Collaborative development of new process technology/equipment in the process industries: in search of enhanced innovation performance

Abstract

When a new production plant is built or an existing one upgraded, it can not be taken for granted that adequate process technology is available off the supplier’s shelves. Rather, it may require a strong commitment on the process firm’s part to find competitive production solutions in collaboration with one or more equipment suppliers. The development of such new or improved process technology may be prompted by the process company’s need for process development, or product development, or both. The purpose of this article is to provide theoretical insight and practical guidance on how both process firms and equipment manufacturers can address the challenges posed by joint collaboration for innovation in new process technology/equipment. Starting with a discussion of motives and the question of why collaborative development of new or improved process technology/equipment should take place a tall, a conceptual model of the full lifecycle of process technology/equipment is introduced together with a classification matrix containing the dimensions of complexity of process technology and newness of process technology. The framework provides a conceptual platform for further research into this area, but can also be deployed by industry professionals in their efforts to improve inter-company collaboration.

1 Equipment supplier/user collaboration in the process industries – a background and introduction

The process industries span over several industrial sectors such as minerals & metals, pulp & paper, food & beverages, chemicals & petrochemicals and generic pharmaceuticals, and thus constitute a large part of all manufacturing industry. Firms in the process industries may focus on being efficient commodity producers, or producers of more functional products, or both (Lager and Blanco, 2010). In most situations, an efficient production process will ensure that production costs can be kept low with higher profit margins and less price sensitivity. One way to improve performance is to invest in better and more efficient process technology (Skinner, 1978, Skinner, 1992).In the process industries it is not so common anymore for individual firms to develop and manufacture their own process technology/equipment, which makes them dependent on external suppliers of process equipment (Rönnberg Sjödin et al., 2011). Historically, it can be seen that many equipment manufacturing companies have grown from collaboration with domestic process firms to the point where they now serve customers primarily active on the global market (Auranen, 2006). The process industries, especially in the Nordic countries, have such along tradition of collaborative development between process firms and suppliers of new process technology.

Such collaboration has historically produced a win-win situation where the process companies, as early users, have gained access to novel technology and equipment needed to process domestic raw materials, whereas the equipment suppliers in a geographically close and often mutually trusting relationship have gained an efficient means of testing prototypes and developing new equipment. As process based firms typically operate in more mature industries (Utterback and Abernathy, 1975), external actors such as equipment suppliers are important sources of innovation in process technology(Hutchesonetal., 1995, Reichstein and Salter, 2006). Similarly, equipment suppliers are dependent on process firms not only as customers for new process technology solutions, but also for testing and gaining feed back on new prototypes. The incentives for joint development efforts through mutual collaboration are therefore still strong. Changes in the external environment, such as the emergence of global markets and the appearance of global suppliers of new process technology, may however cause this situation to change (Williamson, 2011).

1.1 Integrating equipment manufacturers into the process firm’s innovation processes

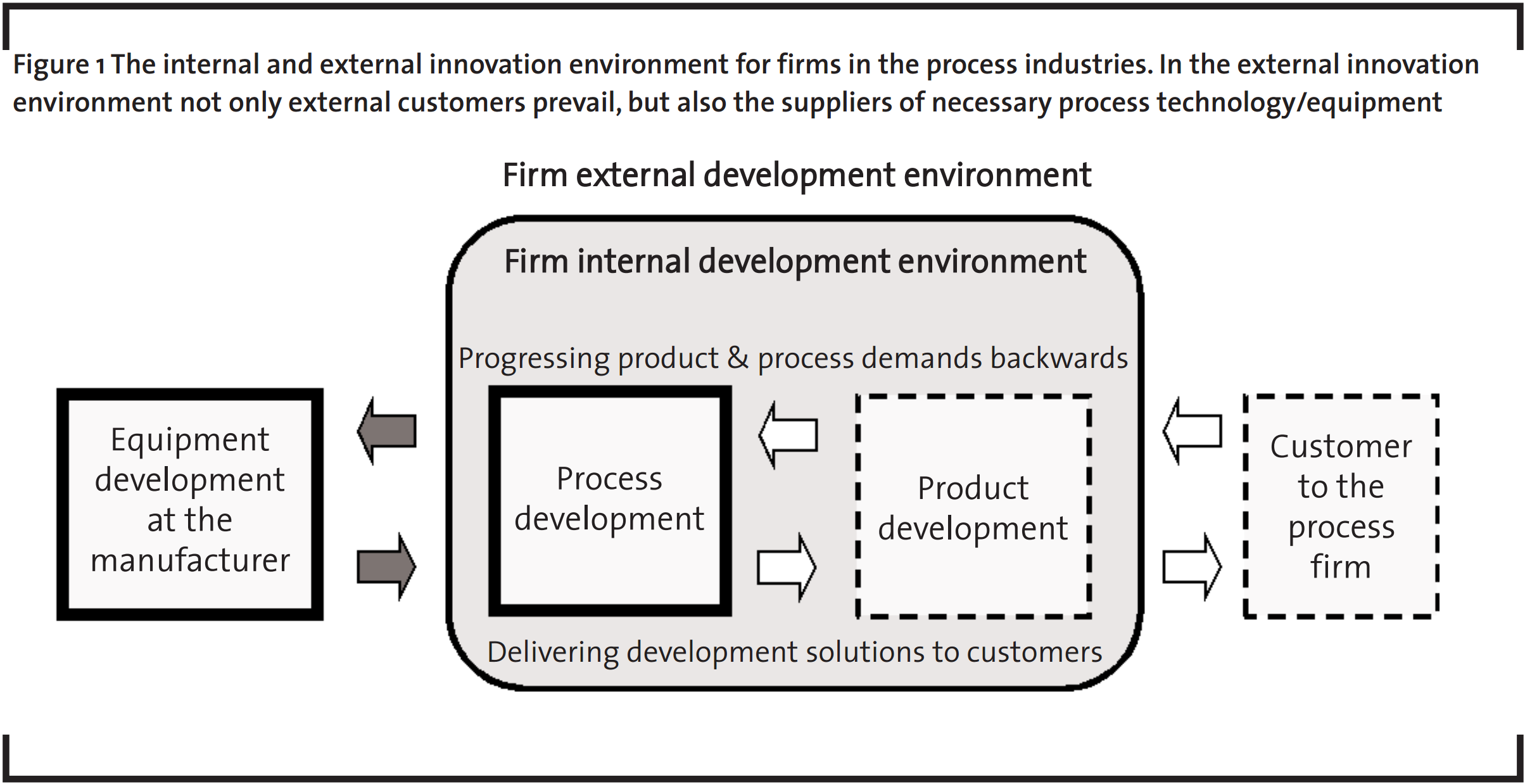

When a new plant is built or an existing one upgraded, as well as in other equipment procurement situations, it cannot be taken for granted that the necessary equipment is available off the supplier’s shelves. It may require a fairly strong commitment on the process firm’s part to find competitive production solutions in collaboration with equipment suppliers. The key reason for this is the often idiosyncratic nature of process technology needed by process firms. The development of such new or improved process technology may be prompted by the process firm’s need for process development, or product development, or both (Frishammar et al., 2012), which is further illustrated in Figure 1. However, for most firms in the process industries, a substantial part of process and product development is not radical development, but rather an incremental refinement of existing products and processes (Lager, 2002).

In the case of incremental product development, it may not be necessary to involve equipment manufacturers in the early stages of the innovation process, while in radical product development this may often be critical. In both radical and incremental process development it is not only advisable but of the utmost importance to have good contacts and strong collaboration with equipment manufacturers in order to explore new process development opportunities. Sometimes process development is organized as a part of the firm’s R&D organization, and sometimes as a part of its manufacturing function (Bergfors and Lager, 2011). Such different organizational contexts may naturally influence not only the collaborative climate but also further tests and implementation of new process equipment. In successful process development, close collaboration with an equipment supplier is often necessary right at the very start of the development of process technology. If the equipment needed is very firm-specific (idiosyncratic), it may even be necessary for the process firm to compensate the equipment manufacturer for such development. However, if the process firm has a large competitive advantage through its proprietary process technology and knowledge in specific areas, it may even have to consider carrying out such equipment development work itself. Alternatively, it may have to secure a proprietary ownership of a technology that is developed in collaboration with an equipment manufacturer, but to grant licenses to the equipment manufacturer for non-competitive customers.

From the equipment supplier’s perspective, the development of new process technology/equipment may be prompted by the identification of customer needs on the world market or internal idea generation and technology push.

