From megatrends to business excellence: Managing change in the German chemical and pharmaceutical industry

1 An industry in transition

The chemical and pharmaceutical industry is an industry in transition. In the past, the chemical industry always altered modern life through the transformation of new scientific findings into marketable products. Business historian Alfred Chandler describes the success model of companies in the chemical and pharmaceutical industry as follows: Successful companies transferred findings from basic research into marketable products and used the profits and learnings from each generation of new products to commercialize the next generation (Chandler, 2005, p. 309). This model of success is in question. Nowadays, companies have to consider that science and technology essential to the growth of high-technology companies might stop being the engine for innovation and growth. The chemical industry with its periods of researchbased growth between the 1880s and 1920s and again during the 1940s and 1950s has to cope with the situation that, since the 1950s, chemical sciences and engineering have ceased to generate major new product developments (Whitesides, 2015, p. 3196; Schröter, 2007, p. 57). As a result, product and process development gain more importance for successful companies in the chemical industry than basic research. For the pharmaceutical industry, on the contrary, the success model of generating new products through basic research findings has not stopped yet: In the 1960s and 1970s, biology and related disciplines – microbiology, enzymology, and the beginnings of molecular biology – were forming the new basis for additional new products, and since the 1980s, new findings in the field of biotechnology fuel the development of innovative products on the basis of basic research findings (“The Biotechnology Revolution”). Chandler thus concludes that “in the beginning of the twenty-first century, the chemical industry is no longer a high-tech industry. Pharmaceuticals, however, remains a dynamic high-tech industry as biotechnology is contributing to revolutionary changes on the scale comparable to those of the Second Industrial (…) Revolution (…) in the 1880s.”

2 Trends driving change

Different authors have been working on the future of the chemical industry (Whitesides, 2015; VCI, 2013; VNCI and Deloitte, 2012). Often, they have analyzed the impact of so-called “megatrends” on the future development of the industry. These longterm trends are defined as drivers of change that affect all parts of society (business, society, and politics), may have a global reach and typically last for more than 20 years. With the help of these megatrends and their complex interplay, political institutions, industry associations or companies create different scenarios in order to shape different pictures of the future. Industry associations use these pictures to communicate to politicians about potential opportunities and risks for an industry, companies to identify relevant fields for action, e.g. the need for cost cutting in one division and the need for investment in another. For managers, the megatrends serve as a common frame of reference when analyzing the need of business transformation in the chemical industry.

There are different ways to group trends for the chemical and pharmaceutical industry (cf. Whitesides, 2015; VCI, 2013; Johansson et al., 2012; Matlin and Abegaz, 2011). A large-scale online survey (called “From megatrends to business excellence”) analyzed the need for business transformation in the chemical industry. In this survey, upcoming trends – creating a potential need for transformation – were addressed and participants asked about the relevant management activities to cope with these trends (for details see Utikal and Leker, 2015). In total, 270 persons participated in the online survey; 141 participants having significant management experience in the chemical industry finished the total questionnaire. Out of these, 34% considered themselves as being experts in the segment of specialty chemicals, 16% in the field of polymers, 22% pharmaceuticals, 10% basis chemicals, 8% agrochemicals and 10% in other fields. 50% of the participants are top-managers (board level), 20% are expert in the field of research and development and innovation, 25% have other leading positions in chemical and pharmaceutical companies, and 5% hold other positions. Different company sizes are reflected as well. The results of the survey have been discussed in different workshops with managers and have been the basis for expert interviews with high-level executive managers from the chemical and pharmaceutical industry.

