Futuring in the European Chemical Industry

Abstract: With the beginning of the new millennium there seems to be growing interest in foresight and futures studies. What was once seen as an intuitive skill practised by individuals with more or less success has grown into a coherent body of techniques and knowledge increasingly described as “futuring” and practised by “think tanks” and professional futurists around the world [1]. It is therefore no surprise that these methodologies are also used in the chemical industry in order to cope with the growing uncertainty and volatility this industry has to deal with. More exceptionally, in the last couple of years different independent industry – wide initiatives were started to evaluate the future of the chemical industry. While in the US the focus was on technology there was in Europe a broader perspective. The European Chemical Marketing & Strategy Association analysed the future success factors, the UK initiative developed a vision for a competitive chemical industry in the UK and the European Chemical Industry Council (Cefic) developed different alternative scenarios in order to objectify the dialogue with the EU Authorities. Despite the differences in the approach there is common learning and the understanding that industry-wide futuring is a valid step in order to create a sustainable future.

1. Introduction

The growing awareness of futuring in today’s chemical industry is not focused on new breakthrough innovations and ground – breaking applications but on concerns about the future of the industry. There is already talk about tomorrow’s steel industry with only a few big players left and tomorrow’s textile industry with migration from the industrialized countries to Asia and/or the Middle East [2]. In addition, the chemical industry, despite significant investments in environmental standards, is again becoming the target of non-governmental organizations demanding stricter regulations and trying to convince the politicians to increase the regulatory burdens.

This explains the initiative of the European Chemical Industry Council (Cefic) to develop scenarios for the future of the European chemical industry [3] and also explains the idea of the UK Government [4] to think about a vision for the industry. The forerunner of these new chemical futuring initiatives was the 2010 concept of the European Chemical Marketing and Strategy Association (ECMSA) [5]. In contrast to these comprehensive approaches, technical and business leaders in the U.S. chemical industry focused on needs in research and development when they started to develop “Technology Vision 2020” for the future of the U.S. chemical industry in 1994 [6]. Different associations formed the Technology and Manufacturing Competitiveness Task Group with the charter to

- “provide technology vision and establish technical priorities in areas critical to improving the chemical industry’s competitiveness

- develop recommendations to strengthen cooperation among industry, government and academe and

- provide directions for continuous improvement and step change technology.”

Finally 4 technical disciplines were selected as crucial to the progress of the chemical industry:

- “new chemical science and engineering technology

- supply chain management

- informationsystemsand

- manufacturing and operations.”

In addition to these technology issues, the concept of sustainable development was analysed and ideas for partnerships among industry, government and academia were reviewed.

The recommendations led to the development of Technology Roadmaps 2[7] in fields like

- bio-catalysis

- combinatorial chemistry

- nano-materials

- reaction engineering

- separations

- etc.

The aim of these roadmaps is to provide a chronological path to achieve the vision. In order to be successful it was recommended that collaborative R & D be done. Today, “Vision 2020” is an

- Industry – led partnership – public and private

- on-going collaborative process to faster technology innovation.

Despite the narrow focus of this early initiative from the US chemical industry, it has the same objective as the subsequent initiatives: to improve the competitiveness of the Chemical industry in a rapidly changing business environment. The US initiative identified 5 major forces as crucial challenges:

- increasing globalization of markets

- societal demands for higher environmental performance

- financial market demands for increased profitability and capital productivity

- higher customer expectations and

- changing work force requirements.

And, in addition to the technical recommendations, the following steps were demanded:

- generate and use new knowledge

- capitalize on information technology

- encourage the elimination of barriers

- work to improve the legislative and regulatory climate

- improvelogisticsefficiencies

- increaseagilityinmanufacturing

- harmonize standards

- create momentum for partnering

- encourage educational improvements

Today, it is obvious that not all company leaders in the chemical industry followed this advice. And in a recent article David Proctor states that the North American chemical industry is under serious threat [8].

In the following chapters we will focus on futuring initiatives in the European chemical industry and compare them at the end with the U.S. initiative.

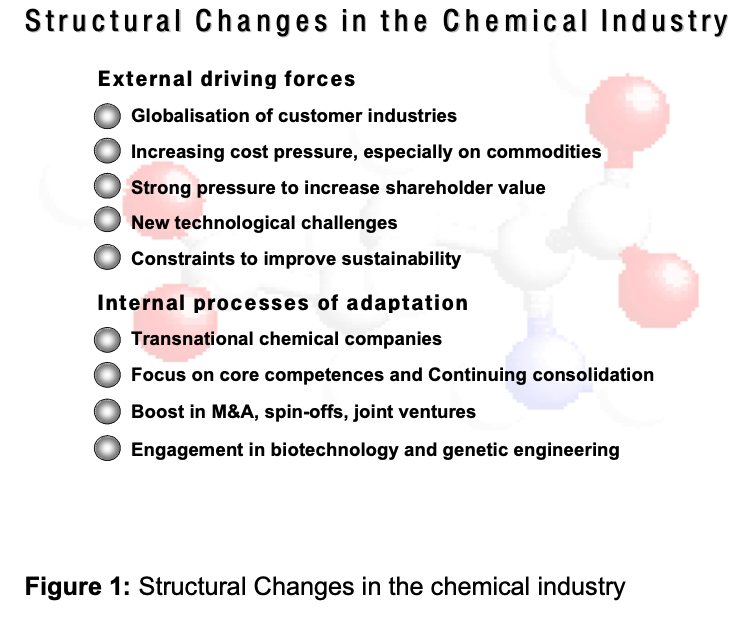

2. ECMSA Scenarios 2010

The European Chemical Marketing and Strategy Association (www.ecmsa.org)) started its scenario 2010 project in 2000 together with its partner organizations CDMA (the Commercial Development and Marketing Association) and LES International (Licensing Executives Society International). The starting point of this initiative was the realization that the chemical industry is facing major structural changes (see figure 1) which make it impossible to predict the future. Therefore it was decided to use the scenario approach as the basic methodology for evaluating the major external driving forces and the processes of adaptation by the industry.