As Figure 1 shows, external customer demands on the products from the process firm may prompt not only a need for the development of new or improved products but also the development of new process technology to enable the production of such products (Lager, 2010 p.92). In addition, customer-driven needs for more efficient and low-cost products may also fuel the development of improved process technology. Successful development of such new process technology, however, depends to a large extent on close collaboration with equipment manufacturers. A note worthy observation on the collaborative development of process technology/equipment is that it may be called either product development or process development depending on the view points of the parties concerned. From the equipment supplier’s perspective, this kind of development is often discussed in terms of entering into a “product development project”, whereas from the process firm’s perspective it is typically discussed in terms of entering a “process development project”. It may, however, be advisable for both the equipment supplier and the process firm to speak in terms of developing both a “product concept” and a “process concept”. That is, for the process firm, product development is prompted by the needs of its customers for improved process technology, which as a consequence may prompt a need for the development of new process technology (see Figure 1).

A similar situation typically occurs for the equipment supplier when the development of a new process technology for the customer (process firm) prompts the need for the development of a new product (the new equipment). The improved use by its customers of a process firm’s already existing products is usually called “application development” in the process industries (Lager and Storm, 2012). In a similar vein, the use of the equipment supplier’s product in the customer’s process may thus also, when the product is further marketed to other customers, be regarded as application development and as improvement of the customer’s further use of the product (equipment). The consequence for the process firm of using this “mental map” is that it focuses the development activities more on improvement of the customer’s process than on the development of the actual product. The consequence for the equipment manufacturer may be that it focuses the customers’ use of the equipment more firmly on improvement of the customer’s production gains, than on the actual development of the equipment as such.

These arguments and examples indeed emphasize the importance of good collaborative efforts. The supply chain perspective presented in Figure 1 also illustrates the importance to the equipment supplier of not only understanding the customer’s needs but, in their long-term development, also of understanding the customer’s customer’s needs. Successful process technology/equipment development by the equipment manufacturer is thus often largely dependent on access to a knowledgeable process firm as a collaborative development partner. One way to speed up the product and process development processes for both the process firm and the equipment manufacturer in the future may be to “short-circuit” the product and process innovation chain presented in Figure 1. Such a desired effect may be best achieved by stronger integration and improved internal and external cross-functional collaboration, a topic that will be further explored and discussed in the following sections.

1.2 A life-cycle perspective on the collaborative development and operation of process technology/equipment

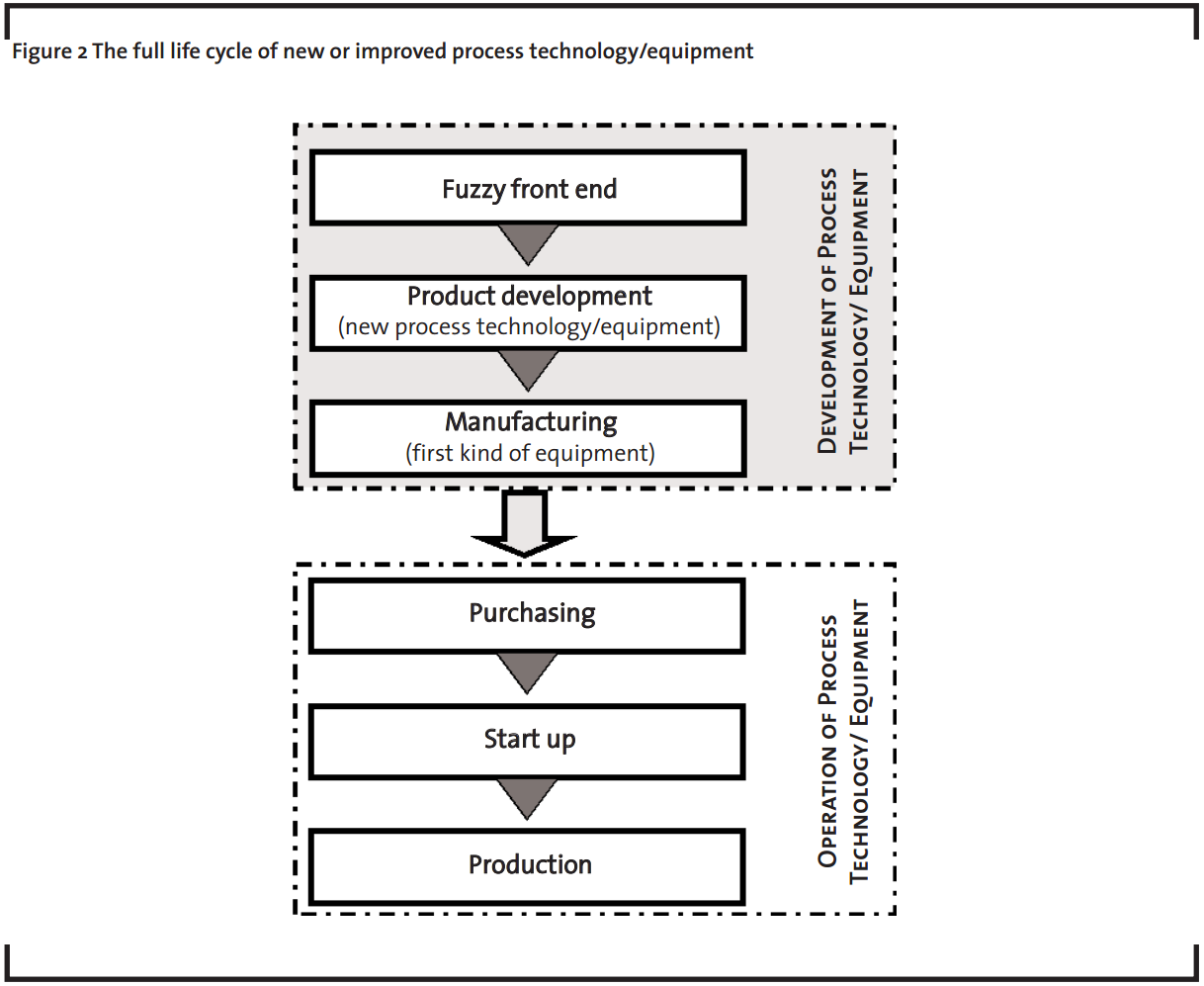

Acquiring and purchasing new or improved process technology/equipment is not, however, necessarily preceded by collaborative development of the equipment (between a process firm and an equipment manufacturer). The full life-cycle of process equipment, broken down into two distinct stages, is illustrated in Figure 2. The full equipment life cycle has been conceptually split up into two distinct stages.

In the first stage, the development activities are often in the hands of and controlled by the equipment manufacturer. In the second, nonshaded stage, the operation of new process technology/equipment is mainly in the hands of the process firm (Lager and Frishammar, 2010).

The two stages are interlocked only if the process firm that collaborated during the development stage also decides to buy the equipment being developed. From the equipment manufacturer’s perspective, the development of new or improved process technology/equipment should preferably be followed by a consecutive sale of such equipment, preferably in quantities which allow a profitable overall business objective to be achieved. The development of such new or improved process equipment for the process industries is therefore in most cases carried out in close collaboration with one firm or a consortium of process firms, often also targeted as future potential customers for the equipment.

In the development stage, the equipment manufacturer is often the “promoter”, most interested in securing development support and collaboration, whereas in the operation (production) stage the process firm is the one who decides whether and on what premises collaboration should take place. In the first stage, successful collaborative innovation depends first of all on input of present and future needs for process technology and good ideas in the fuzzy front end (sometimes from different firms). Further on, the execution of an efficient product development phase often uses process firms’ production plants for testing or installation of demo plants if such a collaborative approach has been selected. Finally, judicious design (engineering) of the new equipment to meet future needs for low-cost operation and good availability is crucial. In the second stage the enhancement of production productivity through technology transfer by means of different forms of collaboration between the equipment manufacturer and process firm could then be a combination of a judicious joint selection of proper process equipment for company-specific production applications, a mobilization of joint resources for a smoothstart-up (Lager, 2012) and a following efficient operation utilizing the combined expertise of both parties.

In this paper we will focus only on the first stage of the process technology/equipment lifecycle, although there may be an interlocking grip between the two stages. Despite the issue of sometimes diverging interests, collaboration during the various phases of the development part of the life cycle of process technology/equipment is likely to be of even greater importance in the future both to process firms in order to secure an efficient production process and to equipment suppliers to secure the development of a competitive portfolio of process equipment. It is therefore justified to ask how such collaboration in the future should be managed, organized and implemented to the maximum benefit of both parties.

1.3 Purpose and research approach

The purpose of this article is to provide theoretical insight and practical guidance on how both process firms and equipment manufacturers can address the challenges posed by joint collaboration for innovation of new process technology/equipment. The theoretical framework could thus be deployed by industry professionals in their efforts to better decide on and improve a collaborative development approach. The framework is also intended to provide a platform for further research into this area. In this study one of the authors’ own industrial experience has given him a status of not only author but informant (Yin, 1994), sharing his knowledge of equipment development in the process industries. On one hand, there is naturally a risk that this author´s preunderstanding will result in research that is not open to the alternative theories and the empirical world, and that new findings will be adjusted and distorted to fit preconceptions. On the other hand the advantages of preunderstanding in research can be many; they have been rather well expressed by Markus (1977):

“The problem is how to get beyond the superficial or the merely salient, becoming empirically literate. You can understand little more than your own evolving mental map allows. A naive, indifferent mental map will translate into global, superficial data and interpretations – and usually into selfinduced bias as well. You have to be knowledgeable to collect good information.”

