Ecosystem for Greentech startups in the Rhine-Main-Neckar metropolitan area requiring dedicated technology infrastructure

Abstract

Is the Rhine-Main-Neckar Greentech Ecosystem prepared to support start-ups along the entire development process from the ideation to commercialization? The developments of novel products and services required in Greentech, specifically in the deep technology sectors of chemistry, green and white biotechnology, and material sciences requires extensive infrastructure. This includes dedicated laboratories, technical equipment, and scale up options like pilot plants, the establishment of which requires cost intensive investment. In chemistry and biotechnology, besides the technical challenges, the regulatory aspects pose a major barrier to the success of start-ups at a certain development stage (Technology Readiness Level [TRL]) and are thus identified as key hurdles for funding new businesses. These and similar hurdles can be addressed while bringing an idea to fruition in a Greentech environment since such ecosystems allow for parallelization of workflows for multiple projects, taking advantage of centralized functions and expertise. In the Rhine-Main-Neckar [RMN] metropolitan area, a united approach from politics, academia, transfer units and technology hubs, accelerators, and industry is being put into place to offer start-ups a tailormade Greentech environment to grow ideas that are urgently required to create a more sustainable economy and combat the climate crisis.

1 Introduction

Greentech Ecosystems, just as in the case of their natural counterparts, are complex interacting networks that require balanced participation of all of the partners involved. Natural ecosystems are characterized as being stable environments where organisms symbiotically interact with other constituents of the system. However, the individual organisms in these natural ecosystems often have no choice in being a member or participant in this environment. Natural ecosystems result from natural local circumstances, evolutionary forces, and in the antrophocene age also human interference, often without regard for the eventual destabilizing outcomes.

In contrast, we treat business ecosystems as the purposive interplay between societal institutions and individual human economic action on a local level. In modern, globalised societies, economic actors may freely choose to participate in any particular ecosystem according to their bespoke preferences. Therefore business ecosystems compete to attract ideas, talent and capital. As an ecosystem is a local network, which is in some facets in competition with other ecosystems, it is important to highlight the increased opportunity to gain benefits and support from e.g., venture capital firms, globally acting companies, and importantly, talents creating new ideas. Sustainable entrepreneurial ecosystems are defined as an interconnected group of actors in a local geographic community committed to sustainable development through the support and facilitation of new sustainable ventures (Cohen, 2006). To realize a transformation in society and science, it is important to understand the urgency with which the actions to mitigate the continued rapid increase in the exhaustion of our planet’s resources are needed to prevent a mass extinction of our natural ecosystems. Climate change initiatives lead by the next generation have gained traction on multiple fronts owing to both their contribution as individuals and as a new generation of employees in the economic network of companies and organizations. In doing so they embody the voice of change instrumental in building internal pressure to concretely initiate “economic action”. One way to achieve this deep-seated structural change while harnessing existing structures is via “business ecosystems” fostering Greentech start-ups. This work focuses on Greentech start-ups that work in e.g. biotechnology, chemistry, or material sciences, which require cost intensive technical development support from ideation up to commercialization, be it laboratory, pilot plants, or dedicated access to specialized equipment. Besides its technical infrastructure, the RMN Greentech ecosystem analyzes if all other required stakeholders are involved to the degree that the ecosystem is capable of developing successful start-ups.

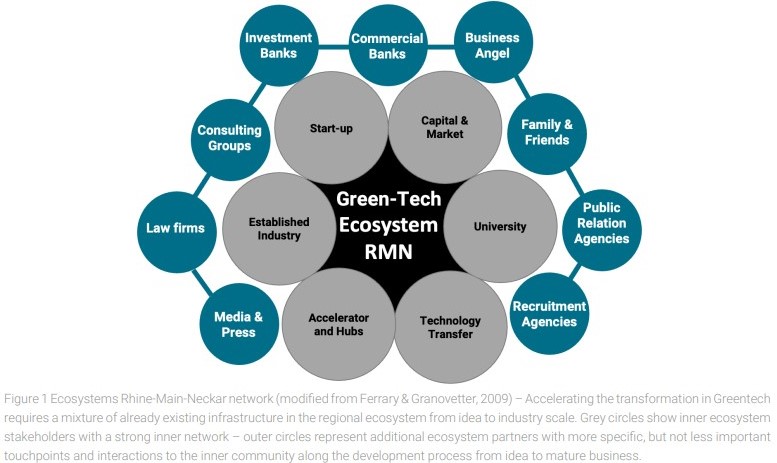

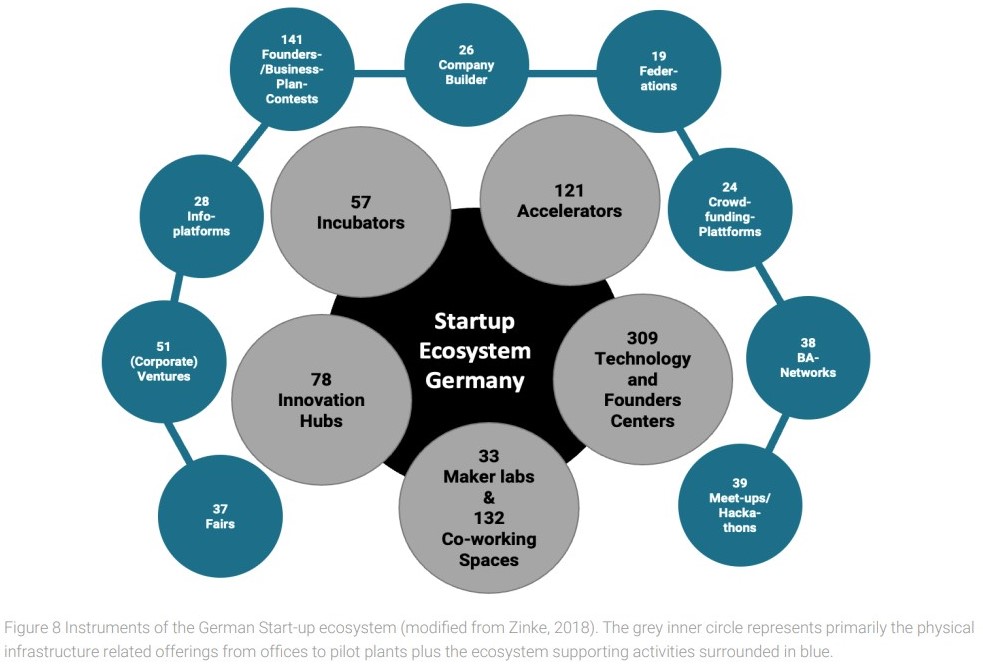

For the economic activities, several stakeholders like Start-up, Universities, Technology Transfer units, and Accelerator and Hubs (figure 1) are required (Ferrary & Granovetter, 2009). These need to be orchestrated to avoid redundancies causing wanton use of resources, but also to develop an ecosystem to be efficient and self-optimizing and to expand. Growing an ecosystem and its continued expansion is relevant for its economic sucess and stability. This is because after a certain critical mass is attained, the ecosystem tends to gain broader attention which acts as an important feeder of new start-ups into the ecosystem. To establish a start-up ecosystem with high performance, it is important to understand the different performance indicators crucial to each of the various stakeholders in the network, which range from measuring actual performance of the start-up as teams and the funding activity. There is also the venture capital (VC) perspective, which extends from market reach and scaling opportunities as well as research and patent activities, especially when considering universities and associated transfer units. This casestudy analyzes the Greentech ecosystem in the RhineMain-Neckar (RMN) metropolitan area (figure 1) which basic setup is comparable to those of other clusters. For further understanding of Greentech ecosystems, from the perspective of central stakeholders, the following article will provide insight into how the RMN ecosystem is set up. For this purpose, facts will be summarized and contextualized for the German or global ecosystem (figure 1, grey dots) with additional information where required for the support functions also part of the complex ecosystem network (figure 1, blue dots).