The scenario approach consisted of two steps. Phase 1 was a top down perspective looking at the industry as a whole. Phase 2 was a bottom up approach looking in detail at the petrochemicals/plastics and fine chemicals/specialties sectors of the industry.

2.1 Top-down scenarios

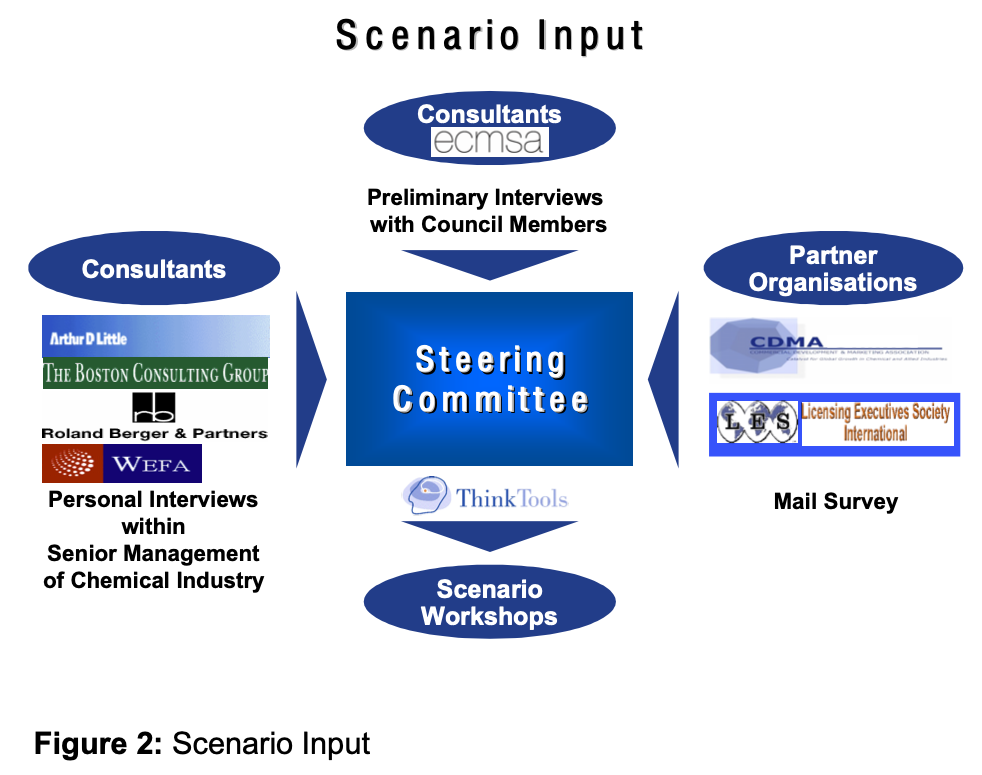

The scenarios for the overall chemical industry depended on the inputs (see figure 2) from the European chemical industry (ECMSA Members), ECMSA partner organizations and consultants.

This input was the starting point of intense scenario workshops based on the methodology from Think Tools. This software together with the strong support from facilitator Adrian Taylor from Think Tools helped to integrate different points of view, controversial opinions and often difficult discussions. Finally, we were able to agree on 3 different possible and realistic futures for the chemical industry:

- Powerful innovation – as the most promising optimistic perspective based on technological breakthroughs especially in biotechnology

- Profitable growth – as a still positive future development, but relying more on globalisation than on new technologies

Missed opportunities – as a very negative scenario with negative macroeconomic developments as well as a lack of proactive action from the industry

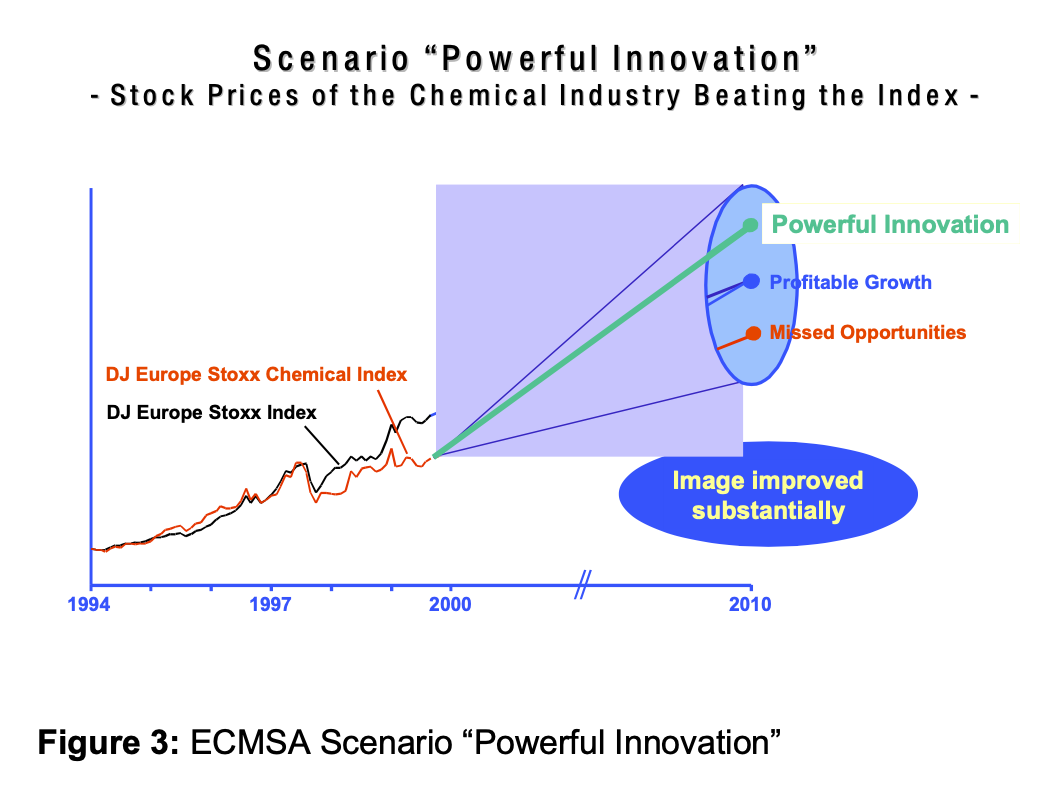

The “powerful innovation” scenario (see figure 3) shows a future where the European chemical industry is able to beat the European Stoxx Index and improves its image among the public significantly.

