Combine or combust? – Circular economy, digitalization and collaboration models for the new chemical industry 4.0

Abstract

The chemical-pharmaceutical industry, like other industrial sectors, is facing transformative changes exemplified by ‘Industry 4.0’ – including digitalization, circular economy approaches, and other innovations impacting its business model. These changes also affect the relationship with its customers, and the required skills and training needs for its employees. Based on several interviews with experts conducted as part of Climate-KIC’s Pioneer in Practice program, this commentary looks at emerging challenges and opportunities the chemical sector will be facing in the next decade and beyond. It also provides examples where new technologies, capacities and collaboration models have been combined into successful sustainable business models.

1 Introduction: The pathway towards Chemistry 4.0

The chemical-pharmaceutical industry1 is facing large structural changes – once again. Increasingly, it needs to adjust to the demands of the transition to Industry 4.0. This includes figuring out how to handle digitalization strategies, circular economy approaches, and new business models. But this is not the first time the sector has faced a fundamental transformation. In fact, it has already come a long way in the past 150 years.

1 The term ‘chemical industry’ will be used subsequently for the sake of convenience.

The chemical industry’s first generation or ‘Chemistry 1.0’ began in the mid-19th century, with increased demand spurred by the Industrial Revolution. Raw materials consisted of coal, tar, organic and animal fats and oils, which were made into products such as soap, dyes and fertilizer. From the 1950s onward, the industry’s second generation – Chemistry 2.0 – focused on petrochemicals. Crude oil had become a rich source of carbon and created almost unlimited possibilities for new syntheses and molecules; also, the new technology of polymerization helped to introduce plastics and chemical fibers as everyday products. Then, beginning in the 1980s, Chemistry 3.0, or the third generation, was fueled by globalization and European (and other) market integration, as well as new production processes and technologies such as genetic engineering and biotechnology. This enabled the chemical industry to create a new and more specialized product range. Also, new business and cooperation models formed: medium-sized companies specialized and prospered, while other companies consolidated through mergers and acquisitions; international trade led to on-site production facilities abroad; chemical parks formed; and basic research at universities blended productively with applied research within the industry (Deloitte and VCI, 2017).

Since the 2010s, the chemical industry has seen the need to adapt once again. By adjusting to ‘Industry 4.0’, with automation and data exchange integrated into new manufacturing processes, the Internet of Things (IoT), cloud computing and ‘smart’ technologies, the sector needs to transform into the next generation: Chemistry 4.0 (VCI 2017). At the same time, other risks and requirements have grown in importance: sustainability risks and the climate crisis; environmental pollution and shrinking biodiversity; agriculture and food production; and the overconsumption of critical natural resources and raw materials – all of these challenges can point to the chemical industry as part of the problem, or alternatively, as part of the solution.

2 Research background and methodology

During Climate-KIC’s Pioneer in Practice program, which is implemented in Germany by the Centre for Industry and Sustainability (ZIN) at Provadis, one of the system innovation challenges focused on the future of the chemical industry. In particular, the challenge was how to envision how the chemical industry could transform into a digital and circular economy knowledge hub in the future, and what skills future changemakers would need in order to make this Chemistry 4.0 happen. In addition to an exploratory review of literature and business cases, three expert interviews were conducted in 2018 and 2019 with lead managers, executives and academics knowledgeable about the chemical sector. The semi-structured qualitative interviews focused on five main issues: 1) challenges and megatrends for companies and the industry within the next 10 and 30 years; 2) key drivers of these trends; 3) the role of innovation and sustainability; 4) the most important future competencies for work and success in the age of Chemistry 4.0; and 5) what the future of the chemical industry will look like in 10 and 30 years.

This commentary will explore upcoming megatrends and drivers and focus on three key issues for the industry’s future: circular economy; digitalization; and required competencies and training needs. It points out challenges and opportunities these transformations bring with them; and provides examples of how these changes are already being addressed in practice.

3 Megatrends and drivers of industry transformation

The chemical industry faces (at least) three main challenges on its path to Chemistry 4.0. First, global demand structures are shifting towards new geographical markets, specifically Asia. Second, the entry of new market players, new technologies and more specialized market needs has increased the level and intensity of competition. And third, an increasing global environmental awareness has led to a qualitative shift of societal priorities, among them sustainability, climate change, and a fundamental rethink of how to use natural resources.

Europe and North America have been experiencing stagnating growth in saturated end markets, while market demand for the chemical industry is shifting to Asia, China and India in particular. In Europe, and especially in Germany, energy and resource costs are relatively higher than in other world regions, which increases the cost of production. In addition, local environmental standards are comparatively higher in Germany and Europe, which further adds to the pressure to remain competitive. Some assets including production facilities are older in Europe, which may make them economically more feasible because of their depreciation; their investments costs have already been written off by their owners. However, this also adds to future needs for investment in aging assets and new production technologies. Huge innovation potential is slumbering in countries like China, which has a vast number of highly educated young people moving back home from their studies abroad, adding to the country’s growing supply of human resource talent in the natural sciences.

One of the big transformations for Chemistry 4.0 and a key driver of change in the industry is the rise of digitalization. The new digital age offers new business opportunities, including faster and ‘smarter’ production processes, new employment needs, new business models, and a more efficient use of natural resources. However, new risks are emerging as well: for example, loss of employment through robotization, higher qualification requirements for new employees, and the question of data security in a Big Data world. All of these changes are taking place in a business culture that, in Germany at least, still leaves room for innovation around new digital business models. The German chemical industry has employees with a high level of technical knowledge and a good understanding of processes. However, with new innovative market players from Asia and elsewhere on the one hand, and a more international client base on the other, the need to deepen knowledge about new digital practices, new business models, and intercultural teamwork competencies will continue to grow.

