Digitalization, chemical distribution and the chemical value chain

Do you still remember ChemConnect, CheMatch, cc-chemplorer and the like? More than 15 years after these companies set out to disrupt the chemical value chain, the topic is back. While most of the then startups have failed (Elemica being the notable exception), today’s efforts might fare differently. In this article we focus on distributors who link producers and (usually) small customers. However, some of our thoughts affect the complete value chain.

We start setting the scene for digitalization, then step back a little to discuss some common misconceptions on the role of a distributor, followed by ideas on properly managing the relationship principal/producer vs. distributor. Finally, we come back to digitalization by discussing electronic marketplaces and their impact on the chemical value chain.

1 Digitalization in chemicals – getting rid of distributors for tail-end customers and unknown territories?

When talking about digitalization, disruption is all the rage. Disruption of business models, disruption of value chains, disruption of everything that has to do with customers. So, with all major chemical producers talking about digitalization projects in the range of two- or three-digit millions, disruption of the chemical value chain is already underway. But what will be affected and – focus of our thoughts – is that the end of chemical distribution?

First let’s start with the good news for all the companies that produce, distribute or process chemicals. We will continue to live in houses, eat what- ever we like (or what an influencer promotes), dress up and use interfaces with the digital world. In our modern world all of that requires chemicals. Hence, whatever digitalization is going to change – chemicals as building blocks or as ingredients that improve performance, safety and durability of things of our physical world are going to last. And thereby its producers as well as processing companies. But what about distributors?

Digitalization will definitely change all processes (and businesses) which deal with information. Whatever can be digitized, surely will. For the market side of the chemical value chain this translates into direct communication between chemicals processing enterprises (customers) and producers. Whenever a customer’s tank or warehouse space runs empty, in a completely digitized world this (already existing) piece of information could directly feed the production (and marketing) plan of the producer, cutting out all the intermediaries, i.e. the chemical distributor. This idea probably resonates well with many a business head who regards distributors as a necessary evil with no other purpose than pocketing the rightful margin of the producer.

