Marketing of chemical parks: Challenges and perspectives

Abstract

Managing industrial parks is a multi-billion euro business with special importance to the asset intensive chemical and pharmaceutical industry. Site managers face many challenges, one of them being attracting new investments to the site. This article describes how site managers may create and implement an effective and efficient site marketing strategy by defining the relevant target group, specifying the adequate value proposition and using the most promising communication channels. The authors illustrate their recommendations with their site marketing experience from one of the most successful industrial parks in Europe, the Industriepark Höchst.

1 Introduction: Marketing specifics of industrial parks

Industrial parks can be found worldwide. In Germany, the chemical industry has 37 (VCI, 2012) industrial parks. Industrial parks are clusters of research, production/manufacturing and service activities of several companies that share one physical location (see for instance, Wildemann 2016, or Suntrop 2016). From the outside an industrial park is seen as “one entity”. One can distinguish between so called major-user parks that are operated and often owned by the largest tenant at the site. The most prominent example in Germany is the BASF Ludwigshafen site. Sometimes, several large tenants provide services to each other and the minor users at the site, as is the case at CHEMIEPARK.LINZ. On the other hand, there are multi-user parks that are owned and operated by a professional service company that does not have chemical production assets at the site, as is the case with Infraserv Höchst, the owner and operator of the Industriepark Höchst in Frankfurt.

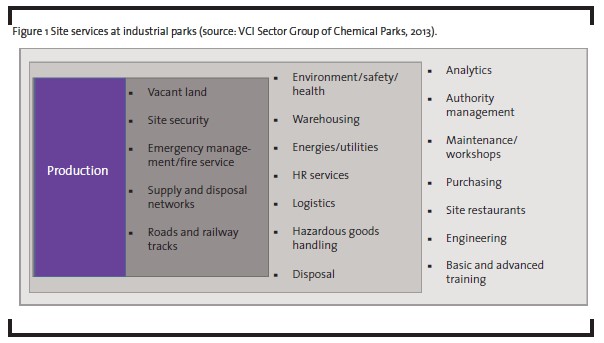

Site service companies at industrial parks offer a range of different services (see Hofmann/Michel 2016). The site service company may organize the management of the facilities, the treatment of waste water, the grids and pipelines for all companies on site, as well as heating and cooling, warehousing, logistics or health and safety services (see figure 1). In addition, the site company may proprovide recruitment and training activities and organize learning processes between companies on site and the relevant external stakeholders (e.g. academia, policy makers).

Service operators argue that outsourcing site operation activities to a specialized site operator, allows companies in the chemical and pharmaceutical industry to focus on their core competencies of developing, producing and selling goods. Furthermore, it creates cost and risk synergies in shared infrastructure assets and provides a sufficient mass for holding expert knowledge available at the site. Operationally, industrial park operators highlight the potential for reducing customers’ costs, increasing their speed and flexibility and improving the quality of services.

And the leverage site operators are working on is significant to their customers in the chemical and pharmaceutical industry: Analysis shows that costs of infrastructure and services outlined above are between 10-15% of the revenues of chemical companies (with core costs in the field of energy, waste management, logistics and facility management) and around 5% of pharmaceutical sales (Wildemann, 2016).

In the following, the term marketing will be used to characterize (a) the general challenge of creating and managing business to business relationships between the industrial park operator and his potential customers and (b) to characterize the tasks of the respective department within the industrial park operator company. Industrial park operators face specific marketing challenges.

They act on business-to-business markets and offer their services to customers in the chemical and pharmaceutical industry. The demand for services in industrial parks ultimately depends upon the development of the consumer markets where chemical and pharmaceutical products are used. If consumers or regulation, for example, decide against plastic bags in Europe, the corresponding production will decrease and there will be lower demand for the related industrial services. For the chemical industry customer, a buying center structure is typical, with multiple persons on the customer side having influence on the buying decision. The decision making process on the customer side is highly formalized and professionalized in terms of methods and tools used for selecting the right production site. The services offered are highly individualized and cannot be stored (Peters et al. (2013), Homburg (2017), Zeithaml et al., 1985). Some of the services may only be offered within an industrial park (e.g. site security, firefighting), some others may be offered to external locations as well (e.g. facility services, consulting). Typically, long-term relationships between industrial parks and their (potential) clients can be observed; personal interaction prevails over mass media marketing.