Another key driver of industry transformation is the new sense of urgency regarding sustainability and climate action, among policy makers and civil society alike. In the Paris Declaration, the world community has committed itself to reduce its greenhouse gas (GHG) emissions in order to keep global average temperatures well below 2°C, and ideally below 1.5°C compared to pre-industrial levels (UNFCCC 2015). This commitment also informs the European Commission’s climate and energy targets, i.e. cutting GHG emissions by 40% (from 1990 levels) and increasing renewable energy and energy efficiency improvements to 32% and 32.5%, respectively (EU 2014; 2018). It is also the main driver of Germany’s renewable energy transformation (Energiewende), which has already increased the share of renewable energy sources to 37.8% of total gross electricity consumption (UBA, 2019). Fridays for Future and other civil society organizations have regularly mobilized millions of people to take to the streets with their demands for far-reaching climate neutrality. And the chemical industry has been taking note as well: sustainable development and digitalization have been identified as two megatrends with a significant impact on Germany’s chemical industry in a recent survey of 60 chemists (Keller and Bette, 2020).

3.1 New business models: circular economy for Chemistry 4.0

One prerequisite for the success of chemical companies and the industry as a whole is that they must understand their own business and their respective markets. However, some industry players have been realizing that they are too far removed from their end clients. This means that chemical companies increasingly feel they are too far upstream in the value chain and might even fear to be ‘cut off’ from their clients’ business activities. The traditional business paradigm – ‘produce a fantastic molecule and sell it to the market’ – looks both more difficult and less relevant today. Instead, a lot of potential for innovation seems to come from a different mindset: (re)using resources, materials and (by-)products from molecules previously believed to be ‘dead’ or waste; and joining and supporting the end client along his or her entire value chain. These new approaches, as well as the underlying new mindset, fall into the realm of the circular economy.

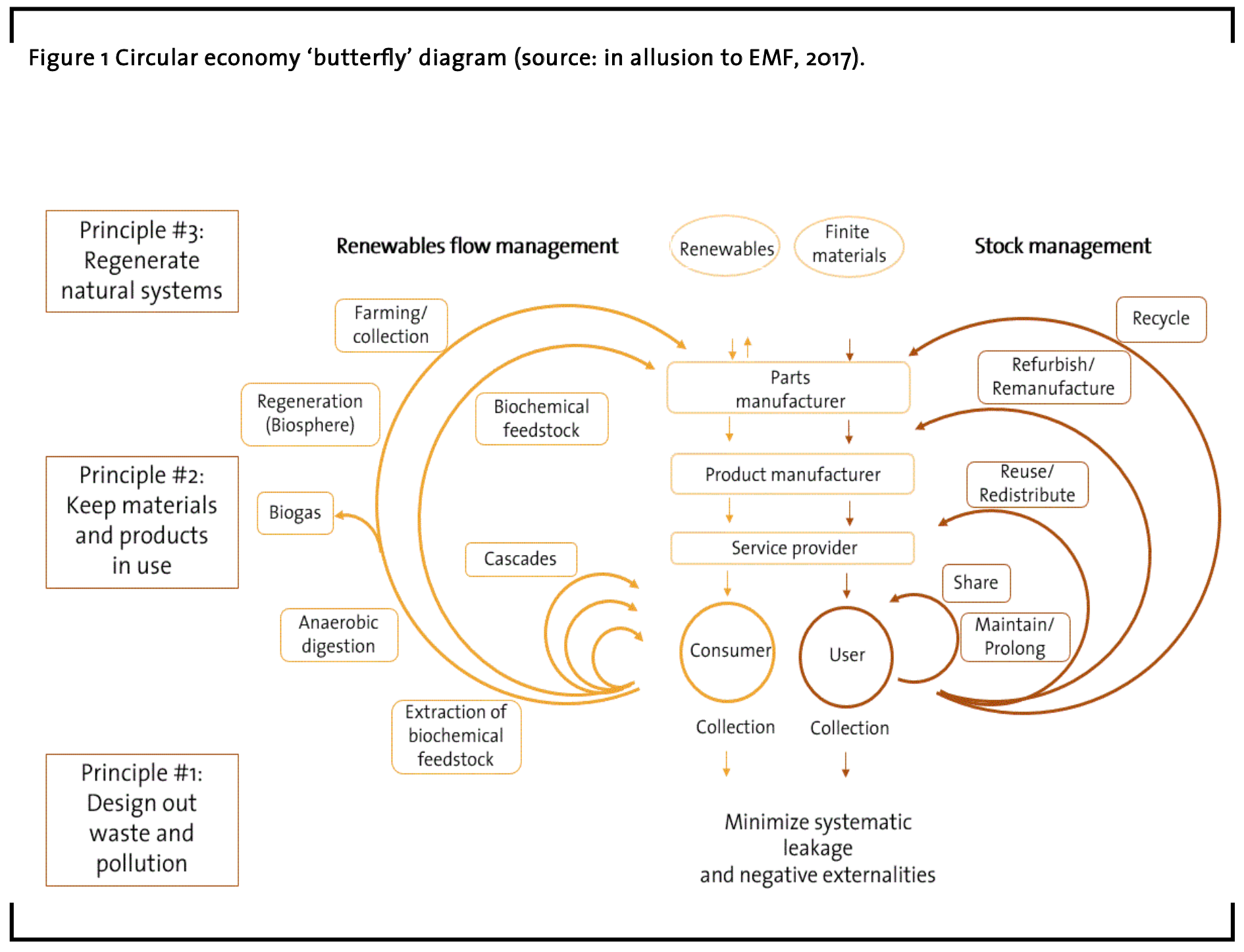

Circular economy approaches focus on closing resource loops and keeping the value of materials and products as high as possible for as long as possible. They aim to design out waste and pollution; keep materials and products in use; and regenerate natural systems (EMF 2017). These concepts have gained much attention from policy makers, civil society and the business community alike, as the circular economy seems to offer a concrete strategy on how to ‘do’ sustainable development (EMF 2013; EC 2020). In particular, the circular economy shows how to break with the traditional linear economy and its ‘take-make-use-lose’ philosophy: extract resources to make a product for short-term use which is thrown away afterwards, taking all its valuable materials with it ‘to the grave’ or the landfill. Instead, the circular economy promises to reduce or even eliminate waste altogether. To use a simplified example, in a natural ecosystem like a forest, a leaf that falls to the ground will over time turn into nutrients for the underlying soil and its creatures. Essentially, any ‘waste’ will return back into the system as input or valuable ‘food’. In the circular economy, this principle is exemplified by two separate material flows: one for organic substances, which will be composted; and one for non-organic materials, which are recycled separately. Ideally, both of these processes are powered exclusively by renewable energies (EMF 2017). One popular illustration of these two looping circles is the ‘butterfly diagram’, with its two ‘wings’ representing the loops for organic and non-organic materials (Figure 1).

