Chemicals Regulation and the Porter Hypothesis A Critical Review of the New European Chemicals Regulation

Abstract

In this contribution, discussions about the Porter Hypothesis and the pros and cons of the new European chemicals regulation system REACH are tied together. The contribution seeks to apply the Porter Hypothesis to the field of European chemicals regulation. Porter’s claim of positive effects of regulation on innovations seems especially important for the chemicals sector pursuing differentiation. But, understanding Porter’s concept of strategic management indicates that certain segments of the chemicals industry will suffer negative effects on competition and innovation.

Introduction

Environmental policy is increasingly coming to the fore among the multitude of factors affecting the corporate competitive environment. The literature theoretically and empirically reveals a divided relationship between environmental policy, competitiveness and innovation [1, 2]. In the traditional view , strong competition and high innovation go hand in hand, as long as product markets are not impeded by state environmental regulations. By contrast, Ashford and Heaten [3], and Ashford, Ayers and Stone [4] empirically demonstrate that a positive link existed between environmental legislation and environmental innovations back in the 1970s. The idea of competition being improved by environmental legislation has since usually come to be associated with studies by the MIT-economist Michael E. Porter. The essence of the ‘Porter Hypothesis’ is that strict environmental regulations can induce efficiency and encourage innovations that help improve competitiveness.

The draft of the European Commission on the future chemicals regulation has triggered a controversial debate about its economic consequences. Although the need for reform is accepted by the European Commission, national authorities and the chemicals industry has been extremely critical of the anticipated economic impacts. Criticism is largely directed against the claimed resulting decline in competitiveness and innovation [5, 6, 7]. Moreover, the proposed regulations extend far beyond the sector of the chemicals industry and affect many related industrial sectors. This opinion is disputed by Experts of the German Advisory Council on the Environment [8], which believes that by bringing about safe, environmentally sustainable products, the new legislation holds and encourages competitive advantages and opportunities for innovation.

In this contribution, the discussion about the Porter Hypothesis and the pros and cons of the new European chemicals regulation are tied together. The contribution seeks to apply the Porter Hypothesis to the field of European chemicals regulation. In addition, it addresses the question of whether the Porter Hypothesis holds in this field. Section I explains the strategy for corporate management referred by Michael E. Porter and the Porter Hypothesis. Section II analyzes the characteristic features of the chemicals sector and the new European chemicals regulation. The following section III evaluates the strength of the hypothesis by examining various regulative aspects of the new chemicals legislation. Section IV gives a summary and some final observations.

I. The strategic management concept according to Michael E. Porter and the Porter Hypothesis

Porter’s strategic management concept and innovation strategies

The ‘Diamant Framework’ in the strategic management concept. The basic idea that the positive effects of environmental policy encourage competitiveness and innovation is attributed to a model of strategic corporate management. In his so-called »Diamond Framework« Porter summarises the relevant competition factors [9]. The model is developed on the basis of (i) company strategy, competition structure and rivalry, (ii) factor conditions, (iii) demand conditions and (iv) related and supporting industries as four determining and (v) chance and (vi) government as two additional factors. In his analysis, Porter focuses on productivity, regarding it as the most important source of economic success [10].

In the »Diamond Framework«, the most important factors influencing innovations are the conditions determining the character and degree of competition and the structure of the industry concerned. The structure and the type of competition result in certain business strategies, which are also responsible for the types of innovations (product vs. processes innovations) pursued. Innovations are in turn the key to achieving and maintaining competitive advantages – in other words, they are the basis of economic success. Accordingly, dynamic competition and innovations are correlated.

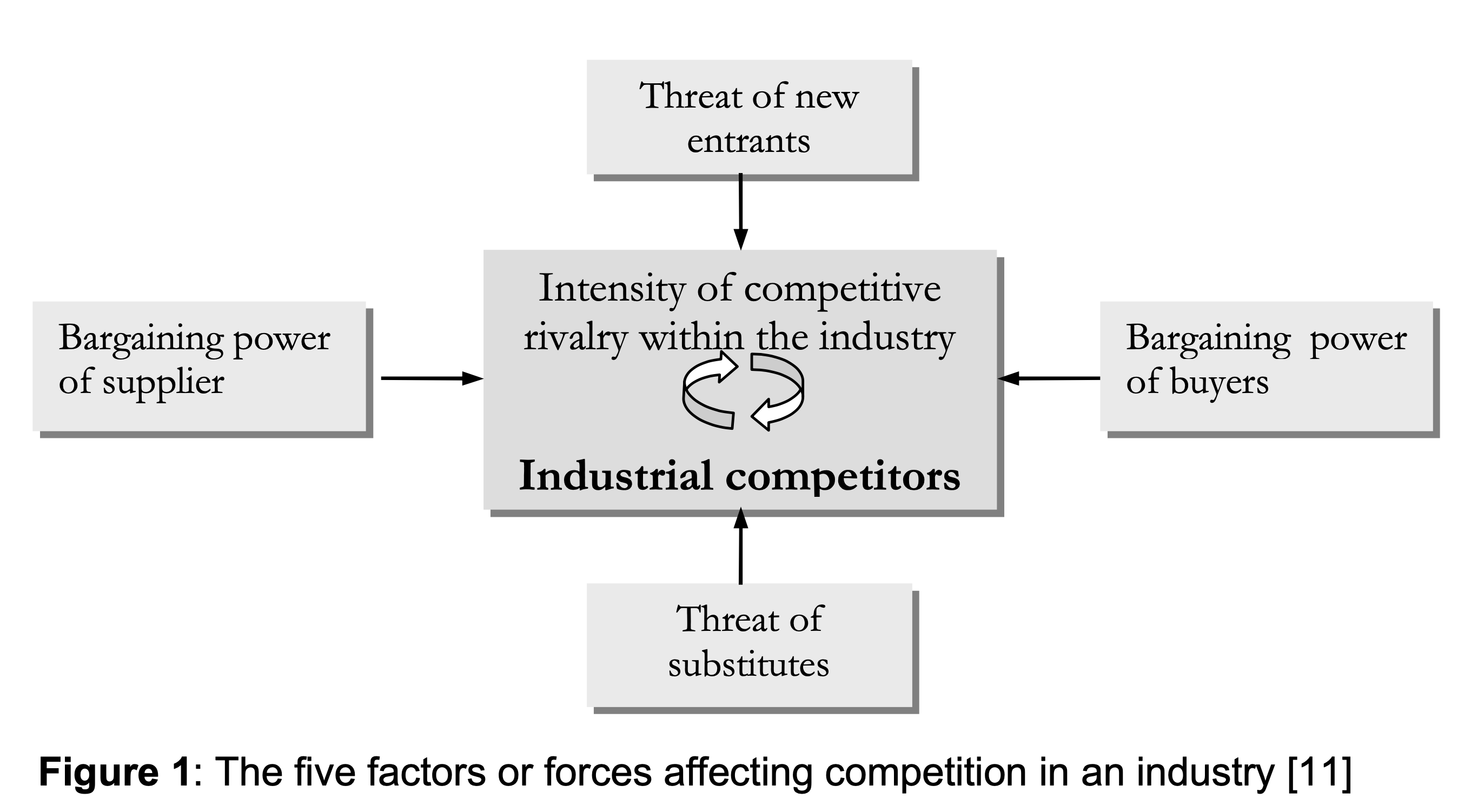

From the »Diamond Framework«, Porter develops ‘five forces of competition’ whose interaction determines the intensity of competition and the profitability of an industry (cf. Fig. 1).