2 Materials

This work analyzes the support functions and stakeholders in the Rhine-Main Neckar Greentech ecosystem along the development path for products and services of start-ups to highlight the strength and weakness of the supporting infrastructure. The aim of this capability analysis is to find gaps in the ecosystem. This outcome of the gap analysis is a basis to work with politics, academia, and industry in the RMN region to implement missing supporting elements along the well described metrics of the TRL. In this work, the RMN Greentech Ecosystem is analyzed to examine if all required functions to support Greentech start-ups are present and exist to: (1) Support functions established along the entire TRL scale, (2) Understand if all elements of a Greentech start-up ecosystem are in place, (3) Understand if these elements are nascent or disconnected and require special attention to grow and connect. This would require Ecosystem building at the intersection of stakeholders along the TRL. Access to funding along the TRL is also examined. These seed investor communities bring capital along with business and industry expertise, and connections to customers and global start-up ecosystems in the RMN area. Finally, industrial interest and the extent of the support to be rendered to the Greentech cluster is evaluated.

The analysis will specifically focus on the following stakeholder groups:

- Rhine-Main-Neckar Ecosystem

- Capital & Market: Greentech Market and regional financial stakeholders

- University landscape in the Rhine-Main-Neckar area

- Technology Transfer Units

- Industry in chemical and white biotechnology and material sciences

- Start-ups

3 Results and Discussion

Rhine-Main-Neckar Ecosystem

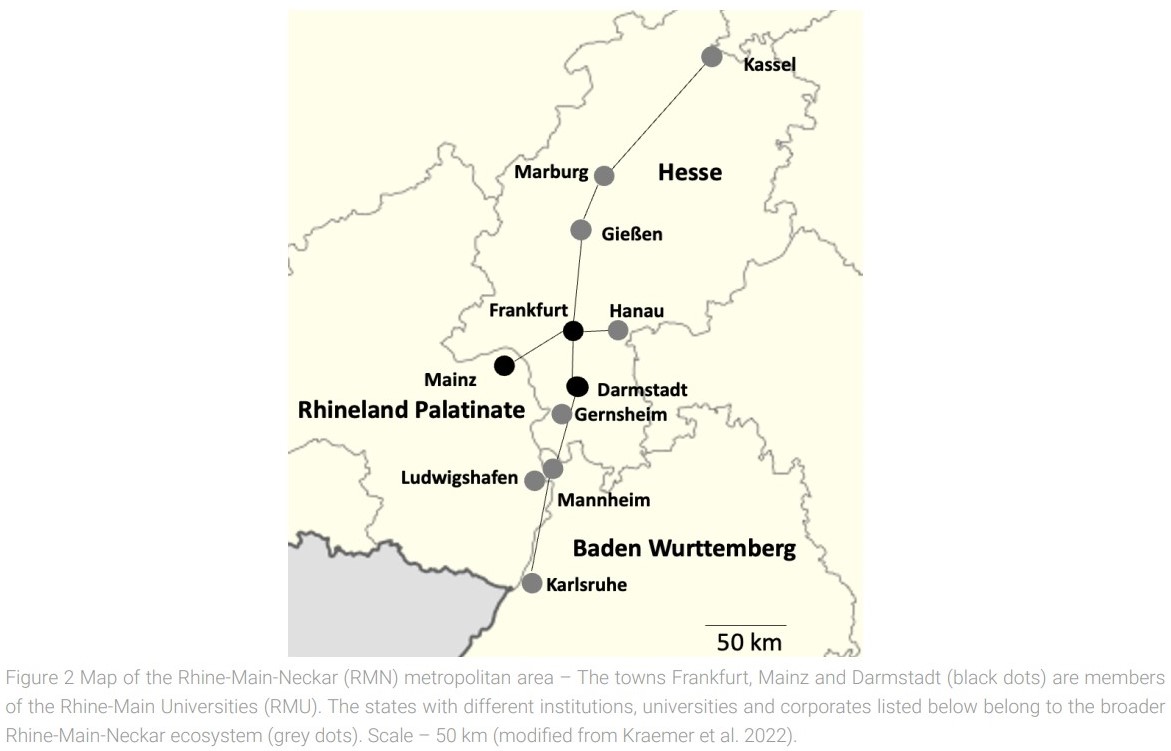

A start-up ecosystem requires the infrastructure necessary for businesses to operate, which means the minimal requirements from infrastructure and operations, supply chain, commercial functions and finance. To build and grow an innovative, competitive cluster in the sector of Greentech in the middle of Germany in the Rhine-Main-Neckar area (figure 1), it is pertinent that it has the capability to nurture the funding of start-ups developing breakthrough technologies (Ferrary & Granovetter, 2009) in the transformationtowards a Greentech Economy. Ideally, this should be complemented with incremental innovations that generated by the established industrial sector in chemistry, green or white biotechnology, and material sciences. With the above outlined prerequisites, the aim is to build and grow a strong ecosystem in an area that covers regions from four federal German states between the states of Hesse, Rhineland Palatinate, and northern Baden Wurttemberg (figure 2).

As detailed in figure 1, the success of the start-up ecosystem depends primarily on the regional presence of the inner circle stakeholders with strong interconnection and established processes and expertise to adequately support the newly formed start-ups. This is essential as the needs of the start-up grow from an idea to the expansion and building of factories. Which also results in a positive economic outcome of increased attractive job offerings in Greentech companies.

