Challenges and strategies for chemical/industrial parks in Europe

1 Introduction

Starting in the United States, chemical/industrial parks have been used since the 1950s to foster economic development and to support the change of industry structures (Griefen, 1979; Reisdorph, 1991). In Europe, the shifting of new investments to locations outside of Europe led to a dissatisfying degree of utilisation of industrial sites and the emergence of industrial parks (Badri et al., 1995). Especially in the chemical and related industries, the last 15 years have seen an increasing trend towards chemical/industrial parks with dedicated infrastructure companies as site operators. After transforming traditional chemical sites into chemical/industrial parks, the whole landscape has been, for many years, in a phase of restructuring and consolidation (Festel, 2007; Festel, 2009). This was the basis for the increasing competitiveness of the chemical industry on a global scale in some European countries, like Germany or the Netherlands.

This commentary gives an overview of the current situation and outlook of chemical/industrial parks in Europe with the focus on success factors and strategic positioning as well as restructuring, consolidation and performance improvement. Some examples of performance improvement opportunities will be given showing cost saving potentials within the supply with electricity, steam and water as well as fire brigades and security services.

2 Positioning and specialisation

The correct positioning based on the specific success factors and strengths of an industrial park is still a major challenge for chemical/industrial parks. This is especially difficult as most of the industrial sites were historically grown with a very broad portfolio of chemical activities. The result being in that we have seen many redundant operations in parks close together. Many of the modern chemical/industrial parks are positioning themselves through product oriented specialisation or by focusing on production strengths in the sense of the existing integrated production networks of the companies that operate at the site. Good examples are the Chempark/Germany (chemical sites of Bayer in Leverkusen, Dormagen and Uerdingen), InfraLeuna/Germany or Chemelot in Geleen/The Netherlands (chemical site of DSM). One key aspect of this focus are the cost advantages of an efficient network structure (for example with regard to the logistics of dangerous or hard-to-transport substances). Chemical/industrial parks also establish an end user or industry oriented specialisation aligned to customers located near the site. The main goal of this type of positioning is to achieve as many scaling and networking effects on the production site as possible, in order to strengthen the network structure. An example for this positioning strategy is the ValuePark in Schkopau/Germany. Size is an important factor for the success of this positioning strategy: the larger the industrial park, the easier it is to strengthen the network structure. To ensure their future existence, smaller chemical/industrial parks have to make themselves attractive through partnerships or specialisation.

In the future, chemical parks will continue to specialise as pure chemical parks (with pure chemical companies as users), chemical/industrial parks with focus on the chemical industry (with chemical companies and related operations as users), and mixed trade parks (with only chemical related operations as users). The drivers for specialisation are the high overhead costs in pure chemical parks (cost intensive infrastructure), legal requirements (licenses, environmental issues) and acceptance by the local community. Only certain chemical companies will be able to carry the overhead costs associated with a chemical park over the long term. Those are mainly companies that have a complex infrastructure by virtue of their production processes or that have to provide certain services because of legal requirements.

Some industrial park operators whose sites are positioned based on the production network will exclude companies that do not fit into the network from the outset. On the other hand, to fulfil their growth targets, which were defined for thinning out fixed costs and the realisation of scaling and network synergies, some chemical/industrial parks are increasingly acquiring customers outside their traditional sphere of activities. A good example for this strategy is the industrial park Oberbruch/Germany, which was able to win a furniture factory and fuel cell producer as new customers for the industrial park. These operations that do not need a special chemical industry infrastructure are normally located on the periphery outside the park premises.