In his paper “Theory Construction as Disciplined Imagination” Weick gives an interesting quotation (1989):

”Theorists often write trivial theories because their process of theory construction is hemmed in by methodological strictures that favor validation rather than usefulness (Lindblom, 1987). These strictures weaken theorizing because they de-emphasize the contribution that imagination, representation, and selection make to the process, and they diminish the importance of alternative theorizing activities such as mapping, conceptual development, and speculative thought. Theory cannot be improved until we improve the theorizing process, and we cannot improve the theorizing process until we describe it more self-consciously, and decouple it from validation more deliberately.”

This somewhat philosophical statement concerns whether a good theoretical framework is necessary for good empirical research, or whether the study of the empirical landscape is the best starting point for the development of “true” theories. For case-study research, both alternatives are advocated by scholars from different domains of theory of science (Yin, 1994). Since the area we are addressing in this study is sparsely researched to say the least, a good theoretical platform is consequently lacking, which has prompted the development of this framework and the following research question:

RQ1 In the development of new process technology/equipment in the process industries, why, when and how should a collaboration between process firms and equipment manufacturers be the advised route to follow?

The article is organized as follows. After the introductory part, a review of extant research in the area of external collaboration is presented. Afterwards the development of the framework is introduced and industry implications are discussed. The framework presented here is thus to be regarded as results from this study to be used in further empirical research for which a preliminary research agenda is provided.

2 A theoretical point of departure: external collaboration

Collaboration issues have been extensively studied over the past decades. One side of the literature has focused on collaboration within firms (Frishammar and Hörte, 2005, Kahn, 1996) with a prime focus on collaboration among functions and departments. Other scholars have studied external collaboration, e.g. (Ahuja, 2000a, Ahuja, 2000b) with a prime focus on collaboration among firms. While collaborations “within” and “among” firms represent two different ideal types of collaboration situations, the concept of collaboration is in itself ambiguous. Notably, several different and complementary terms have previously been used in the extant literature. These include cooperation (Hillebrand and Biemans, 2004), interaction (Ghosal and Bartlett, 1990) integration(Barki and Pinsonneault, 2005) and coordination (Kogut and Zander, 1996). Although there is an overlap among these concepts, as researchers often refer to them interchangeably; see for example (De Luca and Atuahene-Gima, 2007), we use the term collaboration in subsequent discussions for two reasons. First, it emphasizes long-term, affective and continuous relationships between firms, as opposed to limited transactions and/or exchange of information (Frishammar and Hörte, 2005). Second, our focus is on collaboration between and among firms, rather than within firms. In this context, collaboration is the most commonly used term to characterize joint development efforts.

The literature on intercompany collaboration spans different research domains or traditions. Writings on intercompany collaboration have for example been grounded in the resourcebased view of the firm (Grant, 1991, Menon and Pfeffer, 2003), the organizational learning literature (Cohen and Levinthal, 1990, Lane et al., 2001), knowledge management (Sveiby, 2001), and product innovation (Chesbrough and Appleyard, 2007). External collaboration may take a variety of forms, ranging from tightly coupled to loosely coupled arrangements. Although an extensive list of forms is presented in the literature, some appear more relevant than others. Specifically, joint ventures, strategic alliances and consortia represent tightly coupled forms, while networks and trade associations (collaborative sectorial research projects) represent more loosely coupled forms (Barringer and Harrison, 2000). A joint venture is created when two or more firms pool a portion of their resources, and create a separate jointly owned organizational unit (Inkpen and Crossan, 1995). A consortium may be viewed as a special form of joint venture (Brooks et al., 1993), consisting of a group of firms which share similar needs and who then create a new entity which satisfies this common need (Kanter, 1989). Alliances, on the other hand, represent an arrangement between two or more firms in the form of an exchange relationship that has no joint ownership involved (Dickinson and Weaver, 1997). Networks are constellations organized through social rather than legally binding contracts (Jones et al., 1997). Nevertheless, in collaboration between equipment manufacturers and process firms, the actors can choose from an array of potentially relevant collaboration modes, ranging from tightly coupled to more loosely coupled ones arranged on an informal basis.

Supplier involvement refers to the resources (capabilities, investments, information, knowledge, ideas) that suppliers provide, the tasks they carry out and the responsibilities they assume regarding the development of a part, process or service for the benefit of a buyer’s current or future product development projects (Handfield et al., 2000, Walter et al., 2001, van Echtelt et al., 2008). A recent study entitled “Supplier involvement in customer new product development: new insights from the supplier’s perspective” (Klioutch and Leker, 2011), reports the results from a survey of chemical suppliers.

In their distinction between innovative and non-innovative suppliers they found that mutual support in NPD and open networks are imperative triggers for the involvement of innovative suppliers. Many authors state that it is largely agreed that world-class R&D performance can no longer be achieved by a firm on its own, and that nowadays meeting customer requirements increasingly needs R&D collaboration in buyer-supplier relationships (Collins et al., 2002, Hurmelinna et al., 2002). This further underlines the importance of using external information and establishing strong external collaborations, a fact that has been stressed in publications in the area of open innovation (Chesbrough and Crowther, 2006, Chiaroni et al., 2010, Sieg et al., 2010, Florén and Frishammar, 2012). In the process industries such collaborative behaviour, e.g. with equipment suppliers, is however nothing new (Aylen, 2010). By combining a product with service (service in the form of innovation), or vice versa, firms may improve both their bottom and top lines (Lichtenthaler, 2006). The conclusion is thus that it is important for a supplier to carefully examine its products and analyse how potential application development could support its product marketing and sales activities.

Regardless of collaboration mode, however, external collaboration as such has both advantages and disadvantages. Advantages include access to resources, economies of scale, risk and cost sharing, enhanced product development, learning, and flexibility (see for example (Grandori, 1997, Hagedoorn, 1993, Hamel, 1991, Kanter, 1989, Kogut, 1988). Disadvantages typically include loss of proprietary information, increased complexity in management issues, financial risks, increased resource dependence, loss of flexibility and antitrust issues (Doz and Hamel, 1998, Gulati, 1995, Hamel et al., 1989, Jorde and Teece, 1990, Kogut, 1988, Singh and Mitchell, 1996).

Although both the benefits and drawbacks of external collaboration have been discussed extensively, the literature seems biased in the sense that collaboration is usually pictured as being a good thing, while in reality the results of joint collaborative efforts may be both positive and negative, depending on the goals and circumstances of each collaborating partner (Cox and Thompson, 1997, Eriksson, 2008). This is apparent in the process industry, where joint collaboration can lead to major improvements in new process technology, but simultaneously allow “unintended knowledge transfer”, as when core knowledge is spread to competitors via equipment manufacturers active on a global basis. So while the literature on external collaboration seems a feasible point of departure, our objective is to further theorize on why, when and how collaboration for innovation should take place between process firms and their equipment manufacturers.

3 The development of a theoretical framework

As external collaboration contains both positive and negative effects and outcomes, it seems justified to ask why, when and how collaboration should take place, rather than just assuming that firms should collaborate for innovation in new process technology/ equipment. Despite the objection that it may not be logical to start with potential outcomes from collaboration, we will nevertheless do so since this is probably where an industry professional would like to begin the journey.

3.1 Why collaborate: expected outcomes from collaboration

A collaborative mode in innovation is not something new in the process industries, where strong collaborative efforts with equipment manufacturers have always been customary. The external collaborative approach and co-development partnerships in innovation are nowadays often referred to as “open innovation” (Chesbrough and Crowther, 2006), talking about the use of purposive inflows and outflows of knowledge during a distributed development process across organizational boundaries.

The motives for defining the business objectives before partnering are stressed and tentatively listed as: increased profitability, shorter time to market, enhanced innovation capability, increased flexibility in R&D, and expanded market access (Chesbrough and Schwartz, 2007). To develop new or improved process technology/equipment as a collaborative effort with equipment supplier(s) and process firms is not a matter easy to decide upon, however, since such collaborative development may have strong strategic implications for both parties. The driving forces behind collaboration between process companies and equipment suppliers are not always obvious and may vary, because such collaboration involves both advantages and disadvantages for each collaborating partner.