The role of environmental regulations within the stimulation of innovation solely consists in influencing the forces of competition: “Regulation creates a new competitive environment.” [3]. Hence, although regulation can increase the chances of gaining a competitive advantage by means of innovation, it cannot create this advantage.

Competition advantages and innovation strategies

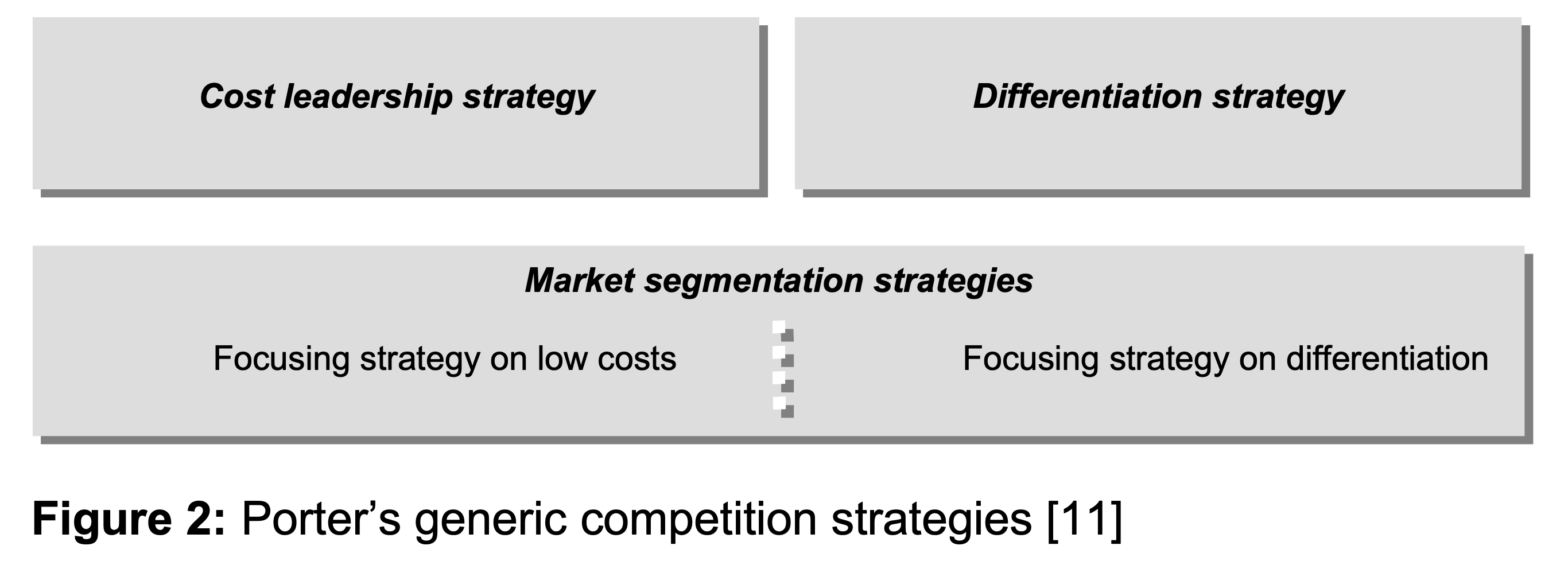

The strategic concepts of cost leadership and differentiation. Porter derives two fundamental types of strategic advantages from the »Diamond Framework«: low costs and differentiation (see Fig. 2). Gearing corporate strategy to cost leadership or differentiation affects not only technology and market strategies, but also the composition of the product portfolio.

The aim of cost leadership is to gain a ‘cost advantage’ over the competition, especially in markets characterised by mass products and price competition. The basis of a competitive cost structure comprises low costs for raw materials and energy, efficient production technologies and locational advantages. Other important requirements for cost leadership are size-related economies of scale based on large market shares, learning effects and a maximum level of production capacity utilisation [12].

Cost advantages mostly arise in the areas of material resource inputs and the technological production process. Since competitive advantages from cost leadership are tied up in cost minimizing strategies, the focus on innovations is primarily on enhanced production technologies and process innovations.

Pursuing the differentiation strategy means attributing key importance to opening up and shaping new areas of market segments, as well as expanding and integrating the spectrum of products and their characteristics. Successful differentiation relies on product innovations which require an at least temporary monopoly position. The monopoly profit is not derived from economies of scale, but rather from having a ‘knowledge advantage’ over the competition, as well as from proximity to customers. Differentiation in quality competition means being able to create and offer new specific characteristics for products which allow a price policy that overcompensates for the additional costs of differentiation, and whose highly specific nature and comparatively high capital requirements act as an entry barrier to competitors [12]. An important factor of successful differentiation is the ability to react flexibly and rapidly to market demands. These characteristics are usually possessed by small and mid-sized enterprises (SMEs) that can in turn gain differentiation advantages.

According to Porter’s strategy concept, the simultaneous combination of cost leadership and differentiation in a single market segment is not recommended, for being “stuck in the middle” entails a high entrepreneurial risk coupled with a low return on investment [11]. However, in a process of successive progression, the advantages of both strategies can be utilized [12]: starting from a differentiation strategy, sufficient market growth enables economies of scale to be achieved, which in connection with high market shares and learning curves result in cost advantages. On the other hand, as far as mass products are concerned, product life cycles are typically advanced and cost advantages are yet to be achieved. Transition to differentiation entails the adaptation or creation of new competence and expertise, which is a harder process altogether.