When an industrial park attracts a new client to its location and the client builds his production facility in the industrial park, a significant lock-in effect occurs after the investment in the park, due to the capital-intensive production assets. Furthermore, the producer is in some cases bound to the service offered within the park. Changes in quality and costs will directly affect the producer’s profit situation. Another important aspect is the path dependency of industrial park development. Some industrial parks exist for more than 150 years; different production activities have been built over the years, hazardous goods have been produced, the land has been used in different ways over time. All these aspects have to be taken into account when an industrial park tries to attract new investments. So marketing of industrial parks is interesting from a broad range of marketing perspectives, encompassing business-to-business marketing, service marketing, information economics, principal agent theory and path dependency theory to name but a few (Hutt/Speh 2003).

2 Case study: Site Marketing at Infraserv Höchst

The Infraserv Höchst Group developed from Hoechst AG in 1997 and is the operator of the industrial park in Frankfurt Höchst. In 2016, it had a turnover of approximately 1 billion Euros and 2,500 employees organized in eight business segments, including energy and waste management, site services, logistics and real estate, as well as education and training specialist Provadis GmbH.

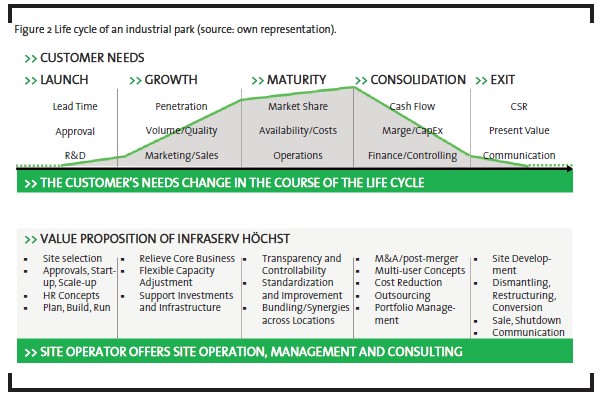

This highly diversified portfolio with at first glance seemingly unrelated services under one roof does, however, add superior value to clients. How so? Rather than just focussing on steady site operation, Infraserv Höchst puts its focus on partnering with clients to dynamically develop their sites. Every client business and every client site undergoes one or even several cycles over time. One way to describe this site development is to differentiate between launch, growth, maturity, consolidation and termination/exit phases, as depicted in figure 2. Obviously, however, businesses and sites have different lifespans, investment cycles, profitrisk-profiles and so on. From our understanding, one key to successful site development is to align both aspects – the needs of the chemical and pharmaceutical company in a specific phase of the product life cycle on the one hand, and the site parameters on the other hand – in the most effective and sustainable way.

For example, in the launch phase a product transitions from the development/approval stage into the production phase. In pharmaceuticals, for instance, when new active ingredients are involved the clock tends to be ticking as patent protections are limited and pharmaceutical companies try to sell the patent protected drug as long as possible in order to generate profit. Speed in scale up of production activities is therefore of the essence for companies in the pharmaceutical industry. But suboptimal sizing of production facilities or lack of flexibility of infrastructure assets, for example, may prove to be costly in the future. Site partners like Infraserv Höchst can play a vital role in making the launch fast, successful and finding flexible and thus sustainable solutions for the site as a whole. The site management company may also help with all legal and regulatory requirements that need to be fulfilled for creating new factories and may find a flexible solution for the infrastructure as well, based on their experience and reputation gathered from multiple projects with many clients in the past.

The growth phase is characterized by market penetration. The volume and/or the quality of the products offered are seen as key success factors. Therefore, the marketing and sales departments lead on this, with production keeping pace as much as possible. Site operators must be able to offer flexible capacity adjustments while relieving the core business activities. During the maturity phase customers are confronted with intensified competition. Thus, availability and costs of products shift into focus. Infraserv Höchst, for instance, provides the ability for continuous improvement and standardization as well as the exploitation of synergies across secondary processes. In order to remain competitive in the consolidation phase customers focus on cash flow, margin, finance and controlling. The site service provider’s value proposition consists of developing multi-user concepts after M&A activities, initiating cost reduction processes and adapting the service portfolio to changing needs. The last phase is described as the termination/exit phase. For customers, present value of their business is of utmost interest. Accordingly, services like dismantling, restructuring and conversion, in addition to sale and shutdown, are in high demand. All in all, in the course of the lifecycle the site operator must be able to respond to the varying customer needs and must offer an integrated solution to enable clients to adapt to their changing business needs, not just at Frankfurt-Höchst, but nationwide at other client sites and parks.