From the process company’s standpoint, collaborative development of new process technology allows the process firm to lower its development risks, assuming the alternative would be to develop in-house, without access to important knowledge provided by an equipment manufacturer. This appears especially important in the situation of a process firm’s need for “one-off” equipment, i.e. when idiosyncratic equipment that do not exist on the market must be developed. Secondly, an early involvement of equipment suppliers may provide opportunities for adapted or even custom-made equipment that better fits the specific needs of the process firm. In a similar vein, collaborative development provides the process firm an opportunity to become an early user and thus get a “first move advantage” over competitors (Liberman and Montgomery, 1988). Finally, new or improved process equipment created through joint collaboration may speed up a process firm’s product and process development.

Clearly, collaborative development has downsides as well. There is a risk that the firm’s “core technology” may be passed on via equipment manufacturers to competitors (Kytola et al., 2006). As a consequence, proprietary knowledge may diffuse via equipment suppliers to main competitors, who are often customers to the same supplier. Furthermore, collaborative development projects, unless prompted by specific needs on the part of the process firm, may imply high coordination costs and resource utilization, where the latter clearly constitute an opportunity cost. The process firm also runs the risk of production disturbances when installing and testing equipment that has been jointly created. Finally, close collaboration with an equipment supplier may impose on the process firm a situation where it is “taken hostage”, i.e. it constitutes a lock-in effect which may favor the equipment supplier in future purchasing situations (Kanter, 1989).

Equipment manufacturers are also exposed to both advantages and disadvantages when engaging in joint development of new process technology/equipment with a process firm. Advantages to the suppliers are several. Firstly, collaborating with a demanding customer frequently allows the supplier to improve its development capabilities and its understanding of customer needs (von Hippel, 1986). In a similar vein, access to the customer’s ideas and partly tacit knowledge can sometimes be transformed into new or even patentable products. Secondly, both collaborating parties often finance joint development projects. Subsequently, the process equipment being developed can be sold to other firms as well, allowing the equipment manufacturer to leverage its NPD on “somebody else’s budget” (Chesbrough et al., 2006). In addition, the new process technology beingdeveloped can typically be more customized with a collaborative arrangement, which increases customer satisfaction but also provides a good reference installation. Also, joint development allows a deeper and more intense relationship through mutual asset specificity. Last but not least, the opportunity and importance for the equipment manufacturer to develop and test prototypes in a real operating process environment setting is second to none.

Disadvantages to suppliers are not to be disregarded. Firstly, development of equipment which is too company-specific or idiosyncratic may have very limited application areas outside the specific collaborative project, and the equipment firm’s alternative use of these allocated resources may be much more profitable in a company perspective. Secondly, failures in joint development and subsequent implementation may hurt the reputation of the equipment manufacturer, which is especially important in the often open and informationintensive sectorial communication. Finally, important internal or even proprietary knowledge critical to the equipment manufacture may “leak” via the process firm to other manufacturers of process technology.

Summing up: reviewing the above lists in the perspective of the previously presented list of business objectives (Chesbrough and Schwartz, 2007), one can interpret many pros as objectives or expected outcomes of importance of interest to be identified before a collaborative partnership is established at the innovation stage. Given that there are both pros and cons of close collaboration from each party’s perspective, it seems justified to ask whether a win-win situation can be created in such collaborations, or if it is unavoidable that either of the parties will lose. The previously presented list of potential pros and cons has been compiled in an attempt to illustrate the complexity of collaboration between equipment manufacturers and process firms during the development stage of an equipment life cycle. It is, however, also intended to serve as a starting point for the creation of an empirically grounded and more complete set of expected outcomes in order to develop a benchmarking instrument that can serve as one guideline for establishing new collaborative and well-functioning relationships. If answering the why questions indicates that some sort of collaborative partnering arrangement should be desirable, it is now time to address the issue of when such collaboration should take place.

3.2 When to collaborate: picturing collaboration over the development stage of the equipment’s life-cycle

If there is a motive to start collaborative development between an equipment supplier and a process firm, the attendant questions are how such development activities should be set up and further when such commitment during the development project’s lifetime should be distributed to obtain a strong but lean development project. A project involving a very complex technology and also of a radical newness may span over a very long period of time in the process industries. Development cycles over 5-10 years are not uncommon if one includes the necessary time for implementation of the new technology in a new production plant.

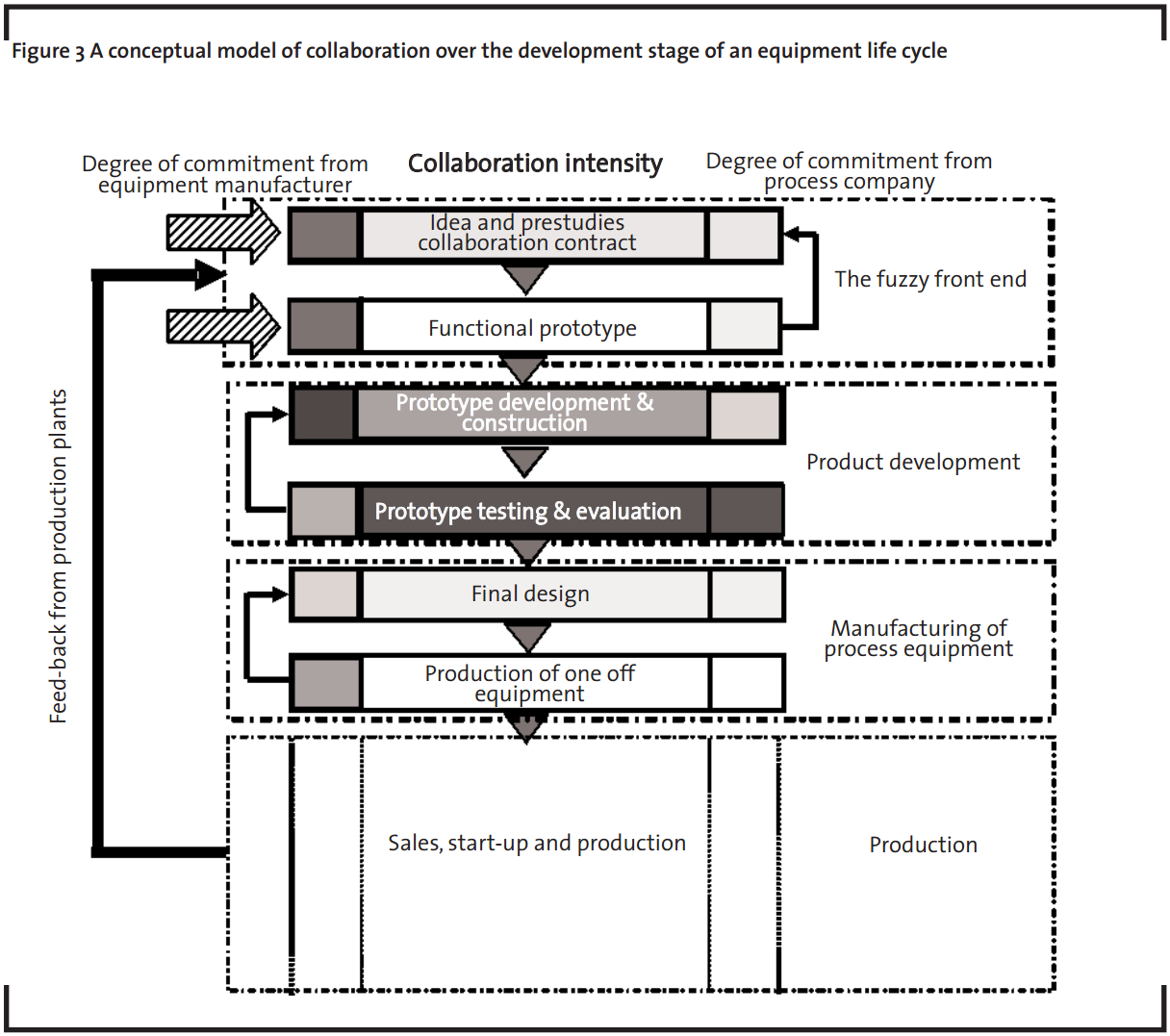

Figure 3 shows a conceptual model of collaboration over an equipment development stage of the life-cycle. The production part of the equipment life cycle will not be further discussed here but is presented and analyzed in depth by Lager and Frishammar (2010). As for Figure 3, the development process has been structured into three distinct phases: the fuzzy front end, product development, and manufacturing of process equipment. Each phase has been further divided into two sub-phases. The process company’s commitment and the equipment manufacturer’s commitment during the different phases and the collaboration intensities have been tentatively illustrated by different shadings (the darker, the stronger). It is thus to be observed that even if the degree of commitment is strong from both parties during different sub-phases, the collaboration intensity must however not necessarily be strong.