The Porter Hypothesis

Innovation effects and first-mover advantages of environmental regulation: the Porter Hypothesis. Based on a growing density of environmental regulations in the industrialised countries, the impact of environmental policies on competition and innovation is the subject of controversial discussion. The Porter Hypothesis expressly emphasises the possibility of a link between environmental objectives and competitive advantages by means of innovation. The performance properties of the competitive forces are altered by legislation; innovations provide a way of compensating for these changes. Porter expounds that environmental regulations can improve the chances of gaining competitive advantages while simultaneously environmental objectives can be effectively pursued (‘win-win strategy’).AccordingtoPorter,regulationcanlead to positive effects for competition; these “can not only lower the net costs of meeting environmental regulations, but can even lead to absolute advantages over firms in foreign countries not subject to similar regulations.” [13] The opportunities for competitive advantages derive from the following implications [14]: (i) regulation may have a signalling effect revealing inefficiencies of the resource management and technological improvements; (ii) information has the character of a public good, i.e. the provision or demand for information by legislation can raise corporate awareness; (iii) regulation may reduce the uncertainty of investing in certain innovations and hence lessen the risks of new technology; and finally (iv), regulation may lead to internal barriers within companies being overcome.

Porter identifies two different effects in which the objectives of environmental improvements and enhanced competitiveness can be combined in a win-win situation [13]: firstly, meeting a more stringent environmental regulation leads directly to competitive advantages for companies through the need for innovations (‘innovation effect’); secondly, companies achieve a technological advantage over the international competition leading to ‘first mover advantages’.

- Innovation effect: A strict environmental regulation triggers the discovery and introduction of cleaner technologies and environmental improvements, making production processes and products more efficient in terms of resource productivity. As well as affecting the economy as a whole, these competitive advantages also result in benefits for individual companies. Porter estimates that in many cases, the cost savings that can be achieved are sufficient to overcompensate for both the compliance costs directly attributed to new regulations and the innovation costs. Thecompensation or even overcompensation for innovation costs solely by the innovation effect (known as ‘innovation offsets’) is referred to as the ‘free lunch hypotheses’.

- First-mover advantage: Competitive advantages are linked to the rising environmental awareness observed throughout the world – but they can only emerge to the extent that national environmental standards anticipate and are consistent with international trends in environmental protection. Competitive advantages will arise for corporations under the regulation in this region as soon as international policy diffusion occurs. This ‘first mover advantage’ comprises using innovative technologies for the first time which, owing to learning curve effects or patenting, attain a dominating competitive position. At the macroeconomic level, a first mover position can also prove efficient if the competitive disadvantages of the polluting industry are compensated (or overcompensated) by first mover advantages of the environmental protection industry.

The innovation effect and the first mover advantages are two mechanisms in which regulation can alter the forces of competition, and bring about beneficial effects for competition. Regarding the perception of competitive advantages, Porter believes in the efficiency and effectiveness with which companies use essential resources: “At the level of resource productivity, environmental improvement and competitiveness come together.” [13] This brings Porter back to his basic hypothesis that holds superior productivity as the most important source of competitiveness. The focus for the advantage of induced competition is in Porter’s view located at the level of individual industries, and must comprise a self-supporting continuous process of improvement with its own momentum based on the enhanced efficiency of resource usage. As far as individual companies are concerned, the competitive advantage is directly generated internally, i.e. within the manufacturing process. However, advantages arising from the efficient use of resources do not only take the form of reduced emissions and by-products or the optimised use of resources in the manufacturing process. Innovations may also result in improved product qualities or characteristics. Furthermore, the safety and resale or scrab value of products may be raised while unit and disposal costs are decreased [15].

Success factors for innovation and their implication for strategy types

The underlying success factors for innovation.

Innovation effect overcompensates the costs of regulation and innovation. The factor which is decisive for the success of compensating by innovations is the way in which a set of parameters relevant to innovations is affected by environmental regulation. These parameters critical to success occur in advance of the innovation itself and have an impact on the potential implementation and success of innovations.

Regulation causes costs (charges, taxes and other financial contributions) – and hence, as far as companies are concerned, involves an additional strain on their limited financial resources. This frequently necessitates redistributing the internal financial budget, which in turn jeopardises the success of innovations in two ways. First of all, regulative demands may tie up innovation capital ‘unproductively’, hence limiting the scope for new products or processes; moreover, budgets for research and development may also be redistributed [2]. Furthermore, the process of adaptation and meeting regulative demands is time-consuming and creates ‘time costs’ [4, 16]. When new products are launched, the delays involved may be crucial for the success or failure of an innovation project. Particularly in the environmental protection sector, being an innovation leader or follower is highly important. Given the shortened amortisation periods of products arising from reduced market life cycles next to longer development periods, technological leadership appears to be an advantageous strategy. High levels of synergy with the existing product programme and the manufacturing process are beneficial for technological leadership, while high product complexity and rapid market development pose high entry barriers for competitors. However, the advantages of technological leadership are accompanied by risks such as dependence on a certain technology path, high market entry costs and the possible competition from the company’s own products (‘cannibalisation effect’). Delayed market entry owing to environmental regulations reduces the likelihood of the innovation leader succeeding. At the same time, the pressure on the amortisation period is increased by the regulation costs. Uncertainties are another parameter critical for innovations which can be influenced by regulation [4, 13, 17]. Abernathy/Utterback [18] distinguish between two types of uncertainties characteristic of a process of innovation: (i) uncertainty concerning opportunities of technological development and (ii) uncertainty regarding opportunities of application and the chances of competitive success. How regulation influences types of uncertainty varies. Development and innovation decisions in new technologies are protected [14, 16]. Anticipating a social trend (such as a high degree of environmental awareness) may, however, increase market uncertainty if markets for these products and services are not yet existing. The increased uncertainty about the success of innovations arising from regulation is reflected in a higher risk premium when assessing investment decisions, reducing the number of promising innovation projects [2].