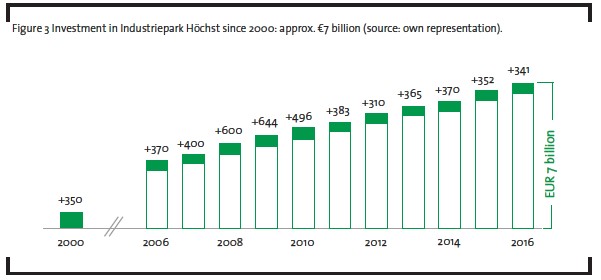

One gauge for the success and long-term performance of a site operator is the amount of investments attracted to the site it is managing. In the case of the Industriepark Höchst with more than 90 chemical, pharmaceutical and services companies and approximately 22,000 employees on around 460 acres, this number totals 7 billion Euros of investments since the year 2000, representing an average of more than 400 million Euros per year.

Each investment strengthens the site´s base and points to a promising future, attracting further investments in turn. Investments are in fact very hard to come by, however. Many sites therefore invest strongly in site marketing activities. But what strategies can the marketing department use in order to attract investments? Chapter 3 will give some methodological background on finding out “where to play”. Chapter 4 will go into more detail on customers’ decision making processes and ”how to win” from a marketing perspective. Chapter 5 will look at the buying centre in more detail and offer some guidance on “where to put your money” in the most cost-effective way.

3 Where to play: Selecting the most promising target segments

Since 2010 the chemical industry has been growing in Germany and Europe at a rate of 2.5 % per year. The German association for the chemical industry predicts only 1.5% growth per year until 2030 (VCI, 2016). Compared to Asia with a predicted annual growth rate of 4.5%, we can consider the German and European chemical industry to be at a mature stage (VCI, 2016). Given this macroeconomic environment, attracting new investments to existing industrial parks in Germany must be understood to be a very difficult task.

Marketing managers at industrial parks should be aware that overcoming general investment barriers for the chemical industry in Germany is hardly possible. To put it simply, most investments in industrial parks stem from existing customers, expanding, overhauling or replacing their existing production assets, as well as subsequent investments by the site operating company. Following a recent study from German Trade and Invest, on average there are 6 new large production facilities built in the chemical industry per year out of which only 1-3 are relevant for industrial parks (GTAI, 2014).

So site operators are correct in putting a major focus on this most important segment and in closely following and accommodating the development of their existing key accounts. Infraserv Höchst, for example strives to achieve close links between management, key account management, sales and operations and the various levels of the client organization to best anticipate and support all developments in order to facilitate growth. Marketing has an important but supporting role focused on activities advancing customer satisfaction, loyalty and promotion.

Beyond that, Infraserv and the business development agency of the region FrankfurtRheinMain carry out a value chain analysis together with customers at the site in order to further develop the production network at Höchst, to identify blind spots or gaps which can be filled by new additions to the value chain. One example of this logic is shown by one company investing into a small plant to capture the surplus CO2 from the production process of another company at the site, as is the case with Westfalen AG and Celanese Corporation at Frankfurt-Höchst.

In order to develop an effective strategy for attracting new customers to existing industrial parks, industrial parks need to combine their knowledge about company’s external developments (investment probability by industry segments; decision criteria for selecting industrial parks; knowledge about buying center structures on the site of the customer) with the knowledge about internal conditions (knowledge about available land; knowledge about goals for attracting new investments; knowledge about one’s own company profit function). Infraserv Höchst developed a five step approach for attracting new customers to the Industriepark Höchst – this approach can be individually adapted for use in other industrial parks too:

Step 1: Define target segments

Firstly, Infraserv Höchst has identified 7 potential target segments with 36 sub-segments in total. Examples of these segments include pharmaceuticals (the production of active ingredients), specialty chemicals (e.g. construction chemicals, fragrances, food additives, pigments) and other process industries.

These potentially attractive market segments have been profiled according to their patterns of consumption of services offered by Infraserv Höchst. Eight profiles with a specific need structure in the fields of production, energy, waste management, logistics, safety, space (square meter) have been identified. These encompass, for example, volume oriented specialty chemistry with a continuous production system, a high energy demand and need for waste management, logistics, safety and space. Another example consists of research based drug producers using batch production, with a high demand for logistics service and medium need for energy, safety and space. Production profiles of smaller research based entities with lower production activities and logistics companies with largespace requirements but little need for energy or waste management services have also been profiled. All market segments have been matched to a specific production type.