But this scenario has a lot of important prerequisites which are difficult to fulfil:

- Comprehensive innovation in all relevant fields

- product innovation

- application innovation

- production process innovation

- business process innovation

- Strong orientation to customer needs

- Measures to improve attractiveness for highly qualified employees

The “missed opportunities” scenario is characterized by weak macroeconomics, chemical demand below GDP growth and increasing regulation as well as by a low-performing chemical industry (clear lack of profitability, weak stock market performance, intense competition, brain drain). In order to avoid such a negative development, three key success factors were identified:

- Innovation (especially in the fields of biotechnology/genetic engineering, process technologies/catalysis, IT- applications/computing, environmental technologies/ processes, alternative energies/fuel cells, nanotechnology, combinatorial chemistry)

- Customers (especially customer relationship management, knowledge of customer needs and management of a global customer base)

- Employees (especially broadening the skills base in the fields of information technology, marketing and combining natural sciences and economics)

The profitable growth scenario was used as the starting point for the bottom-up scenarios which are described next.

2.2 Bottom-up scenarios

The feedback on the publication of the top- down scenarios was very positive but they seemed to be too generic to represent the complexity of the chemical industry and to illustrate the specific challenges the different industry sectors are facing. Therefore, ECMSA decided to develop specific industry sector scenarios based on the general scenarios.

2.2.1 Petrochemicals/Plastics Scenarios

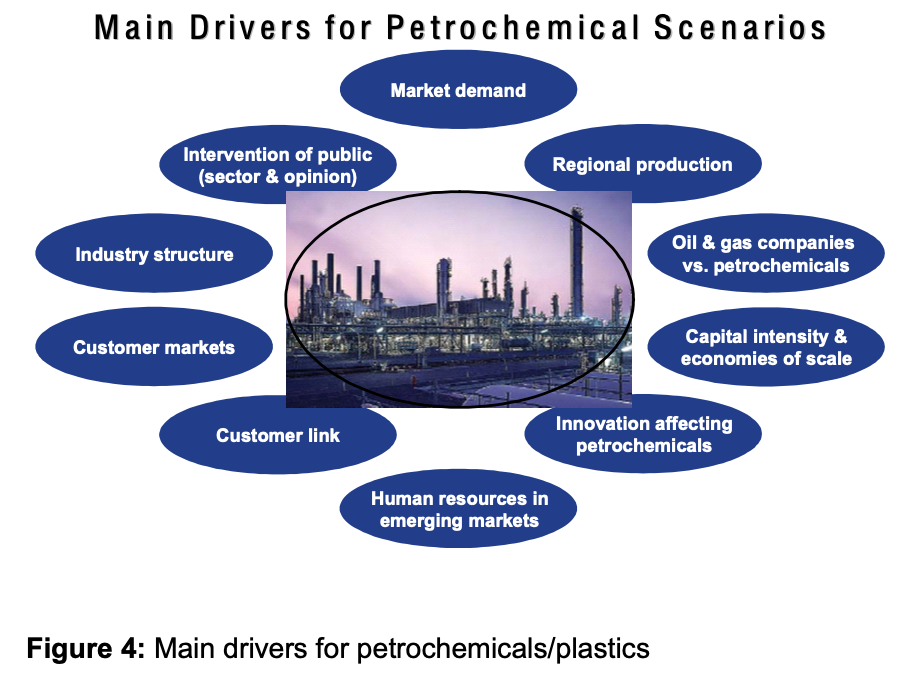

The starting point of the development of the petrochemicals/plastics scenarios was a list of 10 main critical drivers (see figure 4) which were then analysed with the Think Tools methodology In the end, four different scenarios were identified:

- Industrial countries sustained:

A petrochemicals/plastics industry which is still prospering in Europe - Same model new geographies:

The European petrochemicals/plastics industry migrating to Asia - Shift to the Middle East:

The Middle East is dominating the global petrochemicals/plastics industry - Tables turned:

Producers from the Middle East and Asia invest in Europe

The discussion with the different players in the European petrochemicals/plastics industry after the publication of these scenarios showed that they helped to stimulate strategic thinking. It should also be mentioned that about one year after publication of the scenarios the Middle East player SABIC acquired the petrochemicals assets from the Dutch company DSM. But up until now, we have not seen a major investment or acquisition from an Asian petrochemicals/ plastics player in Europe with the exception of Reliance from India acquiring in 2004 the former HOECHST polyester fibre business TREVIRA.