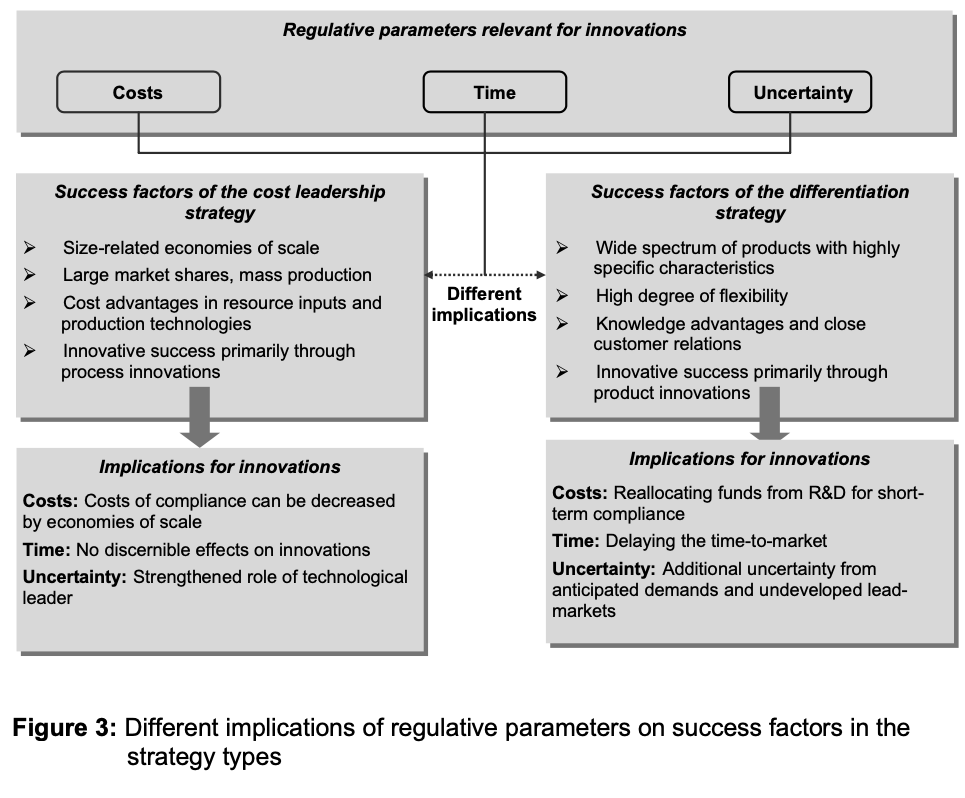

Hence costs, time and uncertainty are critical success factors for innovation caused by regulation. It must be stressed again that the implications for the competitiveness and innovative ability of individual industries can only be determined in the context of the strategy types, cost leadership and differentiation.

Implications of critical success factors for strategy types

The effects of costs, time and uncertainties for cost leadership and differentiation. The effects of an environmental regulation on competition and innovation vary depending on the strategic management concept adopted (cf. Fig. 3). In the case of cost leadership, company size and the economies of scale in the mass market have a favourable impact on decreasing the costs for compliance. Since the pressure to redistribute R&D funds is not mandatory, the cost burden will not negatively affect production innovations. However, incentives are highly likely to emerge for the reorganisation of the production process. In the long term, integrated production technologies [19] are advantageous over end-of-pipe solutions. With their inherent environmental protection, improved resource productivity and more efficient resource use are incorporated and they do not tie up capital unproductively. With cost leadership, the time factor does not directly lead to discernible effects on innovation, although to a certain extent the uncertainty across the width of future technological developments will be reduced. As far as process technologies are concerned, the role of the technological leader is strengthened, hence rewarding innovative pioneering achievements.

In the differentiation strategy, the critical factors for innovation success are weighted differently, resulting in different stimulations for innovation. Costs directly attributable to regulation unfold due to the smaller company size, the smaller assigned market segments and the lower capital stock in a much bigger impact on innovation than in cost leadership. In order to achieve rapid compliance under the terms of a thin capitalisation, the costs caused by regulation need to be covered by reallocating funds from the R&D budget. Short- term compliance activities make it difficult to perceive competitive advantages and innovation potential. Moreover, the time needed to develop and implement compliance strategies jeopardises innovation. Differentiation advantages are based on the efforts of being able to respond quickly and flexibly to customers demands. Given the prospect of regulation delaying the market launch of innovations, companies risk losing their competitive advantage permanently and the incentive structures for innovations may be neutralised. This negative effect manifests itself in decreased innovation rates. However, whether the quality of innovations will change can only be assessed by taking into account other internal and sector-specific factors. Regarding the success of product technologies, additional uncertainty builds as soon as environmental regulation anticipates changing consumer needs, calling into question whether a market for the products or the products itself still exists. The challenge consists in developing lead markets [20, 21] in which companies with the differentiation strategy can find opportunities for innovations and early-mover advantages.

The Diamond Framework developed by Porter highlights how focusing on strategic management concepts affects the competition and innovation strategy.

The fact that environmental regulation has a major influence on competitiveness and innovation (the Porter Hypothesis) became apparent from the regulation-related innovation parameters critical to success costs, time and uncertainty.

By considering both strategy types broken down into cost, time and uncertainty factors, different innovation effects were ascertained. The following section transfers the findings obtained to new chemicals regulation’s effects on competition and innovation.

II. Characterisation of the chemicals sector and the new European chemicals legislation

Characterisation of the chemicals sector

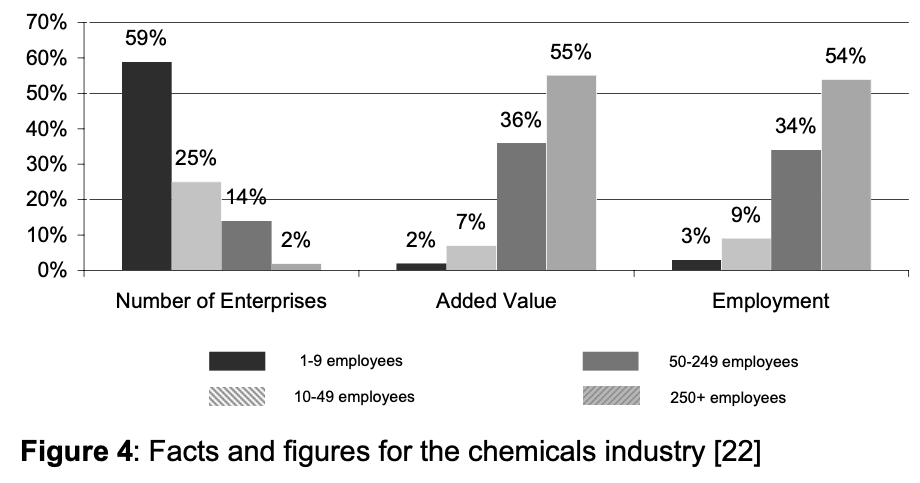

The some 25,000 companies in the chemicals industry in the EU have an annual turnover of €534 billion [22]. The chemicals industry comprises 2.4 % of the EU gross domestic product, employs a total staff of about 1.7 million, or 7% of the overall workforce in the manufacturing industry, and accounts for approximately 12% of the EU manufacturing industry’s gross value. These clearly added a major economic factor (cf. Fig. 4). However, the function of SMEs in the chemicals industry deviates from that prevailing in other types of manufacturing industry.

Whereas in many other sectors, small and medium-sized enterprises mainly act as suppliers, in the chemicals industry the production of basic substances is mostly the realm of large companies.

In contrast, SMEs tend to produce final chemical products (formulations and preparations) and are – like large blue chip companies – represented on world markets [23]. Small and medium-sized enterprises offer a large number of products to counter the high structural concentration linked to high turnover and a huge workforce. The chemicals industry is a cross- sectional industry by nature and is characterised by large structural diversity. The manufacture of a broad range of products – both basic substances for the chemicals industry itself and other industrial sectors as well as special preparations for final consumption – is characteristic of this diversity. Owing to the high degree of vertical integration, more than a third of demand for chemical products comes from the chemicals industry itself. One special feature of the chemicals industry is by-production of substances. Close product links in the manufacturing process of usable main products and by-products lead to closely interdependent relationships and sensitivity to changes within a production chain.