3 Service offerings and customer requirements

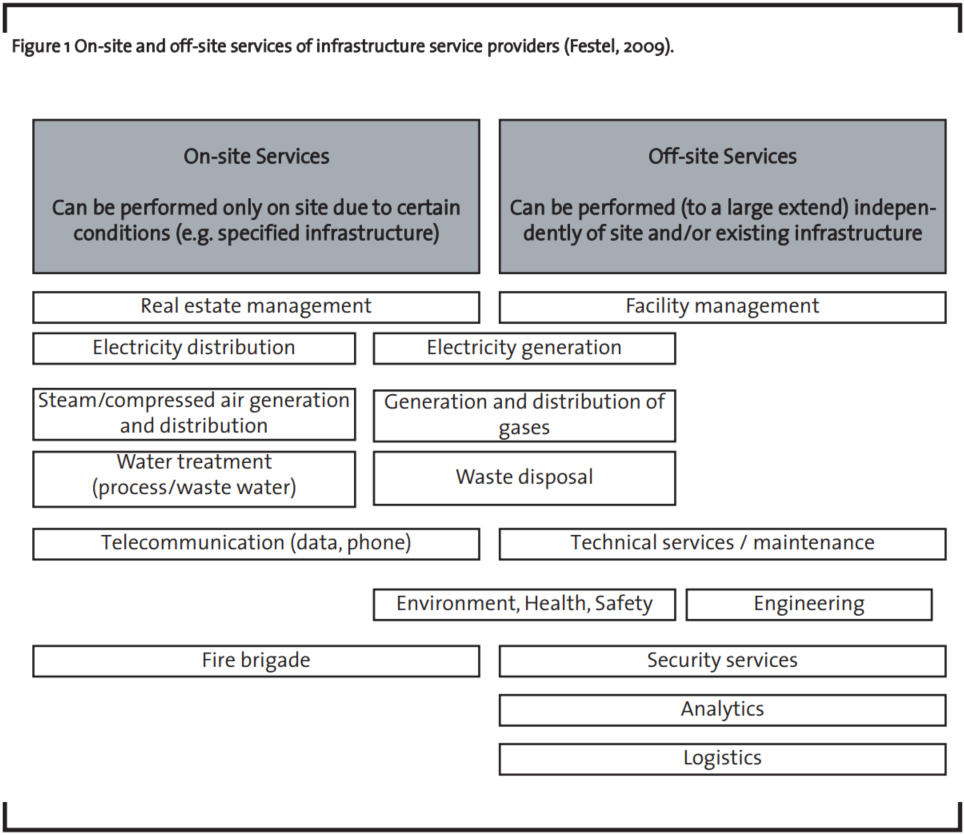

Chemical/industrial park operators offer services specific to the site (on-site services) and services independent of the site, i.e. independent of the existing infrastructure (off-site services) (Figure 1). The respective classification is dependent on as to what extent cost benefits, specific to the site, can be implemented through the proximity to the site users as customers of the services or synergies (e.g. between operation and maintenance of the facilities or infrastructure). An infrastructure network typically has synergies that are generated through the existing infrastructure and the services available for the companies located there.