Step 2: Determine profit potential/customer lifetime value

The market segment profiles have been evaluated on the basis of Infraserv Höchst’s profit function. This profit function includes the dimensions “profit per square meter”, “revenue per square meter” and “growth potential over the next five years”. The different dimensions were weighted by board room members and applied to the 36 market segment profiles. Eight market segments were excluded from further analysis as they did not signify adequate profit potential.

Step 3: Estimate the probability of an investment in Europe

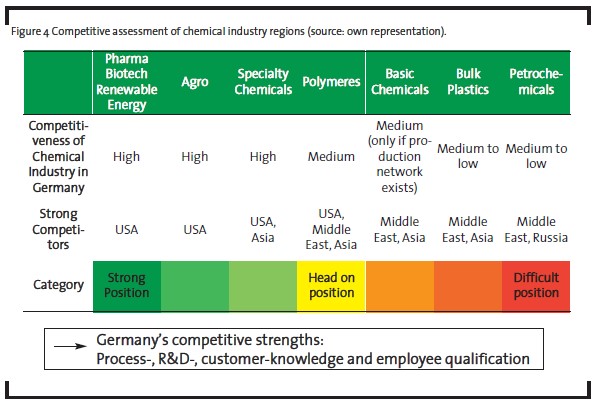

In order to further narrow down the list of potentially relevant market segments, the probability of an investment by a company – belonging to one of the prioritized production profiles – was analyzed in a multi-method, multi-source approach. While the basic work was done in 2010, the results are frequently updated to readjust the site marketing activities. This approach screens publicly available data sources such as ebsco.com, chemie.de, chemanager-online.de. In addition a semi-standardized questionnaire was used for expert interviews to evaluate the probability of investment in production facilities in Europe. As a result, new production activity and growth is predicted in innovative fields such as pharmaceuticals, specialty chemicals, biotechnology (medical and industrial uses) and green technology (with renewable energy). The following table summarizes Germany’s competitive position and lists the strongest competitors.

As a result investments seemed likely to result from around 17 out of the initial 36 industry segments analyzed.

Step 4: Identify relative competitive strength

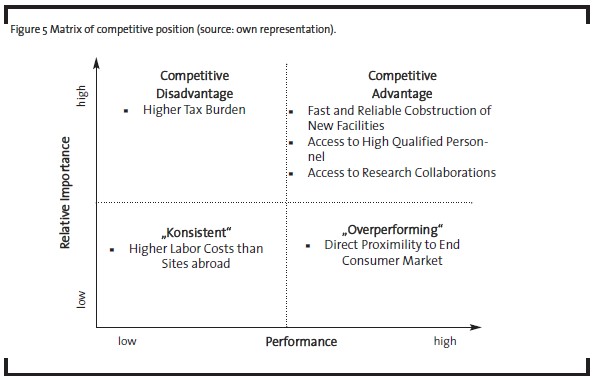

Finally, the competitive position of Industriepark Höchst was analyzed from a customer perspective (concept of competitive advantage, see von der Gathen/Simon, 2002). Therefore, in-depth interviews were conducted with existing customers (site managers) in order to better understand

- the importance of different criteria when selecting a production site and

- the perceived performance of the indus trial park compared with that of the next best alternative.

The results of the interviews were integrated into a matrix of competitive advantages. Each decision criterion was depicted according to its relative importance (as evaluated by all respondents in a specific market segment) and according to the industrial park’s relative performance (as compared with the strongest competitor evaluated in a specific segment). Consequently, the industrial park’s competitive advantages (above average importance of a criterion and better performance than competitors), competitive disadvantages (above average importance but performance lower than competitors), fields of overperformance (low importance of the criterion but performance beyond competitors) and the levels of consistency (low importance with low performance) were identified.

The analysis showed that the industrial park’s competitive position varied significantly depending on the market segment studied.