Capital & Market: Greentech Market and Regional Financial Stakeholders

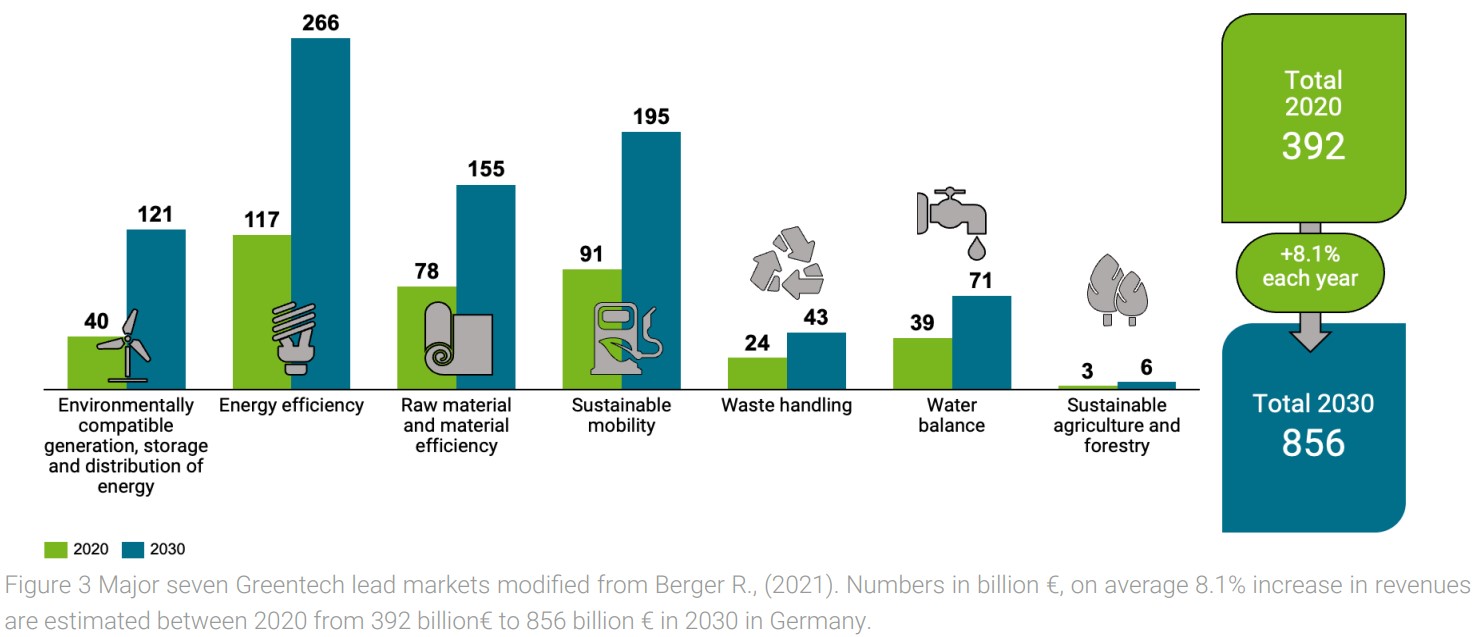

Venture capital firms in the RMN area are well established and major global banks have offices in Frankfurt and are already well underway especially in the start-up community for e.g. the TechQuartier in Frankfurt. Leveraging the expertise towards the Greentech industry is an intrinsic motivating factor for banks as already they experience the need and willingness of their customers to invest in sustainable financial products. But this goes beyond financial offerings highlighted by the product developments required for the green transformation as indicated by the seven key lead markets defined by the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (Berger, 2021), figure 3. The Greeninnovation consists of either green products or green processes and services. Greentech comprises technologies for energy saving, pollution prevention, waste recycling, green product designing, and corporate environmental management (Chen et al., 2006) and are some of the key attractive financial markets.