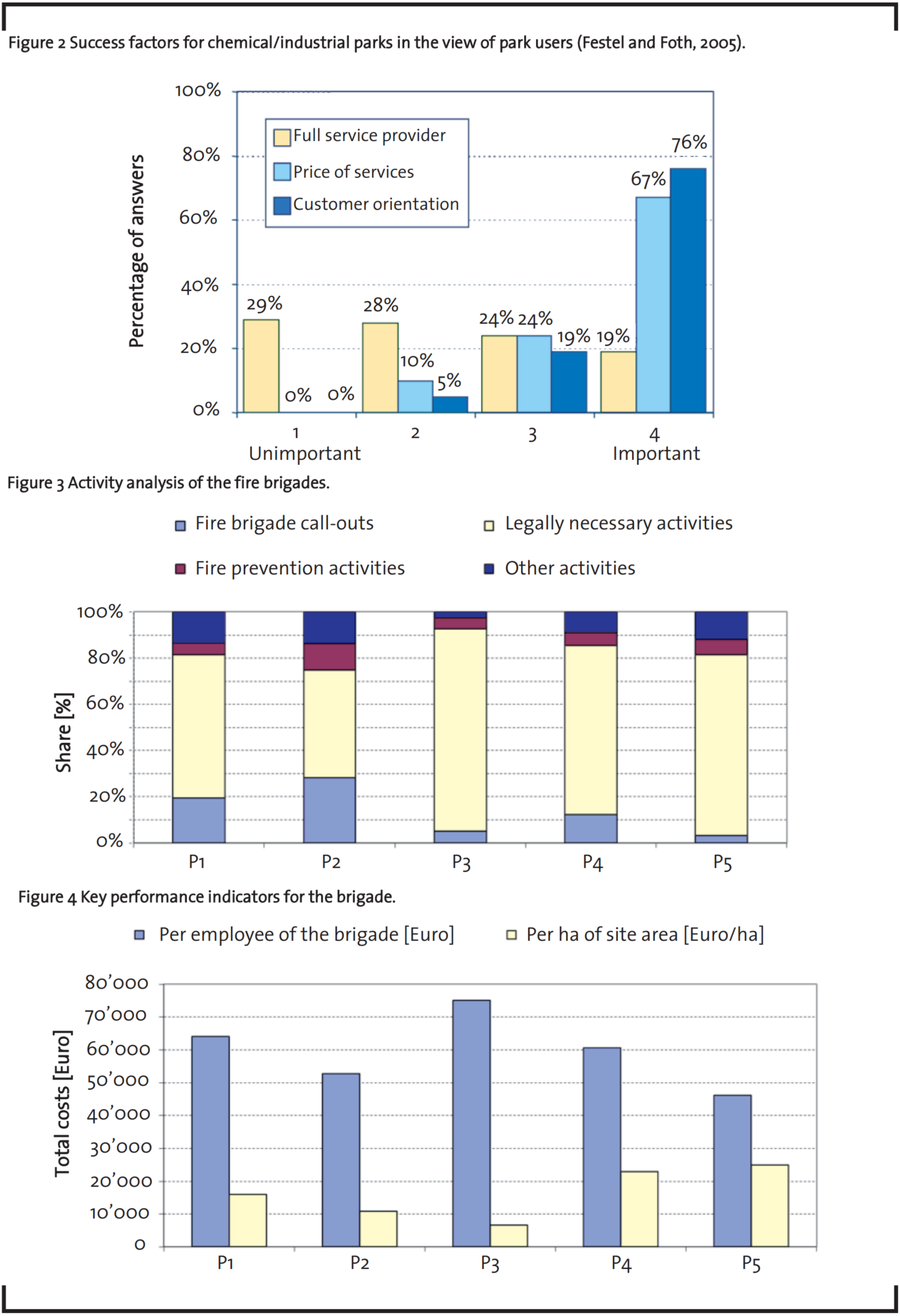

For some customers, it is important that the services can be bundled by the infrastructure company to form complete packages (full-service) so that producers have only one main contact partner. Combining services reduces interfaces and management costs for the customer, which is especially important, as the decisive factor for the long term success of chemical/industrial parks is a competitive price level (Figure 2). Competitive prices are necessary, because the chemical/industrial park operators compete with other locations and external service providers in many of their services, and are intending to increasingly make business outside of their chemical/industrial park (Festel, 2008).

Besides prices, the decisive factor for the attractiveness of chemical/industrial parks, in the park users’ view, is customer orientation, i.e. flexibility and speed, professional expertise (qualification of the employees and quality of the services offered), as well as the existing service range (type and scope of services). The companies within chemical/industrial parks expect a site operator to realize the greatest possible synergies from the integrated network (integrated product or infrastructure network), and pass these on to his customers. Examples are the management of peak demand of energy and media supply (steam, water, compressed air), the individual regulation of security of supply for customers (with fair billing according to consumption), and management systems for energy data.

4 Benchmarking and performance improvement

Performance improvement is a key success factor for chemical/industrial parks. Between 2006 and 2007, a benchmarking study with 9 chemical parks and chemical related industrial parks in Europe was conducted (Festel, 2008; Festel, 2011). The size of the industrial parks was between 30 and 230 hectare (ha). The organisational structures ranged from infrastructure divisions, still integrated in the parent company, over infrastructure divisions own legal entity to independent infrastructure companies. The main focus of this study was on operational and maintenance costs of selected services within chemical/industrial parks. More than 50 key performance indicators were defined and calculated. Conceptual questions, such as operating and maintenance budgets and costs, as well as performance and pricing models were also discussed during workshops to give the participants the chance to share their experiences and to learn from each other. The goal was to obtain an overview regarding the operational competitiveness of the participants and to find first indications for improvement and cost saving potentials.