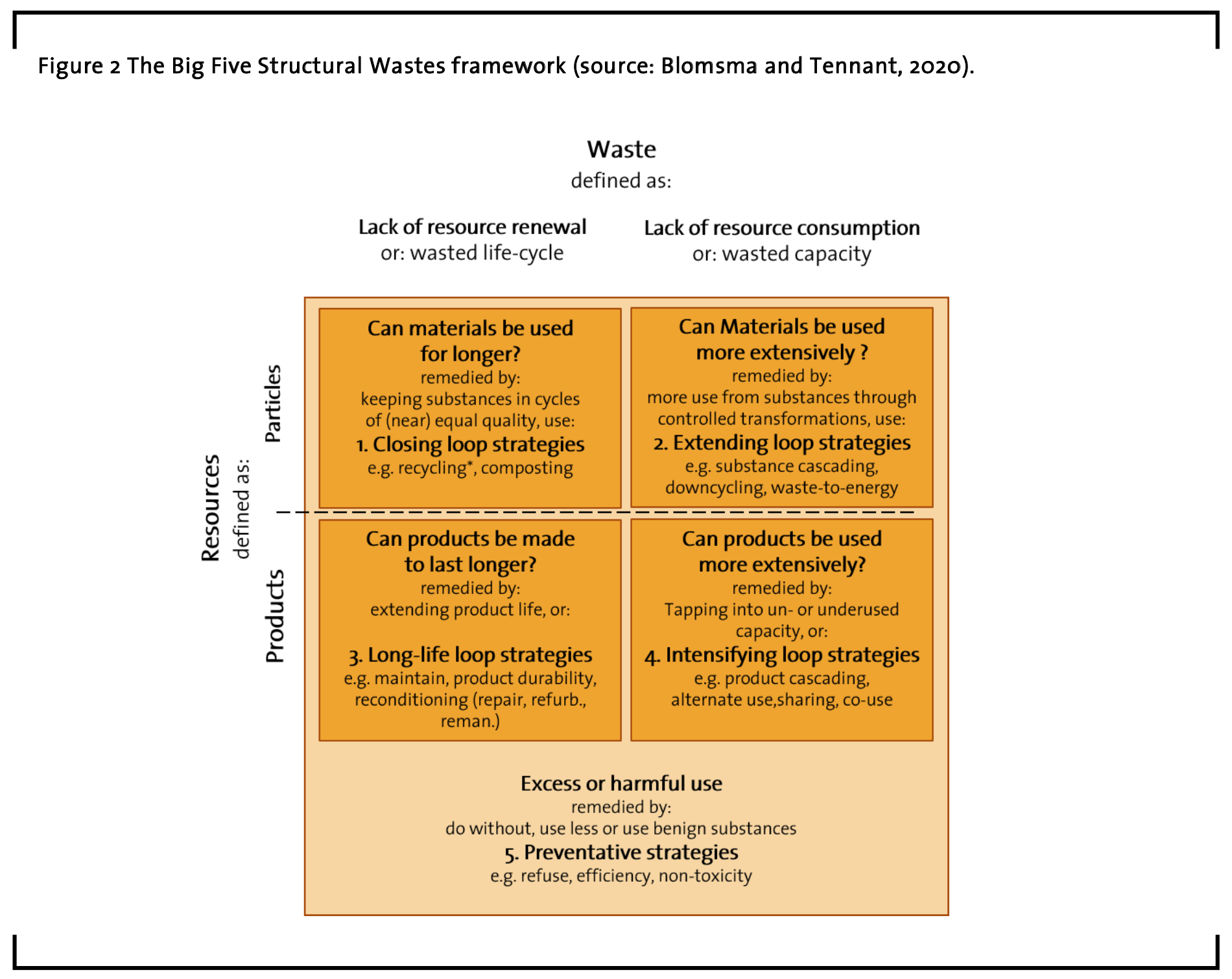

The circular economy and its focus on resource and product (re)use and waste avoidance can help to define innovative new business strategies (Kopel and Utikal 2019). One helpful concept for systematically exploring new ways of using resources and products is the Big Five Structural Wastes framework (Blomsma and Tennant 2020). This waste and resources grid offers five ‘sets’ of circular strategies by differentiating between two types of resources, i.e. particles (raw materials) and (finished/manufactured) products, and two types of waste, i.e. a lack of resource renewal and a lack of resource consumption. Subsequently, a fifth dimension is added to the grid, i.e. preventing or reducing material use altogether. Thus the five resulting sets of circular economy strategies – creating or improving specific loops – are (Figure 2):

- Closing loop strategies like recycling or composting to use materials longer;

- Extending loop strategies like substance cascading, downcycling or waste-to-energy in order to use materials more extensively;

- Long-life loop strategies like maintaining, improving durability or reconditioning (e.g. repair, refurbishment, remanufacture etc.) to make products last longer;

- Intensifying loop strategies like product cascading, alternate use, sharing and co-use to utilize products more intensively;

- Preventive strategies like refuse, reduce, replace in order to not use more resources than necessary and prevent the use of harmful (e.g. toxic) materials.

These circular strategies have the potential to spur necessary innovation in the chemical industry. Present and future industry challenges can be addressed by utilizing circular economy principles (Deloitte and VCI 2017):

- ‘Making the most of’ resources by increasing resource efficiency in all stages of the value chain (including suppliers and distributors as well as the end customer). This may entail – at the particle stage – closing loop strategies by improving and scaling recycling/composting processes; or extending loop strategies by cascading or downcycling substances, or using them for energy recovery.