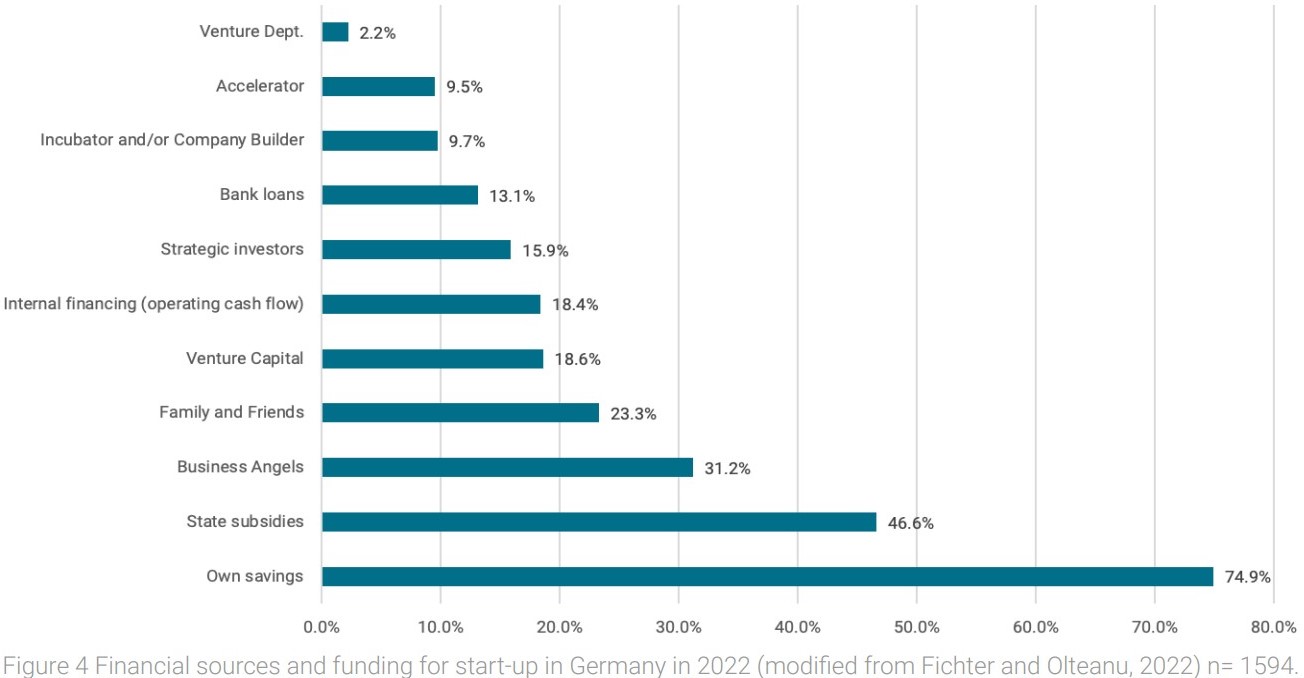

To assess the vitality of the local start-up ecosystem regarding quality, quantity, and ease of access to funding in the RMN region in Greentech, it is important to identify capital investors with expertise and interest to fund longer term projects, as Greentech often requires technical development and Capex expenditure over years rather than month. Therefore, access to funding should start as early as possible, tracking early-stage funding rounds to assure the entrepreneurs are getting the support required. Here especially, local investors will help to better understand the investment trends in a local ecosystem and regional investors will help to connect to foreign VCs already investing in the local start-up ecosystem and allow to build bridges and make regional start-ups more competitive abroad, which is important for the reputation and attractiveness of the entire ecosystem. Here it is important to mention that building a tech ecosystem may take years to decades and requires continual effort and investment (Darko, 2019); in particular, the funding dictates where innovation evolves. However, here VCs play a central role beyond funding as they select the most attractive projects in the ecosystem and help the start-up to embed themselves in the network (Ferrary & Granovetter, 2009). The idea and foundation for innovation starts with VC as one of the key elements of the infrastructure of innovation (Powell et al., 2002). For a successful ecosystem, a one hit wonder is not enough, since the success of one start-up valued over 1 billion € in the ecosystem is regarded as a unicorn even if it may raise attention and attract further start-ups to the ecosystem. But to be sustainable one needs a continuous flow of novel ideas and start-ups to ideally attract and cultivate multiple future successes. In a functioning Schumpeterian ecosystem failing startups will quickly disappear and their resources redirected to promising new ones .The continuous attraction of new startups requires financial support in various phases to become successful, and besides the business of VC firms the federal and state government programs are important to feed the finance consuming Greentech start-ups as they often require costly equipment, laboratory and pilot plant infrastructure, as well as skilled technical personnel. In Germany in 2022, 18.6% of startups received funding from VC, 13.1% from banks, and 15.9% from strategic investors like family offices, but most startups relied on their own budget (74.9%) or family and friends (23.3%) taking into account that startups used multiple financing options (figure 4). The governmental programs reached 46.6% of the start-ups, but with significant regional or state differences, and with 31.2% Business Angels played a major role in financing the German start-up community (Kollmann et al., 2022) especially in mid-phases along the development process. In addition to government funding, industry funds, banks, private, and family and friends’ financial investments for start-ups, the Business Angels Network Germany published that in 2016, around 7500 active Business Angels invested a total of 650 Mio Euro in the development of start-ups (Guenther, 2016).

University landscape in the Rhine-MainNeckar area

To maintain the flow of constant innovation and funding of start-up in the RMN area, universities are essential talent developers and idea creators. Here a regional cluster comprises numerous well ranked research universities like Darmstadt (*269), Frankfurt (*340), and Mainz (*427) in the inner region as well as in proximity like Karlsruhe (*136), Heidelberg (*65), Mannheim (*423), Gießen (*490), and Marburg (*701) along with multiple Max Plank institutes, Fraunhofer institutes, European Molecular Biology Laboratory (EMBL) and the German Cancer Research Center (DKFZ), etc. to mention some institutions with a well-known world-wide reputation (* QS World University Rankings 2022). Universities fulfil the central tasks of creating an environment where talents are attracted because of the reputation and the offered research fields and infrastructure. These talented students need a setup where they can unfold their ideas supported by an excellent academic scientific surrounding. In the RMN area this pool of ideas is enormous and not only are the universities important for the success of a functional start-up setting. Within the RMN Greentech ecosystem, there are dedicated technologies in research groups and departments where technical engineering, material science, biotechnology, and chemistry are subjects of world class research. In these faculties, novel ideas for the green transformation originate to develop new products and services. In the Greentech Ecosystem of the RMN region, two technical universities are members of the TU9–German Universities of Technology, namely Darmstadt and Karlsruhe, which excel in pioneering creative research in engineering and the natural sciences to feed the local ecosystem with groundbreaking innovation through collaboration with academics worldwide. One way of doing this is through programs such as “Unite!” which is a European University alliance of innovation, technology, and engineering.

As a strategic, agile, and dynamic alliance of 9 universities with a total of 167000 students and 36700 graduates as of 2018, there is a strong focus on basic future-oriented science with the sense for urgent need in GreenTech (Winkler et al., 2020). In addition, the participating RMN universities have extended research and cooperation networks, and partners around the globe in industry, mid-sized enterprises, and start-ups, which allows to identify key technologies and make them accessible to the local ecosystem by technology transfer units of the universities and thus pave the path for additional novel developments and take off new businesses.

Technology Transfer Units

In the RMN ecosystem, universities offer different models and strategies to translate academic research to business by supporting scientists to pursue the career path to start their own business. In Germany, this is still not a common widespread personal development path besides either the academic or industrial career paths. Stimulating scientists and graduates to start their own businesses requires dedicated support around certain aspects. In the first place, a key question to address is the intellectual property right of the invention the start-up would need to develop unique products or services. As the first experiments are typically conducted in the academic research groups led by a senior researcher and professors, the start-up needs to assure access to the IP rights under promising conditions, which would make starting a new business worthwhile. The Goethe University of Frankfurt as an example has implemented the technology transfer office INNOVECTIS, which enables scientists and companies with patent management and commercialization research and development projects, spinoffs from the university and scientific consulting. Similarly, the Technical University Darmstadt has implemented the networking platform HIGHEST as the Innovation and startup Center, where founders are supported with a wide range of services for setting up a company. HIGHEST regards themselves as companions, starting from the idea to the scientific knowledge leading finally to a newly funded start-up. The service covers coaching, networking events, contacts to relevant players in the business, sciences, and politics as well as the search for investors and expertise and knowledge regarding funding programs and the already above-described access to IP by a process in place called IP for shares where the start-up pays back money when they are successful in the market and earn money. A third example that extends the offering from Fintech to Greentech is the TechQuartier (TQ) based in Frankfurt, which is unique in that it offers for B2B start-ups a partner network. Based on their technology needs and challenges, start-ups are regularly matched, introduced, and connected through the TQ scouting team. The three examples show that specialization in the complex start-up scenery is a potential benefit for the entire ecosystem, and the complementary offerings support each other, ideally maximizing the value for the start-up and the entire innovation cluster. The TQ is offering in addition to Fintech start-up support programs also the expertise required for Greentech start-ups in a joint program named h_ventures. This refers to a start-up program that gives first-time founders the knowledge and the connections to build a viable team. This activity for Greentech startups is sponsored by the Hesse Ministry of Economics, Energy, Transportation and Housing and powered by Goethe University Frankfurt and TechQuartier, this program was created to empower professionals and students.

Industry sector and companies active in chemistry, white biotechnology, and material sciences

In the RMN area besides specialized VC firms also several company venture funds invest in start-ups or grown-ups (late stage start-ups) mainly when the idea fits with the company strategy and the products or offering is suiting to the portfolio of the parent company. The RMN area is home to several globally active Corporates like BASF, Evonik Industries, or Merck KGaA, which also invest through internal VC Funds. A first example is the Evergreen fund of 250 Mio€ which invests in seed to Series B in e.g., circular economy and decarbonization of start-ups. Another interesting approach is Evonik Industries, a Specialty Chemicals multinational headquartered in Essen, Germany, with operations in Hanau and Darmstadt, both in the RMN area. They also have a cooperate VC arm which makes direct investments into cutting-edge start-ups while also investing in funds like the German HTGF (High Tech Gruender Fond) and other diverse set of technology funds in key geographies and areas of interest to Evonik. As a third example for a corporate fund located in the RMN metropolitan area is the strategic corporate venture capital fund of Merck KGaA, with a dual remit of strategic and financial returns. In 2021 the fund available for investment was increased by an additional 600 Mio€ to enable increased and larger investments across the two investment areas of biotechnology and technology. Together the three mentioned companies comprise 55000 employees in the RMN area of the total 306823 employees (18%) in the chemical sector according to the German Federal Employment Agency in 2021 in whole Germany. With regard to revenues the BASF headquartered in Ludwigshafen generated a turnover of 89.4 billion USD

in 2021 and was placed at the top 1 world-wide among the chemical companies. The chemical sector is the third largest industry sector in Germany with huge relevance for the supply chains of other large sectors like automotive and mechanical engineering. The number of employees is not directly linked to start-up funding, but the traditional relevance of the chemical sector to the RMN area is

important to align corporate and political mindset that a Greentech cluster in this region is self-feeding the existing job machinery if all stakeholders contribute adequately.