Above all, the chemicals industry differs from other sectors regarding the heterogeneity of its products. This diversity can be attributed to the special circumstances of the production process. A classification into certain product groups has proved useful.

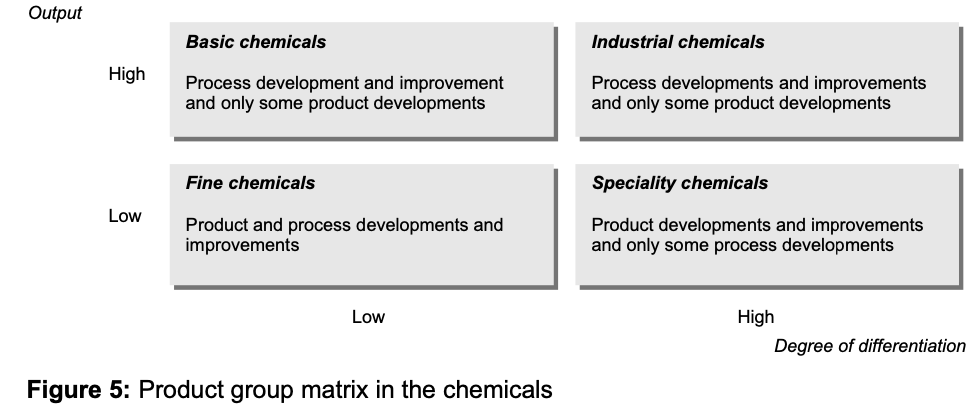

Kline [24] distinguishes between basic chemicals, industrial products, fine chemicals and specialty chemicals (cf. Fig. 5).

The classification of chemicals within a product group matrix depends on production quantities and the degree of differentiation. The advantage of this arrangement is the possibility to derive innovation strategies.

Different technological development tendencies result from the product group matrix. New products introduced are mainly in the group of fine chemicals and specialty products – which are usually sold at high prices and produced in low quantities. These product segments feature high profit margins and low competitive pressure, and are closely costumer-oriented. Fine chemicals are distinguished from the special performance characteristics of specialty products by virtue of their high quality and purity [25]. The prevailing technological priorities in these areas are product development and improvement. As far as the mass-production of basic chemicals and industrial products are concerned, the situation is reversed. Basic chemicals form the basis for production in the chemicals industry. Industrial chemicals provide fundamental manufacturing technologies for economic sectors outside the chemicals industry. These two product groups are typically in the phase of technological maturity. Innovations are largely restricted to process innovations; production developments and innovative applications are less frequent (but cannot be ruled out altogether) [3].

The product group matrix also provides information about the concentration of firms in specific market segments. The high capital intensity in the manufacture and formulation process of basic chemicals necessitates a certain company size. At the other end of the scale, the production of fine and specialty chemicals is characterised by a high grade of flexibility and knowledge intensity, and this upper are market segments mostly engaged by SMEs. Product innovations by SMEs are usually preparations and formulations – in other words, innovative applications of existing substances [26].

Referring back to the strategy types mentioned by Porter, the chemicals industry can be summed up as follows: basic industry provides large quantities of chemical products and hence requires a certain company size. Due to technological maturity, competitive advantages are mainly achieved in the form of lower costs (cost leadership) and process innovations. SME’s dominate the downstream industry of specialty and fine chemicals with a huge variety of different products; flexibility and rapid market entry are important parameters of success. Apart from the restructuring processes to be observed among traditional chemical manufacturers all over the world [27], the increased importance of product innovations indicates the limited scope for innovation in basic chemicals. This is a market segment which is being increasingly characterised by the entry of competitors from third countries with their own resources and who can take on the downstream processing steps at the end of the supply chain [28]

The structure of the new European chemicals regulation: the REACH system

The new European chemicals regulation is designed to ensure the safe production, usage and application of chemicals. Under the principle known as ‘Duty of Care,’ which protects human health and the environment, manufacturers, importers, formulators and users are obliged to reduce the risks of handling chemical substances and preparations. This new risk management is expressed by the fact that the burden of proof is now on industry (primarily manufacturers and importers) to provide information about the properties of chemicals, their intended uses and their exposition respectively. However, formulators and users are also involved in this product responsibility whenever ‘unintended uses’ occur. The present division of chemicals into new and existing substances is to be abolished and a joint chemicals control system set up. At the core of the new European chemicals regulation is the REACH system (Registration, Evaluation, Authorisation of Chemicals):

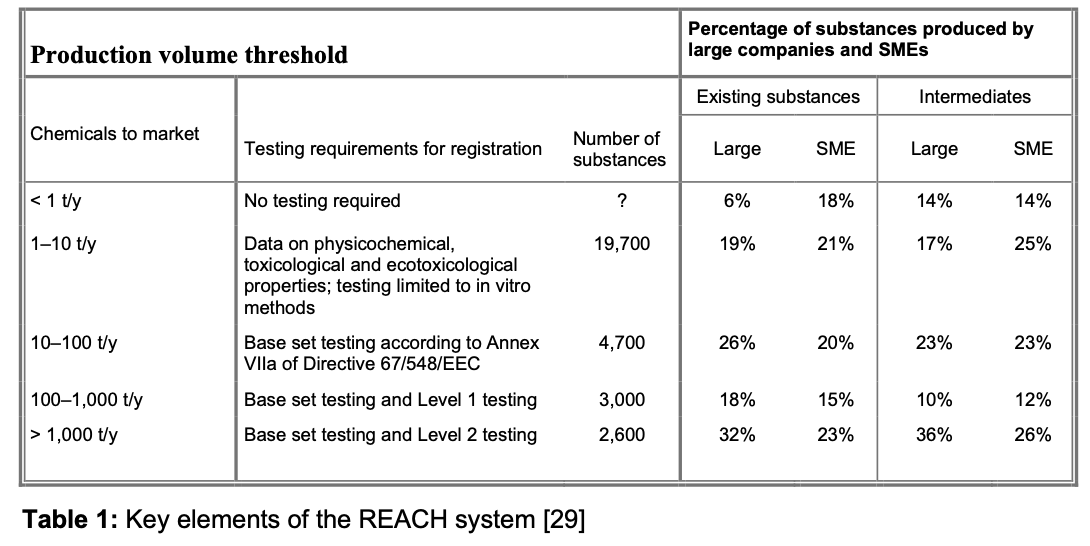

Registration of the approximately 30,000 chemical substances produced in quantities of at least 1 ton annually. The registration procedure is designed according to a threshold approach (cf. Tab. 1). Registration and provision of information about the properties and uses of chemical substances are now the responsibility of manufacturers throughout the supply chain, be they substance producers or formulators of preparations. SMEs in the chemicals industry tend to operate in the low- tonnage range, underlining the importance of this class of enterprises as specialised manufacturers whose competitive potential lies in using a large number of substances used in small amounts. The information gathered upon registration provides a basis for efficient risk management. The burden of proof and the costs of registration are borne by the chemicals industry.