- Increasing the lifetime of products and components. This may entail – at the product stage – intensifying loop strategies by reusing, sharing or cascading products; or long life loop strategies by maintaining products, increasing their durability, or reconditioning them through repair, refurbishment, remanufacturing etc.

- Reducing resource use when products are utilized. This may entail preventive loop strategies less at the manufacturing stage, but rather in designing the product to function more efficiently, e.g. making it use less energy or other resources.

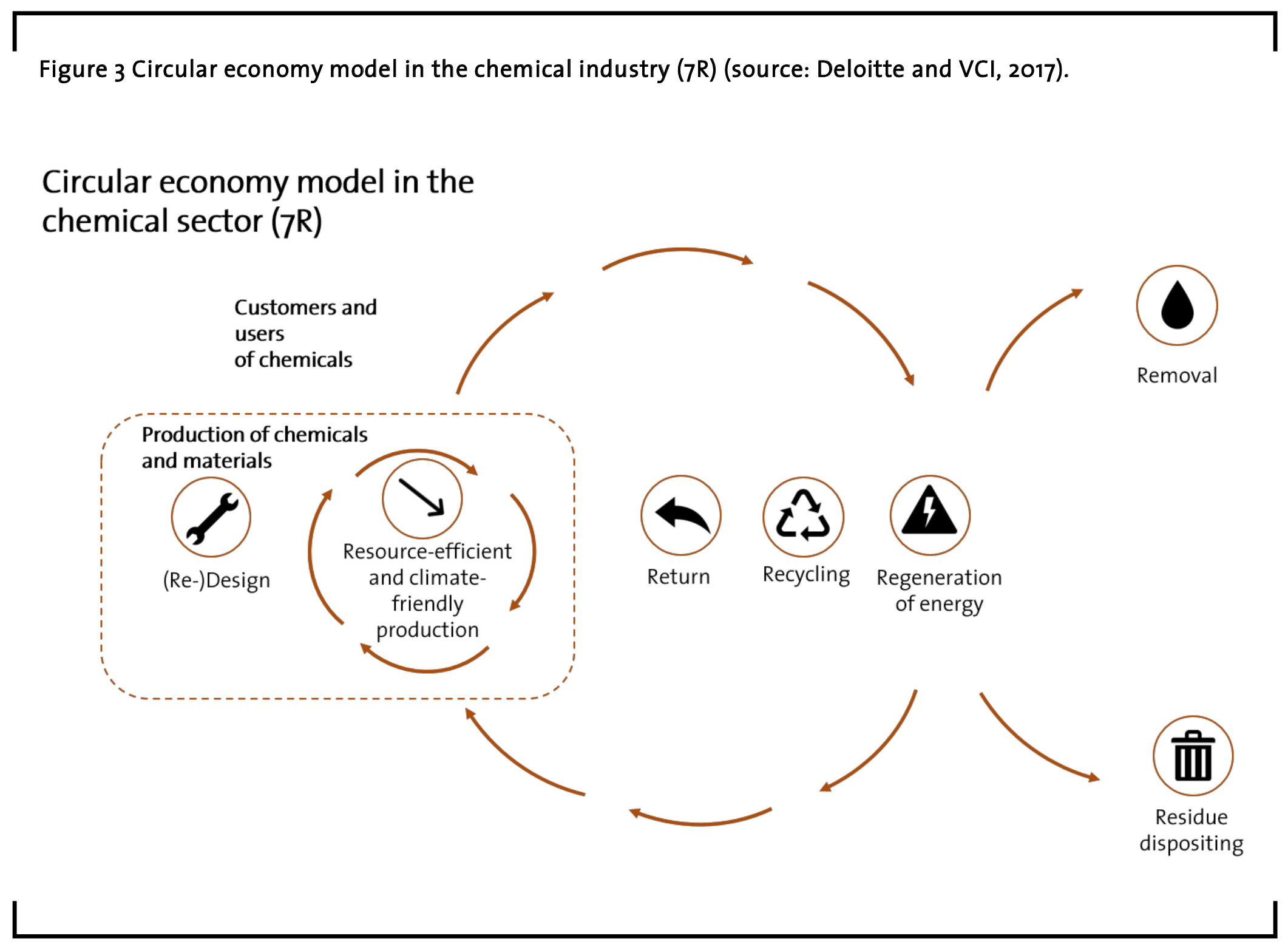

The different looping strategies can also be found in the ‘seven levers’ (or ‘7R’) the chemical industry may employ going forward (Figure 3): 1) (Re-)Design (all loops); 2) Resource-efficient and climate-friendly production (all loops); 3) Return (long-life loops); 4) Recycling (closing loops); 5) Recovery of energy (intensifying loops); 6) Removal (long-life or preventive loops); and 7) Residue depositing (extending or preventing loops).

Examples: Recycling CO2, reusing carbon.

Examples of practical applications of the circular economy approach – turning previous waste streams into valuable new inputs – include the (re)use of carbon dioxide (CO2) as a resource. Emissions of CO2 as the most prominent GHG from burning fossil fuels need to be curtailed drastically at a global scale. At the same time, carbon, one of the components of CO2 that is usually extracted from coal, gas or crude oil, is an important building block for a vast range of chemical products, including plastics. A cooperation between RWTH Aachen University, the Max Planck Society and Covestro AG is now helping to ‘close the carbon cycle’ by replacing petroleum-based raw materials for chemical production with CO2 (RWTH 2019). Up to 5,000 metric tons of polyol infused with carbon can be produced at Covestro’s pilot plant to be processed and used as foam for mattresses, car seats or insulating materials. Another joint research project between Evonik and Siemens delves into the biologization of chemistry, a field that has a lot of potential for the chemical industry. It explores the use of electrolysis and fermentation processes to turn CO2 into specialty chemicals such as butanol and hexanol, both of which are feedstocks for special plastics and food supplements (Siemens 2018). The test plant planned for 2021 would not only offer ‘green chemistry’ – i.e. the sustainable production of chemicals with the help of bacteria and renewable energy – but also provide multiple benefits: it would also function as an energy store, which can help stabilize the grid by responding to power fluctuations. Thus, the project also supports Germany’s renewable energy transformation and energy system restructuring.

