisano became CEO of IBM, he declared that the company would make much more of its IP freely available (open source).

Organizational structure and processes should facilitate collaboration on IP issues. This is both necessary for providing top management with relevant and aggregated data and for driving functional work (R&D, NPD, etc.)

Very often collaboration on IP issues is difficult as experts from different fields use different languages about the same technology (patent attorneys, technicians, business managers). But when there are incentives to collaborate on a common IP project, they manage to overcome these hurdles. By the mid-1990s IBM had already created so-called inventor teams, motivating people by initially creating a common professional spirit (Hall of Best Innovations) and then providing monetary incentives. In particular, business-unit mangers were made accountable for IP projects.

Monitor progress

In order to ensure that IP is taken seriously and creates value, companies have to regularly quantitatively and qualitatively measure and report IP success. The following are standard topics that companies should report, discuss, and eventually translate into action on a quarterly basis:

- IP returns: How has IP created value for your company, for example, through instituting a price premium?

- Competitor actions: Has your IP created obstacles to competitor actions?

- Emerging threats: Do you see competitors moving into your territory?

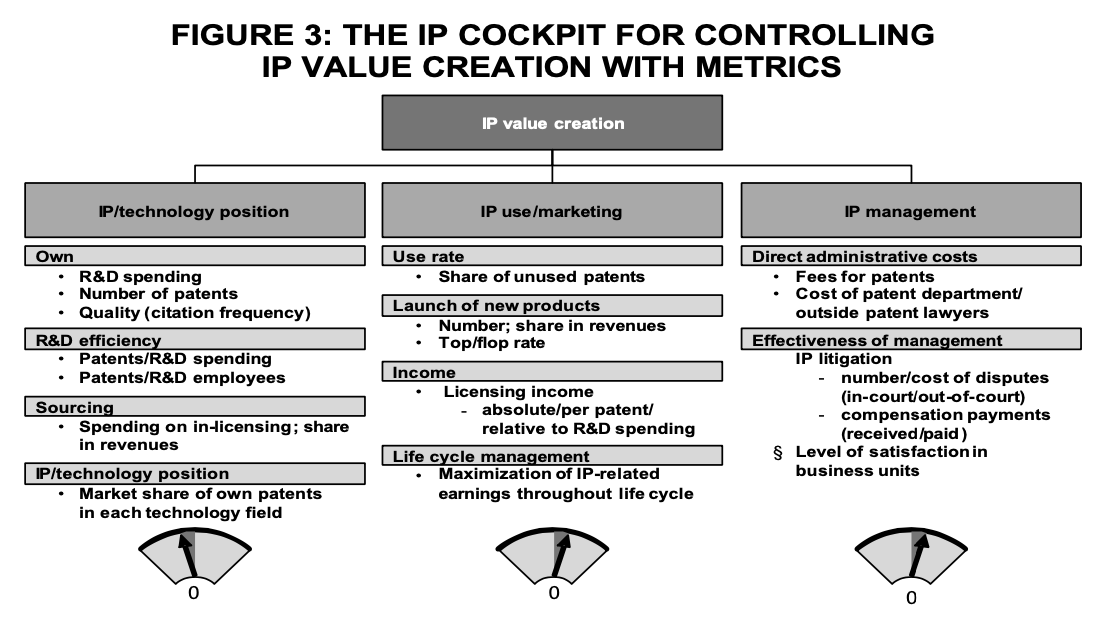

Although there is no best-practice set of indicators that companies should employ, several indictors to measure IP value creation do exist (see Figure 3).

The above indicators are meant to track a company’s IP-related value creation and the efficacy of its IP administration. So far, few companies really try to maximize their IP-related revenue over an IP’s life cycle as a standard approach for tangible assets. In order to ensure collaboration, companies should also evaluate their business units’ satisfaction with the IP department.

Summary

Despite the importance of protecting IP in the chemical industry, IP management has thus far focused primarily on technical and legal issues. IP management, however, belongs to the strategy process.

We propose instituting a simple, structured, three-step approach to develop and implement a patent strategy: Create more transparency in companies’ patenting behavior is an important first step in realizing successful strategy development. Once top management has understood the big picture as the IP landscape outline it, it is far easier to identify strategic IP options, evaluate their business value, and, ultimately, find the right strategy to capture value. Companies should evaluate and convert all options, economic opportunities, and risks using the knowledge gained. Specific action plans with clear roles and responsibilities are crucial for implementation.

Companies such P&G, Hitachi Chemical, and Henkel have successfully adopted more systematic approaches to IP management, some of them have even introduced fundamental changes. We strongly believe that more companies—from chemical and other industries—should follow and make IP a key issue as this will be one of the main factors driving future business success.

References

[1] Rivette, K. G.;Kline, D. (2000), Discovering New Value in Intellectual Property. Harvard Business Review, No. 1, pp. 54-66.

[2] Reitzig, M. (2004), Strategic Management of Intellectual Property. Sloan Management Review, Vol. 45, No. 3, 2004, pp. 35-40.

[3] Anand, B., Galetovic, A. (2004), How Market Smarts Can protect Property Rights. Harvard Business Review, No. 12, pp. 73-79.

[4] See www .micropatent.com.

[5] Source: Darwin Magazine, 2002, http://www.darwinmag.com/read/060102/ intellect.html?Page =2.

[6] K. Klee (2005), Procter & Gamble once kept R&D close to the vest. Now outlicensing is driving its growth. IP Law and Business, Vol. 05, No. 2.

[7] Chemical Week, 24 March 2004.