- Risk evaluation of chemicals exceeding production volumes of at least 100 tons per annum (about 5,000 substances) and those of lower volumes where there exists a concern. The relevant authorities are responsible for evaluation, which includes the development of substance-tailored testing programmes.

Authorisation of chemical substances with properties that give a very high cause for concern. Substances that are carcinogenic, mutagenic or toxic to reproduction as well as very persistent and very bio-accumulative pollutants require authorisation before they may be used for a certain purpose, irrespective of the tonnage threshold. The European Commission expects this category to cover about 1,400 substances. The burden of proof and the registration costs are to be borne by the chemicals industry.

Cost and time implications of the REACH system

The economic effects for competitiveness and innovations of the new chemicals regulation arise from the structure of the REACH system. Being a cross-section industry, the chemicals industry has the function of an innovation supplier [30]. An extensive preliminary input involving intensive research by the chemicals industry is the basis of not just the chemicals industry’s own competitive potential, but also the technology management of different downstream industries in the manufacturing and process-related use of chemical substances.

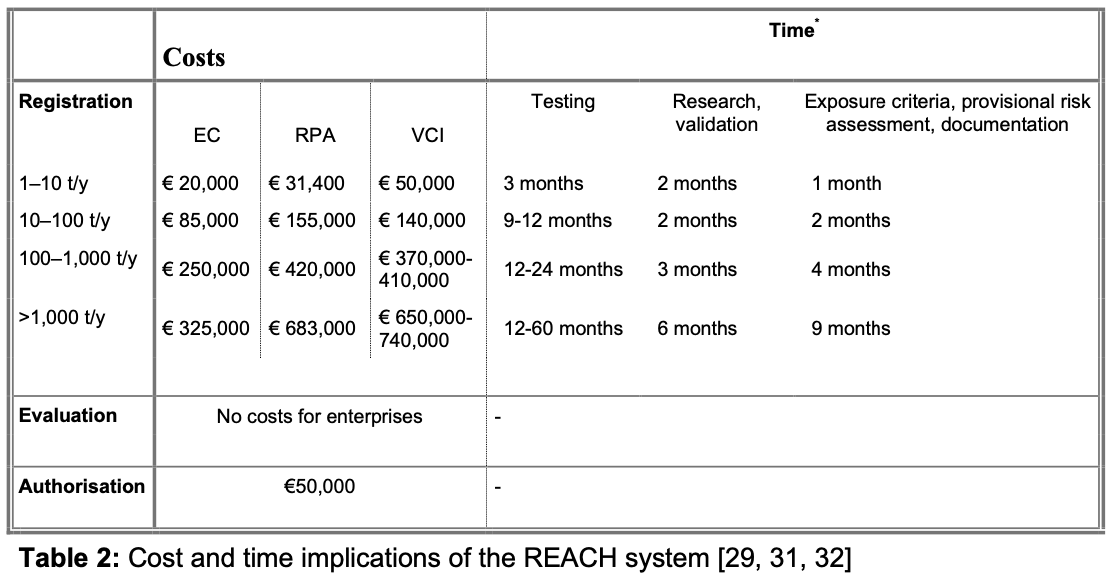

The REACH system comprises regulative parameters which affect competitiveness and innovation both directly and indirectly. Inherent economic effects lie in two aspects of the REACH system, the cost burden and the time factor applied. The economic implications are chiefly connected to the registration and authorisation procedure. The regulation has a direct impact since the opportunities to innovate, as well as the costs and time of innovation are affected directly [26].

The cost burden depends, on the one hand, on the probability of exposure, which in turn requires toxicological and ecotoxicological data ranked in terms of the tonnage threshold. On the other hand, additional tests need to be carried out if specific substance properties are known. In addition to the cost burden, the obligation to produce and submit test data is time-consuming and generates time costs. The costs of the time factor will have an impact on competitiveness of enterprises throughout the supply chain if it counteracts specific competitive advantages or delays the market launch of innovations. However, the time investment will only be relevant to competitive matters once the initial 10-year legal continuation permit expires (time period for completion of registration and testing for chemicals already on the market). After this time period and for new chemicals immediately, the REACH system will take on the character of a approval procedure. Table 2 contains an overview of the estimated costs and time scales of the REACH system.

The indirect impact of the new chemicals regulation on competitiveness and innovation stems from the direct cost and time implications. The companies indirectly affected by the chemicals regulation are not primarily manufacturers of chemical substances but rather companies in industrial sectors who use chemicals in their processes and end-products not previously involved in registration or authorisation. Industrial downstream users working in preparation and formulation are mainly SMEs. If chemical manufacturers and importers are not willing to register and authorise certain substances or uses, the chemical companies downstream face a withdrawal of the source materials they need to process in order to manufacture products for end-use.

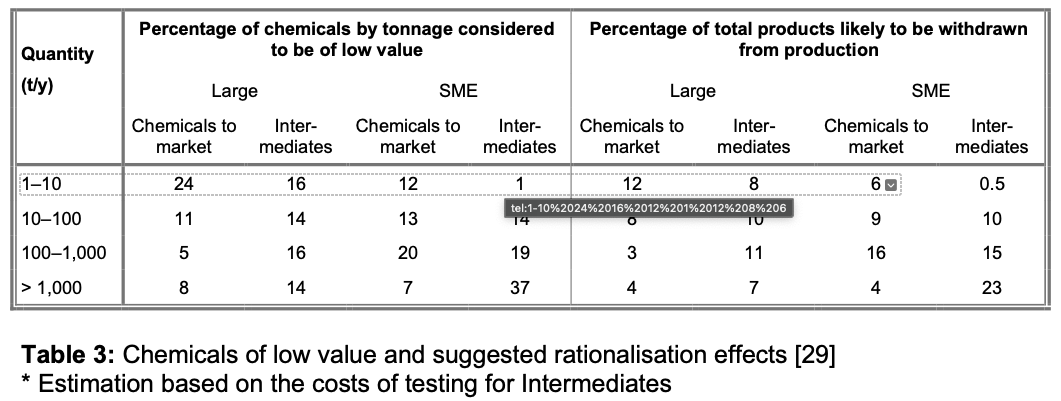

The probability of chemicals being rationed will increase given the cost burden per quantity unit to be borne by individual substances under the REACH system. After all, especially subsceptible for non-registration are substances which earn only a small marginal income. As Tab. 3 shows, SMEs’ product ranges usually comprise a much smaller number of low-margin substances than is the case with large companies. This underlines the high significance of low-volume, high-margin substances for SMEs, which rely on pronounced flexibility and rapid market entry. This trend is also apparent in the manufacture of intermediate products, where low tonnages are especially economically successful.