All of these innovative processes use circular strategies, i.e. closing loops strategies, by ‘upcycling’ CO2 into valuable carbon for reuse, as well as intensifying loops, by transforming CO2 from a underutilized byproduct – basically a waste stream – into a useful resource input for a brand-new production process and value chain. Also, preventive strategies reduce natural resource inputs (e.g. petroleum) whose extraction, transport and use cause unnecessary environmental pollution, by replacing them with readily available CO2. Ideally, CO2 concentrations from the atmosphere are reduced by breaking them into carbon for productive products and applications, doubling as longterm carbon sinks. Finally, providing multiple benefits or different services – e.g. energy storage within a restructured electricity grid – goesbeyond the ‘product level’ of circular strategies. However, it shares certain attributes with intensifying loop strategies and creates more capacity from the same resources, by enabling co-use, alternate uses, and sharing services for greater functionality.

For the chemical industry, new business models must be innovative, sustainable and, of course, profitable. But innovation is difficult. In many cases, innovation ‘appears’ in an emergency situation that demands new and adaptive solutions. However, in situations where people already have more than they need – which arguably could be said for many parts of Europe, and Germany in particular – a certain complacency can set in, which kills the innovative spirit. Realizing the inherent need to innovate is a prerequisite for creating the necessary motivation; research and financial support are further important enablers. Also, producing a chemical ‘blockbuster’ has become more difficult for the industry. Customer needs – for the chemical industry and other business sectors – are becoming more diverse and more context-specific. Volume- or quantity-based business models may be replaced over time by performance-based solutions. This means innovative companies may shift from selling inputs to ensuring outcomes, including switching to product-as-a-service models – another innovative circular business strategy.

Example: Cleaning solutions as a service.

Chemical leasing is an example of a product-as-a-service model (UNIDO 2020). The traditional business model based on product volume sold defining profit is replaced by the service of ‘delivering’ pre-defined outcomes. This turns the business model upside down: using fewer chemical inputs would now be more profitable for the company providing the service. The amount of chemicals used is transformed from a revenue factor to what is now a cost factor for the company, thus creating incentives for innovation and increased resource efficiency.

One such innovative chemical service provider is Safechem (2020). The company offers various solvents for cleaning, industrial parts, textiles and asphalt testing applications. It also offers a host of related services: assistance and advice on safe use, quality assurance, collaboration with clients and related stakeholders (e.g. cleaning equipment manufacturers, waste managers, oil producers, local authorities, distributors and associations), and ensuring sustainable and circular solutions by decoupling the expected outcome from resource use and enhancing the performance and durability of the customer’s products. The cleaning product has been replaced by a product-as-a-service business model, saving time for the customer and reducing the use of chemicals for the benefit of the environment.

3.2 New technologies: digitalization and Chemistry 4.0

Novel technologies and the new market opportunities they offer are often key drivers for industry change. Digitalization is one of these current megatrends. It fuels Industry 4.0 and its promise of ‘smarter’ solutions: smart cars, smart buildings, smart energy grids, even smart cities. However, it also raises concerns regarding data security, transparency for customers and also towards market competitors, and how to innovate beyond traditional business structures.

For the chemical industry, collecting and analyzing more data within an own company provides opportunities to optimize operations, production and business processes, and efficiency gains for increased profitability. But digital technologies also offer completely new possibilities. Large data sets regarding the actual use of products were previously not readily available for systematic analysis of, for example, customer behavior and preferences, the environmental properties of products, product usage, effectiveness and durability, etc. Digitalization enables chemical companies to integrate further into end customers’ value chains and provide them with more far-reaching business solutions. These new digital opportunities for companies come in three categories (Deloitte and VCI 2017):

- Increased transparency and digital processes: collecting and using data from processes within the company. This enables efficiency gains within largely unchanged production and business models.

- Data-based operational models and analysis: adding external data about customers, markets and competitors to the internal process data. This enables advanced data analysis for enhanced decision-making, efficiency and flexibility.

- Digital business models: new value creation models that fundamentally change existing processes, products and business models. ‘Digital add-ons’ to existing products and services can be tailored to specific customer needs, potentially within a digital platform in collaboration with other companies.

Data collection to improve process efficiency has already been used in the chemical industry for some time, although there is still room for a higher level of automatization and the use of robotics. Nevertheless, the innovation potential here is more at an incremental scale. More disruptive change and innovation potential comes with data-based operational models. For example, predictive maintenance can minimize failure of production components and increase their durability. Connected logistics optimize inventory management and transportation of materials and products. Smart factory and virtual plant approaches employ automatization and modular production, all the way up to a complete virtualization of the entire production facility that achieves cost, quality or process improvements through real-time simulations within the ‘digital twin’.

The largest reservoir for change and innovation lies in the implementation of new digital business models. This has the capacity to change companies’ product portfolios, their relationship to their customers, and ultimately their own business model. One new opportunity, for example, is the ‘personalization’ of the chemical product desired by the end client, down to its technical properties and composition. These can be specified by the client via an interactive business-to-business (B2B) platform that is directly integrated into the customer’s value chain. New business models may also include process management services for the client’s production facilities that employ real-time data monitoring and long-distance maintenance. New forms of cooperation models with clients, suppliers, distributors and competitors are emerging as a result.

Example: Data platforms for digital farming.

Digital farming is one of the new market opportunities a digital business model provides for the chemical industry. In industrialized agriculture, highly automated tractors and harvesters already gather data on plant health, soil composition, harvest yields and the topography of wheat, corn, rapeseed and soy fields. This real-time data collection is supported by geographical information from satellites. It can then be correlated with historical data to more accurately assess and forecast soil quality and expected yields and to make more informed decisions on what crop to grow.