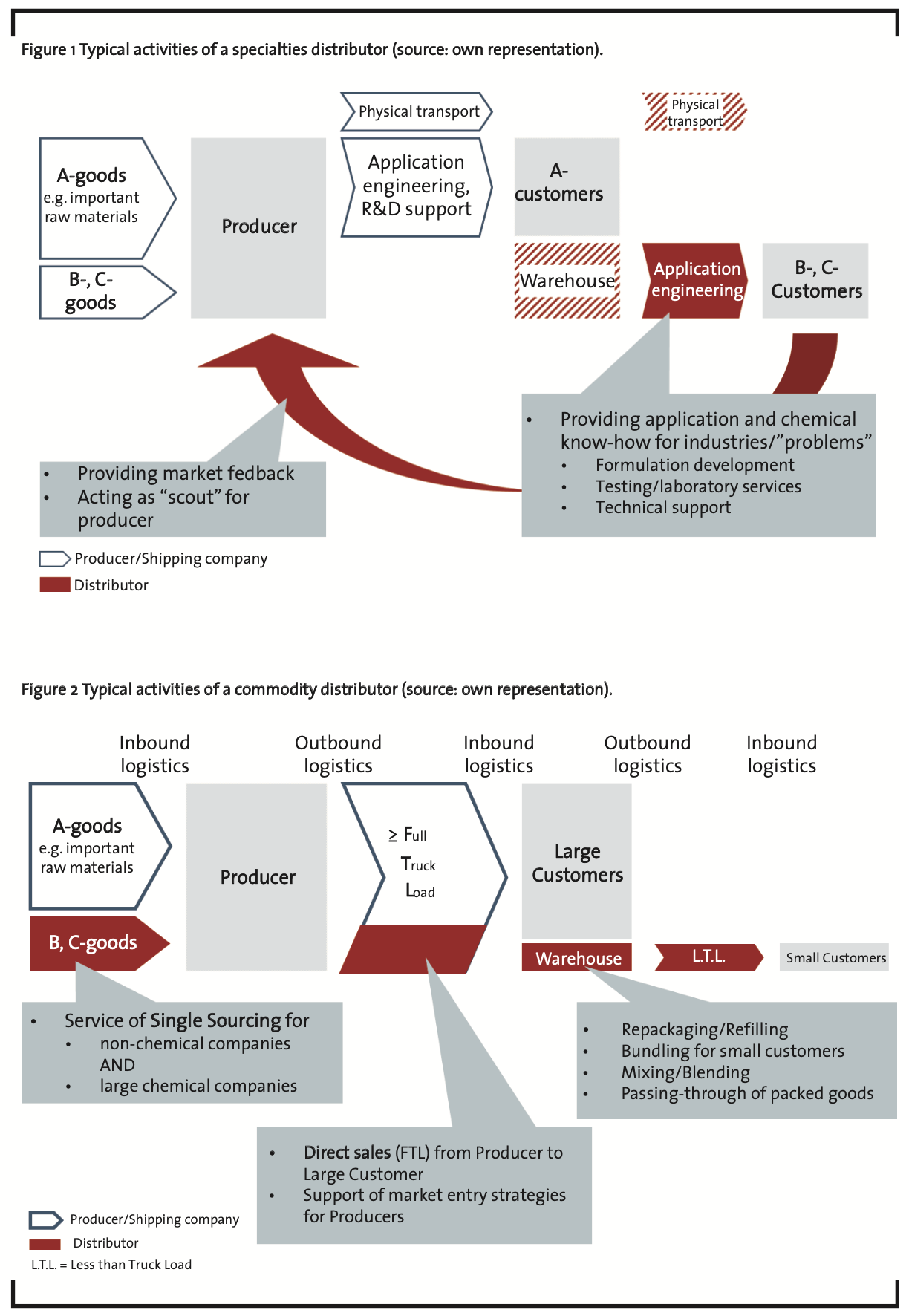

However, if we take a closer look at the value chain AND at the wishes of the customers, there is more to a distributor than just passing through information. Firstly, the distributor not only acts as demand bundler in the above sense towards the producer, rather it bundles the demand for various chemicals/supplies towards the customer. Accordingly, a customer is not interested in getting chemicals from several producers (meaning several deliveries at its warehouse), if he can get them bundled in one delivery from one distributor. Secondly, the distributor takes care of the physical delivery of the chemicals, if required including repackaging in unit sizes smaller than the producer offers. Thirdly, with some specialties, the distributor acts as technical “first level support”, freeing time of technical sales staff of the principal. And fourthly, a distributor can and should act as a trend scout and service provider (e.g. customs clearance) in markets too small for a producer/principal to serve. This latter function makes sense, if the distributor is already present in a certain market the principal wants to enter.

In a first and quick assessment, the market scout function and the technical “first level support” could indeed fall victim to digitalization:

- Market scout to artificial intelligence which systematically collects all data on a certain market and then comes up with predictions on which sectors will grow at what speed and with which demand of certain machinery, chemicals, financing etc. However, this kind of information will then be available to ALL interested buyers and no longer confined to a one-to-one distributor/principal relationship.

- “First level support” to artificial intelligence and/or augmented reality. In case of problems with the use/application of a chemical, there might be solutions coming up with no human staff involved. E.g. an artificial intelligence interface with search options for solutions of the problem within a huge database of reported problems. Or, if machinery or the like is involved, augmented reality might guide through the problem-solving process.

For the two other roles of a distributor in the value chain there is no digital replacement in sight – the bundling of products for the customer and its physical delivery. That’s the good news. The bad news is, there are different players operating in these areas which might qualify as the future winners, hence have to be watched: chemical distributors, (chemical) logistics companies, amazon/Alibaba or similarly powerful internet giants.

We do not reckon incumbent chemical companies as serious competitors in this arena, due to the customer need of bundled deliveries (often more than one supplier) and physical delivery. While the information flow from customers to producers/principals will work seamlessly, the complexity of managing all the product needs in addition to one’s own products is going to kill any business case. Especially since the logistics requirements usually differ in size and volume, asking for infrastructure investment at the wrong (tail) end of the customer base.

If a business head of a producer still thinks the chemical distributor a redundant money-grubber, a different understanding of the business model might help. But that’s topic of our next section.

2 Chemical producers and chemical distributors – often a story of many misunderstandings

Over the last decades we’ve seen distinct developments on both the producers’ as well distributors’ side. Whereas distributors are increasing geographic spread (consolidation) and application technology know-how, producers are focusing on core businesses while divesting others. These trends are leading to distributors covering ever larger geographical areas and producers concentrating on a limited range of products/applications with (in total) smaller sales teams. Those two developments should generate various opportunities for mutually beneficial collaboration. However, it is surprising to see how often little knowledge about the other side exists and how many prejudices still pre-vail. One minor reason might be a hazy positioning as commodities/specialties/full line distributor. Already difficult for producers, a distinct focus on commodities, specialties or both is extremely hard to achieve for distributors. (Due to the almost endless variety of chemicals and their applications sold to almost all industries.)