For example, respondents in segment A – high quality, research intensive development and production of active ingredients for pharmaceuticals – highlighted relevant competitive advantages in the field of fast and reliable construction of new facilities, and access to high quality personnel and research collaborations in the neighborhood as relevant competitive advantages of the Industriepark Höchst compared with all other production sites analyzed. These characteristics supported the company’s goal of ensuring a short time to market for patent protected new drugs produced at Industriepark Höchst. Competitive weaknesses such as, for example, the higher tax burden compared with low cost production sites abroad, were not seen as very significant. The direct proximity to end consumer market was not seen as an important characteristic, the park was seen to be “overperforming” in this area from the customer perspective.

Step 5: A focused marketing strategy

As a result of this four step approach, 12 market segments have been identified as most important for active site marketing activities. The list of these target segments is updated yearly. It goes without saying that new customer insights are then worked into the industrial park’s value analysis and marketing and sales materials. In order to develop a precise value proposition, a matrix of competitive advantages is very helpful: Those aspects identified on a segment basis as competitive advantages (thus receiving high relative importance scores and representing a stronger performance compared with the strongest competitors) form the basis for the value proposition. These aspects are used in the individual sales pitch and can be adapted to specific customer requirements.

4 How to win: Finding the right marketing strategy

For the selected target segments, a detailed customer acquisition strategy was developed. For each segment, the market specifics were identified and answers to the following questions were found:

- Who are the main players in the relevant market arena?

- What are the phases of the customer deci sion process? 3) How can the industrial park influence the different actors in the buying center?

In order to answer these questions, internal workshops were held with Infraserv Höchst sales managers, key account managers and relevant market partners. The decision process and the role of different actors were analyzed through semi-structured interviews. On this basis, a segment-specific marketing strategy was developed.

The decision making process of the potential customer was taken as a starting point, i.e. the chemical or pharmaceutical company looking for a new production site. Even though the chemical or pharmaceutical company may have experience in selecting production sites, this is typically an extensive and highly formalized decision process (Robinson/Faris/Wind, 1967).

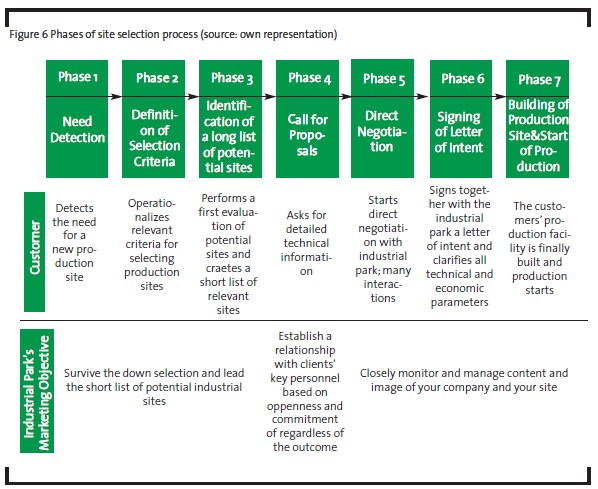

The site selection process can be structured into seven phases. From the customer’s point of view, the process starts with the perceived need for a new production site (phase 1). Then the relevant criteria for searching and evaluating potential sites are defined and operationalized by the customer (phase 2) before the customer actively invests time and money in searching and defining a long list of potential sites (phase 3). Phase 3 ends with an initial evaluation of the potential sites and the creation of a short list of up to 10 sites that will be evaluated in more depth. Most of these activities will be conducted undetected and with an air of great secrecy, involving only few people within the client organization below board level and maybe a handful of external partners. This is done with good reason, as adding capacity is a competitive maneuver in any market and may be subject to counter-measures by competitors. Also, listed companies may want to pay close attention to timing their announcements just right so that they can avoid the need to react to market rumors with adhoc notices.

So by now we have prioritized market segments and have a solid understanding of the general decision making process. But how can the industrial park be positioned best in the sphere of the buying center and its influencers without spending enormous amounts of money? First off, industrial parks have to realize that the target segments will share some similarities but will probably be quite different in the detail. Chemical companies, for example, organize the site selection process in various ways. Typically a formal team is installed for screening and selecting potential production sites. This team consists of experts in the field of production planning, controlling, research & development and purchasing and is often formally structured as a project within the company. This team defines the site selection criteria, searches for the relevant information (stages 1-3 in the above mentioned site selection process) and proposes a short list of potential locations for the new production site. While all relevant competencies are represented in this team, the final decision on the short list is made by the chemical company’s board and the head of the production units. After this decision a core team with experts from the production and purchasing departments is put together to gather in-depth information, make on-site visits and start the negotiations with potential production sites. Again, the final decision is made by the board.