2.2.2 Speciality Chemicals Scenarios

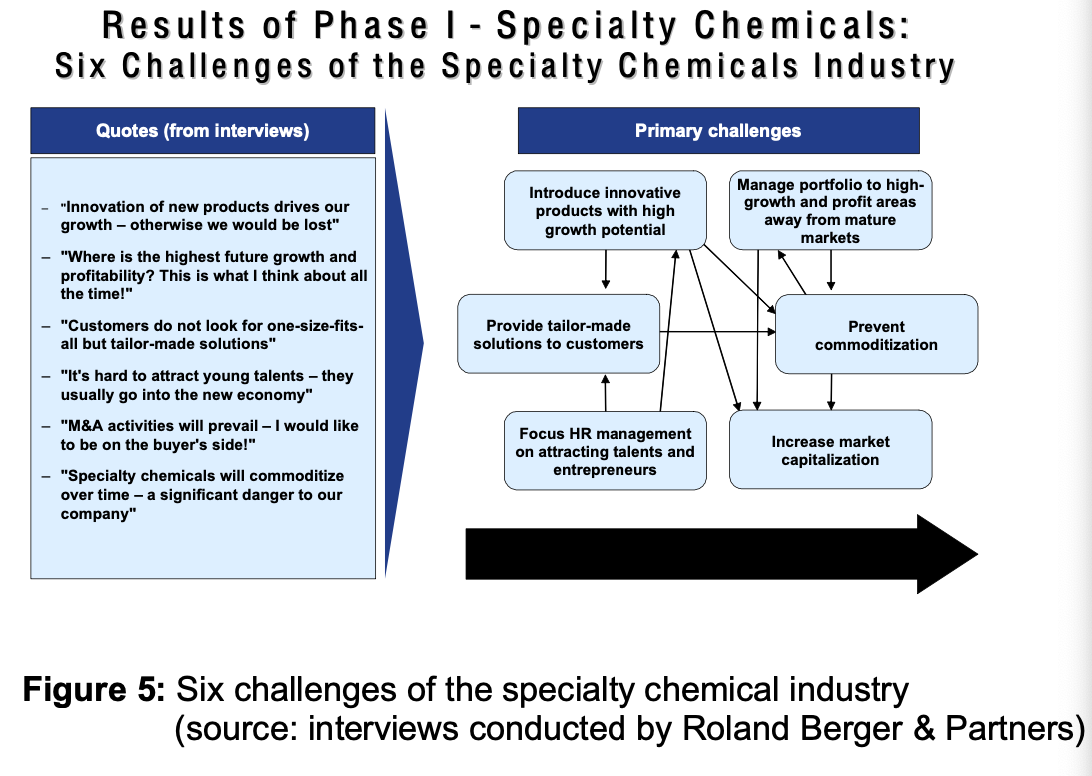

The development of the speciality chemicals scenarios started with the input from Phase 1 (see figure 5) where six challenges were identified. Finally, the following scenarios were found with the Think Tools approach:

- The Asian Wave: Strong imports from Asia into the European market

- Differentiation by Innovation: Increasing competitiveness by the European specialty chemicals industry with innovative products and applications

- Global Rules: Commoditizing helps European companies which focus on economies of scale and scope

- Breaking the Mould: Reinventing significant parts of the European chemical industry with biotechnology

Looking backwards, it is easy to notice that imports from Asia have grown, but the other scenarios could still happen.

It seems that the ECMSA-Scenario helped to stimulate futuring and scenario thinking in the European chemical industry. But, primarily, increasing competition from Asia and the Middle East and especially pressure from the regulatory side pushed the industry to think more systematically about the future.

3. A vision for the UK chemicals industry

In January 2002 the UK’s Department of Trade and Industry (DTI) launched an initiative for a “road map for formulating the actions that need to be taken now to ensure a vibrant and competitive chemical industry in the UK for the future under the leadership of Lord Sainsbury (Parliamentary Under-Secretary of State for Science and Technology).” [9] The “Chemicals Innovation and Growth Team” was established, which during the course of its work,

- “evaluated the key factors impacting on the chemicals industry globally,

- identifiedtheopportunitiesandchallenges for the UK

- formulated a vision of what the future chemicals industry should look like and

- maderecommendationsforindustry, government and others for specific actions.”

The vision for the UK chemicals industry was described as “seizing the agenda to profitable growth” [10]

- • The chemical industry is seen as part of the solution and not of the problem with a charismatic leadership which addresses its future productivity in two ways:

- “by being innovative in using science and technology to develop new products and processes

- and by ensuring its workforce has the right set of skills and competences.”

- In addition, the chemical industry has successfully responded to the challenges of sustainable development

- and therefore earned a better reputation.

In accordance with this vision, the Chemicals Innovations and Growth Team developed ten key recommendations [11]:

- Form a Chemistry Leadership Council (CLC) Headed by Barry Stickings, chairman of BASF (UK/Ireland) this group is already working on all the challenges facing the chemical industry, including raising its public profile and giving the industry a voice.

- Set up a Futures Group to develop Policy Frameworks on Sustainable Development, Reputation and Self-Regulation In July 2003, the Futures Group concluded that the reputation of the industry would not be improved without firstly addressing the sustainable development recommendation [12]. This in turn could not be addressed effectively without dialogue and stakeholder engagement. Therefore the Futures Group asked “Forum for the Future” to develop a concept for a stakeholder dialogue Central to the dialogue is the “Sustainability Matrix” which plots the five capitals “Natural, Human, Social, Manufactured and Financial” against “the three ways in which an organization can be considered to manifest’ itself – as a business, as a provider of products and services and finally as a significant member of the wider community.”

- Set up a Chemicals Innovation Centre (CIC) to act as the specialist central hub for the networks relating to innovation and technology and product development. This recommendation is clearly related to the next three recommendations on innovation.

- The Chemical industry should develop an agreed view of science and innovation priorities to communicate with the UK science base.

- The Chemical Innovation Centre (CIC), with the relevant regional and national agencies should promote the UK as the location of choice for start-ups in chemicals and related technologies.

- The Chemicals Leadership Council should carry out a review of marketing excellence in the industry. In order to fulfil all these innovation-related targets, the Chemistry Leadership Council has set up an Innovation Group which is supported by an Innovation Task Force (ITF). They first defined a framework for action [13] and began work on four topics:

- defining a set of research priorities (In July 2004 the CLC Innovation Task Force published a report on “Research and Technology Priorities”)

- looking at the entire innovation process • evaluating the UK science base

- supporting the establishment of the Chemical Innovation Centre

- Set up a Skills Network Group (SNG) to enable the industry to formulate more clearly and inclusively its priorities on skills issues and propagate them through the Sector Skills Councils (SSC) and other bodies, for instance the research councils.

- The Skills Network Group and the Government should consider how to extend the present remit of the Process Industry Centre for Manufacturing Excellence.

- The Chemicals Industry should encourage diversity. The Skills Network Group was formed in mid-2003 and is the largest of the groups representing the chemical industry, the Sector Skills Councils3, the trade unions, universities and the professional bodies. In July 2004, the Skills Network Group presented to the Chemistry Leadership Council a report on the “Skills for the 21st Century Chemicals Industry”.

- The UK government, in particular the DTI, should continue to act as a champion for the industry and support the work of the Chemistry Leadership Council and its groups (Futures Group, CIC, Skills Network)

The most ambitious recommendation from this report is “setting a Gold Standard for the Chemical industry. This ‘Gold Standard’ should define the skills, competencies and qualifications that the Chemical industry needs if it to be world class”. This Gold Standard should first of all focus on

- the licence to operate

- productivity , and later on

- innovation.