Nevertheless, distributors can work towards a better recognition at producers. Usually, producers see distributors as THE channel to serve small- to midsized customers. Whereas this view is clearly understandable, it is a little surprise that often the physical realization of the distribution is not recognized. In contrast, distributors see their role without exception in exactly this physical distribution and, to a large degree, in the bundling of products for customers. Explanations for the different views probably come down to different perspectives due to one’s own day-to-day work. Whereas bundling represents the customer perspective of a distributor, which is (rightly) neglected by most producers, the wish for serving and developing small customers of a producer is only part of the self-image of distributors. These different conceptions offer an opportunity to start discussing what a producer expects from a distributor and what a distributor can offer.

Merely seeing distributors as an extended sales arm means missing chances of benefitting from their physical infrastructure (e.g. labs, warehouses, etc.) or their knowledge about untapped mar- kets. The same applies to know-how. Producers (principals) require distributors to be just as knowledgeable about applications as they are about products; distributors, however, value their application know-how much higher. And rightly so. Solving customers’ problems offers more business opportunities (and stabilizes relations) than pure product know-how. Therefore, principals should expect their distributor to be an application expert and jointly discuss applications and their development. But they should also reward them accordingly.

Equally, distributors should, to a larger degree, accept this role as an extended sales arm. Even if own product lines could prove highly successful, the exceedingly larger part of the business will result from the sales of principals’ products. Therefore, winning over the right principals with appropriate offerings must be at the centre of attention. The design of respective offers should also consider those wishes of principals on which distributors seem to focus less. This is presence in countries which are no longer or not yet served by principals, offering lab capacities for dedicated applications as well as having low cost structures. However, it is not quite clear as to whether principals’ wishes (such as reducing administrative cost) have been achieved already and simply not been talked about, or whether this is another opportunity for distributors to enhance their offerings by services that aim at exactly this goal.

3 Systematic approach to distributor management

As long as producers/principals on the one and distributors on the other hand have a blurred picture of each other, no mutually beneficial relationship will evolve. Therefore producers/principals should be able to clearly address what they expect from a distributor. Not an easy task, if the overwhelming majority of one’s business (and attention) dictates different priorities. However, for a systematically run business, successful distributor management can be done along a few simple rules.

It all starts with the “ordinary” business strategy, including focus products, target customers, regions etc., followed by a respective resource allocation to make the plan work. (Step 1: Build on your business strategy) Business as usual. And as long as key customers or key regions are concerned – planning should be easy. But, whenever one of the following situations turns up, a distributor might be of help (Step 2: Identify relevant areas):

- a new market shall be developed

- a large number of small customers (“tail end”)

- a market has become too small to justify full sales resources

- customers ask for complexity-increasing additional services

And, the classic rule of thumb, always think about handing over the last 20% of customers, since they usually don’t contribute to profits.

Next, search for distributors with expertise in the required applications or regions. Big full-line distributors are always a choice, but there are several specialists in a variety of fields. When discussing with the selected distributors, a combination of the above-mentioned situations might be addressed. (Step 3: Select the right support). However, besides distributors there are different options. These include using agents, sharing staff with other businesses or dropping the business altogether.

Assuming, principal/producer and a distributor agree upon working together, the most difficult issue is to manage the business relation in a trustful manner. (Step 4: Manage the relationship) It is important to clearly define targets and the way to measure their fulfilment as well as to agree upon the depth of information exchange. Even more important is the definition of the most critical issues in such a relationship: how to proceed if a market or a customer grows above a critical threshold or giving technical and specialist support/training. This is the last moment when both parties can clearly announce and write down their particular expectations from the relationship. It is understandable if a producer/principal wants to take back customers grown above a certain threshold – but it is also understandable that the distributor who has put all his effort in growing this customer wants a reward for this achievement. Possible solutions could be a joint discussion with the customer about the best way to serve him in the future and/or some profit sharing for a defined number of years to come between distributor and producer/principal. Thus, for a distributor it is quite helpful to recall from time to time one’s positioning in the value chain. But this is no one-way-road. A producer/principal has to accept, that a distributor is managing complexity and needs a certain budget (i.e. margin) to do so. This has to be fixed in the contracts as well.

As long as all this is done right at the outset, both parties are able to develop a trust based relationship.