Sometimes, the process is steered by a company’s “site selection and benchmarking department”. Thus, while the board of the chemical company may be characterized as the key promoter of the site selection decision, the team also consists of expert promoters and they are coordinated by the site selection department as expert and process promoters (Webster/Wind, 1972; Backhaus/Voeth 2014). Important influencers in the process are plant manufacturers that, together with the chemical company, develop the new production facility and share their expertise with different industrial sites worldwide. Further important influencers include industry associations and business development agencies. Relevant information sources for chemical companies in the site selection process include international databases summarizing the technical characteristics of industrial parks (homepages e.g. VCI, ECSPP), industry associations conventions, industry publications and personal networks and experiences of the actors involved. The confidential nature of the site selection process on the customer side rules out any direct marketing and sales approaches geared at lead generation. Imagine an outbound marketing campaign centered upon calling up companies asking them for upcoming investment projects. Chances of not talking to the right person are high and even if you were, he or she would not want to let you know or even talk to you. Chances of not making a good impression this way are also very high. Regarding these first phases, the main marketing task is to make as much information as possible publicly available and position the industrial park in the relevant networks so as to be in the relevant position to enable the potential client to make an informed decision. Chapter 5 will provide more details on this.

Marketing objective: Survive the down selection and lead the short list of the potential industrial sites.

The other phases are no longer characterized by marketing activities but mostly driven by sales and top management. The customer makes the first move in phase 4 with the call for proposals. Here the customer lists his needs and describes his requirements in a technical manner. This is also usually the first time he or his consultants will speak with the industrial park directly. This will always be a lengthy and time consuming process that will go back and forth, but reaching a more detailed level each time. This process helps the client evaluate the different proposals and reduces the number of names on the list. This process should be used to build up trust and establish viable relationships with the potential customer. The goal of the industrial park in this phase is to be a good host, give open and honest answers to all potential client questions and ask the right questions in return. Ultimately, the potential client’s needs are highly specific and often the potential client will not continue to the later stages because their project does not fit the site. Nevertheless, the industrial park wants to leave a good impression in case the potential client ever comes back or is asked about his experiences with the industrial park.

Marketing objective: Establish a relationship with clients’ key personnel based on openness and commitment regardless of the outcome.

In phase 5, the customer starts negotiations directly with an even shorter list of industrial sites. In phase 6, a letter of intent is signed and all technical and economic parameters are clarified. In phase 7, the production facility is finally built and production eventually starts. These final stages are exclusively driven by top management, sales and finance. However, the number of employees involved directly or indirectly on the client side will grow during these stages. A good marketer will make sure that client information needs are met in a consistent manner and all information promotes the site in the best possible way. This is a complex process as it may range from between 18 months and five or more years for major projects. A consultative selling approach is used by Höchst industrial park during this process, with the aim of continuously adapting to the potentially changing specifications of customer demand (Moncrief, Marshall and Lassak, 2006).

Marketing objective: Monitor and manage closely content and image of your company and your site.

5 Where to put your money: defining an efficient communication mix

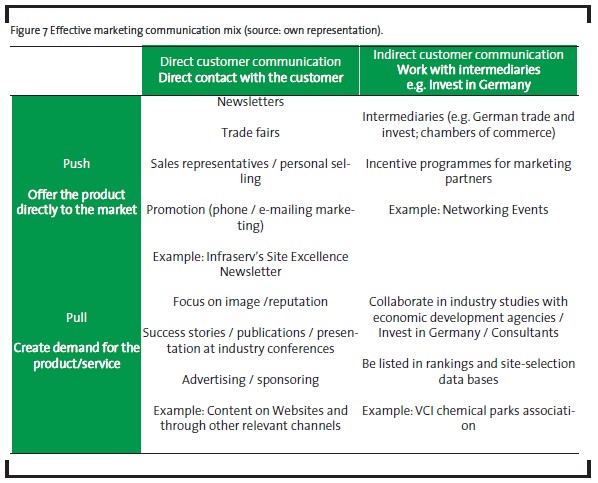

Even though the most important decision makers for site selection are the chemical company’s board and the head of the production department, a broad variety of actors need to be influenced using marketing measures to increase an industrial park’s success in acquiring new potential production activities for its site. Four directions for any marketing communications mix can be defined according to the marketing activity goals (push vs pull marketing) and the character of the communication activity (direct vs. indirect customer communication).