Summing up and evaluating the outcomes of the visionary approach of the UK’s Chemicals Innovation and Growth Team, we have to admit that it not only produced an interesting and visionary report on the future of the UK chemical industry, but really succeeded in starting many concrete actions.

It seems that the key success factor for this initiative is not only the active participation of the industry and the industry association, but above all the strong commitment of the UK Department of Trade and Industry. The mission statement of this department speaks for itself: “Working with businesses, employees and consumers to drive up UK productivity and competitiveness to deliver prosperity for all.” (www.dti.gov.uk)

4. Cefic: European Chemicals Industry Scenarios Horizon 2015

In 2002, the EU authorities requested a view allowing them to understand better the long-term prospects of the European chemical industry and to act accordingly. At that time only players in the European chemical industry (which, by the way, includes thousands of SMEs) and the related manufacturing industries had already realized that Europe’s position as a major production and innovation base for the chemical industry was eroding and that additional regulatory burdens could become the last straw. Therefore the European chemical industry Council Cefic (www.cefic.be) started a scenario initiative with the objectives of

- providing Cefic with arguments for the political discussion in the EU,

- supporting the Cefic member organizations with a guideline for dialogue with the national governments,

- helping the chemical industry in its communication with the financial community,

- underpinning the communication with the public by pointing out the consequences of different developments and

- assisting the chemical industry and Cefic organization in their long-term planning and strategic thinking.

The decision was made to establish a consensus on a set of scenarios based on a comprehensive analysis of the global market environment. The geographic scope was focused on the EU 15 with additional consideration of the 10 new EU member states. The scenario analysis started with macroeconomics and the analysis of the impact of different possible EU developments on the future of manufacturing in Europe and then on the future of the chemical industry in Europe.

4.1 Macroeconomics, customer Indus- tries and the future of the chemical industry

Traditional forecasts assume a strong correlation between chemical demand and the development of the Gross Domestic Product (GDP). This proved to be true for a long time period [15] ,but during the last few years it has become evident that something has changed. In the past, the chemical industry always grew faster than the GDP, but now chemicals growth is below the GDP level and it has to be expected, that this trend will continue (see figure 6). Looking at the components of GDP, it is remarkable that, in the industrialized countries, GDP is more and more driven by the service sector and, because the chemical industry is primarily delivering goods to the production sector (manufacturing, construction, agriculture) the traditional correlation between GDP and chemical demand is fading away.

But this means also that a traditional paradigm has to be skipped: the chemical industry is no longer an engine of growth in the industrialized countries.

As the details of the manufacturing sector were examined further, another structural change appeared: the output of the manufacturing sector in the industrialized countries is growing more slowly than in the past because there is a migration of manufacturing industries from high-cost countries to low-cost countries. This structural shift could be observed in North America when more and more manufacturers delocalized their production from the U.S. to Mexico and nowadays more and more to Asia, especially to China. These migration effects are not totally new and are well known for the textile, shoe and toy industries.

But what is new is that more and more industries are following this trend, and that the speed of migration is increasing.

In Europe, these structural changes happen with a certain time lag in comparison with the U.S. The dominant trend is a shift of manufacturing industries from western Europe to eastern Europe. This shift, which can be observed very well in the automotive industry, especially in the automotive supply industry, is focused primarily on the ten new EU countries. But, for more and more industries, countries like Turkey, Ukraine and Russia are becoming important. And, more and more, the shift of production to Asia, especially China, is becoming attractive.

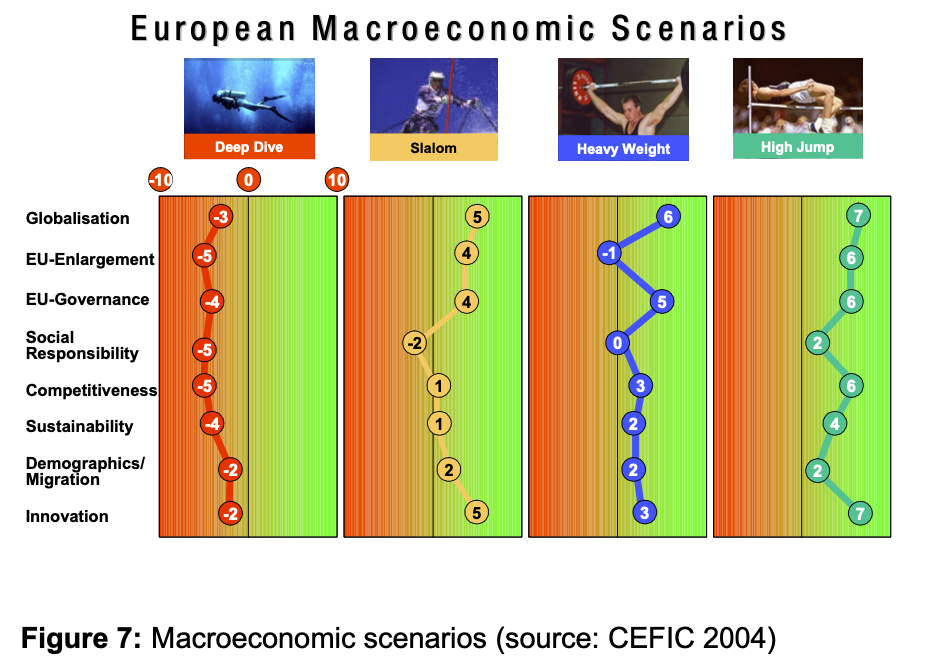

The good news for the European chemical industry is that as long as its customers stay in Europe – either western or eastern Europe – it does not have a strong impact on production because of the limited distances in Europe. Having these structural changes in mind and understanding the overall trends in the European economics, the macroeconomic scenarios could focus on different political and economic environments (see figure 7).

The four macroeconomic scenarios developed differentiated the future development with regard to the driving forces Globalization, EU Enlargement, EU Governance, Social Responsibility, EU Competitiveness, Sustainability, Demographics/Migration and Innovation/Lisbon Agenda.

The quantification of the four macro economic scenarios was done with the help from Global Insight (www. Globalinsight.com) and their strong global data base on economies and industries as well as their econometric modelling tools.