Agricultural experts from Bayer have been working on intelligently combining these different data sources into a digital management tool for farmers called an ‘Agronomic Decision Engine’, which would enable farmers to decide how much and what kind of pesticides to use, where on the field, and at what time (Bayer 2017). Apart from choosing what crop to sow, this data can also help to design how much irrigation is needed at what time. At the core of these enhanced forecasting and decision-making capabilities is the data platform, which bundles at least five and potentially more different sources of data: environmental data, e.g. soil properties and the exact temperature, weather information and water retention within the field; data on pathogens or other harmful factors, e.g. fungi, insects, worms, arachnids, weeds or other pests; data on plant properties, e.g. different crops’ reaction to pathogens, water needs etc.; what agricultural management techniques are used, including what pesticides and what kinds of tillage the farmer uses; and, finally, a ‘library’ of available pesticides, their properties and effectiveness, including information about which herbicides work best at what stage of plant growth.

The potential benefits for the chemical industry and its clients are threefold. First, by analyzing and adapting to an individual locality’s, field’s and even field area’s specific circumstances and needs, the use of chemicals can be kept to a minimum. Still, care must be taken to not overlook potentially more effective and sustainable solutions that avoid the use of chemicals in the first place, i.e. crop rotation, less intensive tillage, organic farming approaches, etc. Second, with the help of digital farming approaches, pesticide solutions can be personalized for each individual client. By creating field-specific digital maps based on available satellite, soil and topography data, any chemical product can be tailored and adjusted to specific plant needs on (or in) the ground. The business advantage of highly tailored chemical solutions is also relevant for other sectors, for example Chemsafe’s personalized cleaning products and services (see Section 3.1). Third, the customer relationship is strengthened, while the value derived from the chemical company’s service is (potentially) much larger. This opens up important new business areas and opportunities for the chemical industry which go beyond the traditional business model as a chemical goods manufacturer. However, finding the right balance of data transparency, value and information sharing between the chemical company and the customer is an ongoing balancing act.

3.3 New competencies: collaboration and training for Chemistry 4.0

Over the decades, the chemical industry in Europe, and in Germany in particular, has benefited from a solid base of engineering know-how, linked to good higher education opportunities in the natural sciences. Process innovations have been continuously implemented. Chemical products are high-quality and reliable. However, a business innovation mentality at the system level, i.e. the readiness to leave behind old business paradigms and envision fundamentally new opportunities, seems to be less common in the industry. Some drivers for change and innovation are perhaps not as pronounced in Europe as elsewhere. The demographic changes Germany and other countries are facing have led to a shortage of skilled young people for the industry. Moreover, opportunities and changes caused by enhanced digitalization and automatization require a potentially smaller yet more highly skilled and interdisciplinary workforce. Employees for the new Chemistry 4.0 need a new skillset to enable innovation.

For people working in the chemical sector, this means a reorientation within their profession. Cross-sectoral and cross-cultural collaboration and teamwork will become more important; so will lifelong learning strategies to strengthen new skills and competencies. This will require new training and professional education formats. More fundamentally, it also involves a cultural change within chemical companies: more tolerance for experimenting and making mistakes; thinking up new ways to tackle old challenges; and integrating new technologies, capacities and business models into a more complex form of collaboration to create customer value. It also means working together with distributors, competitors and clients in new ways to provide joint services and increased value collaboratively.

However, if the chemical industry wants to integrate digitally versed innovators, start-up entrepreneurs and sustainability pioneers into its workforce, it will need to be able to attract such talent. In that case, it will compete for such experts not only with other traditional industries, but also with start-ups, creative industries and the tech sector, including the likes of Apple and Google. It may prove challenging to attract innovative ‘digital natives’ with an entrepreneurial background to the chemical industry. However, their new ideas will support business innovation.

Examples: Stakeholder collaboration for digital farming and material exchange platforms.