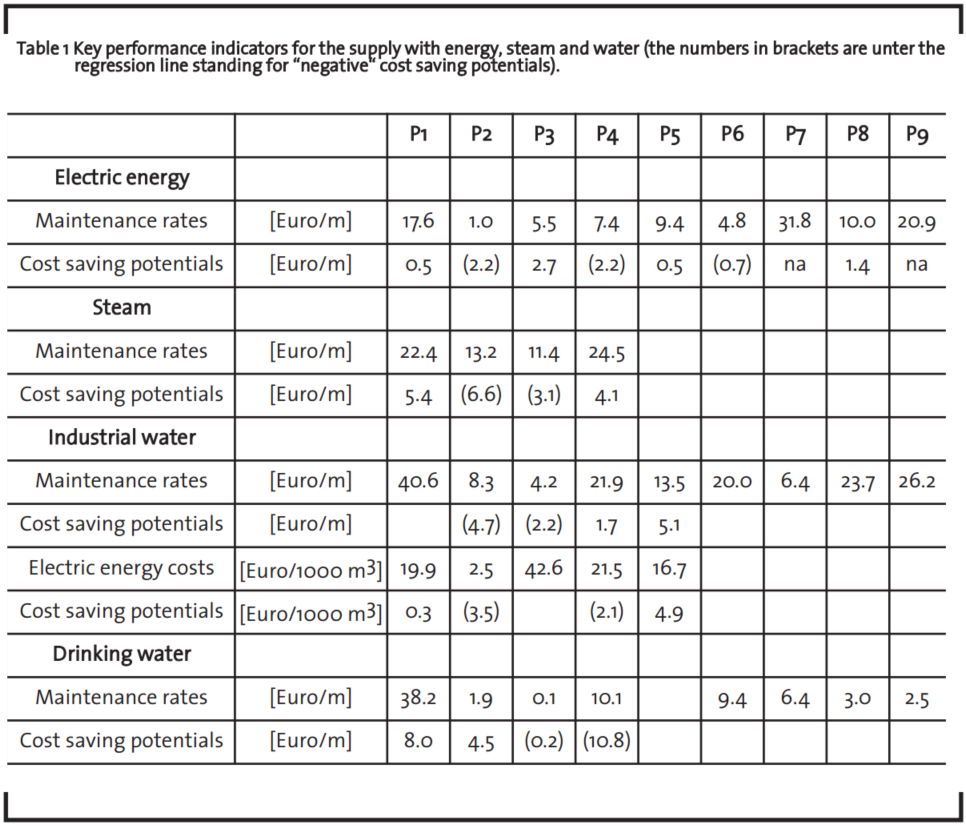

One analysed area was the supply with electricity, steam and water. To determine the maintenance rates of electricity grids, the maintenance costs in relation to the length were taken and gave maintenance rates in the range of 1.0 to 31.8 Euros per metre (Table 1). After considering the special aspects and taking into account the complexity of the networks, a cost saving potential of up to 2.7 Euros per metre could be identified. Especially through an extension of the revision cycles of the electricity networks costs could be saved. While the average revision time span is 5 years, a yearly revision is norm at many of the participating parks. At best, the revision cycle could be extended to 10 years. The range of the maintenance rates of steam networks in relation to the length of the network was between 11.4 and 24.5 Euros per metre. The cost saving potential of a maximum of 5.4 Euros per metre is higher than that of the electricity grids. The maintenance rates for industrial water are in the range of 4.2 to 40.6 Euros per metre showing cost saving potentials from 1.7 to 5.1 Euros per metre. Within a continual optimisation of water networks, the many weak spots and leakages, which lead to significant losses, have to be identified. Some of the participants have systematically set up a network of water metres which has led to an improvement of the identification of weak spots and a decrease in losses. Also, the installation of energy efficient pumps is becoming important, due to the ever increasing energy prices. The electricity costs for the generation and distribution of industrial water are between 2.5 and 42.6 Euros per thousand cubic metres, whereby the specific electricity costs were corrected by the discharge and production volume showing cost saving potentials from 0.3 to 4.9 Euros per thousand cubic metres. The maintenance rates for drinking water are between 0.1 and 38.2 Euros per metre with cost saving potentials from 4.5 to 8.0 Euros per metre.