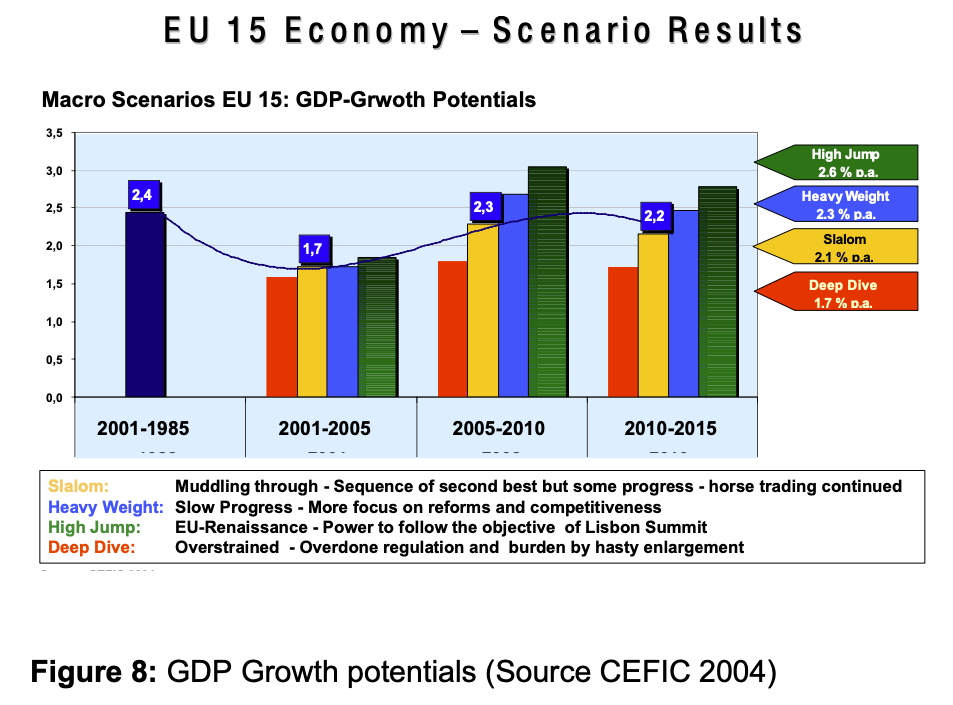

Despite the enormous efforts invested in the modelling of the four macroeconomic scenarios, they seem not to differentiate a lot with respect to the expected GDP growth rate (see figure 8). But, because of the huge leverage effect, even small differences count.

4.2 The 4 chemical industry scenarios

The next step after the macroeconomic modelling was the development of the chemical industry scenarios.

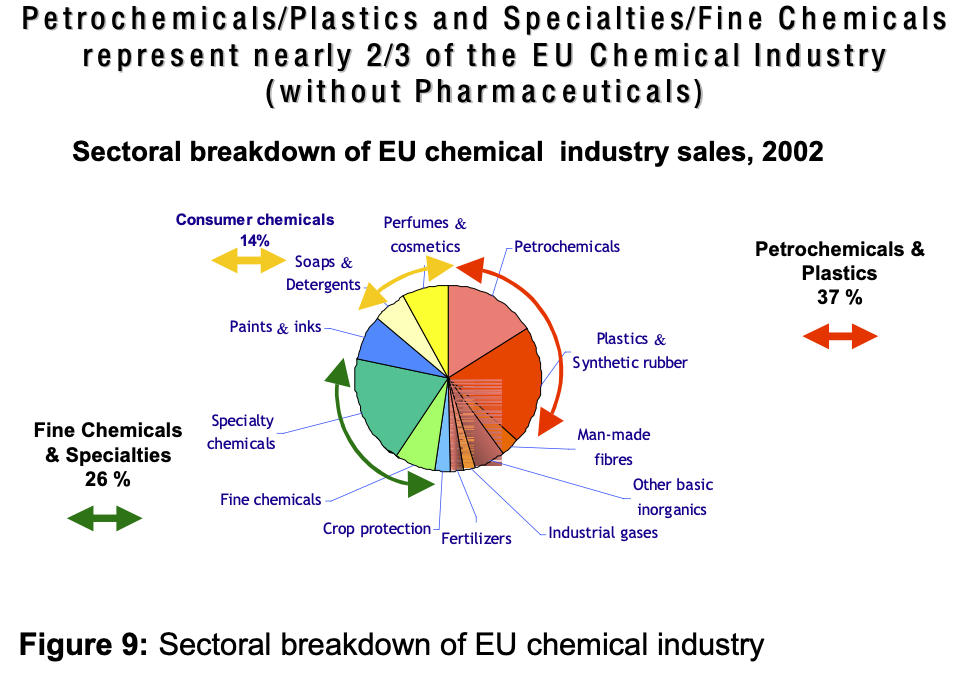

This requires not only an understanding of the relationship between the European chemical industry, its customer industries and the European economy within the global context but also an understanding of the critical drivers for the future development, which are specific to the chemical industry. This turned out to be a difficult undertaking because the business environment differs significantly in the different sectors of the chemical industry, because the perception regarding the future challenges differed significantly between the country representatives involved, because the degree of awareness differed significantly between big companies and small/medium-sized enterprises and because the interest in focusing on Europe varied enormously between global players and local companies. To solve these problems it was first decided to look at the chemical industry not only from an overall perspective but also to differentiate between the most important sectors (see figure 9), namely petrochemicals/plastics and fine chemicals/speciality chemicals, and thereby to represent two-thirds of the EU chemicals industry (without pharmaceuticals).

But how to overcome the different perceptions and interests of the people and organizations involved? The solution came with the Think Tools methodology (www.de.redit.ch), which offers an intelligent combination of a workshop approach together with a user-friendly software package. The powerful facilitator concept and the visualization and consensus-building tools helped to overcome all the problems mentioned above.

This concept helped to identify the critical driving forces for the future development of the European chemical industry as well as to build up different possible and realistic futures for the European chemical industry.

At the centre of all reflections on the future of the chemical industry is the competitiveness of the industry in the global context.

Competitiveness is threatened by a combination of factors, first of all by the regulatory environment, especially the new REACH chemicals policy. But also higher energy prices, higher logistics costs and a business environment that is generally not promoting innovation are playing an important role.