Start-ups

The fact that the RMN ecosystem generates start-ups and showing that the actual approach is successful is seen in the annual start-up Monitor 2022 (Kollmann et al., 2022). In 2022 there were 1588 start-ups founded in Germany. Among top 10 ranked German universities the founders had received, with the indicated percentage, their degrees from the following universities: Mannheim with 2.5% (top4), Darmstadt with 1.8% (top6) and Frankfurt with 1.6% (top10).

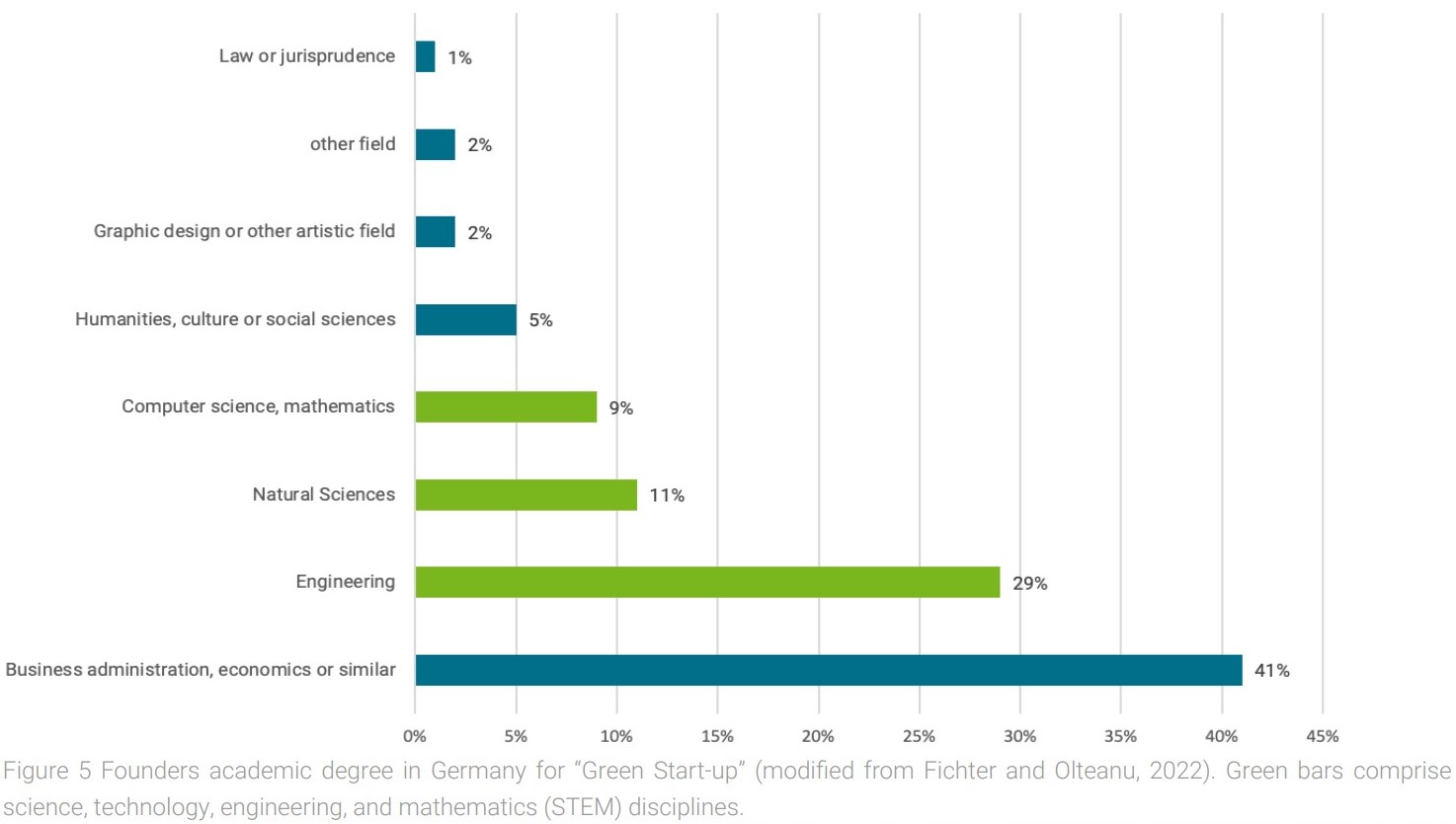

Interestingly, among all Greentech start-ups investigated in that publication, founders have an educational background in engineering sciences with 29% followed by natural sciences with 11%. In total 40% of all startups are technology driven developments (figure 5). The highest educational qualification of the green start-up founders is 36% masters, 18% diploma and followed by 16% PhD and in total summed up that in Germany 86% of all founders have an academic background (Fichter & Olteanu; 2022). Thus, it is evident that for founding a start-up in technical disciplines the proximity to universities and the associated technology transfer units is matter for a successful, functioning ecosystem. As outlined in figure 5 among founders of Greentech start-ups the key faculties and qualifications are business administration and economics (represented by 41%).