4 Electronic market places as sales channel to eliminate distributors for small customers?

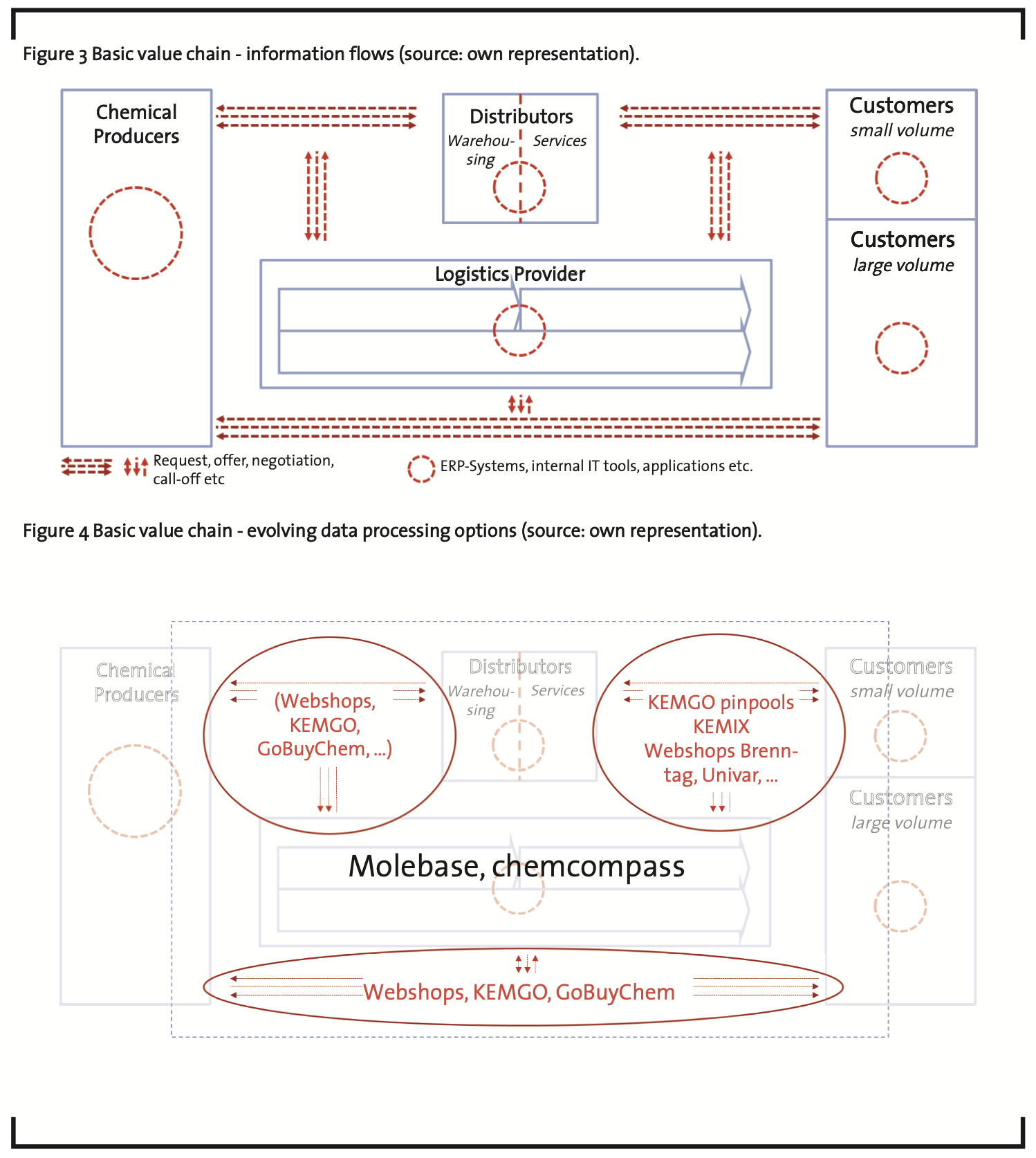

As already described above, distributors have an important role in the chemical value chain. They serve small customers, act as market scouts, offer services and commission as well as refill/repackage products. Market places on the other hand try to match supply and demand, i.e. are – at least at the moment – mainly dealing with information flows only.

These information flows are important, since they are the basis for any sale to be made. A customer who wants to buy a certain chemical product needs to find suppliers. After finding them, either a deal can be made immediately (if volume/price quotes exist) or negotiations take place before agreeing on a deal. All that is pure information (or data) and can be dealt with by a market place. The moment the delivery comes into play, data is still required but no longer sufficient. Now physical product flows have to be handled – repackaging/refilling, commissioning and transportation. And that’s the domain of distributors and logistics companies. Based on this understanding the “easiest” future scenario is market places managing the information flows, all other elements of the value chain remaining the same. However, due to the disruptive potential of today’s technology, there are some more options imaginable.