The pressure on chemical prices caused by increasing commoditization, customer trends and growing competition from Asia and the Middle East is seen as an already considerable threat.

On the other hand, the industry itself has the power to increase its competitiveness by restructuring and improving its operational performance, by making use of improved market & sales excellence and more market and customer orientation, and by more, and sustainable, innovation. The results of improved competitiveness would be higher profitability, better payoff, of investments and, together with all the aforementioned actions a better reputation, which would also help to recruit and retain the best work force.

These driving forces are reflected in the four scenarios which were formed as the final outcome of the workshops:

- Sunny: A revitalised EU chemical industry with increased innovation and customer orientation

- Cloudy: A focused EU chemical industry with strengths in high-end products and sustainability

- Rain: A EU chemical industry without confidence in the attractiveness of the European market

- Storm: A shrinking EU chemical industry not able to beat imports

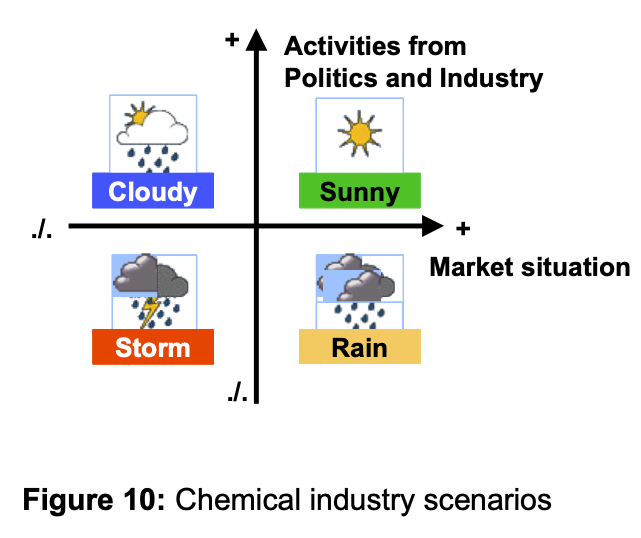

The four scenarios reflect two major dimensions (see figure 10):

- The market situation and

- activities from politics and industry.

The general learning from this scenario approach was that, by joint action by politicians and industry, the competitiveness of the EU chemical industry could be defended or even improved. But without political support the EU chemical industry would lose competitiveness and, in a negative market situation, this could even lead to a shrinking EU chemical industry with a negative impact on the whole European manufacturing industry [16] because of the high importance of chemicals for the production and innovation of finished goods [17]. However, the scenario approach also showed the importance of actions by the industry itself. It has the chance to improve even by increasing competition, but there is a high risk of losing out if it does not take proactive action.

The demands for actions from the political side are

- a balanced chemicals policy

- incentives for innovation

- non-bureaucratic regulations

The action demands for the industry itself are active measures for restructuring4 innovation in new products, processes and business models increased market & customer orientation and a sustainable balance of economic, ecological and social requirements.

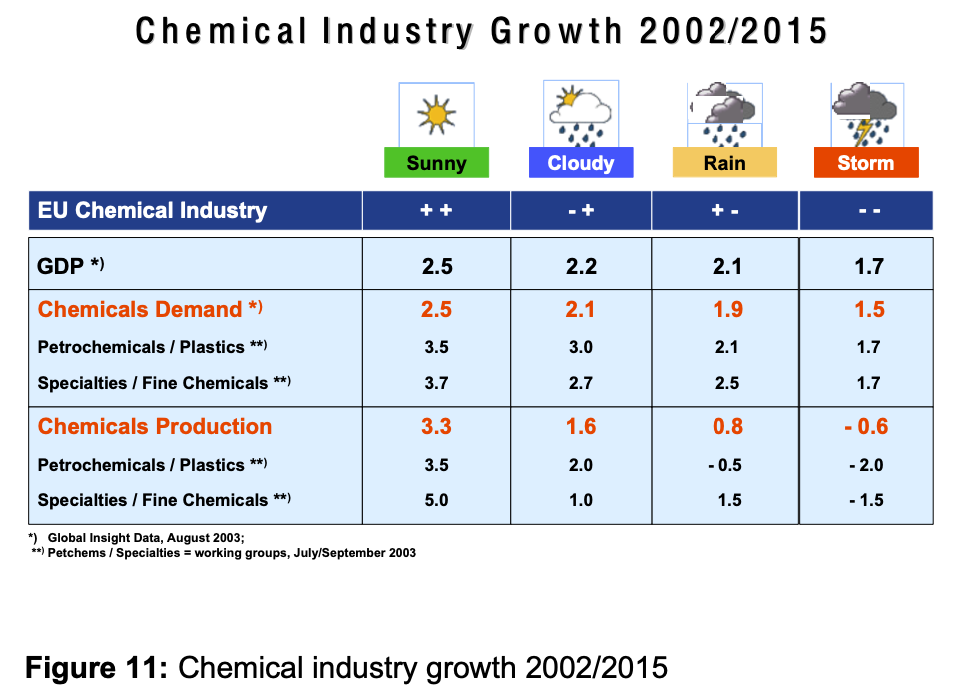

In terms of quantification of the four chemical industry scenarios, the future chemical demand growth differs only by 1.0 % p. a. (see figure 11). But looking at the production side, which reflects competitiveness, the negative scenarios show slow or negative growth in contrast to the positive scenarios with moderate and strong growth.