The shaded arrows symbolize necessary external input for the development work at the fuzzy front end. The large black arrow illustrates that necessary input from operating plants is also of importance for the development of new process technology and equipment. The iterative nature of development work is symbolized by the small arrows. How company commitments and their collaboration intensity ought to be in different kinds of projects for efficient project execution today and in the future needs to be further researched. It is also important to understand what sort of collaborative behavior is efficient during different phases of a project’s lifetime. Since outcomes of alternative collaboration modes are difficult to measure, it is feasible to look for what is often called “best practice” or “success factors”. The life-cycle perspective on collaboration presented in Figure 3 may then also serve well as a framework for studying success factors for collaboration, since they will presumably differ during different phases of the equipment development life-cycle.

Collaboration during the fuzzy front end phase

Development of new or improved process technology/equipment may be prompted by the equipment supplier’s discovery and recognition of a need for such equipment on the market or, alternatively, individual process firms may in their strategic production and development plans have identified a need for a specific process technology that is not currently available on the market. In both cases, process firms and equipment manufacturers need to engage in an array of important and interrelated activities. These include idea refinement and screening of ideas (Cooper, 1988a, Elmquist and Segrestin, 2007), early customer involvement (Gassman et al., 2006), senior management involvement (Khurana and Rosenthal, 1998), preliminary technology assessment (Kim and Wilemon, 2002, Verworn, 2006), and assessment of the NPD project vis-à-vis company strategy (Khurana and Rosenthal, 1997).

Development work in the early stages is typically exploratory with many iterative loops (Frishammar et al., 2011, Kurkkio et al., 2011). It is, however, important to articulate the needs of the process firm(s) and translate these into a product concept (Cooper, 1988a, Khurana and Rosenthal, 1997). A product definition should well represent the objective of the development process and is a statement of both technology and customer benefit issues (Montoya-Weiss and O’Driscoll, 2000).

Depending on the project’s character, this is a phase when preliminary experimental tests take place, complemented in the process industries by modeling and simulation. Since this phase strongly affects future product performance and costs in the following development phase, it is important that the collaborative partners have carefully discussed and agreed upon product specifications and preliminary operating and investment costs for such equipment (Cooper, 1988b). The creation of a functional prototype is the next sub-phase when the equipment has been engineered and designed in order to study its functionality. Such studies can preferably be carried out at the equipment supplier’s premises in order not to disturb the process firm and to stay in touch close to the design staff.

Collaboration during the product development phase

The different development environments for the development of process technology have been discussed in previous research (Pisano, 1997, Utterback, 1994), and in further research about the process innovation work process. The iterative loops start in the laboratory (at the equipment supplier’s premises or in a process firm’s laboratory), going further to pilot plant testing (at the equipment supplier’s premises or in the process firm’s laboratory) and further to demonstration plant testing. Because of the often necessary need for test material in larger processed quantities and a further need to handle the products from the testing, there is often a need for a “process infrastructure” that only a process firm can provide.

Taking a functional prototype into a production environment makes very strong demands on both the equipment supplier and the process firm (Lager et al., 2010). The potential operating disturbances to the firm’s production processes must be carefully considered by both parties long in advance, and necessary risk analysis must have been carried out before testing starts. The privilege for the equipment supplier of operating untested equipment in such production environments must be acknowledged. How long such testing must go on depends, of course, on the character of each project and on the complexity of the process technology, but it typically takes more time than anticipated to develop robust equipment that is not oversensitive to production changes and disturbances. Now is also the time to study wear problems and other operating problems which always occur but are difficult to spot in advance.

Collaboration during the manufacturing of process equipment phase

After a successful collaborative product development phase, the commitment for the process firm typically becomes much weaker, see Figure 3. However, this is a collaborative phase when there is much important feedback from the process firm to the equipment manufacturer that can improve the final design. This can be in areas like designing equipment that is easy to operate and with the maintenance costs in focus. For the equipment supplier, this is a phase when the product development “work process” goes into a progressively more commercial phase and when there are not only strong contacts with the collaborating partner(s) but when marketing of the new equipment goes into a more aggressive phase. We may here have different scenarios, all focusing on the importance of getting a first reference installation to promote further sales:

- The process firm has already purchased the equipment for further installation in a new or already operating plant.

- The process firm may now discuss a possible purchase of such equipment.

- The process firms decide not to purchase the equipment, which puts the equipment manufacturer in a more difficult position.

Because of these foreseeable scenarios, process firms sometimes have to make preliminary purchase commitments. Summing up: Not only the overall time frame for a collaborative development project but the intensity of collaboration and commitment of company resources during different phases will vary between different collaboration projects. The previously presented driving forces and problems with collaboration during the development stage of the equipment’s life cycle (see section 3.1) have already been tentatively arranged in life-cycle order, but they can now be directly connected to each individual phase of the equipment’s life cycle. This will not only facilitate their use but they can also be connected to individual success factors that need to be identified and developed and which are also related to the different phases of the life cycle.

Turning problem areas from the previously presented lists of cons into success factors – a problem viewed from the opposite perspective always constitutes a success factor (Lager and Hörte, 2002) – it will be an interesting opportunity to study these success factors as independent variables and the drivers (expected outcomes) as dependent variables in further empirical research. The time span for the collaborative development of new or improved process technology/equipment is one dimension that may influence the collaboration intensity and thus also related forms for collaboration.

3.3 How to collaborate: selecting organizational forms for collaboration

Collaboration between an equipment manufacturer and a process firm may be arranged and decided on a project level, but may also sometimes have to be subordinated to other R&D or strategic considerations. The collaboration between equipment manufacturers and process firms may thus have a hierarchic dimension which is also well worth studying in further research. Holden and Konishi (1996) note that short-term, quick-gain, opportunistic behavior by firms is unproductive and will give them the reputation of being bad collaborators and will be counterproductive in the long term. Referring to the literature review on collaboration and alternative forms of collaboration, there are today an abundant number of different collaboration forms to choose among, each of them differing in the degree of collaboration intensity as well as in legal and other practical consequences. In collaborations between equipment manufacturers and process firms, may some forms be more or less suitable under different circumstances? It therefore seems justified to elaborate upon the criteria for selection of different forms of collaboration, i.e. the key contingencies that determine how collaboration should materialize.

Determinants for different forms of collaboration

There may be a number of possible criteria to consider when selecting a proper form of collaboration during the collaborative development of process technology/equipment. In a consideration of potential contextual determinants for selecting plant startup organizations, the newness of process technology, the newness of products, the complexity of technology and the size of installation are discussed (Lager, 2012). All of them are potential contextual determinants, but the time dimension previously touched upon could also be one candidate, since some collaborative developments may take a short time but others up to five to ten years. Nevertheless, we argue that “newness” and “complexity” are two key variables which could allow a deeper understanding of when different forms of collaboration are suitable.

Newness of process technology/equipment on the market

In 1982 the consulting organization Booz, Allen & Hamilton presented an investigation of product development performance which included the process industries (1982). They concluded that it was important to distinguish between different categories of new product development in order to better understand and position the company’s product development efforts.

The newness of product development was considered in two different dimensions; “newness of the product to the market” and “newness of the product to the company”. A matrix was constructed along those two dimensions, classifying newness on a scale from low to medium to high. The importance of a better classification of product development is now gaining acceptance in industry, and the Booz, Allen and Hamilton Product Matrix has also been used in the classification of different types of success measures for product development (Griffin and Page, 1991). Since this classification is usable both in industry and in academia, it creates a good communication interface (Cooper, 1988b).

In a classification of different kinds of process innovation, the “newness of process innovation on the market” has also proven useful in previous studies (Lager, 2002). In the categorization of collaboration projects between equipment manufacturers and process firms, “newness of process technology/equipment on the market” was thus selected as one important determinant, composed of the values low, medium and high. One way to define a concept is to make an intentional definition, trying to describe what is contained in the concept. Varying degrees of newness, from low to high, can in this manner be illustrated by examples below from two sectors of the process industries; the petrochemical and mineral industries.

- Low: Well-known process technology/ equipment available “off the shelf” through many equipment suppliers (a valve);

- Medium: Incrementally improved process technology/equipment (an improved cracker for crude oil);

- High: A radically new process technology/ equipment not previously used and possible to protect with patent (a new natural gas liquefaction plant).

Complexity of equipment/process technology

In the consideration of different contents of the concept “complexity”, two alternatives were considered. First of all the “complexity in the development process” itself, which may result in more or less resources needed or different time frames for development, and secondly the “complexity of the product/system” to be developed. The latter alternative was selected because it was easier to grasp and comprehend before development starts. In a buyer-supplier relationship, the complexity of the equipment is one factor that has been recognized as a determinant for collaboration intensity; the greater the complexity, the greater the need for stronger forms of collaboration/cooperation (Eriksson, 2008, Olsen et al., 2005). The system scope dimension proposed by Shenhar & Dvir provided an important missing link (1996). Their original trichotomy has been modified to suit the Process Industry startup context better:

- Low: Only one process unit operation (a grinding operation)

- Medium: A process system including a number of unit operations (a blast furnace in pig iron production)

- High: A super-system of process systems (a large production plant, e.g. a new paper mill for paperboard production).