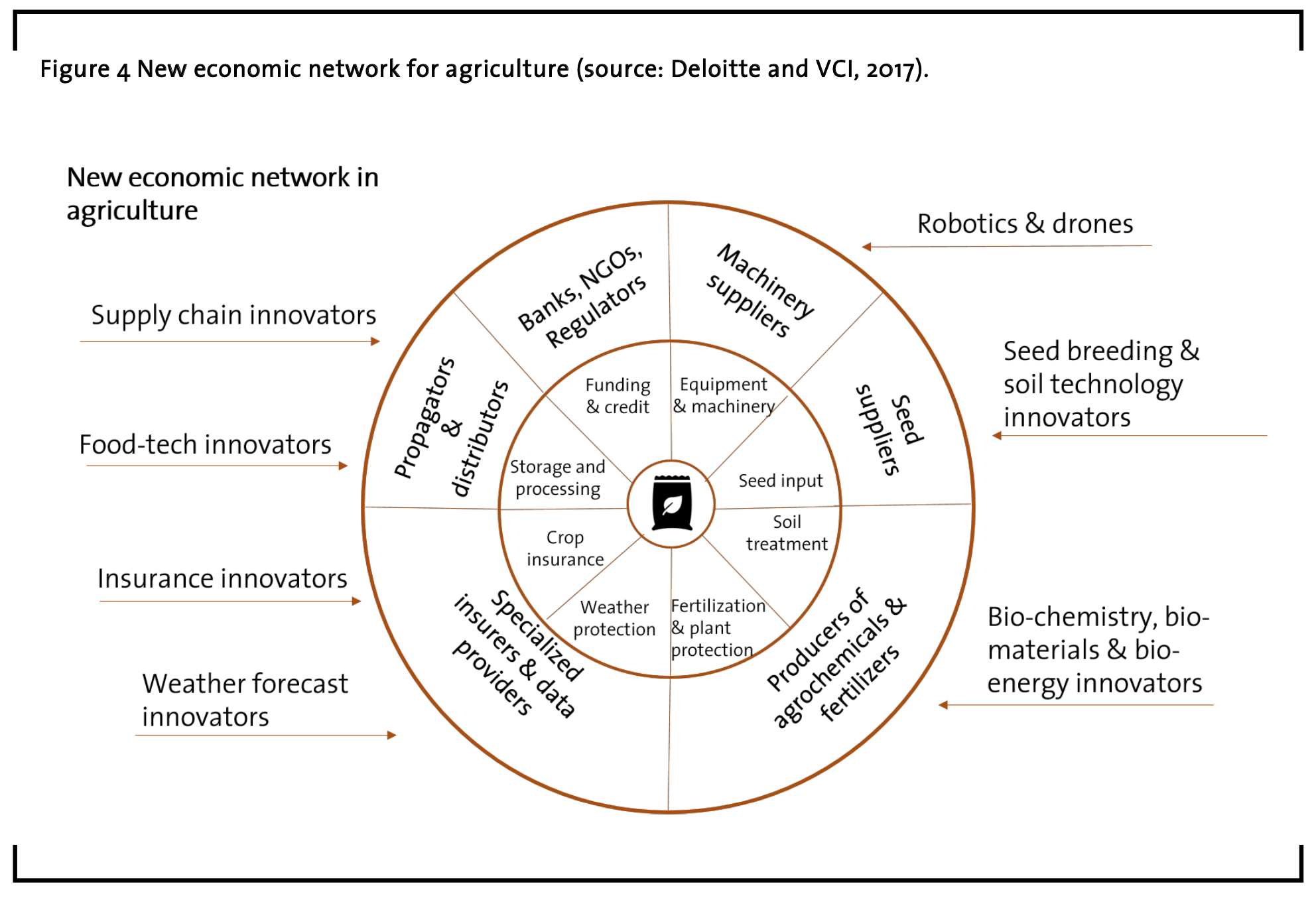

Some of the chemical industry’s new market opportunities show what complex collaboration skills are needed to design future business models with a diverse set of old and new stakeholders. The linear value chain model of business relationships – from the supplier to the chemical manufacturer on to the distributor and finally to the customer – has become more permeable and flexible. More and more often, customer and supplier relationships are realigned within an ecosystem that also includes hardware and software producers as well as companies from outside the chemical industry.

Digital farming (see section 3.2) may once again serve as an example of these new complex networks and the chemical industry’s role in them (Figure 4). Established market players in the agricultural sector work even closer together. This includes various companies in the biochemistry sector, i.e. suppliers and manufacturers of seeds, fertilizers and pesticides; producers of agricultural machines; the food processing industry; logistics and transportation providers; and financial service and insurance companies. However, the further integration of digital services provides new collaboration and market entries: e.g. information providers for soil quality, field topography and satellite data; software developers for data processing and analysis applications; and hardware producers for drones, robots and sensors for real-life data collection and monitoring. Products and services are bundled by many different providers, focusing on outcomes – e.g. soil quality, plant health, harvest yield, etc. – rather than individual chemical or other inputs. The digital collaboration is essential for the business model. Current data about the soil, plants, field, weather and machines is collected and analyzed. This data can then be cross-referenced with ‘library data’ on pests and pathogens, plant properties, agricultural techniques etc. The final step is the adjustment of the fertilization and watering process in real time for optimal results (Deloitte and VCI 2017). Altogether, this new ecosystem of interrelated producers and providers ideally helps farmers to receive more relevant information, make better decisions and grow more with less.

A different digital collaboration model for circular economy business opportunities is the Materials Marketplace (USBCSD 2020). Implemented by the United States Business Council for Sustainable Development, this regional and national platform lets companies connect and build new joint business models on the basis of sharing, recycling and reusing resources. Sur-plus materials, packaging or by-products from industrial or other waste streams may be offered and accepted by all members of this marketplace. Thus the traditional industrial symbiosis model is transferred into the digital space. Companies can create joint circular business strategies at the material (or particle) level: in particular, closing loops through better recycling and composting opportunities; and intensifying loops by material cascading and secondary use of by-products, downcycling and using potential waste-to-energy opportunities. Benefits for companies and the regions include: reduction of landfills (where waste would end up otherwise); additional revenue streams (by converting waste streams into valuable secondary resource inputs); cost and energy savings (for waste removal or purchasing/ refining materials); new employment opportunities (e.g. in the recycling sector); new business opportunities (by creating more resources); and potentially less demand for virgin materials and less exploitation of natural resources elsewhere.

4 Summary: Combining circular, digital and collaborative innovation

In the coming decades, the chemical sector will continue to be an important element of society and business. No matter what changes and innovations a digital future might hold, people will still need physical products, medicines and pharmaceuticals, water, energy, and food. Commodities and basic chemicals will still be needed. Society will likely still rely on some forms of fossil fuels and hydrocarbons, although their importance will diminish in relation to renewable energy sources. However, sustainability, climate change and the ecological boundaries of resource extraction will increasingly shape future decisions and put circular economy strategies front and centre. Public pressure will increase to prevent natural resource exploitation, attempt carbon-neutrality or even carbon-negativity, and focus on adding net environmental (and social) benefit instead of minimizing harm. The ‘biologization’ of chemistry and the focus on natural-based solutions will likely grow, e.g. through bacteria that can dissolve certain types of plastic waste or create specific proteins. Recycling and the recovery of valuable substances is another field with enormous potential, e.g. recovering phosphates from wastewater instead of the energy-intensive and highly polluting process of extracting them from the ground. New catalytic processes – for energy production, material refinement and pollution reduction – will continue to create value and new research opportunities.

Nevertheless, the chemical industry – in Europe and in Germany in particular – will need to change in fundamental ways. Basic chemical production may shift to other regions where energy and labor costs are lower. Future relevance and market success will largely depend on companies’ ability to create new business ecosystems: diverse stakeholder networks that redefine traditional supplier and customer relationships. Instead of the old linear ‘supplier-manufacturer-distributor-client’ processes and value chains, future business models will depend more heavily on the ability to help a client solve a particular problem, in collaboration with a diverse set of other market participants. Ideally, the chemical industry will change from a ‘materials producer’ to a hub within an innovation ecosystem that can steer and direct new processes for higher-value products and services.