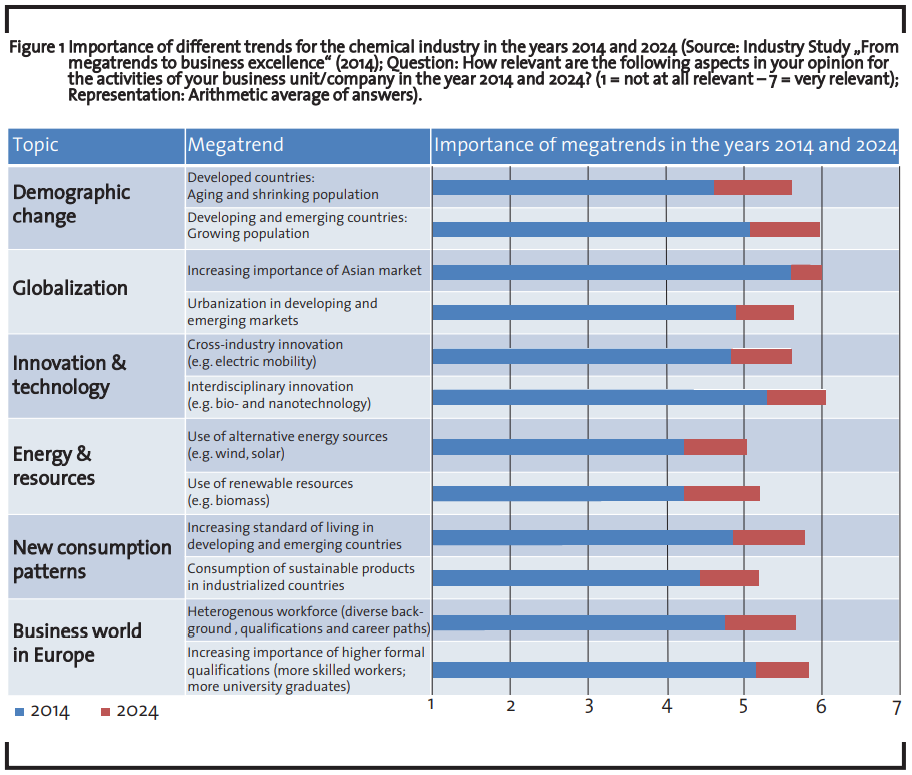

Within this survey, participants were asked to rate the importance of selected megatrends for their business activities in the years 2014 and 2024 (see figure 1). We distinguished five topics and ten trends: (1) Globalization and urbanization, (2) Crossindustry and interdisciplinary innovation and technology, (3) Energy and resources, (4) New consumption patterns, and (5) Demographic change/business world in Europe.

Across all segments, the most important trends for the year 2014 are:

- Globalization: The most important and continuing trend is globalization. Participants assume that especially the Asian market will continue to increase in volume and value. Of course, this has implications for the configuration of the value chain and for the steering of business activities.

- Cross-industry and interdisciplinary innovation: Participants state that innovations will still be a key value driver, whereby they expect crossindustry innovation or innovation based on interdisciplinary cooperation to gain further importance.

- Higher qualification: Participants see an increasing importance of higher qualification for the chemical industry.

The chemical industry in Germany is thus getting more international, it opens up to other scientific disciplines and believes in the importance of a highly skilled workforce to attain its goals. It is interesting to see that for the year 2014, so-called “green issues” – e.g. sustainable products, the shift to alternative energy sources and the use of renewable resources – are considered to have the least relevance out of all potential megatrends. At the same time, participants assume these aspects to be of increasing importance until the year 2024.

3 Fields of transformation

Can companies in the German chemical and pharmaceutical industry be adequately transformed in order to realize the opportunities inherent in the outlined trends? Beyond the specific focus on the chemical industry, this question has gained a lot of attention in management literature on organizational change. Organizational change is defined as a difference in form, quality, or state over time in an organizational entity (Van de Ven and Poole, 1993, p. 512). Change processes can be analyzed for multiple entities (e.g. for whole industries) or for a single entity (e.g. a single company). One influential school analyzing change on the level of multiple entities, is the population ecology school stating that the ability of a single entity to change is very limited. This school proposes that a Darwinian view describing change processes as a result of variation, selection and retention may be adequate to understand change processes (e.g. Hannan and Freeman, 1986). The opposite position is taken by the school of planned change. The planned change model views developments on the level of the single organization as a result of an active organization design process where decision makers formulate goals, implement measures and evaluate the impact of these measures on the defined goals (for the different models see e.g. Van de Ven and Sun, 2011). In the following, organizational change is examined from the perspective of a single company. The reasoning is based on the assumption that companies and acting managers have some discretion in actively designing change processes. Organizational change processes can be further characterized with regard to their intensity as incremental or radical changes. Incremental changes encompass minor modifications of the status quo, radical changes have a profound impact on different fields of an organization (Levy and Merry, 1986).