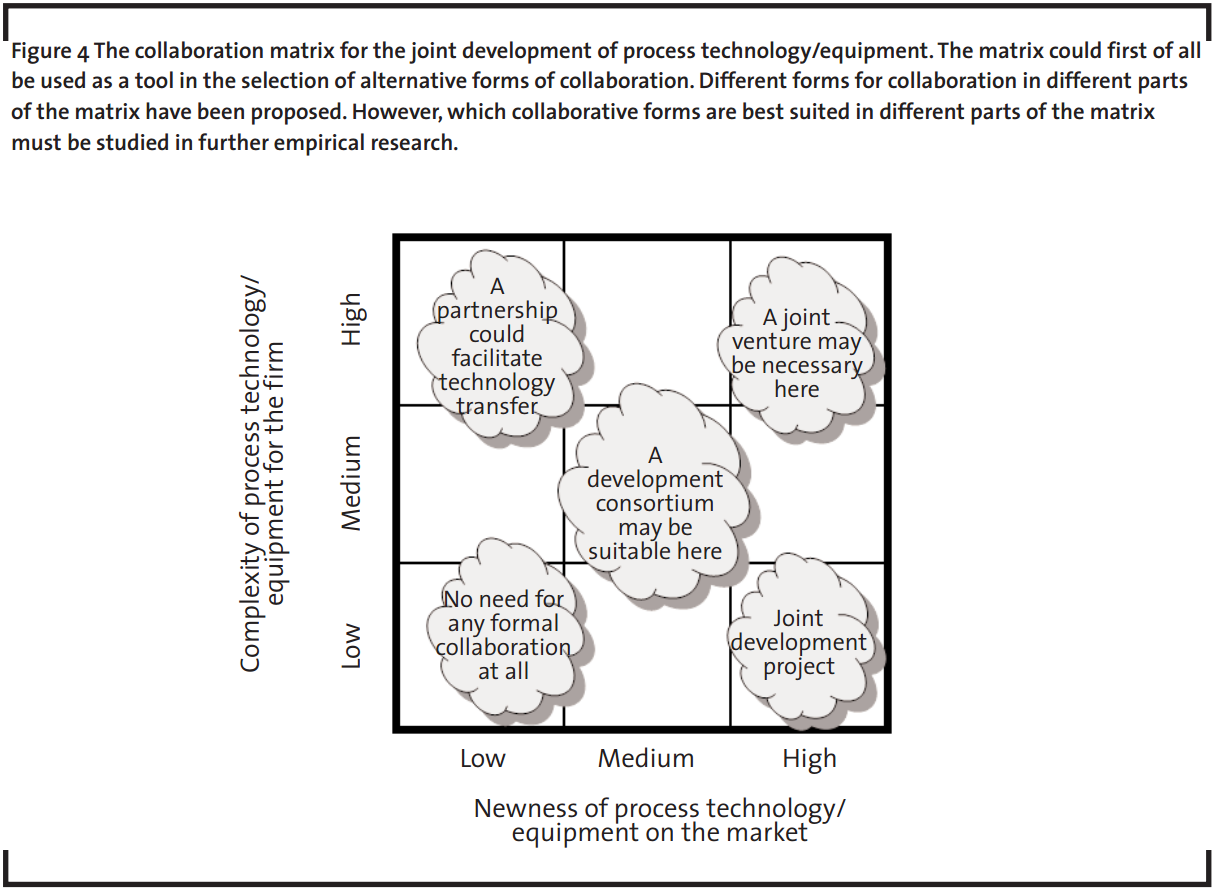

A matrix using the above presented dimensions was constructed and is presented below in Figure 4. Ought collaboration on innovation and other collaborative ventures between equipment supplier and process firms to take different forms and be conducted in different ways, all according to both the complexity of the equipment and newness of the equipment? The matrix can thus first of all be used to position collaborative development projects of different kinds to evaluate whether a collaborative approach is of interest at all.

Secondly, how strong should such collaboration be (something denominated collaboration intensity in this article)? Looking at the different areas of the matrix, one could speculate that in the lower left corner the needs for formal collaboration are small if not nonexistent.

On the other hand, going to the upper right corner, there seems to be a need for more tightly coupled arrangements, maybe even a joint venture. In the medium-complex area and medium-to-radical newness areas, a larger development consortium sharing costs and risk can be suitable. In the lower right corner, the ownership of the development results is something important to consider. Referring to the previous section, the theoretical point of departure, the suggested forms for collaboration can be looked upon as five propositions to be verified in further empirical research. The structural dimensions and scales from the matrix are retained but the number of areas has been reduced to five, a common practice in the analysis of sociological data (Barton, 1955).

Summing up: it seems first of all of interest to empirically research what kinds of collaboration are suitable in different areas of the matrix, and on which terms such collaboration should take place. Hence, different ideal types of development situations seem to call for different forms of collaboration.

In the previous section it was suggested that success factors for collaboration between equipment manufacturers and process firms may be related to a time dimension, more specifically to the life-cycle perspective of the equipment. Similarly, it is likely that not only the time dimension will influence such success factors but that the development project’s position in the matrix also would. The conclusions presented by Griffin & Page (1991) support this notion and suggest that the new matrix could be used not only to select suitable forms for collaboration but also to identify related success factors for such collaboration.

4 Implications for industry and academia

It is to be hoped that a solid theoretical framework has been constructed upon which future empirical research can be built. Nevertheless, our efforts are a first attempt to bring some structure into this important area of industrial enterprising. Starting with “grounded theory” where the pragmatic criterion of truth is its usability (Glaser and Strauss, 1967), and following later post-modernistic views that the value of knowledge is considered as a function of its usability (Lyotard, 1984), we encourage further testing of the usability of the proposed framework both by industry professionals and by academia.

4.1 In search of enhanced innovation performance with new process technology/ equipment.

The proposed framework and related discussions may first of all be used by industry and industry professionals as some sort of reminder of the importance of this subject area, which has been very sparsely treated in scientific journals or in other industrial publications. Hopefully it may shed some light and possibly initiate further fact-based discussions. The tentatively compiled lists of pros and cons can be used in internal brainstorming exercises at firms to create more company-specific drivers for collaboration in some sort of ranking order. In collaboration between equipment manufacturers and process firms, such a platform may be jointly discussed and agreed upon in order to ensure long-term and trustful collaborations.

Further on, when such collaboration should take place in different development environments is a question of the highest importance that should be discussed at the management level. The conceptual model of the development part of an equipment life cycle is one tool for the collaborating partners for deciding on necessary resource allocations during different stages of a development project’s life cycle (degree of commitment), and not only that, but in discussions of how to successfully collaborate in practice during the different phases of the full development life cycle. Choosing among the different organizational forms for collaboration is something that must be partly guided by company specific considerations. The proposed matrix can also be used in such discussions, never forgetting the future competitive implications.

4.2 A proposed research agenda

The development of this conceptual framework has resulted in a number of unanswered research questions, some of which have already been touched upon in the foregoing text. Three general areas of interest have however been identified, some of them also supplemented by more specific research questions not presented in ranking order:

A first critical issue concerns why firms should engage in collaboration in the first place. Should collaboration between equipment manufacturers and process firms take place at all? What are the expected outcomes from such collaborations? Clearly, both parties will experience and evaluate outcomes differently and also differently for individual projects.

A second critical issue concerns when to collaborate. What collaboration intensity is required during the development phases of an equipment life cycle? It is reasonable to believe that different project conditions and collaboration strategies need different collaboration intensities over the full life-cycle of process technology development.

It is also justified to ask how a mutually efficient collaboration between equipment manufacturers and process firms takes place, using the notion of success factors for collaboration. Arguably, such success factors will differ during different phases of an equipment development life cycle. Referring to the front-end stage of collaboration, future studies should address how an equipment supplier can secure an early input of the very long-term future product and process needs process firms may have for new equipment. How to get and secure input from operating plants that may give ideas and incentives for new product development is another important issue. Similarly, how to secure the input of new ideas from the equipment supplier’s vast number of employees who in their daily work have contacts with people in process firms.

For the process firms: should they be involved at all in this equipment development business and on what conditions – what are the possible incentives? As far as actual development goes, a first important issue to consideris how to arrange a win-win collaborative development. How can equipment suppliers “serve” their multiple customers in the best way without breaking someone’s confidence? It is also important to consider how to arrange collaborative development and tests that take a fair amount of resources from both parties, and how to handle the immaterial property rights and licensing in a manner acceptable to both parties. Manufacturing issues cannot be forgotten either. Specifically, how to develop flexible equipment that can serve different customers and how to develop equipment/ service concepts during the development phase that can serve both parties well.