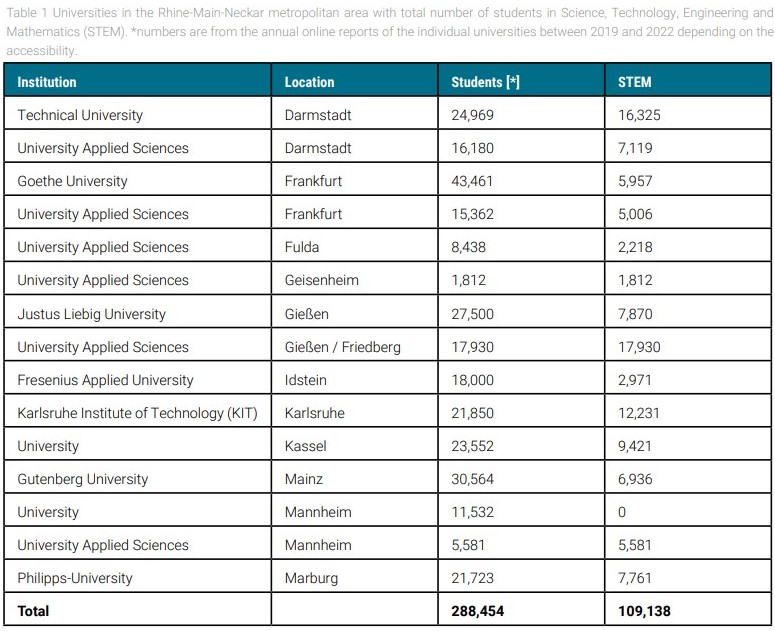

This high percentage is not surprising as in the early phases of getting a business started a lot of activities are business model generation and financial aspects. But to develop Greentech products and solutions it is often even more relevant to have technical ideas (figure 5 grey bars represented by 49%) which are feed into the ecosystem with novel technologies and solutions which requires a decent number of students in science, technology, engineering, and mathematics (STEM) disciplines relevant to develop innovative products and solutions in the Greentech sector. This percentage of founders with technical background are the basis for the Greentech products. The RMN ecosystem would like to lift the absolute number of startup in Greentech. With the rich plethora of universities in the RMN area, there is no dearth of qualified STEM graduates. The actual question is how to motivate more of them to become entrepreneurs. Taken together the RMN area and its associated universities have 109138 STEM students corresponding to 38% of the total students from the universities listed in table 1. The pool of creative, driven, and energetic STEM students is the technical basis for novel Greentech inventions resulting in novel products and services relevant to generate start-up ideas and built a cluster gaining both regional and international attention.

Founders with an academic degree claim that 64% of startups they have founded were independent of any support by an university or research organization (Fichter and Olteanu, 2022). This possibly indicates that starting a business with a non-technical idea requires less technical infrastructure and does not necessarily rely on formal support by universities and associated organizations. 80% of technologically focused Greentech start-ups in Germany were supported by universities and transfer organizations to advance the business idea, business plan, and financing. In total 72% had received support in order to apply for governmental funding like EXIST founders program. For 69% it was deemed crucial to get access to the network of mentors, founders, business angels and others. Around 47% of the start-ups received dedicated support in particular through transfer organizations from the university like Innovation and Technology Transfer Centers and 43% had utilized specific research infrastructure to advance the product TRL in the form of technical equipment and laboratories from the originating university (Fichter and Olteanu, 2022). This indicates a difference between start-ups in term of budget sufficiency needed to develop their idea to a viable market ready product. In the technology disciplines of chemistry, white biotechnology, and material sciences a higher order of magnitude of investment is required. In the RMN cluster best practice sharing with other clusters would be key to improve the financial offerings and funds as a joint effort between the state governments with the associated institutions and VC. Financial support is to keep start-ups afloat before achieving sufficient turnover to become an independent viable business which in turn would be able to contribute to the regional ecosystem.

Discussion

In general, German universities do not produce a significantly rising number of Greentech start-ups despite a decade long effort and the implementation of entrepreneurship professorships. Most graduates still move on towards employment in research, industry or government institutions.

To leverage the existing elements in the RMN ecosystem it is important to connect the further elements required to raise the number of successful start-ups in particular those with focus on biotechnology, chemistry, and material sciences for

Greentech applications and pave the way for entrepreneurs to be able to choose business building their own businesses as a viable career path. Our analysis of the stakeholder groups and the supporting infrastructure led to the identification of the following three points to improve from the perspective of Greentech startups.

- General RMN Ecosystem requirements for Greentech start-up to form a cluster

- Technology Readiness Levels and Valley of Death

- Innovation infrastructure: From Accelerators and Hubs

RMN Ecosystem requirements for Greentech start-ups

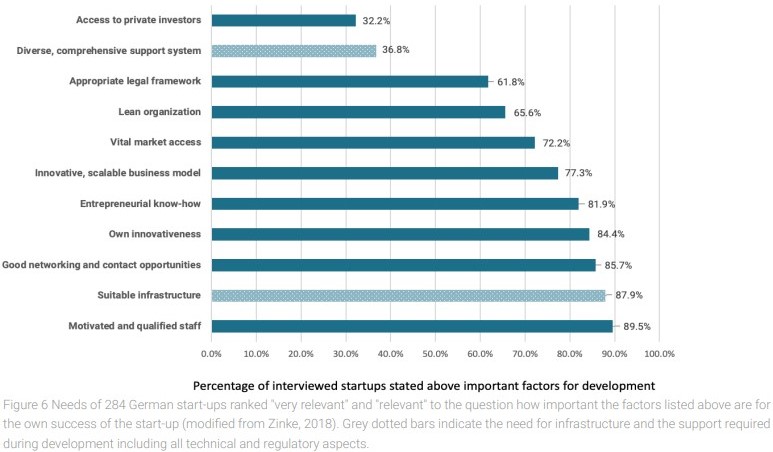

Since a specific evaluation for the RMN area has not yet been published, an analysis of German start-ups was conducted to understand gaps in the RMN Greentech ecosystem, by interviewing 284 start-ups. This led to the identification of key needs to further develop the ecosystem [Zinke, 2018] and is summarized below (figure 6).

In this analysis, of 11 factors ranked as ‘relevant’ and ‘very relevant’ two pertained to the need for a diverse and comprehensive support system. This could be addressed through an offer of agile technical coaching for topics from regulatory, safety, scale-up and other technical aspects which are typically not in the focus of university transfer organizations. Furthermore, in the aforementioned analysis, 87.9 % of the start-ups claimed that suitable infrastructure was pivotal for their success. This would hold true especially for founders working in the area of biotechnology, chemistry or material science which requires regulatory compliant laboratories and pilot plants for scale up optimization.