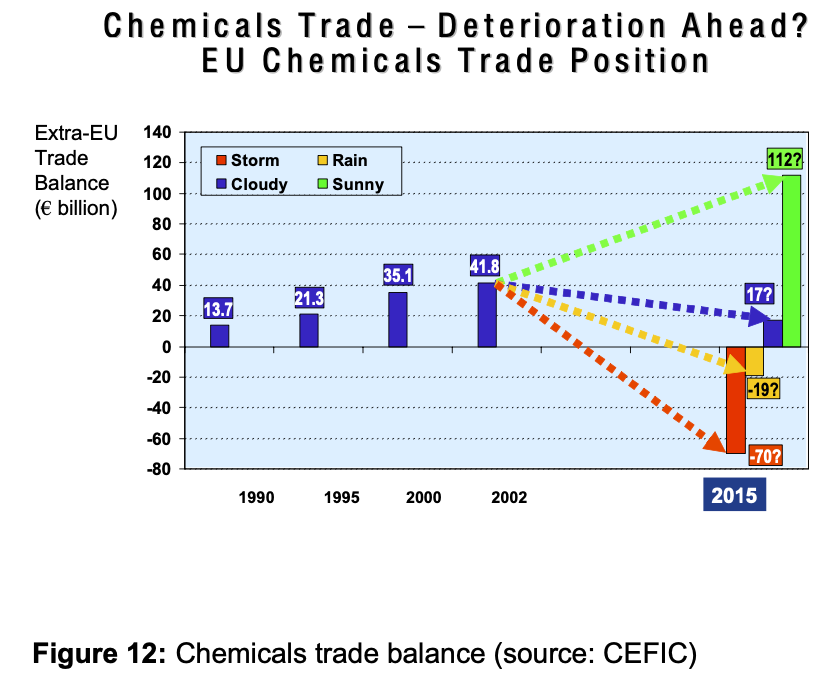

What that really means is even better reflected by looking at the chemical trade position which turns negative if industry and politics do not act proactively (see figure 12).

Therefore it was the logical result of this scenario exercise that Cefic recommended the establishing of a Chemical Advisory Networking Group for Europe (CHANGE) consisting of members from

- European Commission

- European Parliament

- Member States

- chemical industry

- trade unions

- downstream industries

The mission of this group is to develop a clear, measurable and agreed longer-term vision for the European chemical industry based on the Cefic Scenarios 2015.

5. Summary and Conclusions

The chemical industry has demonstrated that futuring is not only possible at the level of a specific company [20] but also with industry-wide initiatives. Obviously, this becomes all the more difficult the more companies and countries have to be involved, but there are tools and concepts available (e. g. Think Tools methodology) which can help in the management of even such complex futuring processes.

Comparing the different initiatives, one issue shows up very prominently: innovation.

In all 3 European futuring concepts, innovation is identified as one of the most important drivers for the positive future development of the chemical industry. In contrast to the US concept “Technology Vision 2020”, innovation is not only limited to scientific and technological results5 but, in a much broader sense, it includes business process innovation, new business models, improvements in supply chain management etc. In all three European futuring initiatives, the people factor is mentioned and related on the one hand with the challenges of knowledge and skills and on the other hand with the risk of brain drain and an eroding knowledge base. But only in the UK concept is a clear action plan already visible with the establishment of a skills network. And even there the unanimous realization that customer orientation and marketing & sales knowledge has to be improved has, up until now, not led to any concrete action.

While action and clear measures are the strength of the UK concept, the strength of the Cefic concept is that it clearly addresses the challenges the chemical industry is facing, including the increasing regulatory burden. It even quantifies the consequences if not enough is done by the authorities and the industry itself. While in the UK concerted action between government and industry is noticeable, in order to defend and improve the competitiveness of the chemical industry, this has still to be achieved at the European level. The establishment of a Chemical Advisory Networking Group for Europe is the right and first step in this direction, with the UK concept as the benchmark.

6. References

[1] Cornish, E. (2004) Futuring: The Exploration of the Future, World Future Society, Bethesda, Maryland, USA.

[2] Spitz, P.H. (2003): The Chemical industry at the Millennium. Maturity, Restructuring and Globalization, Philadelphia, Penn. Chemical Heritage Press.

[3] Cefic (2004) Chemical industry 2015: Roads to the Future, Final Report Cefic, Brussels, Belgium.

[5] Heinzelbecker, K. (2001) The Future of the Chemical industry: ECMSA Scenarios 2010, ECMSA Conference, Berlin, Germany.

[6] The American Chemical Society (1996) Technology Vision 2020 for the future of the US chemical industry, Washington, USA.

[7] www.chemicalvision2020.org/techroad maps.html

[8] Procter, D. (2004) : The future of the chemical industry – the challenges and opportunities ahead for the U. S. chemical market. July 8, 2004, www.philamixers.com

[9] Grote, B. (2002) Chairman’s Foreword,Enhancing the competitiveness and sustainability of the UK chemicals industry, DTI, London, UK.

[10] Chemicals Innovation and Growth Team (2002) Executive Summary. www.dti.gov.uk

[11] Chemicals Innovation and Growth Team (2002) Final Report, www.dti.gov.uk

[12] Forum for the Future (2002) The Sustainability of the Chemical industry, 19-26, www forumforethefuture.org.uk

[13] Harrison, C. (2003) Innovation in the UK Chemicals Industry : The work of the Chemistry Leadership Council. Dicida-UK conference paper Grimsly.

[14] www.cogent-ssc.com

[15] Heinzelbecker, K./Gronych, R. (1995): Scenario 2010. Challenger Asia. Economic Bulletin, Cefic Brussels, www.cefic.be/activities/eco/ecobul/Eb 9511b.htm

[16] Fondazione Rosselli (2003) FuTMaN: The Future of Manufacturing in Europe 2015-2020. The challenge for sustainability. Final Report for the European Commission. Directorate- General Joint Research Center

[17] Roveda, C./Vercesi, P (2002) FutMan: Case Sector Report Basic Industrial Chemicals, europa.eu.int/…/industrial_technologies/p df/pro-futman-doc8.

[18] Rammer, Ch. (2003): The Chemical industry as Driver for Innovation in other Industries. In: M. Droescher, G. Festel,, M. Jager, The Power of Innovations, How Innovations can Electricize the Chemical industry, Aachen, 50-66.

[19] Chem. System (1998): Industrial Restructuring in the Chemical industry. Final report prepared for the European Commission DG III-C-4.

[20] Mannerma, M. (2004): Traps in Futures Thinking – and how to overcome them. In: Thinking Creative by in Turbulent Times (Ed.: Didsbury Jr. H) World Future Society, Bethesda, Maryland USA, 50-51.

[21] Coates,J.F./Mahaffie,J.B./Hines,A. (1997): 2025. Scenarios of U.S. and Global Society. Reshaped by Science and Technology. Grennsboro, Oakhill Press. USA.