If the industrial park focuses on a direct communication line with the (potential) customer, the activities may be defined as:

- customer push-marketing activities (e.g. newsletters; trade fairs; activities of sales representatives) which are designed to promote the industrial park’s services directly to the customers’ buying center or as

- customer pull marketing activities that address a customer need, highlight the industrial park’s benefits indirectly (e.g. by using case studies) and thereby create a pull for the industrial park’s services.

Another important way to promote an industrial park’s service is to work with intermediaries such as the agency Invest in Germany, chambers of commerce or business development agencies. Depending on the character of a specific activity, the activities may be characterized as:

- push marketing activities which focus on influencing intermediaries directly with the goal of using the intermediary as an ambassador for the industrial park’s services.

- pull-marketing activities for intermediaries. Typical activities here focus on supporting the intermediary in creating demand for the industrial park’s services. For this goal, industrial parks may support industry studies, create joint internet sites or become involved in joint activities.

Infraserv Höchst uses all four options in its communications mix. The “Site Excellence Newsletter” may be understood as a push-oriented medium aimed directly at potential clients. It is a regular push medium to engage with the site marketing network and (potential) clients about current park developments and best-in-class service examples. In addition, a range of other push-oriented activities focusing on the indirect client are also used. Infraserv participates in and hosts regular networking events with site marketing partners, such as on-site business breakfasts or invitations to trade fairs and events. A pull-oriented approach is illustrated through the presentation of content on the website and via other relevant channels. Here all relevant information that is showcased is highlighted in such a way which supports screening processes and builds brand preference. Pull-oriented communication activities aimed at indirect clients are also used. Infraserv makes sure that all relevant multipliers have access to the relevant information conveyed via the various relevant network partner media channels based on standardized templates.

6 Summary and Outlook

This paper has presented the marketing insights of a site service operator. The established concepts in the field of business-to-business marketing, service marketing, personal selling as well as the underlying theories of information economics, principal agent theory and path dependency theory have all been helpful in developing the marketing strategy and implementing it effectively.

As the chemical and pharmaceutical industry faces more and more pressure from competitors outside Germany and Europe, site service companies have to position themselves in the best possible manner to be shortlisted by relevant customers. Growth opportunities exist not only externally through acquiring new customers, but also internally through offering extended or better services to already existing customers. The past has shown that it is very difficult to realize large site settlements by companies. Therefore, focusing on gaining “smaller” investments from existing customers might be the better option.

Marketing of industrial parks is a challenging endeavor, facing a high level of market and technical complexity. Insights from a variety marketing perspectives can be applied to support practical decisions in this context.

- Marketing of industrial parks means that industrial services are to be sold. These services have a high impact on a client’s profit position and are subject to extensive decision making processes. Insights from service and business to business marketing have proven to be very helpful to better understand the marketing situation. The market size for industrial park is determined by the general market development for chemical and pharmaceutical companies in a specific segment. These general market developments on the customer side determine local investments in research&development and production facilities. Marketing of an industrial park thus cannot easily broaden the market for industrial site services. However, in this given and externally determined market having a precise picture of what market segments fit best to a specific site and have the highest probability to invest is the prerequisite for focusing site marketing activities. The Infraserv Höchst approach has proven valuable for identifying the most attractive target segments and can be adapted to further sites.

- Understanding and managing the customers’ buying center is crucial for professional site marketing: As selecting and building a new site is a highly complex, costly and risky decision, several departments are involved on the side of the customer. The industrial site operator, thus, has to collaborate with different departments with specific roles (technical experts, decision maker, influencers) and decision criteria. In the early phases of the decision making processes, the marketing department has to make sure that the industrial park is in the relevant set of decision makers in the chemical and pharmaceutical industry. When the direct interaction begins, the steering role lies with the site marketing departments and the general marketing department takes a supporting role of securing consistent messages to the potential client. The applied selling approach can be characterized as consultative selling where the industrial park adapts to the demand of the individual customer.

- A variety of communication measures can be used for creating awareness and preference for a specific industrial park. With regard to the identification of the adequate marketing mix, industrial parks have to decide about the right mix of pushor pull marketing activities in order to achieve their communication goals. This depends largely on the targeted market segments. In this context, findings on social media marketing in the business to business context have proven to be helpful for developing a viable marketing mix. But estimating the return on marketing remains difficult.