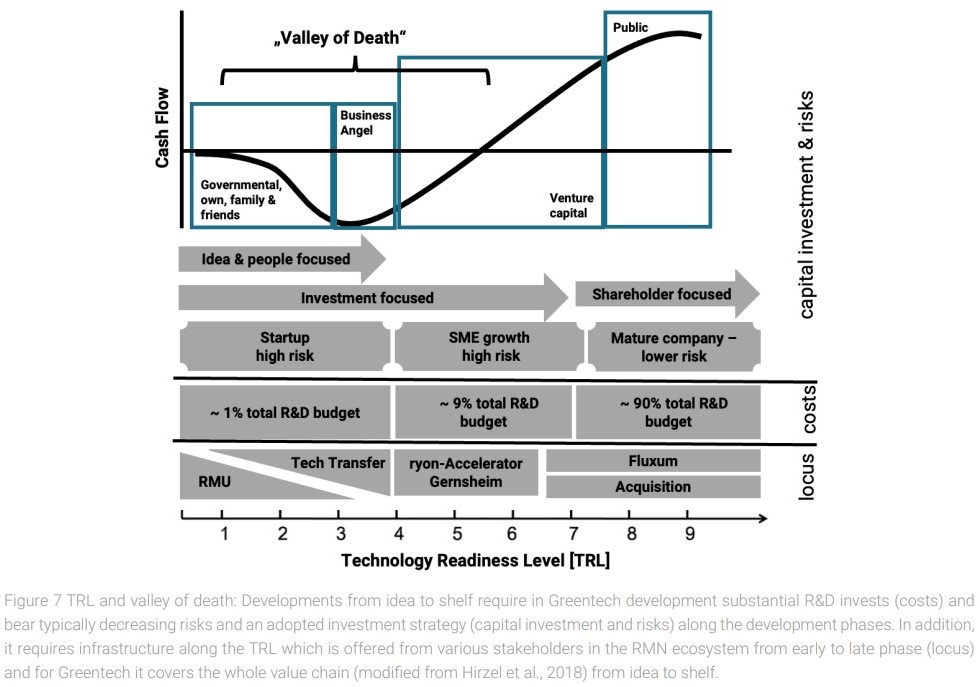

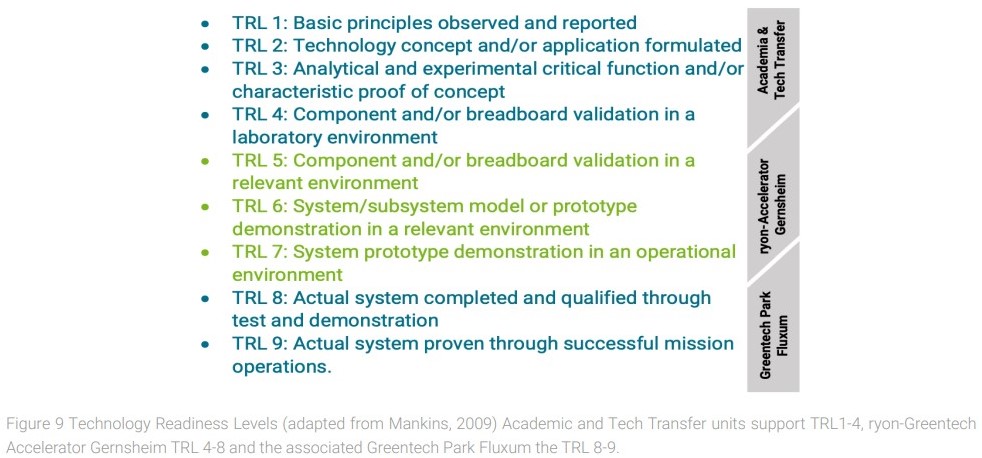

Technology Readiness Levels and Valley of Death

To describe and evaluate the maturity of a technology or product, it is classified using a scale of 9 Technology Readiness Levels (TRL) introduced by the US Department of Defense (Mankins, 2009). The basic assumption of the classification is that a technology element is “critical” if the system being acquired depends on this technology element to meet operational requirements (within acceptable cost and schedule limits). A further assumption is that the technology element or its application is either new, novel or in an area that poses major technological risk during detailed design or demonstration (Mankins, 2009). In the RMN region the support to achieve TRL 4 to 9 especially in terms of infrastructure and funding for chemical, biotechnological and material science related development programs was identified as a gap to be addressed. This included infrastructure and help to start-ups by mentoring, coaching and peer to peer learning to develop the idea to industrial maturity. Further details are published in the White Paper – start-up State Hesse. This gap is regarded as a major risk since failing to address it would mean local start-ups migrating to other regional ecosystems that do provide sufficient infrastructure and help that would result in regional fluctuations. To counter this brain drain, the state government of Hesse is implementing funding programs for Greentech start-ups and their special needs (Kraemer et al. 2022) as one example the above-mentioned h_venture program.

The valley of death theory proposes that there is a key hurdle despite the good start at the initial phases, for new startups in the ecosystem supported by the universities and their associated Technology Transfer Centers, where start-ups have been encouraged to new idea creation, to file patent applications and to found new businesses. Especially when applied to the RMN ecosystem but also in other regions in Germany, the number of start-ups is still to improve due the lack of an adequate technical infrastructure mainly related to the higher end of the TRL scale in later development phases especially in technology applications. With regards to the TRL, academic research focuses on the development at the levels 1 to 4, whereas industry requires products to enter the market at TRL of 8 or 9. Industry is generelly interested to license or incorporate products close to market viability, i.e. at TRLs of 7 to 9, rarely ever at 6. Therefore, TRLs 4 to 6 represent a gap between academic research and moving the development of the technology towards industrial commercialization. This gap is referred to as the technological “valley of death” to emphasize that many new technologies reach TRLs 4–6 and die before having the chance to get picked up for completion. In Germany with more conservative funding of cost intensive product developments like in Greentech the valley of death forms an often insurmountable hurdle for its typically undercapitalized Greentech start-ups. As stated above this should be substantially supported and selected by VC firms and fund for tech products and services. German VC firms are smaller and generally considered more risk averse than their US peers. This results in a more conservative and later stage investment of start-ups by VC firms. These early phases require less capital than the later stages where 90% of the total development budget required in technology intensive developments from TRL 7 and beyond (figure 7) which is brought in by VC firms at the later stage. Along the development path for start-ups there are two critical points in time where financing and technical handover and the required infrastructure determine the success rate of an ecosystem in total. At these timepoints, the VC remains the main driver of innovation by selecting what will be needed and developed into the upcoming markets (Ferrary & Granovetter, 2009) but the technical handover requires in Greentech laboratory and pilot plants to scale and develop products under real conditions in an industrial setting and are often not available as needed.

Innovation infrastructure: From Accelerators and Hubs

In the RMN ecosystem, there are several start-up support institutions with different offerings. Hub31, TIZ, Unibator, Research and Technology Transfer Mainz are some examples of additional spin-off units of the RMN universities. These institutions often engage with further partners like chambers of industry and commerce or others. Together with the previously mentioned TQ, HIGHEST and INNOVECTIS, their main focus is to support the start-ups to gain investor readiness and help them successfully applying for funding by business angels, capital firms or governmental support programs. They offer dedicated events around founding firms in addition to the legal framework to set up new businesses in Germany. Further, they offer match making to potential corporates. As mentioned above the RMN ecosystem still requires bridging technical and infrastructure support regarding market and product readiness to close the gap between TRL 3-4 and 7. This requires for STEM – technology start-ups with focus on chemistry, green or white biotechnology and material sciences access to a dedicated laboratory and pilot plant infrastructure. This bespoke infrastructure needed to support Greentech start-ups exists in few regions in Germany but with different technological depth and offering. The general comparison is not made as the supporting institutions do not divulge adequate information about the detailed offering.