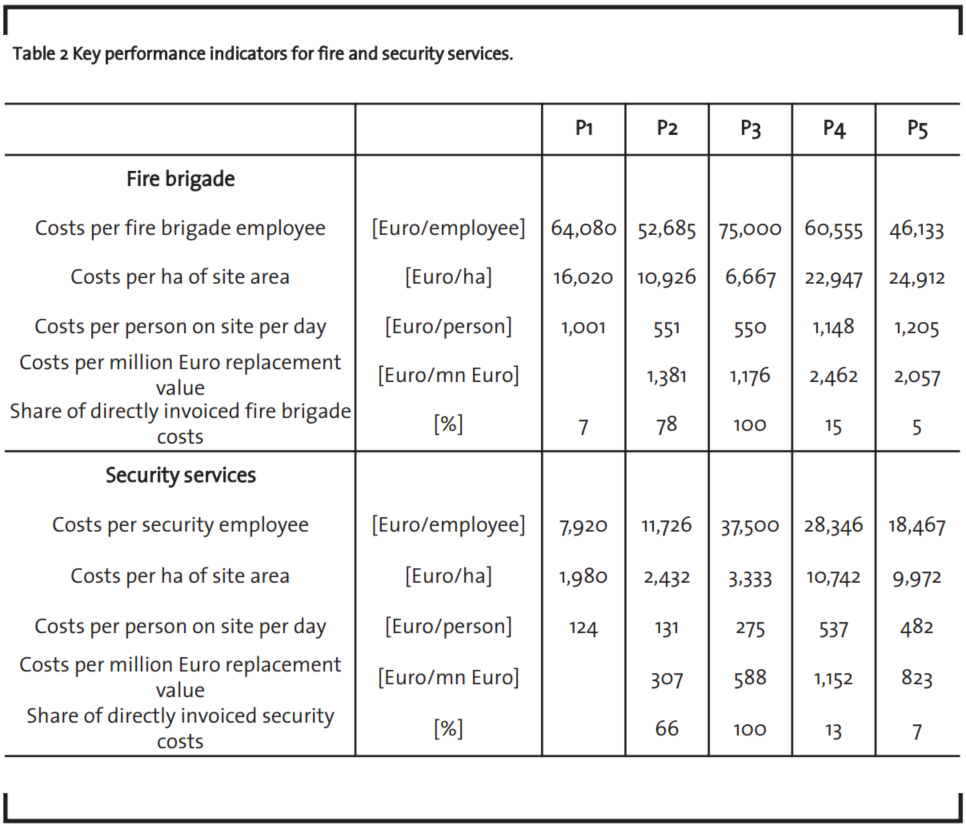

Another area within this benchmarking and best practice initiative was the fire brigade and various security services (property and building surveillance, access control, company and contractor ID cards, reception services, visitor assistance, personal protection, event security, investigation service) with the definition of specific key indicators (Table 2).

Figure 3 shows the activities of the fire brigades based on an activity analysis within all participants. Most of the activities are fire brigade callouts and legally necessary activities, i.e. activities which are required by law or authorities. The fact that these legally necessary activities are between approximately 60% and 90% gives a clear indication that there is a cost reduction potential in some chemical/industrial parks. The impression is that the fire brigade still has a special position in many chemical/industrial parks with lower pressure to reduce costs compared to other functions. This statement is strengthened by analysing the key performance indicators for the fire brigade. Total costs per employee of the fire brigade and per ha of the site area are presented in Figure 4. The performance differences between the participants are large, ranging from approximately 46,000 to 75,000 Euro per employee of the fire brigade and 6,700 to 24,900 Euro per ha of the site area. Especially the per ha figure shows that some chemical/industrial parks have not done their homework regarding the realisation of cost reduction potentials. This is also stated by many companies, as users, at these parks with bad performance.