A third critical issue concerns how to collaborate. What kind of collaboration between equipment manufacturers and process firms should be chosen under different circumstances and what are the possible determinants for such a selection? The matrix presented here is a feasible starting point and a tool for selecting different forms of collaboration.

5 Conclusions

A theoretical framework has been constructed based on the input from a review of previous publications related to this subject area, a review of collaboration concepts, and some practical previous experience from the authors and some industry representatives. This article can hopefully provide both theoretical insight and practical guidance on how process firms and equipment manufacturers could address the challenges posed by joint collaboration. Its main contribution and purpose is thus first of all to stimulate industry professionals in their search for enhanced innovation performance for the collaborative development of new process technology/ equipment in the process industries. Secondly, the framework is intended to provide a platform for further research into this area, which is of the utmost importance to effective R&D management in the process industries. The proposed framework includes a discussion of expected outcomes for such collaboration and a preliminary list of pros and cons from the perspectives of the different parties. A new conceptual model for the full life cycle of process technology/equipment development is presented, relating potential drivers for collaboration and success factors to be investigated to different phases of the development life cycle.

Furthermore, a classification matrix for collaboration has been constructed using the dimensions “complexity of equipment” and “newness of equipment” as determinants. The matrix is introduced as a part of the theoretical platform, to be used in the selection of alternative forms of collaboration and in the further development of success factors for such collaborations.

6 Acknowledgements

Financial support from the Swedish research foundation VINNOVA for the development of this framework is highly appreciated. The contributions from Höganäs AB and LKAB in the area of pros and cons for collaboration are gratefully acknowledged. Finally, the input from Dr. Per Erik Eriksson and doctoral candidate David Rönnberg-Sjödin in discussions and review of previous versions of this article are gratefully recognized.

References

Ahuja, G. (2000a): Collaboration Networks, Structural Holes, and Innovation: A longitudinal Study, Administrative Science Quarterly, 45, pp. 425-455.

Ahuja, G. (2000b): The Duality of Collaboration: Inducements and Opportunities in the Formation of Inte-firm Linkages, Strategic Management Journal, 21, pp. 317-343.

Auranen, I. (2006): METSO minerals: Needs for R&D and education; strength through co-operation, In The yearly Promote workshop; Innovation in the Process Industries. Luleå.

Aylen, J. (2010): Open versus closed innovation: development of the wide strip mill for steel in the USA during the 1920’s, R&D Management, 40(1).

Barki, H. & Pinsonneault, A. (2005): A model of Organizational Integration, Implementation Effort, and Performance, Organization Science, 16, pp. 165-179.

Barringer, B. & Harrison, J. (2000): Walking the Tightrope: Creating Value Through Interorganizational Relationship, Journal of Management, 26(3), pp. 367-403.

Barton, A.H. (1955): The concept of property-space in social research, The language of social research. Lazarsfeld, P.F. & Rosenberg (Eds.). The Free Press.

Bergfors, M. & Lager, T. (2011): Innovation of process technology: exploring determinants for organizational design, International Journal of Innovation Management, 15(5), pp. 1113-1140.

Booz Allen & Hamilton: (1982). New Product Management of the 1980s.

Brooks, M., Blunden, R. & Bidgood, C. (1993): Strategic Alliances in the Global Container Transport Industry. In Multinational Strategic Alliances. Culpan, R. (Ed.). New York: IB press.

Chesbrough, H. & Appleyard, M.M. (2007): Open Innovation and Strategy, California Management Review, 50(1), pp. 57 – 76.

Chesbrough, H. & Crowther, A.K. (2006): Beyond high tech: early adopters of open innovation in other industries, R&D Management, 36(3), pp. 229-236.

Chesbrough, H. & Schwartz, K. (2007): Innovating Business Models with Co-development Partnerships, Research Technology Management, January-February, pp. 55 -59.

Chesbrough, H., Vanhaverbeke, W. & West, J. (2006): Open innovation: Researching a new paradigm, Oxford: Oxford University Press.

Chiaroni, D., Chiesa, V. & Frattini, F. (2010): Unravelling the process from Closed to Open Innovation: evidence from mature, asset-intensive industries, R&D Management, 40(3), pp. 222-245.

Cohen, W.M. & Levinthal, D.A. (1990): Absorptive Capacity: A new Perspective on Learning and Innovation, Administrative Science Quarterly, 35, pp. 128-152.

Collins, R., Dunne, T. & Michael, O.K. (2002): The “locus of value”: a hallmark of chains that learn, Supply Chain Management: An International Journal, 7(5), pp. 318-321.

Cooper, R.G. (1988a): Predevelopment Activities determine New Product Success, Industrial Marketing Management, 17(3), pp. 237-247.

Cooper, R.G. (1988b): Winning at New Products, London: Kogan Page.

Cox, A. & Thompson, I. (1997): Fit for Purpose Contractual Relations: Determining a Theoretical Framework for Construction Projects, European Journal of Purchasing & Supply Management, 3(3), pp. 127-135.

De Luca, L. & Atuahene-Gima, K. (2007): Market Knowledge Dimensions and Cross-functional Collaboration: Examining the Different Routes to Product Innovation Perfromance, Journal of Marketing, 71, pp. 95-112.

Dickinson, P. & Weaver, K. (1997): Environmental Determinants and Individual-level Moderators of Alliance Use, Academy of Management Journal, 40, pp. 404-425.

Doz, Y. & Hamel, G. (1998): Alliance Advantage, Boston: HBS Press.

Elmquist, M. & Segrestin, B. (2007): Towards a New Logic for Front End Management: From Drug Discovery to Drug Design in Pharmaceutical R&D, Creativity and Innovation Management, 16, (2), pp. 106-120.

Eriksson, P.E. (2008): Achieving suitable coopetition in buyer-supplier relationships: The case of AstraZeneca, Journal of Business-to-Business Marketing, 15(4), pp. 425-454.

Florén, H. & Frishammar, J. (2012): From preliminary ideas to solid product definitions: A framework for managing the front end of new product development, California Management Review, summer issue.

Frishammar, J., Florén, H. & Wincent, J. (2011): Beyond Managing Uncertainty: Insights from Studying Equivocality in the Fuzzy Front-End of Product and Process Innovation Projects, IEEE Transactions on Engineering Management, 58(3), pp. 551-563.

Frishammar, J. & Hörte, S.Å. (2005): Managing External Information in Manufacturing Firms: The Impact on Innovation Performance, Journal of Product Innovation Management, 22, pp. 251-266.

Frishammar, J., Kurkkio, M., Abrahamsson, L. & Lichtenthaler, U. (2012): Antecedents and Consequences of Firm’s Process Innovation Capability: A literature Review and Conceptual Framework, IEEE Transactions on Engineering Management, Accepted for publication Forthcoming.

Gassman, O., Sandmeier, P. & Wecht, C.H. (2006): Extreme Customer Innovation in the Front-end: Learning From a New Software Paradigm, International Journal of Technology Management, 33(1), pp. 44-66.

Ghosal, S. & Bartlett, C.A. (1990): The Multinational Corporation as an Interorganizational Network, Academy of Management Review, 15, pp. 603-625.

Glaser, B.G. & Strauss, A.L. (1967): The dicovery of grounded theory: strategies for qualitative research, New York: Aldine de Gruyter.

Grandori, A. (1997): An Organizational Assessment of Interfirm Coordination Modes, Organization Studies, 18, pp. 897-927.

Grant, R.M. (1991): The Resource-based Theory of Competitive Advantage: Implications for Strategy Formulation, California Management Review, 33, pp. 114-135.

Griffin, A. & Page, A.L. (1991): PDMA Success measurement project: Recommended measures for product development success and failure, Journal of Product Innovation Management, 13(6), pp. 478-496.

Gulati, R. (1995): Does Familiarity Breed Trust? The Implications of Reported Ties on Contractual Choises in Alliances, Academy of Management Journal, 38, pp. 85-111.

Hagedoorn, J. (1993): Understanding the Rationale of Strategic Partnering: Interorganizational Modes of Cooperation and Sectoral Differences, Strategic Management Journal, 14, pp. 371-385.

Hamel, G. (1991): Competition for Competence and InterPartner Learning within International Strategic Alliances, Strategic Management Journal, 12, pp. 83-103.

Hamel, G., Doz, Y. & Prahalad, C. (1989): Collaborate with your competitors and win, Harvard Business Review, 89(1), pp. 133-139.

Handfield, R.B., Krause, D.R., Scannell, T.V. & Monczka, R.M. (2000): Avoid the Pitfalls in Supplier Development, Sloan Management Review, Winter.