By contrast, a far greater number of large companies regard low-volume substances as ‘low- valued’. This proportion declines with larger production quantities (over 100 tons per annum). The high testing and registration costs in relation to low quantities make the rationing of certain product groups with low-margins likely. Nevertheless, estimates indicate that not all ‘low- value’ chemicals will be rationed. Even if the additional costs cannot be recovered in the short or medium term, there are various reasons why manufacturers, importers and processors may still carry out registration [29]. Numerous by- products of high-value chemical products arise in the complex manufacturing processes of the chemicals industry. The registration of these by-products is encouraged by high production quantities and growing demand for the main product. Similarly, a substance may be of relevance for particular customers which also purchase other, more expensive chemicals. In the case of low margins per production unit, meeting the registration costs may also be justified by high production quantities. If no substitutes are available or if a substance decisively contributes to maintaining competitiveness or flexibility, registration on the part of the downstream industrial user may be expected.

To sum up, four factors can be identified which affect decisions about product rationing [29]:

- The estimated registration costs for a substance: the costs depend on the volume threshold, data already available and the cost- sharing among a registration consortium

- Market analyses about current and future market shares and profit margins

- The importance of the chemical or substance in current and future markets, manufacturing processes and applications

- The importance of the chemical or substance for the product portfolio of individual companies and the degree of competition in this product field.

As already outlined in this chapter, the REACH system in the new European chemicals regulation is closely linked to certain critical factors of competitive success. Both the impact of the direct cost and time implications on competitiveness and innovation and the indirect effect of uncertainty on the innovation process differ depending on the strategic orientation in the individual sectors of the chemicals industry [33]. Using the analytical framework presented in section I, the Porter Hypothesis for the chemicals regulation will now be subjected to final review and evaluation. Using this analytical framework will also show the fundamental condition on which the validity of the Porter Hypothesis rests.

III. The Porter Hypothesis in the new chemicals regulation – does it hold?

The impact of the new chemicals legislation on innovation within the cost leadership strategy

Cost leadership has been identified as a strategy which chiefly enables large companies to achieve competitive advantages through economies of scale. The success factors of a comparatively low cost structure combined with low costs for raw materials, energy and manufacturing are unaffected by the new chemicals legislation. The product portfolio of companies in this segment is relatively small, but involves high tonnages of both the chemicals used and the products manufactured.

High volumes involved in economies of scale minimize the financial burden per substance on registration and authorisation costs [34]. Moreover, the time factor resulting from the testing and registration procedure will not impair the success factors typical for the strategic management concept in this production segment. Compliance to the chemicals regulation and compensation for the cost burden resulting from the new regulations are hence negligible with this strategy type and do not have any disadvantages for product innovations. The competitive advantages for these companies arise from process innovations. However, incentives to process innovations and enhanced resource productivity are unaffected by the new regulation.

The existing production structure and value creation, which consists of relatively few basic chemical products but is nonetheless very capital- intensive, means that achieving a first-mover position and innovative advantages are still very important. Yet, the two effects described by Porter are of a technological and a process-orientated nature. An efficient manufacturing process is the basis for securing cost leadership. However, the new chemicals regulation has no discernible impact on success factors which are fundamental to achieving a competitive advantage from cost leadership.

The impact of the new chemicals legislation on innovation within the differentiation strategy

In contrast to the cost leadership strategy, the new chemicals regulation will have a much bigger impact on competitition and innovation in connection with the differentiation strategy. Regulative factors critical for success of the strategy type impede the implementation of the differentiation advantage and restrict innovation.

Competitive advantages from differentiation are mainly achieved by companies in the fine and specialty chemicals sector. One characteristic feature of the manufacturing process in this very large number of individual production segments is the multitude of chemical base materials and intermediate products used in relatively low amounts (typically less than 100 tons per annum). A large available portfolio of base materials forms the basis needed to be able to react rapidly and flexibly to the demands of customers. Changes to specialty and fine products (innovative applications) and new product developments normally result from close customer interaction and specific demands of buyers or changed requirements. Hence the crucial factors for a competitive advantage based on the differentiation strategy are a large pool of chemical substances and preparations that are immediately available, short market entry times, and the protection of knowledge advancements owing to the high capital intensity involved.

The possible loss of the differentiation advantage is based on two effects caused by regulation: (i) restrictions to the flexible response to the need for new products owing to the limitation of the pool of available substances, and (ii) the prolongation of the time-to-market needed for a substance or preparation due to the approval procedure relating to the registration process.

The reduced size of the substance pool available is a result of the costs of registration and authorisation. The limited financial resources of SMEs can generally not afford to register the multitude of substances used and produced and their applications by themselves. Similarly, fine and specialty chemicals are market segments in which registration costs cannot be substantially decreased by means of economies of scale owing to the low production volumes. The partial withdrawal of chemicals and the restriction of market availability will mainly focus on substances which are produced in low quantities and at low profit margins. In particular chemical companies are affected whose competitive advantages are based on rapidly producing very specific low-volume products such as paint or varnish and other chemicals for photography in expensive processes [35]. Because of the cost burden, chemicals in this segment will also experience a negative innovation effect stemming from possible savings in R&D budget and on capital tied up ‘unproductively’. Hence the cost burden accounts for the limited access to the available substance pool. Accordingly, the regulation costs will impair the competitive advantage of flexibility typical of the differentiation strategy. Rationing at the manufacturers level partly also has decisive consequences for the competitiveness and innovation of downstream user sectors if the production process in the supply chain is linked to the immediate availability of high-value innovative chemicals [5, 29].

The demand-based market for fine and specialty chemical products requires rapid customer tailored production. This in turn entails short market cycles and high development expenditures for manufacturers of chemical formulations. However, market entry is delayed by the first-time registration of substances and preparations, the registration of applications and the authorisation of chemical substances (cf. Tab. 2). The implications of the time factor of the REACH system could therefore potentially restrict the differentiation advantage of the rapid and direct market availability of chemical products.

One result of the two effects – the partial ration of the substance pool for chemical source materials and delayed market entry – will be a decline in the rate of innovation. This ‘innovation shock’ typically occurs in connection with a new regulation [36] and is primarily a result of the cost burden imposed by the new chemicals regulation. Another indirect effect of increasing the costs and time required for innovation is the reassessing “portfolio effect” [26].