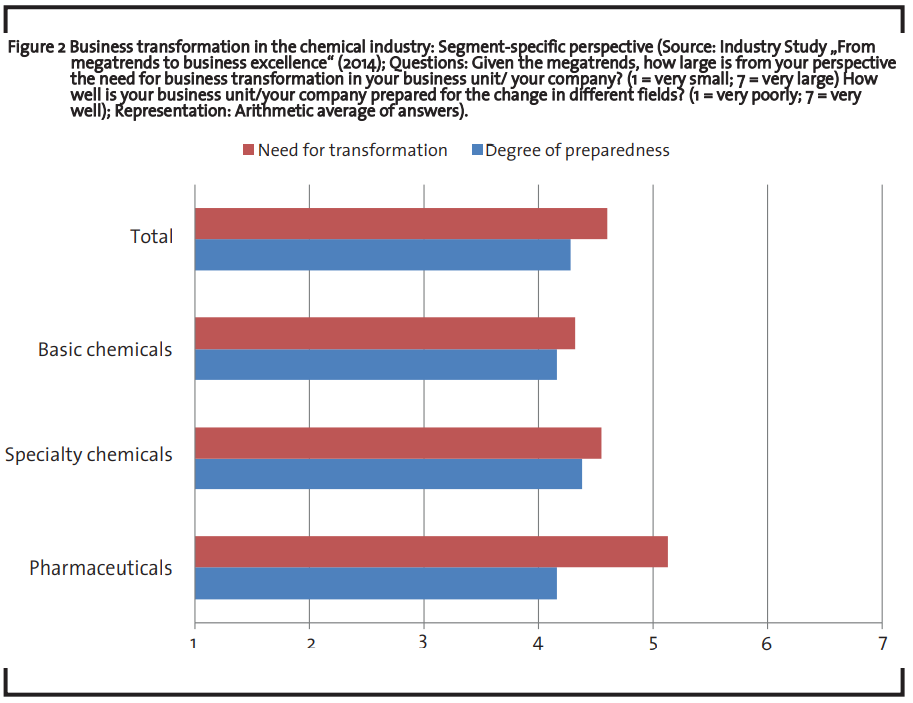

The participants of the survey “From megatrends to business excellence” evaluated to what degree their business unit or company would have to change in the light of the above-mentioned trends (need for change) as well as to what degree the respective unit is already prepared for this upcoming change (degree of preparation). Across all segments, participants identified a medium need for change. The respondents are thus expecting – on average – more evolutionary than revolutionary change for their companies. The degree of preparation corresponded – only looking at the means of the answers – to the needed change. Additionally, different fields for change were addressed: The participants identified a medium need for change of their company’s strategy and business model and the existing business processes; here they considered their companies as being sufficiently prepared. However, in the fields of workforce qualification and company culture, the respondents identified a relevant discrepancy between the need for change and the degree of preparation. This aspect can be further explored in a segment-specific analysis (see figure 2), whereby the split by industry segments reveals the following interesting differences:

- In the field of base chemicals, respondents identify compared to all other segments the lowest need for change but the highest degree of preparation. This can be interpreted as a sign for respondents considering their business as being stable and already highly optimized. They focus on process innovations and select their production site based on global market demand on the one hand and energy and raw material costs on the other hand. They do not see any far-reaching shift in their energy and raw material basis away from fossil fuels until the year 2024. From the perspective of the respondents, these two drivers will not heavily influence existing operations – even though they are often cited in research and policy publications as extremely relevant trends for the industry segment.

- In the area of specialty chemistry, a higher need for change can be observed. Overall, the degree of preparation corresponds to the needed change, but discrepancies exist in the field of workforce qualification and corporate culture. Obviously, the participants assume that the expected changes in the field of cross-industry and interdisciplinary innovation (identified as very important trends for this segment) imply changes on the side of workforce qualification and the company’s values. The conducted expert interviews additionally revealed that companies in the specialty chemical segment face challenges in implementing the desired change from a product to a solution provider: Given the high complexity and diversity of value chains on the side of their customers, employees have difficulties in determining and quantifying the specific value their products provide in these different value chains. With regard to cross-industry collaborations in innovation projects, managers identify a lack of knowledge about partners and uncertainties in handling different industry cultures as main deficits. Some companies manage the needed adaptation proactively: For instance, the specialty chemical company Clariant organizes workshops with potential customers in order to get a deep understanding of customer requirements. After the ideation phase, the management mode changes in order to guarantee a short time-to-market. This opening up of the innovation process is a new development.