1. Chemical producers serve small customers

It is easy to establish an information channel to small customers (webshop, market place), learn about their demand, offer a price and negotiate a contract. However, delivery has to be covered, too. Firstly, the respective infrastructure is required (tanks, warehouse space, filling stations, …) and secondly, delivery costs for customers could increase dramatically if they have to buy from various producers instead of getting one pallet with several products from the distributor. Chemical producers shouldn’t underestimate the complexity they would insource by tunneling the distributor.

2. Market places offer additional distribution and logistics services

This is probably an option, market place oper- ators have already in mind. However, it will prove difficult to find distributors willing to act as a mere contract refiller/warehouse provider for market places. They would have to leave parts of the margin with the market place and lose their customer contact. Not a promising option.

An additional difficulty – largely underestimated in today’s discussions – is providing an electron- ic data interchange (EDI) interface to connect distributors, logistics companies, other service providers to the market place. Replacing/improving existing data exchange solutions will become one of the biggest obstacles on the way to a digitalized value/supply chain.

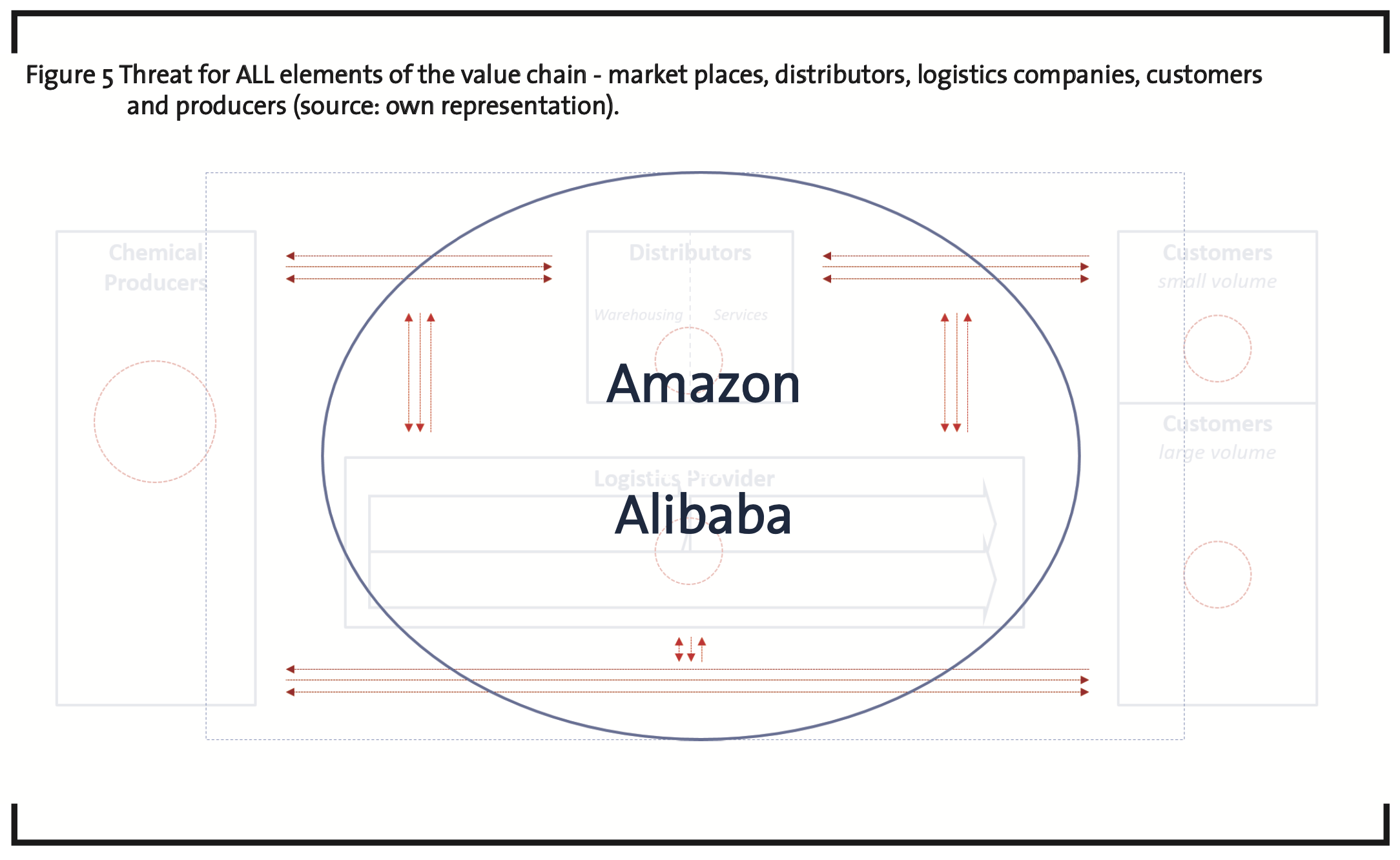

3. Amazon/Alibaba/… manage everything between customer and chemical producer

This is the most worrying option for EVERYONE in the value chain. First of all, market place operators will die since they are not able to compete with size and data processing power of the giants. Then distributors/logistics companies will both be downgraded to mere contract companies delivering warehousing/transportation services to the giants. After a while even chemical producers come under pressure. Due to their data analyzing power the giants are quick to spot best-selling/high-margin products and will, step-by-step, offer their private label products – downgrading even chemical producers to contract manufacturers. And finally, customers have no longer any bargaining/negotiation power since the data giants have total transparency on the supply/demand-situation and adapt prices accordingly.

(In addition, we could imagine distributors adding logistics capacities or logistics companies adding distribution capabilities. However, this is just a sub-case of the current “hardware set up” and not dealt with separately.)

To deal with today’s uncertainty, we think it helpful to always distinguish between “hardware” (i.e. physical assets) and information or data. Digitalization starts with the latter and influences the “hardware”. BUT, “hardware” will always remain a vital part of the chemical value chain. And in this sense distributors (i.e. their hardware) won’t be eliminated. They might operate in a different setup, but their role in the value chain won’t disappear. The much more pressing question for all players in the chemical value chain is, how to avoid the third option mentioned above.

5 Surviving as part of the chemical value chain