To close the technical gap and support start-ups with the infrastructure to achieve the required market and product readiness, the Hessian government represented by the Hessian Trade & Invest (HTAI), the Hessian business and infrastructure bank (WI Bank Hesse), Goethe University Frankfurt, Technical University Darmstadt and Merck KGaA Darmstadt have funded their own technical accelerator (ryon – Greentech Accelerator) located at the Merck KGaA site in Gernsheim (figure 1) as part of the Greentech Park Fluxum. The ryon – Greentech Accelerator combines the laboratory and pilot plant infrastructure combined with a bespoke technical program supplementing the activities provided already in the ecosystem – Greentech Accelerator Gernsheim with focus on agile technical and regulatory coaching and support by experts from academia and corporates. The accelerator is an open innovation forum where stakeholders meet to connect, match start-ups and corporates, and is a multiplicator in communication and networking in the RMN Greentech Cluster and beyond. Fluxum, where the ryon – Greentech Accelerator is embedded, is itself an additional element in the ecosystem where small and medium enterprises or grownups with need for place to grow their businesses have a Greentech Park in their vicinity, which allows them to build own buildings according to their needs on a rented area of land with access to existing facilities like industrial wastewater treatment, chemical factory fire brigade, site security, and energy and gas supply. The grownup needs to fulfil criteria to be in line with the guiding Greentech principles on site to enter the final stage of their development across all TRL from idea to market. This finally benefits the entire ecosystem and is a key driver of supporting the ecosystem for examples with jobs and taxes that stay in the region, which in turn works to secures the future economy in the RMN region.

One outcome from summarizing all mentioned aspects is that in Gernsheim, in the geographical center of the RMN metropolitan area, the infrastructure for Greentech start-ups with the need for laboratory and pilot plant infrastructure and the required expertise and technical support is under stepwise implementation. Laboratories are available and will be built to support teams with all necessary required regulations mandatory for safe operating chemical plants or biotechnology laboratories under state law regulations for genetically modified organisms. After founding the ryon – Greentech Accelerator Gernsheim the missing technical infrastructure to support start-ups to bridge from TRL 4 to 7 allows the RMN ecosystem to grow and requires that all stakeholders play in concert and set the basis for a successful Greentech cluster with the main emphasis to lift the potential of what already exists an academic setting embedded in a strong chemical, biotechnology and material science industry cluster.

4 Summary

As shown in the capability analysis above, the RMN ecosystem offers Greentech start-ups the entire support chain along all TRL. However, the community of stakeholders especially with focus on developing solutions and services for biotechnology, chemistry, and material sciences are not yet connected as required. This highlights the importance and critical need for such a Greentech cluster where all the stakeholders are brought closer together. Doing so will heighten their ability to support start-up funding, allowing them to grow in the region. It would also allow for harmonized financial programs from private investment, business angels, and firms to cover costs with growing needs later in the TRL development process. Germany and the global community have developed the need to urgently move to sustainable products and services to manage the climate crisis and offer solutions resulting in more sustainable materials for daily use covering all aspects of life. To support the green transformation, it is important that new ideas become vivid and bring forth novel materials in areas where structures are already in place to help to accelerate this transformation. The Rhine-Main-Neckar metropolitan area has a strong ecosystem comprising all the required stakeholders with relevant preconditions offering goldilocks conditions for such an environment. The time is ripe for the players within Europe to unify to develop the recognition that the region is the chemical, biotechnology, and material science hotspot. Thus, the RMN ecosystem has the potential to become a true global cluster in Greentech with significant impact to improve people’s lives for generations to come.

Acknowledgments

Thanks to Andrew Salazar for review and editing the manuscript. Thanks to Julian Wenzel for the support in preparing the graphics for this manuscript.

Author Contributions

Conceptualization, J.v.H.; writing—original draft preparation J.v.H.; writing—review and editing, J.v.H; visualization, JW and JvH.; supervision, J.v.H.; project administration, J.v.H.; and funding acquisition, J.v.H. The author has read and agreed to the published version of the manuscript.

Funding

This publication was funded by Merck KGaA, Darmstadt, Germany.

Data Availability Statement

The data and sources are available from the authors upon reasonable request.

Conflicts of Interest

Joerg von Hagen, Andrew Salazar and Julian Wenzel are associated with Merck KGaA, Darmstadt, Germany.

References

Berger R., (2021): GreenTech made in Germany Federal Ministry for the Environment, Nature Conservation and Nuclear Safety available at https://www.bmuv.de/en/topics/sustainability-digitalisation/econom/environmentaltechnology/greentech-made-in-germany-40

Chen Y.S., Lai S.B., Wen C.T., (2006): The influence of green innovation performance on corporate advantage in Taiwan, Journal of Business Ethics, 67 (4), pp. 331-339.

Cohen, B., (2006): “Sustainable Valley Entrepreneurial Ecosystems.” Business Strategy and the Environment 15 (1), pp. 1–14.

Darko J., (2019): Understanding Tech Ecosystems & How They Support Growth and Innovation available at https://medium.com/@joe_darko/understanding-techecosystems-how-they-support-growth-and-innovationd4e345de20da

Ferrary & Granovetter, (2009): Economy and Society Volume 38 Number 2 May: The role of venture capital firms in Silicon Valley’s complex innovation network.

Fichter, K. & Olteanu, Y., (2022): Green Start-up Monitor 2022. Berlin: Borderstep Institute, Start-up Verband available at https://start-upverband.de/fileadmin/start-upverband/mediaarchiv/research/green_start-up_monitor/gsm_2022.pdf

Guenther U., (2016): Business Angels Network [BAND] available at https://www.business-angels.de/wie-vielebusiness-angels-gibt-es-wirklich/

Hirzel S. et al., (2018): Bridging the valley of death: A multistaged multicriteria decision support system for evaluating proposals for large-scale energy demonstration projects as public funding opportunities; ECEEE industrial summer study proceedings – industrial efficiency available at https://epub.wupperinst.org/frontdoor/deliver/index/docId/7079/file/7079_Hirzel.pdf

Kollmann T. et al., (2022): Deutscher Start-up Monitor 2022 available at https://deutscherstart-upmonitor.de/ – Bundesverband Deutsche Start-ups e. V., PWC

Kraemer R. et al., (2022): White paper – Start-up State Hesse – Hessian Ministry of Economy, Energy, Transport and Housing available at https://wirtschaft.hessen.de/sites/wirtschaft.hessen.de/files/2022-02/whitepaper_start-up_ state_hessen_web. pdf

Mankins J.C., (2009): Technology readiness assessments: A retrospective, Acta Astronautica, 65 (9-10), pp. 1216-1223, ISSN 0094-5765.

Powell W. et al., (2002): The Spatial Clustering of Science and Capital: Accounting for Biotech Firm–Venture Capital Relationships, Regional Studies, 36 (3), pp.291–305.

Winkler A. et al. (2020) available https://www.uniteuniversity.eu/

Zinke G., (2018): Studie: Trends in der Unterstützungslandschaft von Start-ups – Inkubatoren, Akzeleratoren und andere im Auftrag des Bundesministeriums für Wirtschaft und Energie (BMWi); available at https://www.bmwk.de/Redaktion/DE/Publikationen/Studien/trends-inder-unterstuetzungslandschaft-von-start-ups.pd