The crucial question regarding the competitiveness and innovative potential of the chemicals industry must be about the duration of the negative effects on competition and innovation. The chemical substances already on the market need to be registered within the first ten years following the introduction of the new regulation. The majority of the costs thereby incurred by the industry sector will be appear during this period. However, the duration of the effects caused by the partial rationing of chemical substances is more or less indefinite. The time factor of the new chemicals regulation will only take effect once the initial ten-year period expires. Therefore, the cost burden imposed by the new chemicals regulation will be responsible for the initial size of the innovation shock. However, the cost factor will only be of limited duration, whereas delays resulting from the registration procedure will have a longer-lasting impact, albeit with a less pronounced effect.

One important factor in achieving competitive advantages through differentiation and the implementation of innovations into marketable products is adequate protection for intellectual property [36, 37]. An at least temporary monopoly position is reasonable for the capital-intensive innovations of the chemicals industry in view of the additional costs entailed by registration and authorisation [38]. The new chemicals regulation provides for the protection of intellectual property and thus supports the characteristic feature and competitive advantage of differentiation through innovation. Original notifications will be granted property rights of the registration data for a certain period of time. This will allow monopoly profit to build and registration costs to be payed off. Even before this protection period expires, the new chemicals regulation opens up the prospects of broader market availability and substances being used by other suppliers and processors [39] on the basis of a licence fee or the post-sharing of expenses in the case of joint registration for original notifications.

In contrast to cost leadership, in the differentiation strategy, products and product innovations enable competitive advantages. As claimed by Porter, the REACH system of the new chemicals regulation has indeed been designed in a stringent way such that first-moving and innovation effects can be expected to generate compensating or even overcompensating benefits. However, the effects postulated in the Porter Hypothesis could mostly be prevented, since the new regulation directly influences the success factors of the differentiation strategy via the critical factors of ‘cost’ and ‘time’. As a result, innovation capital is tied up in order to maintain production and value creation, the substance pool is limited and market entry delayed.

The new chemicals regulation is not connected to any direct first-mover effects in international competition, since all substances with an annual production volume exceeding 1 ton are subject to the REACH system. The positive innovation effect expected from the new chemicals regulation – safer chemicals and chemical applications due to the systematic provision, evaluation and management of information about substance properties and exposure – does not make for cost or time advantages in registration.

The implementation of positive innovation effects of the chemicals regulation into a competitive first-mover role is tied to corresponding market demand, which does not necessarily always exist [40]. Furthermore, the development of less harmful substances, which is one aim of the new chemicals regulation, conflicts with certain market demands, because specific substance characteristics are actually required or because certain chemicals cannot yet be substituted [5, 41]. In the Porter Hypothesis, competitive advantages for businesses from regulation result from enhanced resource productivity internally compensating for the regulation and innovation costs. However, an internally generated competitive advantage cannot be achieved through the impact and way of regulation in the differentiation strategy since the new chemicals regulation is aligned towards products, not manufacturing processes. Moreover, in contrast with the Porter Hypothesis, no direct internal competitive advantages result for manufacturers or processors from substance innovations and innovative applications.

The new chemicals regulation has a large impact on the success factors in the differentiation strategy. However, neither a first-moving nor an innovation effect which would enable a competitive lead to emerge from the new regulations. Furthermore, one basic condition of the Porter Hypothesis is not met. The special impact of the critical factors of the regulation along with the market structure and company sizes typical of differentiation mean the regulative and innovation costs will not be internally compensated for. Hence the benefits for competitiveness and innovation claimed in the Porter Hypothesis are not to be expected in the differentiation strategy.

IV. Summary and concluding remarks

Michael E. Porter’s hypothesis that a stringent environmental regulation encourages efficiency and innovation and hence helps improve competitiveness is a key argument in the discussion surrounding the positive impact on competition of the new European chemicals regulation. But does his hypothesis really stand up to closer scrutiny?

Both the Porter Hypothesis and the ways environmental regulations affect businesses’ competitiveness and innovation are tied to an extensive concept of strategic corporate management [11]. Competition and the forces of competition in an industry emerge from the »Diamond Framework« as the crucial factors influencing innovation. Competition and innovation effects of regulation are in turn rooted in the way the forces of competition are affected. Seen from this angle, the regulation cannot create the advantage itself. Instead, the effects on competition and innovation of an environmental regulation are restricted to accelerating or increasing the chances of achieving a competitive advantage by means of innovation.

Considering the company itself is important for the competitive effect of a regulation. The company is mapped in terms of its competitive strategy concept and the related competitive advantages. Porter distinguishes between two basic concepts of strategic corporate management: the strategy concept of cost leadership and the differentiation strategy. Both strategies are tied to certain market and competition factors. In addition, cost leadership and differentiation feature specific success factors enabling competitive advantages but which are affected differently by regulation. Competitive advantages of cost leadership are based on a comparatively low cost structure and process innovations – success factors which are not affected by the new chemicals legislation. By contrast, the new regulation entails significant implications for competition for specialist companies downstream in the supply chain of fine and specialty chemicals. The impact on costs and delayed market entry limit differentiation advantages and impede innovation. Neither first-moving effects nor overcompensating innovation effects can be easily achieved with the new system of chemicals regulation; the companies concerned deal in products, which do not allow an improvement in resource productivity or internal compensation for the additional burdens.

Consequently, the Porter Hypothesis’s claim that the new chemicals regulation will help to improve competition and innovation only holds to a certain extent. It is restricted to an environmental policy which responds to negative environmental effects by using certain production factors and manufacturing technologies. Regulation is needed in such cases owing to production risks, i.e. mainly the possibility of pollution caused by harmful emissions. By-products which arise during the manufacturing process and which cannot be put to any useful purpose may harm environmental compartments or be hazardous to health. Consequently, such regulations are designed to focus on environmental media affected by problematic substances. Hence, the Porter- Hypothesis works well in terms of encouraging innovations for enhancing resource productivity.

Unlike such environmental protection regulations, the new chemicals regulation is directed at the substances produced and marketed by chemicals companies. Dumping chemicals into the environment in terms of products is the fundamental aim of the chemicals industry [28]. These product risks can be regarded as the main source of generating risks by the chemicals industry. Products as emissions ultimately determine the reason for intervention by means of chemicals regulation. However, the “Risk reduction activities (…) seem less likely to fit the Porter Hypothesis.” [42]. Therefore, the Porter Hypothesis does not provide a sound argument that the new chemicals regulation will have a positive impact on competition and innovation. In fact the understanding of corporate strategies, forces of competition and the regulation upon which the Porter Hypothesis is based seems to indicate that certain segments of the chemicals industry will in fact suffer negative effects on competition and innovation.

Acknowledgement

Part of this paper is based on an earlier German version which was circulated as a discussion paper. See Frohwein, T. (2003): Die Porter-Hypothese im Lichte der Neuordnung europäischer Chemikalienregulierung – Does it Hold? –, UFZ- Centre for Environmental Research Leipzig-Halle, Discussion Paper 7/2003, Leipzig.