This requires the chemical industry and its employees to adopt an innovative mindset, including a deeper understanding and application of new circular and digital business strategies. Better product and service design for increased reusability, recyclability and sharing is still a huge challenge. However, the goal must be to go beyond resource efficiency gains and related cost reductions to offer new and improved services to customers. Employees will need to engage in lifelong learning strategies and develop a culture that encourages innovation and change; this includes taking advantage of new technological opportunities. Companies need to employ ambidextrous structures that can progress in both exploitation and exploration, i.e. increase efficiency and flexibility at the same time. Innovative chemical start-ups may offer new services in collaboration with other companies via customer platforms, where physical, digital and even payment infrastructures are offered by other service providers, similar to current internet retailers. The emerging digital infrastructure will enable significant transaction cost reductions, which enable more collaboration with the customer and his specific product and service demands. For example, ‘smart’ chemical production process components within a company could communicate with the customer’s enterprise-resource planning (ERP) system to create just the right kind of product at the right time with minimal amounts of materials and energy. These digital B2B platforms have the potential to create new forms of value-creating networks and circular ecosystems.

Companies need to figure out how to combine these new technologies, circular economy strategies, and collaboration opportunities. Only then will they be able to create sustainable business models that stay competitive in a changing market. If they don’t want to go bust, they need to adapt to Chemistry 4.0, which is more collaborative, more circular, and more sustainable.

Acknowledgements

The author would like to thank all experts from Provadis and Infraserv who generously shared their time and knowledge, as well as his Climate-KIC Pioneers team who shared and supported the research and innovation challenge: Laura Gonzalez, Ni Ke, Maria Rudz, and Melanie Vogelpohl.

References

Bayer (2017): Der vernetzte Acker – Digitale Revolution: Effizientere Landwirtschaft und sichere Ernten. https://www.research.bayer.de/de/digital-farming-digitale-landwirtschaft.aspx, accessed 20 March 2020.

Blomsma, F. and Tennant, M. (2020): Circular economy: Preserving materials or products? Introducing the Resource States framework. Resources, Conservation & Recycling 156. https://doi.org/10.1016/ j.resconrec.2020.104698

Deloitte & Verband Chemische Industrie (VCI) (2017): Chemie 4.0: Wachstum durch Innovation in einer Welt im Umbruch. https:// www.vci.de/vci/downloads-vci/publikation/vcideloitte-studie-chemie-4-punkt-0kurzfassung.pdf, accessed 10 March 2020. [English version: https://www.vci.de/vci/ downloads-vci/publikation/vci-deloitte-studychemistry-4-dot-0-long-version.pdf].

Ellen MacArthur Foundation (2013): Towards the Circular Economy: Economic and business rationale for an accelerated transition. https:// www.ellenmacarthurfoundation.org/assets/ downloads/publications/Ellen-MacArthurFoundation-Towards-the-Circular-Economyvol.1.pdf, accessed 15 March 2020.

Ellen MacArthur Foundation (2017): What is a circular economy? A framework for an economy that is restorative and regenerative by design https:// www.ellenmacarthurfoundation.org/circulareconomy/concept, accessed 15 March 2020.

European Commission (2014): A policy framework for climate and energy in the period from 2020 to 2030. https://eur-lex.europa.eu/ legal-content/EN/TXT/? uri=CELEX:52014DC0015, accessed 10 March 2020.

European Commission (2018): 2030 Climate & Energy Framework (including revised renewables and energy efficiency targets). https:// ec.europa.eu/clima/policies/ strategies/2030_en, accessed 10 March 2020.

European Commission (2020): Circular Economy Action Plan: For a cleaner and more competitive Europe. https://ec.europa.eu/ environment/circular-economy/pdf/ new_circular_economy_action_plan.pdf, accessed 10 March 2020.

Keller, W. and Bette (2020), N.: Shaping digital sustainable development in chemical companies. Journal of Business Chemistry, 02.2020. https://www.businesschemistry.org/article/? article=373.

Kopel, T. and Utikal, H.: Zirkuläre Wirtschaft: Eine reale Geschäftschance. Nachrichten aus der Chemie 67, Februar 2019. https:// www.gdch.de/fileadmin/downloads/ Netzwerk_und_Strukturen/Fachgruppen/ Vereinigung_fuer_Chemie_und_Wirtschaft/1902_nch _nachbericht_circ_econ.pdf, accessed 10 March 2020.

RWTH Aachen University (2019): Pioneering Research into the Use of CO2. https:// www.rwth-aachen.de/cms/root/Die-RWTH/ Aktuell/Pressemitteilungen/November/~evxre/ Richtungsweisende-Forschung-zur-Nutzung/ lidx/1/, accessed 5 March 2020.

Safechem (2020). https://safechem.com/ en/. (accessed 15 March 2020).

Siemens (2018): Evonik and Siemens to generate high-value specialty chemicals from carbon dioxide and eco-electricity. https:// press.siemens.com/global/en/pressrelease/evonik-and-siemens-generate-high-value-specialty-chemicals-carbon-dioxide-and-eco), accessed 5 March 2020.

United Nations Industrial Development Organization (UNIDO) (2020): What is Chemical Leasing? https://www.chemicalleasing.org/ what-chemical-leasing, accessed 15 March 2020.

Umweltbundesamt (2019): Erneuerbare Energien in Zahlen. https:// www.umweltbundesamt.de/themen/klimaenergie/erneuerbare-energien/erneuerbareenergien-in-zahlen#uberblick, accessed 10 March 2020

United Nations Industrial Development Organization (UNIDO) (2016): Chemical Leasing towards a sustainable future (video). https:// www.youtube.com/watch?v=Dst2PMreujc, accessed 15 March 2020.

United Nations Framework Convention on Climate Change (2015): Paris Agreement. See https://unfccc.int/files/essential_background/ convention/application/pdf/ english_paris_agreement.pdf, accessed 10 March 2020.

United States Business Council for Sustainable Development (USBCSD) (2020): Materials Marketplace: Facilitating company-to -company industrial reuse opportunities that support the culture shift to a circular, closedloop economy. https://usbcsd.org/materials/, accessed 20 March 2020.

Verband Chemische Industrie (VCI) (2017): Die Ära Chemie 4.0 eine Branche bricht zu neuen Ufern auf. https://www.youtube.com/ watch?v=4caNVSo03A8, accessed 10 March 2020.