The concept of the industrial parks is a multibillion business around the globe. Experiences of successful site marketing are shared across the different locations and help to further refine the positioning of the industrial parks. This fascinating task desires further attention from theory and practice.

References

Backhaus, K., Voeth, M. (2014): Industriegütermarketing Grundlagen des Business-to-Business-Marketings, Vahlen, München.

CheManager (2017a): Chemiekonjunktur – Asiens Chemie auf Wachstumskurs, available at http://www.chemanager-online.com/themen/konjunktur/chemiekonjunktur-asiens-chemie-aufwachstumskurs, accessed on 01.06.2017.

CheManager (2017b): Chemiekonjunktur – erfreulicher Jahresbeginn für Europas Chemie, available at http://www.chemanager-online.com/themen/konjunktur/chemiekonjunktur-erfreulicherjahresbeginn-fuer-europas-chemie, accessed on 15.06.2017.

German Trade and Invest (GTAI), Schmidt, M. (2014): Ausländische Direktinvestitionen in der Chemieindustrie – Wunsch oder Wirklichkeit?, company presentation.

Hofmann, C.; Michel, C. (2016): Standortdienstleistungen in der chemischen Industrie als Wettbewerbsfaktor, In: Suntrop, C. (Ed): Chemistandorte: Markt, Herausforderunen und Geschäftsmodell, Wiley: 2016, 179-191.

Homburg, Christian (2017): Marketingmanagement, 6. Auflage, Springer Gabler,Wiesbaden, p. 140.

Hutt, M.; Speh, T. (2012): Business Marketing Management: A strategic view of Industrial and Organizational Markets, 11th ed., Fort Worth.

Kotler, P., Keller, K.L., Bliemel, F. (2007): Marketing-Management Strategien für wertschaffendes Handeln, Pearspn Studium, München.

Moncrief, W. C.; Greg, W. M.; Lassk, F.G. (2006): A Contemprary Taxonomy of Sales Positions, Journal of Personal Selling & Sales Management, 26(1), 55-65.

Peters, L. D., Pressey, A.D., Vanharanta, M., Johnston, W.J. (2013), Theoretical developments in industrial marketing management: Multidisciplinary perspectives, Industrial Marketing Management, Vol 42(3), pp. 1-8.

Robinson, P. J., Faris, C.W., Wind, Y. (1967): Industrial Buying and Creative Marketing, Allyn & Bacon, Boston.

Simon, H.; von der Gathen, A.: Das große Handbuch der Strategieinstrumente, Frankfurt, 2002.

Suntrop, C.: (2016): Chemiestandortperspektiven und –strategien. In: Suntrop, C. (Ed): Chemiestandorte: Markt, Herausforderunen und Geschäftsmodell, Wiley: 2016, 3-31.

VCI (2012), Chemical Parks, available at https://www.vci.de/vci/downloads-vci/media-infografik/dokumente/2012-06-19-standortkarte-chemical-parks-and-sites.pdf, accessed 20.06.2017.

Verband der Chemischen Industrie (2016): Die deutsche chemische Industrie 2030 VCI-Prongnos-Studie – Update 2015/2016. Frankfurt am Main.

Verband der Chemischen Industrie (2017): Konjunktur aktuell – Die wirtschaftliche Lage der globalen Chemie im 1. Quartal 2017, available at https://www.vci.de/ergaenzende-downloads/ka2017q1.pdf, accessed 20.06.02017.

Von der Gathen, A.; Simon, H. (2002): Das große Handbuch der Strategieinstrumente: Alle Werkzeuge für eine erfolgreiche Unternehmensführung, Campus Verlag, Frankfurt am Main.

Webster, F.; Wind, Y (1972): A General Model for Understanding Organizational Buying Behavior, Journal of Marketing, 36 (2), 12-19.

Webster, F.E., Wind, Y. (1972): Organizational Buying Behavior (Foundations of Marketing), Prentice Hall, Upper Saddle River.

Wildemann, H.: (2016): Das Chemieparkkonzept – Ein Modell mit Zukunft? In: Suntrop, C. (Ed): Chemiestandorte: Markt, Herausforderungen und Geschäftsmodell, Wiley: 2016, 35-60.

Zeithaml, V.A, Parasuraman, A. and Berry, L.L., “Problems and Strategies in Services Marketing,” Journal of Marketing, 49 (2), 1985, pp. 33-46.