In the last section we mentioned the scenario of a large internet giant occupying the space between customers and chemical companies – leaving producers, distributors, customers and platform operators worse off. Is there a way to prevent this?

Firstly, in case one of the giants is attracted by the chemical distribution business, that’s probably it. With their huge advantages in gathering, pro- cessing and analysing data, they will outsmart any established player. Add the state-of-the-art logistics capabilities of an amazon (Alibaba?) and little more than the current customer base and deep knowledge on handling chemicals will remain. Given Jeff Bezos’ infamous “Your margin is my opportunity”, there would be one solution: become efficient and keep the margins razor-thin. Since this is definitely no solution for listed companies (and I guess neither for family-owned ones), is there any other way out?

One option is to create an amazon-inspired customer centric buying experience. This means creating a market place with a wealth of chemicals offerings – delivering transparency and comparability. In a second step, additional functionalities like safety data sheet handling or smooth payment processes could be included. However, there is one huge difficulty in such a marketplace becoming successful. It is the question of ownership.

- If a third party operates the market place, neither producers nor distributors will post a substantial number of offerings – due to the fear of losing valuable information AND a transaction fee.

- If one of the relevant producers or distributors operates the market place, the problem remains.

- Thinking it through, the obvious answer is – make it a jointly owned entity. By the way, this concept has already worked with Elemica. (In the early noughties almost all of the big chemical companies bought shares in the newly founded marketplaces).

Whether such an idea will get a chance, much depends on how likely a market entry by amazon, Alibaba etc. is seen. Opinions will vary. However, even if a joint platform comes into life, there are more obstacles to overcome. The biggest one is to ensure none of the owners interferes with the daily business of the platform. This has to be taken care of in the founding stages and requires codification in the charter. The same is true for a joint understanding of ways to generate revenues on the platform as well as profit distribution. In addition, the platform needs funding for the initial steps – a difficult issue among competitors. And as if that wasn’t enough, in most cases the existing IT setup is not even near a status which allows for an integration into a platform. Neither are the internal processes “digital ready” nor is the required data readily available.

However, realizing the internet giants posing a threat to EVERYONE in the value chain should be motivation enough to start thinking about an industry wide platform. Whether the first steps are gone among distributors and customers or distributors and producers/principals finally doesn’t matter. Doing nothing is likely to be the worst option.

References

Stratley (2012): CHEMICAL DISTRIBUTION – Findings at the distributor-principal interface.