- With regard to the pharmaceutical segment, the biggest need for change and the lowest degree of preparation was stated. A high demand for change is shown across the fields corporate culture, employee qualification, strategy/business model and business processes. Compared with the other segments, it is interesting to see that for pharmaceuticals – with the exception of the topic strategy/business model – the degree of preparation is much lower than the needed change. This holds not only true for the so-called “soft issues” of corporate culture and workforce qualification but as well for the “hard” fields of business processes. In the expert interviews, this was explained by regulatory requirements decisive for the pharmaceutical industry. These requirements increase costs for continuous process optimizations and sometimes may even prevent them. Some pharmaceutical companies open up their research and production activities and cooperate more than in the past with partners – this change has to be accompanied with a change of the corporate culture as well.

4 Managing evolutionary change

One central conclusion from the study “From megatrends to business excellence” is that companies in the chemical industry do not see the need for a short-term, radical change. This holds true – to a lower degree – for pharmaceutical companies as well. Regarding the intensity of change, companies in the chemical and pharmaceutical industry thus differ significantly from companies in other industries, such as the financial, publishing or music industries. These sectors are confronted with disruptive change initiated by the internet which profoundly puts established business models into question. Single chemical and pharmaceutical industries can as well be faced with the need to start and steer profound transformation processes. This holds especially true if they redefine their business and do not only focus on technical innovations but on their role in creating socio-technical innovations in the fields they are working for (e.g. mobility, health, energy production and consumption). To create socio-technological innovations, chemical companies must consider themselves as being part of a wider innovation network with actors from different sectors and a variety of stakeholders.

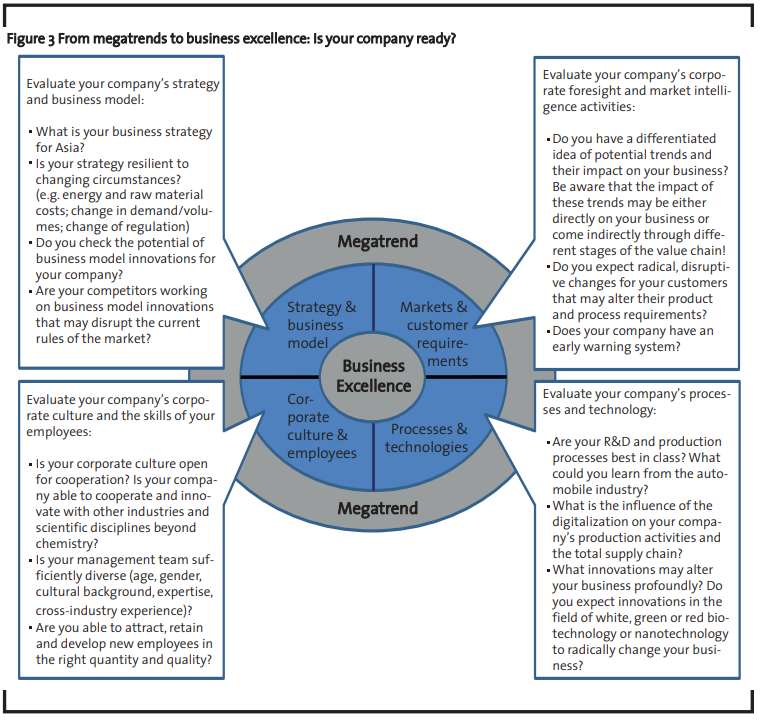

Researchers from the field of transition management have formulated recommendations on how managers can prepare their companies for change – be it evolutionary or revolutionary in kind. These recommendations may be of value for managers in the chemical and pharmaceutical industry as well (cf. figure 3):

- Markets & customer requirements Chemical and pharmaceutical companies need to have an in-depth understanding of the changing market requirements on the different activities in the value chain up to the final consumer market. Given the diversity and complexity of the different value chains chemical companies are involved in, this is a significant challenge. Companies should have discussion platforms involving various stakeholders, such as non-governmental organizations, as part of an early warning system in order to detect weak signals of changing requirements.

- Strategies & business models Companies should develop their strategies outside-in and work with scenarios. They can thus guarantee that potential developments are taken into account and simplistic views of the future are avoided. With this in mind, strategies and business models should be tested with regard to their resilience in the light of changing circumstances. And ideas for business model innovations may be collected beyond the chemical and pharmaceutical industry.

- Processes & technologies Production assets, IT-systems and processes in the field of innovation, production and marketing should be investigated with regard to their flexibility. Of course, this is hard to be achieved in the chemical and pharmaceutical industry with its high capital intensity and regulatory framework. But in times of increasing volatility, flexibility of resources is a company goal per se and may lead to investments in multi-purpose assets.