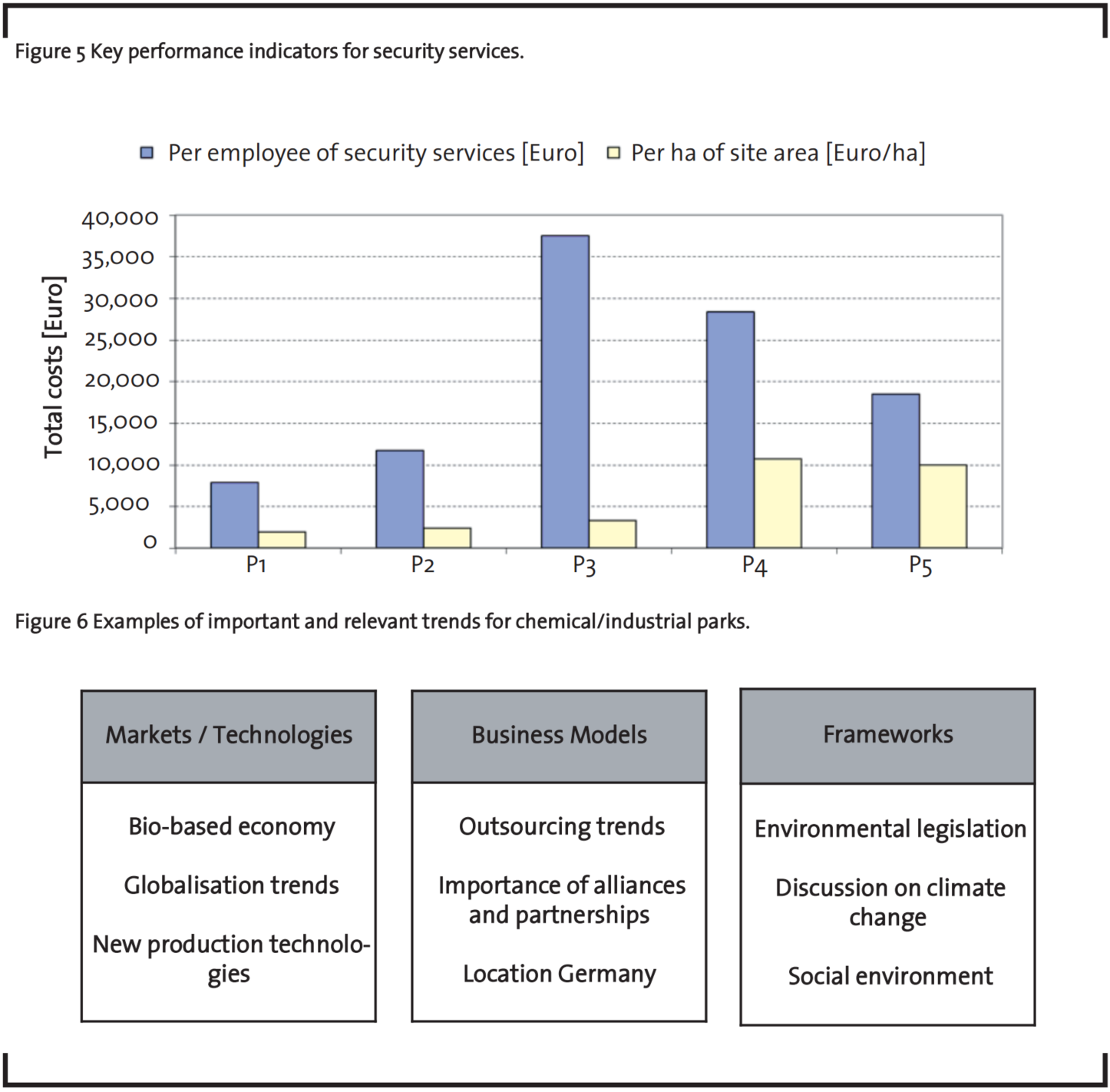

The correlating key performance indicators for security services are shown in Figure 5. The performance differences between the participants are even more significant ranging from approximately 7,900 to 37,500 Euro per employee and 2,000 to 10,700 Euro per ha of the site. This is especially surprising as the salary level and the activity portfolio between the chemical/industrial parks is not so different which was also shown by an activity analysis within the security services. The more detailed analysis and discussion of these differences gave the clear picture that the workload is the decisive factor. Then it was possible to define first indications for cost saving potentials, like modified processes to reduce idle time.