Hillebrand, B. & Biemans, W.G. (2004): Links between internal and external cooperation in product development: An exploratory study, Journal of Product Innovation Management, 21, pp. 110-122.

Holden, P.D. & Konishi, F. (1996): Technology Transfer Practice in Japanese Corporations: Meeting New Service Requirements, Technology Transfer, SpringSummer, pp. 43-53.

Hurmelinna, P., Peltola, S., Tuimala, J. & Virolainen, V.-M. (2002): Attaining world-class R&D by benchmarking buyer-supplier relationships, Int. J. Production Economics, 80, pp. 39-47.

Hutcheson, P., Pearson, A.W. & Ball, D.F. (1995): Innovation in Process Plant: A Case Study of Ethylene, Journal of Product Innovation Management, 12, pp. 415-430.

Inkpen, A. & Crossan, M. (1995): Believing is seeing: Joint ventures and organizational learning, Journal of Management Studies, 32, pp. 595-618.

Jones, C., Hesterly, W. & Borgatti, S. (1997): A general theory of network governance: Exchange conditions and social mechanisms, Academy of Management Journal, 22, pp. 911-945.

Jorde, T. & Teece, D. (1990): Innovation and cooperation: Implication for competetition and antitrust, Journal of Economic Perspective, 4, pp. 75-96.

Kahn, K.B. (1996): Interdepartemental integration: A defenition with implications for product development performance, Journal of Product Innovation Management, 13, pp. 137-151.

Kanter, R.M. (1989): When Giants Learn to Dance, New York: Simon & Schuster.

Khurana, A. & Rosenthal, S.R. (1997): Integrating the Fuzzy Front End of New Product Development, Sloan Managemet Review, 38(2), pp. 103-120.

Khurana, A. & Rosenthal, S.R. (1998): Towards Holistic “Front Ends” in New Product Development, Journal of Product Innovation Management, 15(1), pp. 57-74.

Kim, J. & Wilemon, D. (2002): Focusing the Fuzzy Frontend in New Product Development, R&D Management, 32(4), pp. 269-279.

Klioutch, I. & Leker, J. (2011): Supplier involvement in customer new product development: new insights from the supplier’s perspective, International Journal of Innovation Management, 15(1), pp. 231-248.

Kogut, B. (1988): Joint Ventures: Theoretical and Empirical Perspectives, Strategic Management Journal, 9, pp. 310-332.

Kogut, B. & Zander, U. (1996): What Do firms Do? Coordination, Identity and Learning, Organization Science, 7, pp. 502-518.

Kurkkio, M., Frishammar, J. & Lichtenthaler, U. (2011): Where Process Development Begins: A Multiple Case Study of Fuzzy Front End Activities in Process Firms, Technovation, 31(9), pp. 490-504.

Kytola, O., Hurmelinna-Laukkanen & Pynnonen, M. (2006): Collision or co-operation course-pulp and paper industry vs. information & communication technology, In The R&D Management conference, Challenges and opportunities in R&D Management – future directions for research. Butler, J. (Ed.). Newby Bridge, Cumbria, England.

Lager, T. (2002): A structural analysis of process development in process industry – A new classification system for strategic project selection and portfolio balancing, R&D Management, 32(1), pp. 87-95.

Lager, T. (2010 ): Managing Process Innovation – From idea generation to implementation, London: Imperial College Press.

Lager, T. (2012): Startup of new plants and process technology in the process industries: organizing for an extreme event, Journal of Business Chemistry, 9(1), pp. 3-18.

Lager, T. & Blanco, S. (2010): The Commodity Battle: a product-market perspective on innovation resource allocation in the Process Industries, International Journal of Technology Intelligence and Planning, 6(2), pp. 128-150.

Lager, T. & Frishammar, J. (2010): Equipment Supplier/User Collaboration in the Process Industries: In search of Enhanced Operating Performance, Journal of Manufacturing Technology Management, 21(6).

Lager, T., Hallberg, D. & Eriksson, P. (2010): Developing a Process Innovation Work Process: The LKAB experience. International Journal of Innovation Management, 14(2), pp. 285-306.

Lager, T. & Hörte, S.-Å. (2002): Success factors for improvement and innovation of process technology in Process Industry, Integrated Manufacturing Systems, 13(3), pp. 158-164.

Lager, T. & Storm, P. (2012): Application development in supplier-customer collaborations: success factors for firms in the process industries, International Journal of Technology Marketing, 7(2).

Lane, P., Salk, J.E. & Lyles, M.A. (2001): Absorptive Capacity, Learning and Performance in International joint ventures, Strategic Management Journal, 22, pp. 1139-1161.

Liberman, M. & Montgomery, D. (1988): First-Mover Advantages, Strategic Management Journal, 9, pp. 41-58.

Lichtenthaler, U. (2006): External technology commercialisation as an alternative mode of technology marketing, International Journal of Technology Marketing, 1(4), pp. 411-430.

Lindblom, C.E. (1987): Alternatives to Validity, Knowledge: Creation, Diffusion, Utilization, 8(3), pp. 509-520.

Lyotard, J.F. (1984): The postmodern condition: A report on knowledge. In Theory and history of literature. Manchester: Manchester University Press.

Markus, H. (1977): Self-Schemata and processing information about the self, Journal of Personality and Social Psychology, 35(2), pp. 63-78.

Menon, T. & Pfeffer, J. (2003): Valuing Internal versus External Knowledge: Explaining the Preference for Outsiders, Management Science, 49, pp. 497-513.

Montoya-Weiss, M.M. & O’Driscoll, T.M. (2000): From Experience: Applying Performance Support Technology in the Fuzzy Front End, The Journal of Product Innovation Management, 17(2), pp. 143-161.

Olsen, B.E., Haugland, S.A., Karlsen, E. & Husöy, G.J. (2005): Governance of complex procurements in the oil and gas industry, Journal of Purchasing & Supply Management, 11, pp. 1-13.

Pisano, G.P. (1997): The development factory: Unlocking the potential of process innovation, Boston, Mass.: Harvard Business School, p. xii, 343.

Reichstein, T. & Salter, A. (2006): Investigating the sources of process innovation among UK manufactuting firms, Industrial and Corporate Change, 15(4), pp. 653-682.

Rönnberg Sjödin, D., Eriksson, P.E. & Frishammar, J. (2011): Open Innovation in Process Industries: A life-cycle Perspective on Development of Process Equipment, International Journal of Technology Management, 56(2/3/4), pp. 225-240.

Shenhar, A.J. & Dvir, D. (1996): Toward a typological theory of project management, Research Policy, 25, pp. 607-632.

Sieg, J.H., Wallin, M.W. & von Krogh, G. (2010): Managerial challenges in open innovation: a study of innovation intermediation in the chemical industry, R&D Management, 40(3), pp. 281-291.

Singh, K. & Mitchell, W. (1996): Precarious Collaboration: Business Survival after Partners Shut Down or Form New Partnerships, Strategic Management Journal, 17, pp. 99-115.

Skinner, W. (1978): Manufacturing in the corporate strategy, New York: John Wiley.

Skinner, W. (1992): The Shareholder’s Delight: companies that achieve competitive advantage from process innovation, International Journal of Technology Management, Special issue on Strengthening Corporate and National Competitiveness through Technology, pp. 41-48.

Sveiby, K.E. (2001): A knowledge-based theory of the firm to guide strategy formulation, Journal of Intellectual Capital, 2, pp. 344-358.

Utterback, J.M. (1994): Mastering the dynamics of innovation: How companies can seize opportunities in the face of technological change, Boston, Mass.: Harvard Business School Press, p. xxix, 253.

Utterback, J.M. & Abernathy, W.J. (1975). A Dynamic Model of Process and Prduct Innovation, Omega, 3(6), pp. 639-655.

Walter, A., Ritter, T. & Gemunden, H.G. (2001): Value Creation in Buyer-Seller Relationships, Industrial Marketing Management, 30, pp. 365-377.

van Echtelt, F.E.A., Wynstra, F., van Weelen, A.J. & Duysters (2008): Managing Supplier Involvement in New Product Development: A Multiple-Case Study, Journal of Product Innovation Management, 25.

Weick, K.E. (1989): Theory Construction as Disciplined Imagination, Academy of Management Review, 14(4), pp. 516-531.

Verworn, B. (2006): How German Measurement and Control Firms Integrate Market and Technological Knowledge into the Front End of New Product Development, International Journal of Technology Management, 34(3-4), pp. 379-389.

Williamson, P.J. (2011): Cost Innovation: Preparing for a “Value-for-Money” Revolution, Long Range Planning, 43, pp. 343-353.

von Hippel, E. (1986): Lead Users: A source of Novel Product Concepts, Management Science, 32(7), pp. 791-805.

Yin, R.K. (1994): Case Study Research; Design and Methods, Thousand Oaks: Sage Publications.