- Corporate culture & employees Corporate cultures in the chemical and pharmaceutical industry will have to open up, so that opportunities of the globalization and innovation across industries and scientific disciplines can be realized. With regard to employee qualification, in-depth knowledge of chemistry and engineering will, of course, be of crucial importance for the success of chemical and pharmaceutical companies in the future as well. However, at the same time, more employees with intercultural, interdisciplinary and knowledge from other industries are needed.

5 Conclusion

Companies in the chemical and pharmaceutical industry in Germany have to focus on their ability to change – even if they consider the upcoming change to be more evolutionary than revolutionary in character. First, they should continue to optimize their current business in order to secure their competitiveness. Second, they should anticipate potential disruptive changes early and work on their value creation capabilities through innovation. And third, they may identify new innovation paths by focusing on the larger socio-technical systems they are working for. The transition taking place in different societal fields such as mobility, food supply, health, environmental protection opens up new opportunities for companies in the chemical and pharmaceutical industry to position themselves in these newly emerging networks and to create new viable business models. Thus, the tension between the “exploitation of current assets and capabilities” and the „exploration of new possibilities“ through innovation, cooperation and new alliances characterizes the fundamental management challenge for companies in the chemical and pharmaceutical industry in Germany on their way “From megatrends to business excellence”.

Note:The data used within this article results from a study jointly conducted by the University of Münster, the Provadis School of International Management and Technology, the association VCI, the consulting firm PWC strategy& and the CHEManager. The corresponding publication and further information can be found at www.chempharmtrends.de.

References

Chandler, A. (2005): Shaping the industrial century. The remarkable story of the evolution of the modern chemical and pharmaceutical industries, Harvard University Press, Cambridge.

Geels, F. W. (2013): The chemical industry in transition?, in: Mohr, R. and Utikal, H. (ed.), Future Chemistry: Glimpses into the world of tomorrow, FAZInstitute, Frankfurt, pp. 192-196.

Giannetti, R., Romei, V. (2007): The chemical industry after world war II, in: Galambos, L., Hikino, T. and Zamagni, V. (ed.), The global chemical industry in the age of the petrochemical revolution, Cambridge University Press, Cambridge, pp. 407-452.

Hannan, M., Freeman, J. (1993): Organizational ecology, Harvard University Press, Cambridge.

Levy, A., Merry, U. (1986): Organizational transformation, Praeger Publishers, New York.

Matlin, S., Abegaz, B. (2011): Chemistry for Development, in: Garcia-Martinez, J. and Serrano-Torregrosa, E. (ed.), The chemical element. Chemistry’s contribution to our global future, Wiley-VCH, Weinheim, pp. 1-69.

Johansson, Å. et al. (2012): Looking to 2060: Longterm global growth prospects, OECD Economic Policy Paper No. 3, OECD Publishing.

Schröter, H. (2007): Competitive Strategies of the World’s Largest Chemical Companies, 1970- 2000, in: Galambos, L., Hikino, T. and Zamagni, V. (ed.), The global chemical industry in the age of the petrochemical revolution, Cambridge University Press, Cambridge, pp. 53-80.

Utikal, H., Leker, J. (2015): Die Studie: Von den Megatrends zum Geschäftserfolg, in: Provadis School of International Management and Technology: Von den Megatrends zum Geschäftserfolg, pp. 5-7 (online: http://www.chemanager-online.com/sites/chemanager-online.com/files/Megatrends_Geschaeftserfolg_Chemie_Pharma.pdf).

Van de Ven, A., Poole, M. (1995): Explaining development and change in organizations, Academy of Management Review, 20 (3), pp. 510-540.

Van de Ven, A., Sun, K. (2011): Breakdowns, in: Implementing models of organization change, Academy of Management Perspectives, 25 (3), pp. 58-74.

Verband der chemischen Industrie in Deutschland (VCI) (2013): Die deutsche chemische Industrie 2030, VCI, Frankfurt.

Vereniging van de Nederlandse Chemische Industrie (VNCI), Deloitte (2012): The Chemical Industry in the Netherlands: World-leading today and in 2030-2050.

Whitesides, G. M. (2015): Reinventing Chemistry, Angewandte Chemie International Edition, 54 (11), pp. 3196-3209.