5 Restructuring and consolidation

Besides performance improvements, also restructuring as the adapting of capacities to the actual requirement, and consolidation as the formation of larger entities based on existing structures, are important. An interesting trend during the last years is the consolidation in certain services sectors as a consequence of focusing on core activities and the sale of non-core areas. This consolidation process, which does not reduce the number of independent chemical/industrial parks, is especially seen in off-site services, such as maintenance. One example is the sale of the technical services of the chemical/industrial parks Höchst and Griesheim to the Munich based industrial service provider Rheinhold & Mahla in 2005. It is expected that this consolidation trend within off-site services will continue in the future.

6 Conclusions

There are many fundamental trends, which are important for industrial parks and, e.g., can be assigned to the areas markets/technologies, business models and frameworks (Figure 6). For instance, the transition to a bio-based economy will make a lasting change to production structures, as new supply chains, based on a changed raw material base, will make other demands to infrastructures. Further important trends are related to business models, e.g., outsourcing trends and the importance of alliances and partnerships as well as frameworks, e.g., environmental legislation and the discussion on climate change.

The relevant trends important to chemical/industrial parks should be recognised and evaluated in the scope of the strategy development process. Based on a fundamental understanding of the trends, the evaluation of these should result in the identification of strategic options. A sensible linking with own strengths together with the necessary resources to realise the developed strategy supplies the unique selling point, in order to achieve “first choice” status with new settling companies. It has been shown that without clear unique selling points the competition for new settling companies is toilsome and does not usually promise success. There are various types of unique selling points, which can be defined on the basis of different strengths, such as composite structures (production, product, infrastructure), the specialisation on certain companies and value chains or the positioning through the geographical location. Most chemical/industrial parks have been successful in realising their strategic goals and are showing real unique selling points.

Most of the chemical/industrial parks in Europe were also successful with performance improvement and restructuring. Nevertheless, benchmarking evaluations and best practice discussions show large differences in performance levels. This is a clear indication that there are still significant cost saving potentials in chemical/industrial parks. It is necessary for each industrial park to understand the individual performance level and adapt best practice in all areas. It is the performance level which makes a clear difference between high performance industrial sites and sites which have to be more consequent in their restructuring and cost saving efforts. The environment for chemical/industrial parks in Europe has worsened during the current financial and economic crisis. Some chemical companies, like Dow Chemical, have postponed investments in Europe until the economic situation improves again (Kaskey, 2012). Those chemical/industrial parks which, in the past, have not done their homework will have a difficult time ahead of them and are going to have to take some painful cuts. On the whole, the situation of most of the chemical/industrial parks in Europe is not so bad and they provide a good basis for sustainable growth in the future taking into account the major trends, like transition to a bio-based economy.

References

Badri, M.A., Davis, D.L., Davis, D. (1995): Decision support models for the location of firms in industrial sites, International Journal of Operations & Production Management, 15(1), p. 50-62.

Festel, G., Foth, O. (2005): Marktstudie zu den Zukunftsaussichten von Industrieparks / Infrastrukturdienstleistern, FESTEL CAPITAL, Hünenberg, p. 68-70.

Festel, G. (2007): Chemical/industrial parks in Germany – current situation and outlook, Chemische Rundschau -Industrial Sites Supplement, 60(5), p. 44-45.

Festel, G. (2008): The performance level makes the difference, Chemische Rundschau – Industrial Sites Supplement, 61(4), p. 16-18.

Festel, G. (2009): Chemical/industrial parks within the economic crisis, Chemische Rundschau – Industrial Sites Supplement, 62(4), p. 18-19.

Festel, G. (2011): Infrastruktur-spezifische Aspekte beim Benchmarking, Chemie Plus, 20(11), p. 10-11.

Griefen, R.J. (1979): The Impact of the Industrial Park, Appraisal Journal, 38(1), p. 83-91.

Kaskey, J. (2012): Dow Chemical to Close Five Plants on Slower European Economy, available at http://www.bloomberg.com/news/2012-04-02/dow-chemical-to-closefive-plants-on-slower-european-economy-2-.html, accessed 9 January 2013.

Reisdorph, D.H. (1991): Chemical/industrial parks as an economic development asset, Economic Development Review, 9(4), p. 29-30.